S To Getting Approved For An Fha Loan

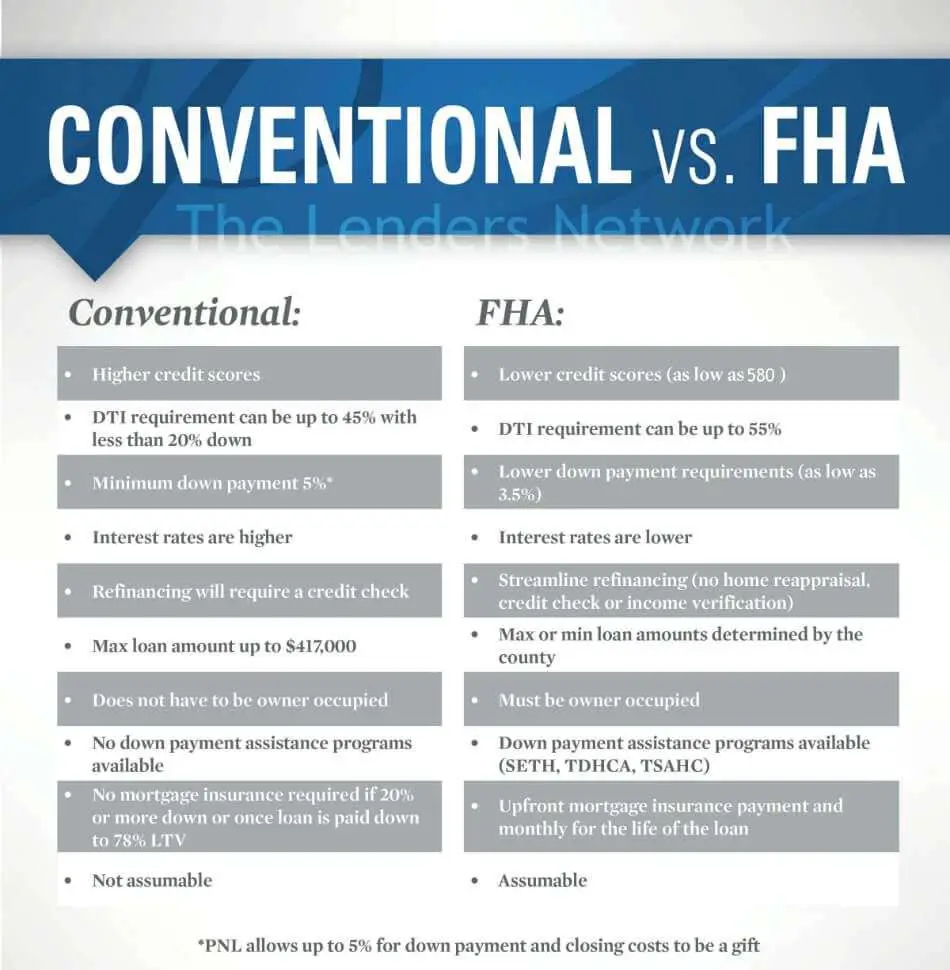

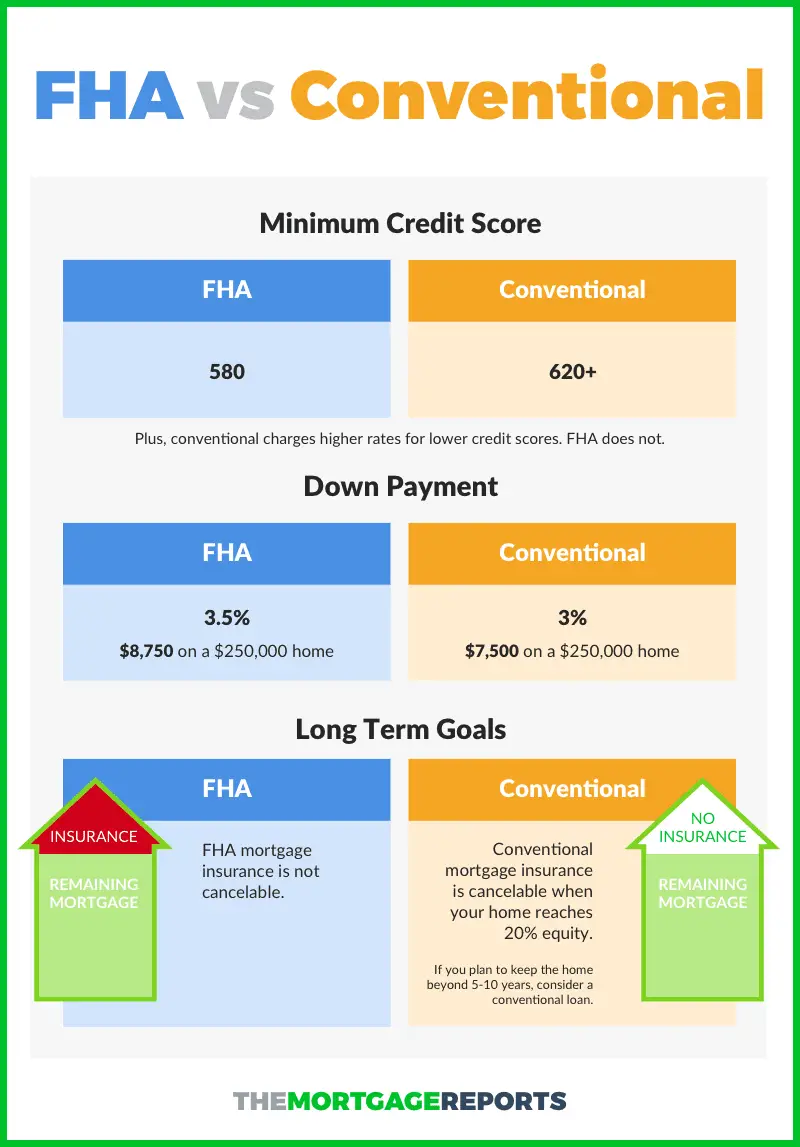

Step 1: Decide if an FHA loan is the right fit for you. The first step in the FHA process is determining whether this type of loan truly suits your needs. If youre having trouble qualifying for a conventional mortgage, either because of an imperfect credit score, high debt-to-income ratio, or limited down payment savings, an FHA loan might provide a feasible path to homeownership. Review the qualifications above to get a sense of whether you meet the minimum requirements for FHA borrowers, and then take a look at your credit score and savings to see what kinds of specific FHA lending options might be available to you.

Step 2: Choose which lender you want to work with. Keep in mind that there are more conventional loan lenders than approved FHA loan lenders, so you may need to do some research before finding one. Better Mortgage offers both options and our FHA loans are available in all 50 states. As a digital lender, weve eliminated unnecessary processing, origination, and commission fees that can drive up the cost of working with traditional lenders. On top of that, our online tools make it easy to instantly compare loan products and see detailed estimates to understand how different down payment amounts and interest rates impact the overall affordability of any mortgage. Note: if you apply for an FHA loan with Better, youll need a 620 minimum credit score.

Fha Vs Conventional Loan Comparison Table

