What Other Factors Do Lenders Consider For A Business Loan

While your personal credit score is an important consideration when youâre applying for a small business loan, itâs not the only factor that lenders consider. Things like assets, time in business and annual revenue also come into play. Hereâs a list of other things â besides credit score â that a lender may look at before approving your loan application:

Watch: 4 Tips To Boost Your Chances Of Approval

Top reasons SBA loans are rejected

Worried you wont get approved? Here are the top reasons the SBA rejects applications.

- Poor credit can cause an issue. While the SBA doesnt have any credit cutoffs, most lenders still prefer to work with business owners that have good to excellent personal credit scores. With that said, a past bankruptcy that youve recovered from wont necessarily hurt you, as long as theres a reasonable explanation.

- Past felonies, current criminal proceedings or still being on parole can disqualify a business from getting an SBA loan. You dont, however, typically need to worry about lower-level crimes from 20 years ago or traffic tickets.

- Student loan defaults by a major business owner or defaults on any federal loan could disqualify your business.

- Too many assets may also be a problem. The SBA wants to see that your business has made a real effort to get financing elsewhere, including tapping into some personal or business assets. This doesnt mean you have to go broke, but that you dont have a goldmine you could use but arent.

You May Like: How Long Do Sba Loans Take To Get Approved

Best Line Of Credit: Lendio

Lendio

If you need flexible financing, consider a small business line of credit with Lendio. Youre not obligated to use all of the funds, and you wont pay for the funds you dont use. Many people consider a line of credit like a safety netits there if you need it.

-

Only pay interest on the funds you use

-

Application takes just 15 minutes

-

Must have $50,000 or more in annual revenue

-

Funding takes one to two weeks

-

Loan terms of only one to two years

Lendio is a small business lending marketplace launched in 2011 that matches businesses with 75+ different lenders to secure the funding they need. Because Lendio doesnt originate the loan, you receive multiple offers and can pick the one that best matches your needs. This is the best line of credit option for small business owners with bad credit because you only need a 560 credit score and you have no obligation to use all of your funds. Plus, you pay nothing on those unused funds.

Line of credit applications take 15 minutes and are a great option for businesses at least six months of age with $50,000 in annual revenue. Business owners must have a credit score of 560 and be willing to wait up to two weeks to receive funding. Loan terms offered are one to two years.

Your repayment amount and frequency depend on the final lender you choose. However, the longer youve been in business and the higher your credit score, the lower your payments will be.

Also Check: Suntrust Auto Loan Customer Service

Writing A Business Plan:

One extremely important aspect of any SBA loan package is the written business plan. Your business plan, which covers 10 essential elements of your business, gives lenders insight into your overall business structure as well as revenue projections and market position. If you are funding a start-up, you should have detailed insights and research into the current market and well thought-out financial projections. If youre acquiring an existing business, your plan should speak to the last five years of performance and how you plan to adjust for any shortcomings.

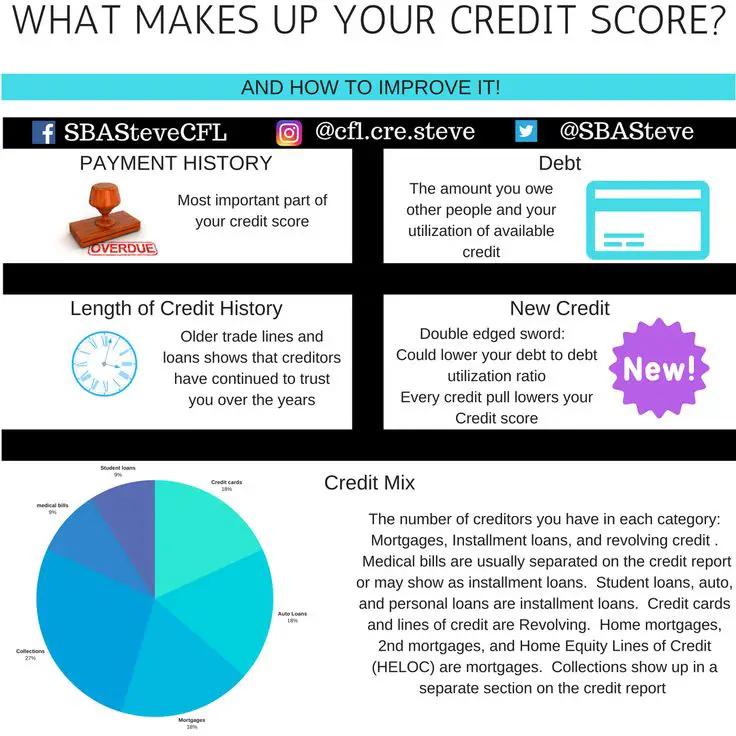

How Does This Information Translate Into A Credit Score

The credit bureaus us the basic FICO formula to score the information they collect about you. They also capture your personal information like name, date of birth, address, employment, etc. They will also list a summary of any information reported to them by your creditors. You should be aware that other information available within the public record like judgments or bankruptcy will also be included on your credit reports and factored into your personal credit score. Whats more, any time you apply for additional credit will also be reflected on your credit report.

