Hoping To Buy A Home In New York State 2022 May Be A Good Time To Do So

Ready to purchase a home and wondering how to go about taking advantage of the new, higher VA or conforming loan limits for 2022? Contact us today to find out how these changes may impact you.

Give us a call at or contact us online to get the conversation started. We can discuss your specific situation and help you understand what type of home loan will be best for you!

Wondering what your mortgage options are in the state of New York? You can explore those here.

Va Funding Fee And Loan Limits

The current VA funding fee is typically 2.3% of the loan amount. It is added to the loan principal, reducing the amount of cash needed. For example, a veteran who buys a $250,000 home with 0% down will have a final loan amount of $255,750.

The funding fee goes directly to the VA to support the costs of the program.

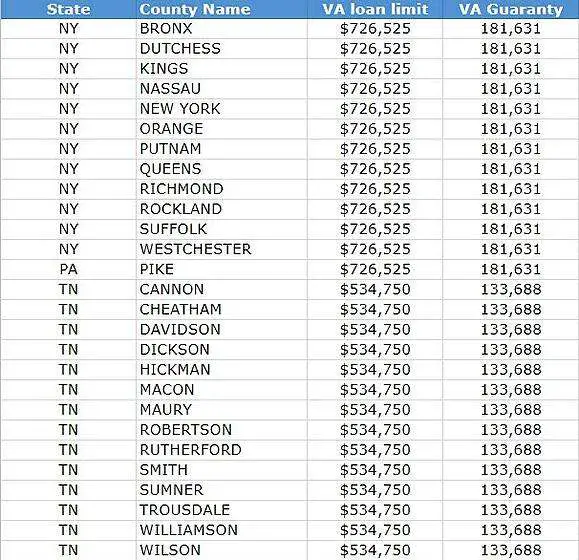

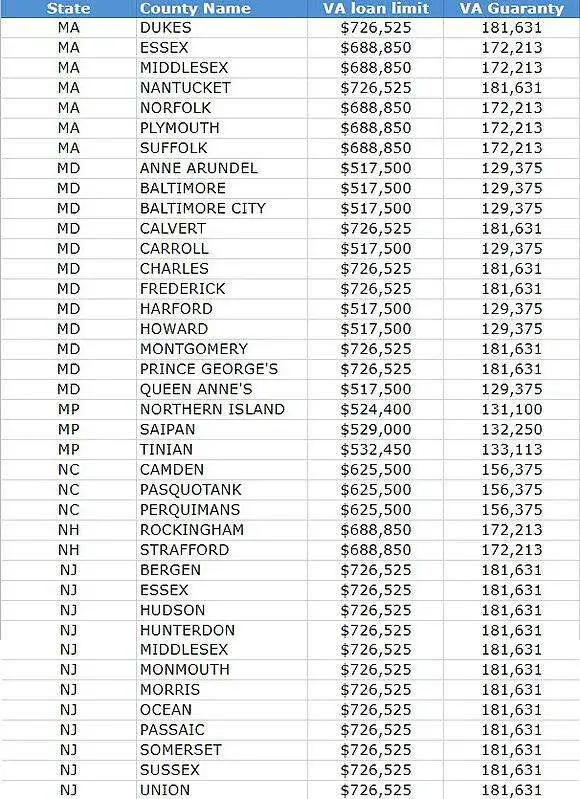

The current VA loan limit is set at $647,200 but can be higher in VA-designated high-cost areas.

For instance, a veteran buying a home in Los Angeles can get a zero-down loan up to $970,800.

Keep in mind that you can open a loan for more than the VA loan limit. However, you would have to pay a 25% down payment on the portion of the loan thats over the limit.

For example, if a veteran opened a loan in an area with a $647,200 limit that was worth $100,000 more than the limit, he or she would make a $25,000 down payment .