Here’s a rundown of how each of these categories stack up:

| Factor | ||

|---|---|---|

| 580 with a 3.5% down payment, 500 with a 10% down payment | 620-720, depending on the situation | |

| Down payments | 3%-25%, depending on the situation | |

| Interest rates | Depends heavily on the borrower’s credit score | |

| Uses | 1-4 unit properties, but only for owner-occupied homes | 1-4 unit properties, owner-occupied homes, vacation homes, and investment properties |

| Standard loan limit | ||

| Costs | Upfront mortgage insurance and ongoing premiums for the duration of the loan | PMI required, but only for down payments below 20%. Only ongoing premiums, and can be dropped when you reach an 80% loan-to-value. |

So Lets First Look At What A Conventional Mortgage Is

The word Conventional generally means something thats more common or typical, something that a majority of the people do. Now almost two-thirds of the borrowers in the US have a FICO that is higher than 620. When you belong to that group , you are amongst the majority and can get what is called a Conventional Loan. You get favorable rates because you are more likely to pay back the lender the amount you owe than those that have lower scores.

Read Also: How To Calculate Amortization Schedule For Car Loan

About The Conventional 97 3% Down Payment Program

The Conventional 97 loan is another low down payment option available to todays mortgage borrowers.

Available via Fannie Mae and Freddie Mac, the program was recently retooled to be cheaper and easier to use.

