Can You Refinance A Car Loan

Yes, many lenders offer auto loan refinance opportunities, and several promise to make the process quick and easy. It can pay to refinance your loan in several different circumstances. For example, you might be able to improve your rate and monthly payment, shorten the term of your loan repayment, or extend the term if you’re having trouble making payments.

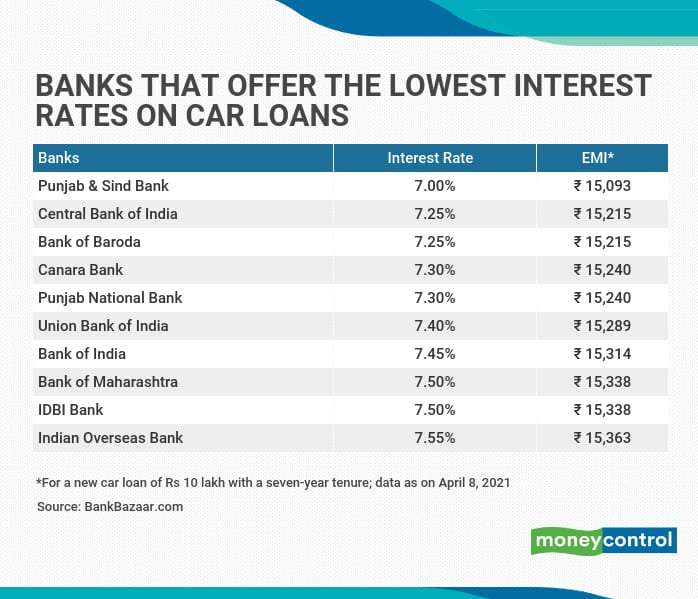

Top 10 Banks Offering The Cheapest Rates On Car Loans

A car loan is a one-time investment received by a bank or other financial entity to finance a car. The interest rate on a car loan varies by bank and is determined by your monthly salary, occupation, current EMI, credit score, and other factors. The interest rate that the bank will owe you on your loan must be the first and only concern you should consider before getting a car loan. There are various banks that have low-interest car loans. Borrowers who already have a relationship with a bank usually get loans at cheaper interest rates. So, if you’re just buying a car because you want to stop using public transit during COVID-19, find out the best car loan rates here.

Faqswhat Is A Car Loan

As the name implies, car loans in Malaysia is a category of loan taken by a borrower for the specific purpose of buying a car. By taking up a car loan, the borrower is obligated to repay the loan amount plus interest to the lender in instalments over a period of time. Failure to comply may result in the car being repossessed by the lender.

You May Like: Aer Loan Balance

Compare Auto Loan Providers

As mentioned, one of the simplest ways to find the best auto loan rates is to shop around. Do this before you get in the room with a loan officer at a car dealership. You can get as many pre-approval offers as you want, as long as you make sure they only require a soft credit check. When youre ready to go ahead with an offer, you can do a full loan application with the financial institution that gives you the best auto loan rates.

What Affects Loan Interest Rates

The rates above are average APRs based on information reported to the NCUA. You may find different rates based on a number of factors, including:

- A low score will require a higher interest rate, and vice versa. Credit score is perhaps the single most important factor lenders use to determine rates.

- Loan term: Shorter terms have lower interest rates. Consider making higher monthly payments to get a shorter-term loan with a lower overall cost.

- Lenders look at your entire credit report, so two people with the exact same score can find different rates based on how their score is calculated.

- Income: Lenders can have minimum income requirements for borrowers to qualify and also to secure the best auto loan rates.

- Down payment: A higher down payment not only reduces the total amount of the loan, but it shows that you are committed to purchasing the vehicle, and this can also reduce your interest rate.

- Interview process: If you impress a loan officer with professionalism and supporting documentation in discussing your financial situation, you may have a better chance of getting the best auto loan rates for your situation.

- Negotiation: If you get multiple pre-qualification offers, you can use those when negotiating interest rates from lenders.

- Autopay: Many lenders offer discounts for making automatic payments. Credit unions can also offer a discount if you pay for the loan with an account at that same credit union.

You May Like: Becu Auto Loan Payoff

If Youre Planning To Take A Car Loan Do Note That Most Lenders Would Finance Up To 80%

After months of setbacks due to the Covid-19 pandemic, the Indian automotive industry has started embarking on a recovery path ahead of the much-anticipated festive season. Top carmakers, including , Hyundai and Tata Motors, saw their year-on-year domestic sales grow by 37%, 26% and 101%, respectively, in July this year.