What Full Entitlement Means

In 2020, the VA removed the loan limits for service members and veterans with a full loan entitlement remaining. You may have full entitlement if you meet one of the following three criteria:

- You have never taken out a VA loan

- You have repaid your VA loan in full and you have sold the house you purchased with it

- You defaulted on a previous VA loan but you have paid back the VA in full

Also Check: Refinancing Through Usaa

When Do Va Loan Limits Apply

VA loan limits are applied to those with no or partial VA loan entitlement.

How do you know if someone has full or partial entitlement? Luckily, we have the answer to this frequently asked question.

You have full entitlement if any one of the following is true.

- You have never used your VA loan benefits before.

- You have paid the previous VA loan fully and have sold the property.

- You borrowed a VA loan and had a foreclosure but repaid the amount in full.

An applicant will be subject to loan limits if any one of the following is true.

- Your VA loan is still active, and youre paying it back.

- You have paid the previous loan amount in full but still, own the house.

- You refinanced a non-VA loan into a VA loan and still own the home.

- You had a short sale on your previous VA loan and didnt repay it completely.

- There was a foreclosure on a previous VA loan you failed to repay.

- You filed a deed in place of foreclosure for an earlier VA loan.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Rv Loan Usaa

Will My Va Loan End Up In The Secondary Mortgage Market

Probably. Most VA loans end up being packaged up by lenders and passed to Ginnie Mae, a government owned corporation that allows individuals and pension funds to invest in the secondary mortgage market. Ginnie Mae guarantees mortgage-backed securities for government-backed mortgages, but doesnt buy them or sell the mortgage-backed securities. Ginnie Mae securities are backed by the full faith and credit of the U.S. government.

Va Home Loan Property Types

You can buy several types of homes with a VA loan. These are:

- Single family homes

- 2-4 unit homes, as long as you live in one of the units

- Manufactured homes

- Condominiums and townhomes

Keep in mind that not all lenders will offer loans on all properties. For instance, fewer lenders will approve a manufactured home loan than a single family home. Check around at other lenders if you are told no to the property you are interested in.

You May Like: What Kind Of Loan For Land

Va Loan Limits: No Maximum Loan Amounts In 2021

If youre a military servicemember or veteran, you may have access to a zero-down loan with no limit, as long as you qualify for the payment.

The Department of Veterans Affairs eliminated VA loan limits for most borrowers in 2020. That means first-time VA homebuyers, and others with their full entitlements, can borrow as much as lenders are willing to approve.

So the size of your VA loan now depends more on your financial credentials than on the local housing market.

VA loan limits still come into play for homebuyers who currently have VA loans and have partial entitlement available.

If youre a qualifying veteran, active-duty military servicemember, or an eligible surviving military spouse, now may be a great time to buy, with a shot at a 0% down mortgage and no loan limit on the type of home you can buy.

What No Va Loan Limits Means For You

The elimination of a max VA loan limit doesnt mean a spending spree is on your horizon. But it does make buying a larger home, or a home in a more expensive market, a little bit easier.

Most importantly, youll be able to purchase that more expensive property without putting a lot of money down .

But before doing that, its important to remember that skipping the down payment while allowed will mean a higher loan balance and, thus, a larger monthly payment. For example:

| Purchase price | |

| 3.75% | $1,250 |

For these reasons, youll need to be smart about buying within your means. Use a mortgage calculator to determine what you can afford, and let that guide your home search.

Don’t Miss: Car Loan Amortization Formula

Why You Would Use A Va Loan If Your Home Costs More Than The Va Will Guarantee

There are several good reasons to apply for a VA loan. The first is that you may be able to buy a home with a lower down payment than you would with a conventional mortgage, unless you are willing to pay for private mortgage insurance , which may add a fairly substantial amount to your monthly payment.

Interest rates are another important factor in your decision. Because VA loans are guaranteed by the VA, they often have slightly lower interest rates than conventional loans .

That said, it pays to shop around. A mortgage is often the largest purchase you will ever make, and even a few decimal points on your interest rate can save you a substantial amount of money, or cost you thousands, over the life of your loan.

