Whats A Normal Interest Rate For A Car Loan

Asked by: Bella Glover

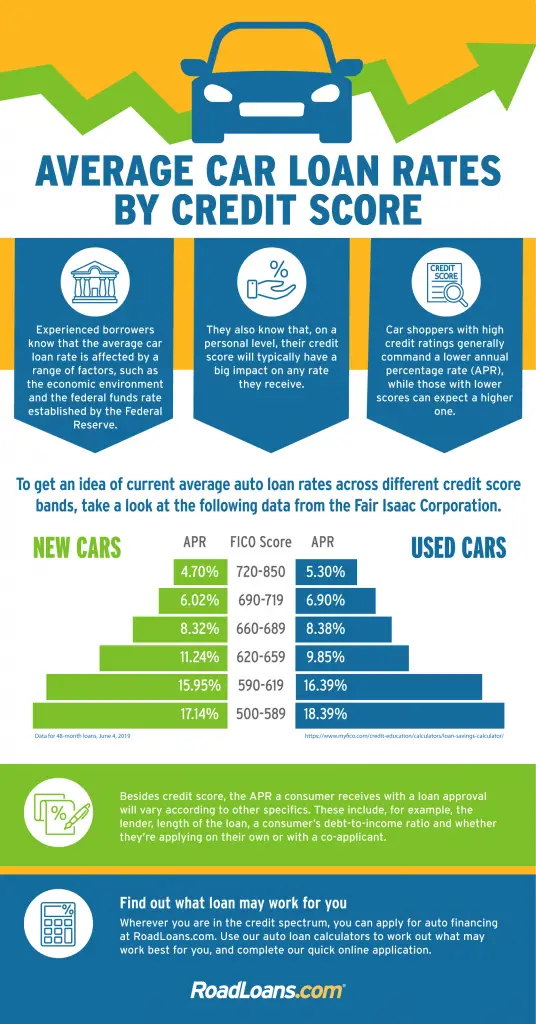

The average auto loan interest rate is 4.09% for new cars and 8.66% for used cars, according to Experians State of the Automotive Finance Market report for the second quarter of 2021. With a credit score above 780, youll have the best shot to get a rate below 3% for new cars.

sometimes even 0%likely be considered a good APR5.07% for a new carFICO Score 833 related questions found

Know Exactly What You Can Afford

While it’s important to take your time to find the best deals available, it’s crucial that you make sure your new car payment works for your budget.

To determine how much car you can afford, factor in all of the costs that come with buying and owning a car, including:

- Loan payments: This includes both the principal amount of the loan and its interest charges. Your loan amount will include your vehicle’s sales price as well as taxes, fees and add-ons like service contracts. What you’ll pay every month depends on your loan amount, loan term and interest rate.

- Auto insurance: A lot of factors go into deciding your insurance premiums, including the make, model, age and condition of your vehicle. Get a quote from an insurer to find out what to expect. In many states, your credit score is another factor that determines what you’ll pay for insurance.

- Maintenance and repairs: Every car requires maintenance and repairs over time, but the older the vehicle, the likelier it is that you’ll have these expenses on the regular. Buying an older car may save you upfront costs but you’ll have to plan for when things may go wrong.

- Fuel: Depending on how much time you spend behind the wheel and the fuel economy of your vehicle, run some numbers to determine how much you’ll be paying in gas.