If there is something that is incorrect, the credit bureaus all offer a process to make corrections of verifiable errors. And, if there is something you feel requires additional information to describe an extenuating circumstance or otherwise provide context to something negative on your report, additions made to the Fair Credit Reporting Act in 1996 allow you to add a 100-word statement to any of the reports that include an item you dispute but wasnt removed because it was verified by the creditor. Sometimes circumstances like a divorce, a prolonged illness, or job loss could explain a negative credit score. This gives you the opportunity to make sure potential creditors see that information.

When a potential creditor looks at your score, heres what they see:

Don’t Miss: Guaranteed Loan For Bad Credit

What Types Of Loan Programs Does The Sba Provide

SBA loans are simply small business loans partially guaranteed by the Small Business Administration. Instead of offering these business loans, the SBA partners with lenders who provide them. The partial guarantee the SBA provides makes these loans attractive to lenders.

The SBA currently offers borrowers 3 types of loan programs:

1. SBA 7 Loans

This is the most common SBA loan program for small businesses that includes help for those needing special assistance. There are various types, including Standard 7, 7 Small Loan, and SBA Express. Theyre ideal for business purchases involving real estate. They can also be used for working capital, refinancing debt, and buying business fixtures and supplies. The maximum loan amount is $5 million.

2. SBA 504 Loans

SBA 504 loans are long-term, fixed-rate loans of up to $5 million used for buying fixed assets. You can access these SBA loans through Certified Development Companies . CDCs are SBA non-profit partners who promote economic development in the community.

3. SBA Microloans

Microloans are the SBAs smallest loan program businesses can use to get up to $50,000 worth of funding. Administration of these SBA loans is through designated intermediary lenders .

Breaking Down The Minimum Credit Score Requirement For Sba Loans

SBA loan programs make it easier for small-business owners to access the capital they need by reducing lender risk. The SBA guarantees up to 80% of the loan amount when the lender approves the loan this provides extra assurance that the lender can get paid even if the business goes bankrupt or closes.

How Much Do You Need?

Don’t Miss: Does Refinancing Car Loan Hurt Credit

Stay In The Know In Order To Meet Sba 7 Credit Score Requirements

Getting approved for your first business loan can be a slippery slope for any number of reasons. You may not have established a payment history, for instance. Or, perhaps you were caught unaware when equipment fixes cut into your cash flow, causing you to miss some payments.

Some advice for business owners is to stay on top of your credit scores so that you know where you stand. And if you get caught with unexpected expenses, keep paying your bills when theyre due even if its below the minimum amount.

Keep your personal and business accounts separate, so any personal credit blemishes dont spill over into your business score. Keep expenses low and strive to operate at a profit. These steps could go a long way with lenders and toward meeting SBA loan requirements in terms of credit score.

asdfad

Whats The Minimum Credit Score For A Small Business Loan

Listen To This Article

This post was originally published on February 3, 2020. It has been updated to include even more information about the minimum credit score for a small business loan.

Your personal credit score can make or break your chances of qualifying for the right business loan. Traditional lenders restrict funding access to those with scores at or above a given minimum, while fintech lenders generally offer options to all credit profiles. But whats the required minimum credit score for a small business loan?

While credit score is far from the only requirement when you apply for a loanand you can qualify with a score on the lower sideits important to be aware of your score, and what that means to lenders.

Don’t Miss: Can You Get Another Va Loan

How To Get A Business Loan With Bad Credit

The process of applying for a business loan varies by financial institution, but most banks and online lenders impose similar requirements. That said, its more difficult to get a business loan with bad credit, so there are some additional steps to take before submitting a formal application. Follow these steps to get a business loan with bad credit:

How Can You Improve Your Business Credit Scores

If your credit scores are too low to qualify for the financing you want, there are steps you can take to improve your credit scores.

- Monitor: Take a look at your credit scores and credit reports to see what needs work.

- Dispute: Dispute errors on your credit report with the responsible credit bureau.

- Pay debts:Pay off your existing debts as quickly as you can to reduce your credit utilization . Consolidate debt or negotiate new loan terms with lenders to make debt repayment more manageable.

- Make on-time payments: Paying your bills on time is probably the most important step to improving your credit scores.

- Borrow responsibly: Keep business credit card balances low going forward and dont borrow more than you can afford to repay.

- Diversify credit: Although credit mix doesnt account for much of your score, it can help boost your scores in addition to managing your credit responsibly .

- Build credit: Build credit by becoming an authorized user on a consumer credit card, getting a credit builder loan, getting a secured credit card or opening new tradelines with vendors, suppliers and lenders.

- Increase business revenue: This is more for your business credit score than your personal, but increasing your revenue and demonstrating financial stability can help boost the Financial Stability Score of your business.

Continue to monitor your credit reports and scores often. Catching errors early may help prevent your scores from dropping unnecessarily.

Also Check: What Is Equity Reserves Fha Loan

What Credit Score Do You Need For An Sba Loan

The Small Business Association does not specify a minimum credit score required to secure an SBA loan. However, SBA loans are provided by lenders who may have minimum score requirements. Typically, this minimum is 620 to 640. However, the higher your score, the more likely you are to receive approval.