What Is A Jumbo Loan

A jumbo loan lets you finance the difference between the VA loan limit in your county and the value of the home that you want to buy. Say you want a house thats $500,000, but the VA loan limit in your county is only $424,100. How will you finance that extra $75,900? With a jumbo loan.

To use a VA loan to finance this example home or any home thats over the local VA loan limit youll need to come up with 25% of the difference between the home price and the loan limit. So, $75,900 divided by 4 is $18,975. You would have to make a $18,975 down payment to finance your $500,000 home.

That may sound like a lot of money but remember that with a conventional loan youd likely have to put down 20% of the full home value, meaning a $100,000 down payment for our example home. Even with the 25% down payment requirement for jumbo loans, the VA loan is still a great deal.

Don’t Miss: Usaa Refinance Auto Loan Rates

Why Does My Coe Say This Veterans Basic Entitlement Is $0

This line on your COE is information for your lender. It shows that youve used your home loan benefit before and dont have remaining entitlement. If the basic entitlement listed on your COE is more than $0, you may have remaining entitlement and can use your benefit again.

On your COE, in the table called Prior Loans charged to entitlement, we list the amount of your entitlement youve already used under the Entitlement Charged column. Your entitlement can be restored when you sell your property and pay your VA-backed loan in full, or repay in full any claim weve paid.

What Is The Va Jumbo Loan Limit

When talking about VA jumbo loan limits, there are two numbers you need to think about. One is the minimum amount after which something is considered a jumbo loan. The second is the maximum amount of any VA jumbo loan. Well start with the VA policy on loan limits and then move on to what most lenders consider to be a VA jumbo loan.

In theory, most people arent likely to have a limit on a VA loan. Beginning in 2020, the VA guaranteed the same percentage of the loan amount for lenders regardless of the loan size as long as you had full entitlement.

If you have a partial entitlement, your VA guarantee works differently. Your maximum loan amount depends on whether youll be making a down payment or have existing equity in your home. If this is your situation, the formula for maximum loan amount is the following:

If youre not making a down payment or have no existing equity, the following formula applies:

Remaining Entitlement x 4

Although the VA doesnt limit the amount you can borrow, the above formulas are the policy of most lenders when you dont have full entitlement for standard VA loans.

Non-VA jumbo loans often require a higher down payment. This isnt necessarily the case with VA jumbo loans.

The other important number to pay attention to is the upper loan limit that lenders have for their VA jumbo loans. At Rocket Mortgage®, you can get a VA jumbo loan in any amount up to $2 million, assuming you can meet qualification standards.

Also Check: Nslds.ed.gov Legit

Can You Reject A Va Loan

VA lenders make money by approving loans, not denying them, so they will do what they can to get your approval. When they can not, they send what is called an alert for unwanted action. To see also : Why do sellers hate VA loans?. This is an official form and required by law to give you a written explanation of why your loan was not approved.

Can you discriminate against a VA loan?

If you want to buy a home with a VA loan, you can not be discriminated against because of your disabilities at any stage of the process, including viewing, inspecting or otherwise having access to the property as a potential buyer or tenant.

Why would a VA home loan be denied?

The most common reason why VA applications for mortgages are rejected is due to errors in the application itself. Lenders cannot issue loans unless they are sure that your personal and financial details are correct. Before submitting your application, take the time to review each claim you make and the numbers you enter.

Va Loan Limit Calculator For 2022

VA loans are available up to $647,200 in most areas but can exceed $900,000 for single-family homes in high-cost counties. Calculate your VA loan limit to see your personalized loan limits don’t apply to all borrowers.

Your VA loan limit or how much you can borrow without making a down payment is directly based on your entitlement. In many cases, you may have no limit whatsoever.

Heres what you need to know about calculating your VA mortgage limits and how they may apply to you.