When Your Credit Health Has Improved

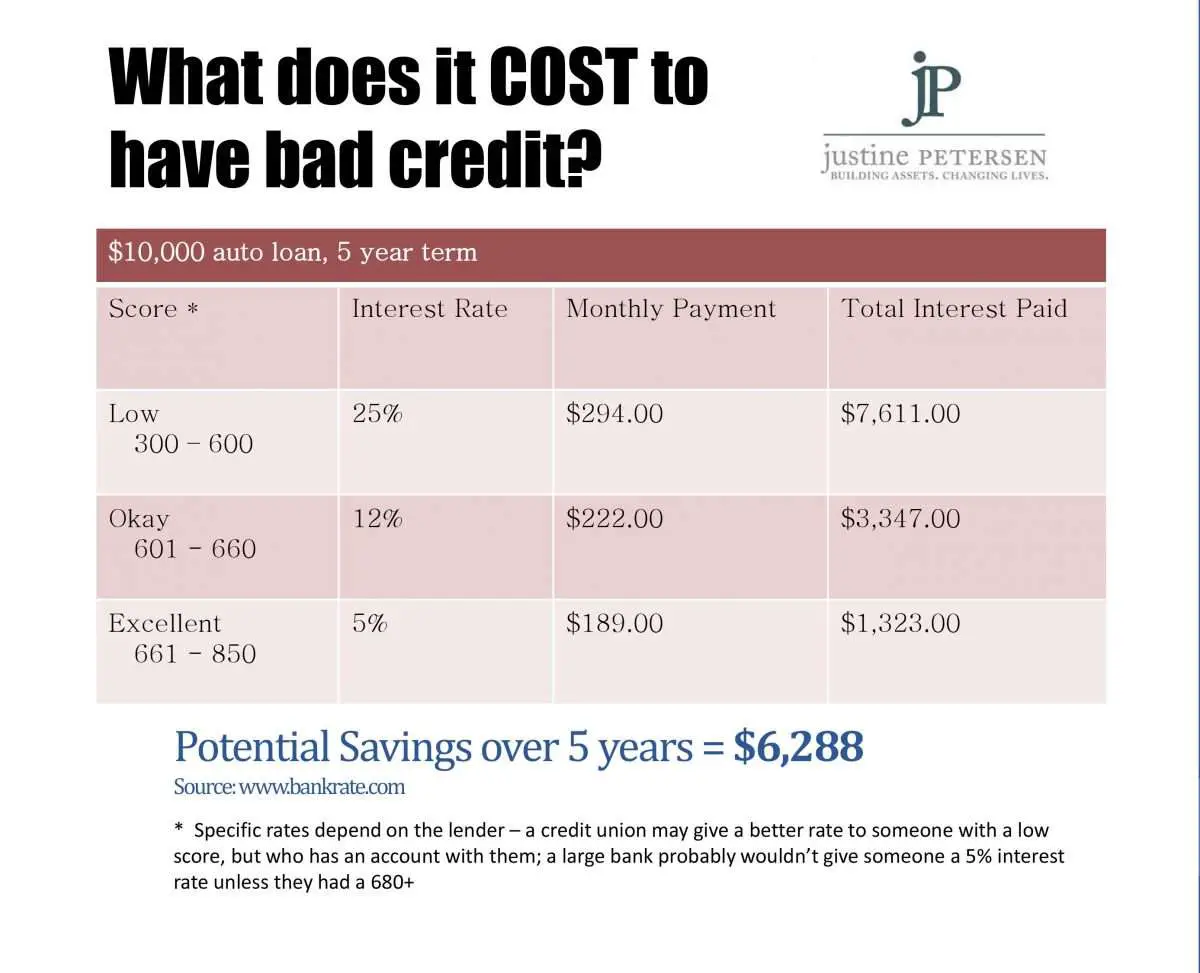

Your credit scores are a factor in determining your auto loan rate. If your scores have gone up since you bought the car, and youve made on-time car payments, you might get a better rate, which could save you money in interest over the life of the loan.

Lenders may use your FICO® Auto Scores or base credit scores to help determine your creditworthiness. But no matter which they use, better credit scores can indicate to lenders that youre more likely to pay off your loan, so they may give you a lower rate.

Not sure if your scores have improved? On Credit Karma, you can get your free VantageScore 3.0 credit scores from TransUnion and Equifax.

Recommended Reading: Stilt Loans

Tighten Up Your Credit

The terms of your loan are based on your . If you have perfect credit, you receive the lowest possible interest rate. If you don’t, you have to pay more because of your questionable repayment history. If you have problems with your credit and you don’t need to purchase a car right now, consider waiting until your score increases. Just a small increase in your interest rate can save you a lot of money over the life of your loan.

What Happens If I Extend My Loan Term

Extending the length of your loan when you refinance will lower your monthly payments. However, you likely wont save money because youll pay more in interest over the life of your loan.

Extending your term could also put you at risk of becoming upside-down on your loan, meaning you owe more than your car is worth. This is a risky situation to be in. If you get in an accident, and your car is totaled, your insurance might not cover what you owe. Also, if you have to sell your car, youd still owe money on the loan.