These trends are testament to the fact that many people are prioritizing buying a car to minimize public or shared transportation and avoid getting infected by the feared virus. Buying a car requires a lot of money however, many prefer using a car loan to finance their purchase especially when car loans are available at competitive interest rates that are usually slightly lower than personal loan rates.

If youre planning to take a car loan, do note that most lenders would finance up to 80%-90% of the cars on-road price for tenures up to seven years, while some banks could lend up to 100% of the cars valuation cost subject to terms and conditions. That being said, the car loan interest rate applicable to you would be determined by the lender based on your age, income, credit score, loan amount, etc, according to BankBazaar.

18 Top Banks Offering Car Loans Starting at under 8% p.a. Right Now

Data compiled by BankBazaar.com, an online marketplace for loans, credit cards and more.

Banks Offering The Lowest Car Loan Interest Rates Right Now

Buying a car is always exciting, and a major financial goal for many of us. Now, there are many ways through which you can fund your dream vehicle through own funds or with the help of financing facilities like a car loan, personal loan or even other types of secured loan products like a loan against property or a gold loan. Now, many prefer a car loan because that is usually available at lower interest rates than unsecured financing facilities like a personal loan.

However, before finalizing your decision, do note most lenders would not lend the full amount of the vehicle but only up to 85% of the cars on road price meaning, the balance amount has to be borne out of pocket. Also, car loans are usually available in tenures up to 7 years. And despite being a secured loan, lenders evaluate the loan applicants credit score to determine the applicable rate of interest. Plus, there is usually a processing fee thats charged according to the policies of the lender. However, some lenders offer concessional car loan interest rates to their existing home loan borrowers. Some lenders also extend pre-approved car loan offers to their selected customers, which could involve preferential rates and quick loan disbursal.

10 Banks Offering the Lowest Car Loan Interest Rates Right Now

Bank name

Also Check: What Car Loan Can I Afford Calculator

Choosing Between A Fixed Or Variable Rate

If you’ve done a little car loan comparing already, you may have seen the terms “fixed rate” and “variable rate” scattered about. Don’t just pick one at random though, as your choice can majorly influence how many dollars you end up paying back in interest or fees. Ultimately, the rate type you opt for should depend on how you intend to use your car loan.

Fixed rates

Let’s look at fixed rate car loans first, where the interest rate is guaranteed to stay that way for the entire loan term. So long as you follow your loan repayment plan, you will know exactly how much money will go to your provider in interest. On the downside, most fixed rate loan providers charge a fee when the total loan amount is repaid early, and many have limits on how much extra you can repay. This is why, when choosing a fixed rate loan, it’s important to select a term that aligns with how many years you want to spend paying off your loan.

Variable rates

Unlike the stability that comes with fixed rate car loans, the interest rate with variable rate loans can change over the course of your loan term in or against your favour. Don’t let that put you off, as they will rarely involve early loan repayment fees. So if your budget can handle a slight rate change, plus you want the opportunity to clear your debt whenever it suits, a variable rate car loan could right for you.

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Don’t Miss: How To Get An Aer Loan

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Car Loans For Bad Credit

Whether youre just starting out and have no credit history, or have simply made some credit mistakes along the way, its still possible to get an auto loan. Many lenders provide car loans for bad credit. If youd like to improve your chances of being approved or possibly get a lower rate now, consider adding a cosigner, making a large down payment or both.

A no-haggle, online experience could be extremely stress relieving. Read our full Carvana review.

WHERE IT MAY FALL SHORTYou cannot use a loan offer you got through Carvana to purchase a vehicle from any other seller.

You May Like: Is Bayview Loan Servicing Legitimate

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

Loyalty Programme Introduced By Hyundai For New Customers

A new loyalty programme known as Hyundai Mobility Membership has been launched by Hyundai. Individuals who buy a car on or before 13 August 2020 will be eligible to avail the membership. However, according to Hyundai, all existing customers will also be eligible for the membership in the next phase. The steps that are involved to enrol for the programme are installing the Hyundai Mobility Membership app are registration, interest selection, details of the vehicle, and completing the registration. Details such as the email ID, mobile number, and VIN are needed to complete the registration. The three categories of the programme are lifestyle, mobility, and core. Hyundai has entered into a partnership with several companies so that various benefits will be provided under the programme. Various needs of the vehicle such as tyres, oil, and accessories are provided under the programme.