For example, as compared to the original Conventional 97, the newest version is available to first-time buyers and repeat buyers alike, where first-time buyer is defined as a person who has not owned a home in the last three years.

This definition of first-time buyer means that consumers who lost a home to foreclosure last decade can be Conventional 97-eligible under the programs new rules.

Furthermore, because Conventional 97 allows for cash gifts for down payments, home buyers are not required to make a down payment from their own funds. Monies may be 100% gifted from parents and relatives. The only requirement is that the gift is actually a gift down payment loans are disallowed.

For eligible borrowers, the rules of the Conventional 97 program are straightforward.

The Conventional 97 program requires a minimum downpayment of 3%, only 30-year fixed rate mortgages are allowed, and the loan must be used for a primary residence.

Beyond that, there is very little to distinguish a Conventional 97 loan from any other conventional mortgage type. Borrowers are required to verify income and employment; the program can be used to refinance a home; and, home buyer counseling is not required.

Who Should Not Get An Fha Loan

Borrowers turned off by the loan limit may find FHA mortgages too restrictive.

Likewise, most lenders recommend your monthly mortgage payments should not exceed 31 percent of your gross monthly income. Some private lenders offering FHA loans may allow up to 40 percent. If either of those rates proves to siphon too much of your monthly income, an FHA loan still may not be right for you.

Read Also: Are There Student Loan Forgiveness Programs

Final Word: Is An Fha Loan Better Than A Conventional One

- There is no definitive yes or no answer, but a seller will likely favor a buyer with a conventional loan approval

- Every loan scenario is unique so be sure to look into both options when shopping your mortgage

- Also consider how long youll keep the loan and what your financial goals are

- Compare and contrast and do the math, there are no shortcuts here if you want to save money!

These days, both FHA and conventional loans could make sense depending on your unique loan scenario. You cant really say one is better than the other without knowing all the particulars.

And as noted, you or the property may not even qualify for an FHA loan to begin with, so the choice might be made out of necessity.

The same could be true if your FICO score is below 620, at which point conventional financing could be out.

Both loan programs offer competitive mortgage rates and closing costs, and flexible underwriting guidelines, so youll really have to do the math to determine which is best for your particular situation.

Even with mortgage insurance factored in, it may be cheaper to go with an FHA loan if you receive a lender credit and/or a lower mortgage rate as a result.

Conversely, a slightly higher mortgage rate on a conventional loan may make sense to avoid the costly mortgage insurance tied to FHA loans.

Generally speaking, those with low credit scores and little set aside for down payment may do better with an FHA loan.

Things To Consider About Fha Loans

Your interest rate may be lower as compared to a conventional mortgage, but FHA loans;require borrowers to pay both the upfront mortgage insurance premium and the monthly mortgage insurance premium . This UFMIP fee is 1.75% of your loan amount, paid in a premium to FHA. FHA loans can be used only for a primary residence, not a second home or investment property, and they have maximum loan amounts that vary by state and county.

Also Check: How To Payoff Car Loan Quickly

Cost Of Mortgage Insurance

Be sure to consider the cost of mortgage insurance when comparing the two. An FHA loan will most likely cost you more in mortgage insurance premiums than a conventional loan.

For FHA loans, borrowers are required to pay a monthly mortgage insurance premium regardless of their down payment amount, and they must also pay a 1.75% upfront mortgage insurance fee when the loan closes. On a $300,000 loan that equates to $5,250.

Conventional loans only charge monthly mortgage insurance, but it can be dropped later on once youve earned enough equity in your home or have reached a certain loan to value . FHA mortgage insurance is required for the life of the loan.

What Are Fha Loans

Federal Housing Administration loans are home mortgages insured by the federal government. Generally speaking, its a mortgage type allowing those with lower credit scores, smaller down payments and modest incomes to still qualify for loans. For this reason,;FHA loans tend to be popular with first-time homebuyers.

The goal of FHA mortgages is to broaden access to homeownership for the American public. While FHA loans are insured by the federal agency with which it shares its name, you still work with an FHA-approved private lender to procure this mortgage type.