To recap our selections

Dont Miss: Best Fha Refinance Lenders

Don’t Miss: 600 Credit Score Auto Loan Interest Rate

Is 7 Percent Interest Good For A Car

Asked by: Abe Nikolaus

According to Middletown Honda, depending on your credit score, good car loan interest rates can range anywhere from 3 percent to almost 14 percent. However, most three-year car loans for someone with an average to above-average credit score come with a roughly 3 percent to 4.5 percent interest rate.

Ready To Find Your Next Auto Loan

Whether you’re shopping for the best interest rate before you buy, or are ready to find something with a more affordable price tag than what you’re driving, CarsDirect wants to help.

You can research new and used cars on our site, and when you’re ready, you can fill out our free auto loan request form from the comfort of home. Once you do that, we’ll get to work matching you to a special finance dealer in your area that’s signed up with subprime lenders who are ready to help get you into the vehicle you need!

Also Check: Usaa Refinance Student Loans

Sell Privately And Buy A Less Expensive Car

If you want to earn even more for your ride, consider selling it privately. You will need time and patience, but you could maximize your cost savings since private sales generally mean more money in the sellers pocket. In turn, you will have more to put down on your new car purchase.

Word of caution: Theres a shortage of cars available for sale nationwide. So, whether youre planning to buy a less expensive new or used model, you may have to do some legwork to find a vehicle that works for your budget.

Get A Longer Loan Repayment Term

A lender will likely show you what your monthly payments will look like with different loan terms . The longer your loan repayment term is, the lower your monthly payments will be because theyre spread out over a lengthier period of time.

But a longer loan term means youll pay more in interest over the life of your loan, and you run the risk of going upside-down on your loan. You may find yourself owing more than your car is worth because its value depreciated quicker than you could pay off your loan.

Recommended Reading: Upstart Second Loan

Shop Around With Different Lenders

Many lenders will show you your preapproved rates and terms online after you fill out and they generate a soft credit pull. Taking the time to get quotes from different lenders, both national and local, will give you more leverage in negotiations because you’ll understand the going rates with your particular credit score for the car you’re interested in.

Don’t just take into account the listed interest rate calculate the total interest you’ll pay over the life of the loan based on your overall loan amount and term length.

While this may sound simple, a lower overall price will reduce the amount of interest you’ll pay on the loan.

You can reduce the sales price by declining add-ons like seat warmers and rear seat entertainment systems. You may also get a lower interest rate on a new car than on a used car, as used cars often have more mileage, expired warranties, and increased wear and tear. Lenders bake the increased risk of mechanical breakdown into the interest rate.

Get Car Financing Online Instantly Instead Of Through A Car Dealer

Over the years the savviest visitors to our site wait until their credit score improves, then they obtain pre-approval instantly from online auto loan sites such as LightStream.

What is the benefit to you and I from applying for car financing online? You get your financing ducks in a row before ever stepping foot into the car dealer. We bypass the car dealer and get much better interest rates online.

Unless you are approved for one of those rare 0% loans subsidized by the car manufacturer, you could be paying high APR interest rates through the car dealer’s financing.

Quite often the efficient online car finance sites with lower overhead beat the rates of the car dealers and some lenders deposit the loan money right into your bank account to use for buying your new car.

Compare that to applying for your car financing at the dealer, where they will sometimes call a week later to tell you the deal fell through because their lender rejected you.

This nonsense never happens with online lenders. You are in control here, not the car dealer. You get your answer a yes or no right away and no games. Once approved, you car loan money is in your account quickly or a check is sent via overnight delivery.

Recommended Reading: What’s Needed To Qualify For A Home Loan

Option : For Your Next Car Purchase Buy Used To Lower Your Monthly Payment By $136

Most of us have heard that the moment you drive your shiny new car off the lot, it loses 10 to 20% of its value. Nothing much has changed except that now youre the owner of a used car. While the rapid depreciation in new car values is annoying to new car owners, it is good news for used car shoppers. Cars are now more reliable and last longer than ever before. All of this means that used cars are better options for many of us than theyve ever been. And heres the best part. The average monthly payment on a used car is about $400, while the average monthly payment on a new car is roughly $536. That $136 difference can help a lot.

When You Shouldnt Refinance Your Car Loan

If youre in the middle of shopping for a personal loan, mortgage or other financing option, now is not the right time to refinance your auto loan. Applying for a loan would hurt your credit score and possibly cause you to receive a higher interest rate on any loan offers.