18 August 2020

You May Like: Is Bayview Loan Servicing Legitimate

Providers With The Best Auto Loan Rates

In the table below are five top providers with the best auto loan rates in 2021. Based on our research, PenFed Credit Union currently offers the lowest annual percentage rate at 1.04%, and Bank of America and myAutoloan.com also offer some of the best rates and financing terms.

Be aware that the lowest rates are available for borrowers with the best credit. In other words, the minimum credit score is the minimum needed to qualify for auto financing from the particular lender, not to get the lowest interest rate. Also, interest rates change frequently. The information presented here is current as of the time of publication.

| Lender With Best Auto Loan Rates | Lowest APR |

|---|---|

| Good |

How Will Your Credit Score Affect Your Car Loan

The higher your credit score, the better rate youll receive on an auto loan. Borrowers with good credit can expect to receive an APR around 5.59% or lower for used car loans and 3.69% or lower for new cars. Its possible to get 0% financing from auto manufacturers, but 0% APRs are typically reserved for those with excellent credit and may only be available on certain makes and models.

Read Also: How To Transfer Car Loan To Another Person

Pros And Cons Of Low Interest Loans

If youre thinking of taking out a low interest personal loan, heres a look at some of the pros:

- Save money. Youll save money on interest payments with a lower rate, which means youll have more money to pay off your loan or buy whatever you want.

- Faster repayments. More of the money you put onto your loan will go towards your principal, so youll be able to pay it back faster.

- Easy process. With the advent of online loans, it can take under 10 minutes to apply for a low personal loan from start to finish. You can start by applying online, and then you can keep track of the loan online as well. If you prefer to apply in person at a store, find a lender that has a physical branch location near you.

- Repayment flexibility. A number of lenders allow you to make repayments according to how frequently you get paid. If you can repay your loan ahead of time without being subject to an early payout penalty, you can save on fees and interest.

- Rebuild your credit. If you have less-than-perfect credit, a personal loan may be a great opportunity to rebuild your credit score as long as you stay committed to making your repayments on time.

Low interest personal loans also come with some downsides to be wary of:

Best For Used Cars: Chase Auto

Chase

Chase Auto offers the security of a stable financial institution with competitive rates, high loan amounts, and a concierge car-buying program that makes it easy to get the best rates and financing options for a used car.

-

Pre-qualify with a soft credit pull

-

Car-buying and car-management services

-

0.25% discount for Chase Private Clients

-

Must finance from a Chase network dealer

-

New application needed when switching dealers

Chase Auto is the car financing arm of J.P. Morgan Chase & Co., the largest bank by assets in the U.S., and allows users to shop for, finance, and manage their vehicle all from one account.

Although Chase Auto doesnt list rates online, it has a calculator that will allow you to get an idea of your potential rate. Chase also offers generous loan amounts ranging from $4,000 to $600,000 and 24 to 72 months flexible repayment terms.

Chase Auto doesnt require you to make a down payment for a loan, though putting money down can reduce the total amount you need to borrow and your monthly payments. You can also get a 0.25% interest rate discount as a Chase Private Client, which requires you to have a minimum average daily balance of $150,000 in qualifying personal, business, and investment accounts or a Chase Platinum Business Checking account.

You May Like: Loan Originator License California

Keep Your Loan Term Short

Signing up for the shortest auto term possible when buying a car reduces the interest paid over time. Keeping your loan to 60 months or less if you can afford it is optimal. Theres no way around that fact that the longer the term of your loan, the more interest youll pay. Instead of just looking at monthly payments, make sure you understand the total cost of the car in various scenarios: the 60-month loan versus the 72-month loan, for example. A shorter term will save you money over the life of the loan.

Get Your Documents And Information Ready

This list relates to applying for conditional approval the first stage of getting a Westpac Car Loan.

If youre already a Westpac customer, youll need to:

- Apply as an Existing Customer in the application form and log in to your account

- Once logged in, double-check that your personal details are up-to-date. If not, log in to internet banking to update them and allow 24 hours for the records to update before you apply.

Whether or not youre already with Westpac, before starting your application, make sure you have everything in the list below:

- Current employers name, address and phone number

- Your income information from the last 3 months, such as payslips, bank statements and rental income

- Recent tax information if you’re self-employed

- Asset, savings and investment details

- All existing liabilities that are in your name

- All your regular monthly expenses

Read Also: Do Pawn Shops Loan Money