Don’t Miss: Should I Choose Fixed Or Variable Student Loan

What Is The Maximum Va Loan Amount

About VA loan limits. The standard VA loan limit in 2022 is $ 647,200 for most U.S. counties, increasing from $ 548,250 in 2021. VA loan limits also increased for high-cost counties, topping $ 970,800 for detached houses. VA loan limits do not represent a ceiling or maximum loan amount.

What is my right to a VA loan? The right to a VA loan is the dollar amount the Department of Veterans Affairs guarantees for each VA home loan and helps determine how much a veteran can borrow before he needs an advance payment. The VA loan entitlement is usually either $ 36,000 or 25% of the loan amount up to the corresponding loan limit.

If You Have Full Entitlement You Dont Have A Home Loan Limit

Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you wont have to pay a down payment, and we guarantee to your lender that if you default on a loan thats over $144,000, well pay them up to 25% of the loan amount. You have full entitlement if you meet any of these requirements.

At least one of these must be true:

- Youve never used your home loan benefit, or

- Youve paid a previous VA loan in full and sold the property , or

- Youve used your home loan benefit, but had a foreclosure or compromise claim and repaid us in full

Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You wont need to use these terms when applying for a loan.

It depends. If you apply and are eligible for a VA-backed home loan, youll receive a Certificate of Eligibility . This is the document that tells private lenders that you have VA home loan eligibility and entitlement.

But your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:

- Income

- Assets

We dont require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare.

Don’t Miss: Usaa Approved Car Dealerships

What Property Cannot Be Financed With A Va Loan

VA mortgage financing is available for 1 to 4 family, owner-occupied properties. VA Loans are not available for non-owner-occupied properties, such as vacation homes or investment properties. To qualify as an existing property, the home must be fully completed for at least one year before occupancy by the veteran.

Va Loan Limits Now Depend On Your Budget

Having no max VA loan amount simply means your borrowing threshold will depend on your unique financial scenario and budget, rather than a government-set limit.

In a nutshell: Instead of asking, how much can I borrow with a VA loan?, you should now focus on how much house can I afford with a VA loan?

To determine what you can afford, youll need to take into account your income, credit score, debts, and other factors.

Ultimately, your VA lender is going to set your max loan amount based on:

- Your income: How much are you bringing in each month? Lenders generally dont want you spending more than 30% of your income on housing costs.

- Your credit score: How creditworthy are you? Higher credit scores will mean a better interest rate and a lower monthly payment to boot. They might also give you a higher maximum loan amount as a result

- Your debts: How much are obligated to pay toward debts each month? How much of your income does that take up? Your debt-to-income ratiowill influence your loan amount as well

- Your down payment : Are you planning to make a down payment? If so, how much? A down payment will make your monthly mortgage costs lower and could qualify you for a larger loan, too

Generally, you can expect borrowers with lower debt-to-income ratios, large down payments, and higher credit scores to see larger VA loan limits.

You May Like: Usaa Car Loan Requirements

Why Do Va Loans Take So Long

Extensive repairs can push the expiration date back by weeks or months. The rate value can also affect the final timeline. VA loans can not be issued for more than the appraised value of the home. If the appraised value falls below the purchase price, buyers have some thinking ahead of them.

Do VA loans take longer? VA loans are quick and easy to process. They should not take a longer process than a conventional loan. Since the length of time can vary depending on the loan volume of the lender, you should ask the lender how long it will take to close the loan.

Can I Have More Than One Va Loan

Yes. However, if you have entitlement in use that will not be restored, your new VA loan must still be over $144,000, and the Freddie Mac county loan limit will factor.

So yes, you can have more than one VA loan. Use the VA entitlement worksheet to calculate your maximum VA loan amount.

Your new VA loan must be on an owner occupied primary residence.

VA uses conforming loan limits established for Fannie Mae and Freddie Mac to determine maximum VA loan eligibility when there is entitlement in use that will not be restored.

If the home you are buying is more than your remaining entitlement allows, you can still use a VA loan if you put down 25% of the difference of the purchase price and maximum loan amount.

Recommended Reading: Refinance Usaa Car Loan