Sba Caplines Program Requirements

The SBA CAPLines program is a line of credit to help you cover short-term or seasonal working capital needs. You can get up to $5 million and continue to use the funds as you repay them.

There are four types of SBA CAPLines, including contract loans, seasonal lines of credit, builders lines, and working capital lines of credit. Each type is designed to fill various cash flow needs and has unique requirements.

The seasonal lines of credit, for example, require that you solely use the funds on seasonal increases of accounts receivable and inventory. No matter which type of SBA CAPLine you choose, however, youâll likely need a minimum credit score of 660 to qualify.

You May Like: What Is The Highest Fha Loan Amount

Other Sba Loan Requirements

Your credit score is just one aspect of your borrower profile. Even if you have an amazing credit score, the SBA still wants to see that you have the business acumen to keep your company afloat for an extended amount of time. They also want to see that your revenue can support your business as well as service your debt.

Whats the mean in practice?

The SBA may have minimum monthly or annual revenue requirements and could also require that youve been in business for a few years. The exact requirements vary between programs, so go take a look at our SBA Loan Requirements: What You Need To Know About Qualifying For SBA Loans feature.

Why Do Credit Scores Matter When Applying For A Small Business Loan

Your credit score is the quickest way for lenders to measure your potential risk as a borrower. If youve historically been unable to repay your debts, banks and other lenders have no reason to believe youll repay their loans. By contrast, your financial history could show that you pay your bills on time and you havent experienced considerable financial challenges such as bankruptcy. The result is that youre more likely to qualify for loans because youve demonstrated your ability to pay them back.

Additionally, some lenders will offer better terms to applicants with higher credit scores. For example, lets say youre applying to a loan that requires a minimum credit score of at least 650. Were your credit score 650, youd qualify, but youd probably get a good-but-not-great deal. Were your score 800, youd likely qualify for the most favorable terms long repayment periods, low interest rates, and more.

Also Check: How To Get Out Of Your Upside Down Car Loan

How We Chose The Best Small Business Loans For Bad Credit

We looked at 19 of the best small business loans available and narrowed it down to the best six options for bad credit based on several features and considerations. We considered rates, credit score requirements, loan amounts, and repayment terms. Reviews of customer service, sales, and ease of use weighed heavily into our decisionobtaining a small business loan should be a pleasant, stress-free experience for business owners.

How Do You Apply For An Sba Loan

Step 1: Check Eligibility

Review the general SBA loan requirements and lender requirements. Heres a recap:

General SBA Loan Requirements: Do I Meet the Following Loan Requirements?

Underwriting Requirements: Am I Likely to Meet Lender Requirements?

While requirements and exact loan terms may differ slightly between lenders, most will look at the following:

Step 2: Choose Your SBA Loan Based on Your Financial Needs

Ask yourself the following questions:

Step 3: Find a Suitable SBA Lender

Find a suitable lender using the SBAs match tool. Heres how it works:

Read Also: How To Lower Student Loan Payments

What Is A Bad Credit Score

Lenders typically look at a business owners personal credit score and business score when evaluating a business loan application. However, for startups and other businesses without a credit history, the applicants personal score is even more important.

A business owner should have a personal FICO Score of at least 500 to qualify for a bad credit business loan. That said, even a FICO Score under 670 is considered fair or poor, and likely wont qualify a business owner for the most competitive interest rates available.

Can A Small Business Get An Sba Loan With Bad Credit

In short: yes. However, the answer to this question significantly depends on the lender. If the lender finds your business or personal credit score unacceptably low, your SBA loan application will not be approved and vice versa. However, if your business credit score is lower due to a one-time event or business crisis as opposed to frequently late on paying your loans, the lender may be lenient and open to approving your SBA loan.

Other factors that influence your ability to get an SBA loan include the number of years youre in business. If youve been in business for a decade or more, you may still get approved even though your business credit score is lower. If youre a new business or startup that doesnt have a long history of track record, a lender is less likely to loan money to you. That said, you can increase your chance of obtaining a SBA loan when your business establishes a healthy payment history.

Overall, your chance of getting an SBA small business loan with a bad credit tremendously varies depending on the lender. If the financial institution is more conservative, youre less likely to get an SBA loan with a bad credit. If you do get approved with a low credit score, your interest rate is likely to be higher than the interest rate of a borrower that has a high credit score.

Read Also: What Do I Need To Get Loan From Bank

Small Business Loan Credit Score Requirement

Opening new credit lowers the average length of your total accounts, which in turn, affects your length of credit history. If you already know what your credit score is and you want to apply for an SBA loan, the first thing you have to do is find an SBA -accredited lender you are comfortable working with.

SBA-qualified lenders usually set their own criteria when assessing your eligibility. Most lenders will require a minimum FICO score of 620 or higher for their SBA Loans. There are no fixed SBA loan credit score requirements since there are different types of SBA loan categories available for you.

Also, the minimum small business loan credit score requirement goes beyond your credit score. SBA lending does require you to meet certain qualifications and youll have to be patient because it can take time for you to get the loan.

Ready to apply for an SBA Loan?