If your current auto loan has a prepayment penalty, then refinancing could incur that penalty. Depending on the penalty and your current interest rate, it may not be worth refinancing. If youre not sure whether your loan has a prepayment penalty, look up the loan contract or call the lender and ask them. Some prepayment penalties only apply if you recently took out the loan, so its best to verify over the phone or through documentation.

You May Like: Do Private Student Loans Accrue Interest While In School

Bank Of America Reviews

Bank of America has a strong standing within the industry, holding both accreditation and an A+ rating from the BBB.

When it comes to customer reviews, the company doesnt fare as well. Bank of America has almost a 1.1 out of 5.0-star rating from consumers on the BBB website and a 1.4-star rating out of 5.0 from customer reviews on Trustpilot.

However, it is important to note that reviews are for the company overall and are not specific to its auto loans division. Even though a number of Bank of America customers complain about high fees and frustrations with phone support, many also report positive experiences with the company, usually pointing to user-friendly online interfaces and supportive customer service.

Our team reached out to Bank of America for a comment on its negative reviews but did not receive a response.

Consider Interest And Repayment Terms

Choose the loan that offers you the lowest interest rate and most acceptable payment terms. If its your existing loan company, ask for the new loan terms in writing and sign the new loan obligation. If youre changing companies, schedule an appointment with the new loan officer to complete your refinance.

Also Check: Www Upstart Com Myoffer

What Is A Good Interest Rate For A Car

According to Middletown Honda, depending on your credit score, good car loan interest rates can range anywhere from 3 percent to almost 14 percent. However, most three-year car loans for someone with an average to above-average credit score come with a roughly 3 percent to 4.5 percent interest rate.

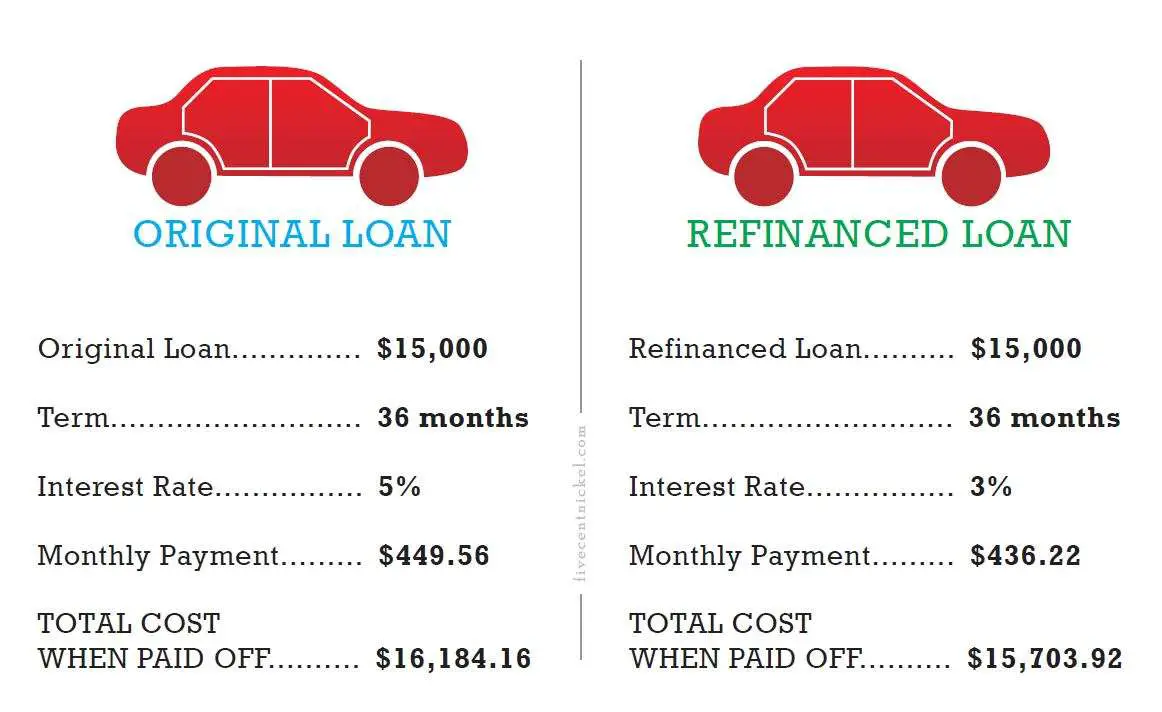

Refinancing Your Car Loan

If you’re not able to qualify for an interest rate that’s as low as you’d like, you may have the option to lower your rate later. If you took out a bad credit auto loan with a high interest rate, it’s been over a year, and your credit has improved, you may be able to refinance at a lower rate.