Recommended Reading: How Much Time It Takes To Get Personal Loan

Stricter Fha Standards As Of 2019

Most FHA-insured loans get approved by an automated system, while a few are referred to the lenders who manually review borrowers’ applications based on FHA guidelines. In 2016, HUD eliminated a rule that required manual reviews for all mortgage applications from borrowers with credit scores under 620 and debt-to-income ratios above 43%. As of March 2019, however, the agency tightened the underwriting requirements for FHA-insured loans; too many risky loans were being made.

Now, around 40,000-50,000 loans per yearâfour to five percent of the total mortgages that the FHA insures on an annual basisâwhich would have previously been approved automatically will now be put through a more rigorous manual underwriting review, according to FHA officials.

What Do I Need To Qualify For A Conventional Loan

You will need to complete a mortgage loan application and, along with paying applicable fees, have a credit report run that examines your credit history and provides a credit score, and also provide supporting documentation.

Such documentation can include:

- Proof of income such as pay stubs, two years of federal tax returns, two years of W-2 statements, etc.

- Asset accounting of bank statements and investments to establish that you can pay the down payment and closing costs.

- Employment verification demonstrating you have a stable work history to encourage lenders to work with you.

- Miscellaneous documents including your drivers license or state identification card and your Social Security number

Conventional loans give the borrower more flexibility when it comes to loan amounts while an FHA loan caps out at $331,760 for a single family unit in most lower cost areas and $765,500 in most high cost areas.;;Conventional;loans often do not come with the amount of provisions that FHA loans do.;They also do not require mortgage insurance if the loan to value is less than 80%: in other words, if the borrower can make a down payment of 20%.

Because Kate has saved enough to put 20% down, this;loan will be a better option because she will not have to pay for mortgage insurance. In addition, if the property you are buying is more of a fixer-upper, a conventional loan or FHA 203k loans could be an option.

Recommended Reading: Is It Easy To Get Approved For Fha Loan

Advantages Of A Conventional Loan Versus An Fha Loan

Generally speaking, you can often borrow more money with conventional or jumbo loans than you can with FHA loans. There are no upfront mortgage insurance premiums with conventional mortgages. And you can avoid paying for mortgage insurance if you make a 20% down payment.

You do have to buy private mortgage insurance when you make a down payment of less than 20% with a conventional loan. It can be easier to stop paying PMI for a conventional loan than it is to stop paying MIP for an FHA loan, however. If your loan is subject to the federal Homeowners Protection Act , you can request to stop paying private mortgage insurance when your home equity reaches 20%. Additionally, if you are current on your loan and it is covered by the HPA, your lender is required to remove PMI from your monthly bill once your home equity reaches 22%.

You can buy a home, vacation home, second home, rental house, or investment property with a conventional loan. You do not have to occupy the house as your primary residence, as FHA loans require.

Whats The Difference Between Fha And Conventional Loans

If youre about to embark on the journey of buying your own house, youre going to need to know what kind of loan options are available for you. Two of the most common types of loans are FHA and Conventional loans. Theyre two very different loan options that first-time home buyers are likely to encounter. Heres a small guide listing the difference between the two and which option would be best for you.

Recommended Reading: How Long For Sba Loan Approval

Which Is Better: Conventional Fha Or Va

In addition to whether you meet the necessary requirements, consider your finances, needs and preferences when comparing a conventional loan to an FHA or VA loan. If you qualify, conventional mortgages generally pose fewer hurdles than FHA or VA mortgages, which may take longer to process.

Remember that conventional loans are usually better suited for borrowers with a higher credit score, while FHA and VA loans can be ideal for those with a lower score. Like an FHA loan, a conventional loan requires PMI payments, but only if youre putting less than 20 percent down, and the payments can be removed when you hit a certain equity threshold.

With an FHA loan, you cant get rid of PMI unless you refinance or pay off the mortgage. With a VA loan, there is no PMI requirement, but youll have to pay a funding fee based on the amount of the loan.

Fha Vs Conventional Loans

Whats a better low-down-payment mortgage: The FHA loan or Conventional 97?

FHA loans are great for low-to-average credit. They allow credit scores starting at just 580 with a 3.5% down payment. But FHA mortgage insurance is always required.

Conventional loans are often better if you have great credit, or plan to stay in the house a long time.

With credit in the mid- to high-600s, you can get a Conventional 97 loan with just 3% down.;And mortgage insurance can be canceled later on.

The right one for you depends on your home buying goals and what you qualify for.