Refinancing is typically done to reduce your monthly payment. This can be accomplished in two ways: by lowering the interest rate or extending the loan term. A lower interest rate is the best way to save when you refinance. It lowers the monthly payment, as well as reduces the interest charges and overall cost. Extending your loan term lowers your monthly payment, but it increases the interest charges, and costs you more over the loan term.

If you cant qualify for refinancing but still need a lower payment, you might consider trading in your vehicle for something more affordable.

Don’t Miss: Restoring Va Entitlement After Foreclosure

Trade In Or Sell Your Car For A Cheaper One

Trading in or selling your car for a less expensive car with lower payments might help you avoid late or missed payments or defaulting on your car loan.

Heres what you need to know if you decide to go down that route:

- Research: Learn the value of your car using online tools like Kelley Blue Book before you put your car up for sale. Its a good way to figure out how much money youll potentially have to put toward paying off your loan.

- Talk to your lender: Let them know that you plan on selling your car. Theyll tell you how much youve got left to pay off the car loan because spoiler alert you still need to pay off your loan even after you sell your car. If your lender placed a lien on your car, which is the lenders right to own your car until your loan is paid off, that might complicate the sale for you because you technically dont have the right to sell the car. So make sure youre not violating your loan agreement. Work with your lender to figure out what steps you need to take to legally sell your car.

- Pick your selling option: There are many ways to sell a car, and some are more convenient than others. You may be able to sell through an online service like Carvana that will pick your car up from your house. You can sell it to a dealership or sell it privately. A private sale might even get you more money for your car.

Cons Of Refinancing An Auto Loan

- Paying more in interest: If you extend the term of your loan, you will end up paying more interest over the life of the loan. Use our auto loan calculators to help you determine if you will end up saving enough money overall for refinancing to be a good choice.

- Paying a higher rate: Freeing up cash fast may sometimes be the only reason for pursuing a refinance. But be careful of higher interest rates. Many lenders charge higher rates on older vehicles, starting anywhere from 5-10 years old. If your car is older, you may be surprised the interest rate you qualify for now compared to when you first financed the vehicle.

Its important to consider all of your options and do your research before deciding you are ready to refinance. Shop around for interest rates so you can be sure you are getting a good deal that will help you save money. Also consider the length of the loan, and try keep it as short as you are able to with your budget. Try to find the shortest loan term combined with the lowest interest rate to ensure you are getting the best deal possible on your auto loan refinance.

Refinance and save with Robins Financial to drive home your savings. To find out how much you could save, give us a call or request an appointment at any of our branches. If youre ready to refinance, apply online today.

Read Also: Does Upstart Allow Co Signers

Lowering Interest Charges On Your Auto Loan

You dont have to refinance to save some money on interest charges, though. Auto loans are typically simple interest loans, which means youre charged interest daily on what you owe. This means that after each payment, theres less to be charged interest on. The faster you pay off the vehicle, the less interest youre charged.

Making some lump sum payments lowers your loan balance and decreases the amount youre charged interest on. Additionally, you could also pay a little extra each month when you can. Or, you can make extra car payments whenever youre able to. Anything you can do to lower your auto loan balance more quickly helps.

If youre about to take out a car loan, and you dont have the best credit, you can be proactive. A way to mitigate the amount of interest youre going to be charged is to prepare a sizable down payment and opt for the shortest loan term you can afford. Bad credit and long loan terms can spell lots of interest charges and often long loan terms mean paying way more than the vehicle is worth!

Pros & Cons Of Refinancing Your Auto Loan

When buying a car, many buyers accept the loan package they are offered at the dealership. Though convenient at the time, you may later come to regret the conditions of your auto loan once youve started making payments. Refinancing your auto loan is one way to get better terms and potentially reduce your interest rate and monthly payments, helping you save more money. An auto loan refinance involves taking out a new loan to pay off the balance of your existing loan, and transferring the title to the new lender. While refinancing your auto loan can improve your overall finances, it may not always be the right choice for you. There are a few things to consider before applying for an auto loan refinance.

You May Like: Signing Loan Agent