Read Also: What Is The Commitment Fee On Mortgage Loan

Fha Vs Conventional Loans: An Overview

Consumers qualify for various types of mortgages based on their financial profiles. A lot of mortgages tend to be conventional loans. But there are others that are backed and insured by the Federal Housing Administration . While both allow consumers to finance the purchase of a home, there are several key differences between the two.

FHA loans make homeownership possible and easier for low-to-moderate-income borrowers who may not otherwise be able to get financing because of a lack of or a bad , or because they don’t have enough saved up. Those who qualify for an FHA loan require a lower down payment. And the credit requirements aren’t nearly as strict as other mortgage loanseven those with credit scores below 580 may get financing. These loans are not granted by the FHA itself. Instead, they are advanced by FHA-approved lenders.

People with established credit and low levels of debt, on the other hand, usually qualify for conventional mortgages. These loans are generally offered by private mortgage lenders like banks, credit unions, and other private companies. Unlike FHA loans, these mortgages aren’t backed or secured by the government.

What Are The Pros And Cons Of A Conventional Loan For An Investment

Some of the pros of choosing a conventional loan to finance an investment property include:

- If you have a down payment above 20%, you arent required to pay extra PMI with a conventional loan.;

- Conventional loans are considered more competitive in a crazy housing market.;

- Conventional loans often offer lower interest rates than FHA loans.;

- Conventional loans often offer higher loan limits than FHA loans.;

- Conventional loans offer more flexibility in terms of your property. For instance, you do not have to make it your primary residence.;

Some of the cons of choosing a conventional loan to finance an investment property include:;

- Conventional loans may still involve extra costs through PMI if you are not able to make a down payment above 20%.

- Conventional loans are harder to qualify for in terms of income, credit score, and debt-to-income ratio.;

- Conventional loans require more paperwork and documentation since the lender is taking on all the risk.;

You May Like: Is It Worth It To Refinance Car Loan

Fha Loan Vs Conventional Loan Eligibility

One way to figure out if an FHA or conventional loan is better for you is to compare the eligibility requirements.

| Requirement | |

|---|---|

| Primary residence only | Can be a primary residence, second home, or investment property |

Its important to note, though, that these are just guidelines. Lenders often set their own standards, and some are able to offer more flexibility than others. The best way to find out what loan types you qualify for is to get preapproved. Then youll know which loan types are on the table for you and how much you can likely borrow.

The best way to find out what loan types you qualify for is to get preapproved. Then youll know which loan types are on the table for you and how much you can likely borrow.

Is It Better To Get A Conventional Home Loan Or An Fha Loan

When starting a search for a new home, one of the early considerations is;deciding;which;type of mortgage;to apply for.;The best place to get started is to;contact a trusted lender;who can guide you through;the;application;process;and recommend which type of loan would be best for your financial situation. By way of preparation, well delve into the differences between the two;of the;most common;types of mortgage loans, conventional loans and FHA loans,;as well as;the benefits and drawbacks;of each.;

Also Check: How To Get Loan Originator License

Conventional Loans Offer Many More Options And Just 3% Down

- Access to more loans programs

- And you can get financing on more property types

- Including vacation homes and investment properties

- And the minimum down payment requirement is now lower!

Now lets discuss conventional loans, an alternative to FHA loans that tend to offer a lot more variety.

With a conventional loan, which includes both conforming and non-conforming loans, you can get your hands on pretty much any home loan program from a 1-month ARM to a 30-year fixed, and everything in between.

So if you want a 10-year fixed mortgage, or a 7-year ARM, a conventional loan will surely be the way to go.

Meanwhile, FHA loan offerings are pretty basic. They offer both purchase mortgages and refinance loans, including a streamlined refinance, but the choices are slim.

In other words, youll most likely be stuck with a 30-year or 15-year fixed, or maybe a 5/1 adjustable-rate mortgage.

So if youre looking for something a little different, the FHA probably isnt for you.

Another benefit of going with a conventional loan vs. an FHA loan is the higher loan limit, which can be as high as $822,375 in certain parts of the nation.

This can be a real lifesaver for those living in high-cost regions of the country . With an FHA loan, you might be stuck with a maximum loan amount just above $300,000.

However, jumbos are still technically considered conventional mortgages because they arent government loans.

Are Fannie Mae and FHA the same thing?