How Is Cash Flow Calculated

A lender will evaluate business cash flow first. Most lenders rely on the most recent tax return as a starting point for the cash flow calculation. They look at the relevant IRS business tax form or personal tax return for sole proprietorships .

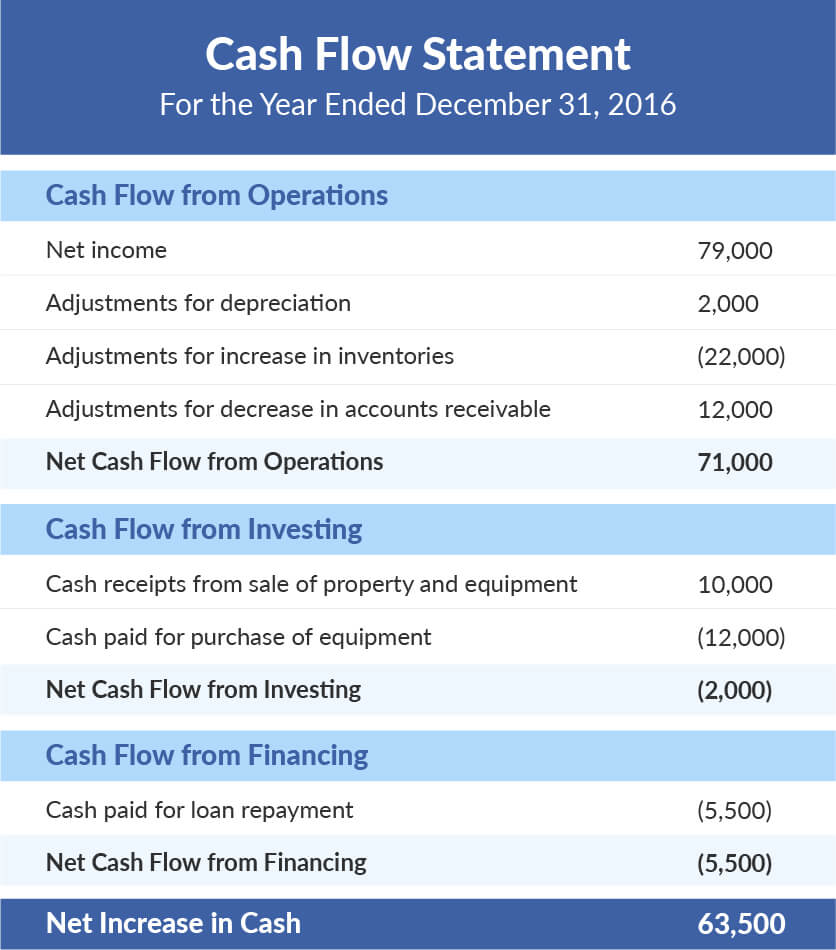

Annual cash flow is calculated by taking the net income or loss earned by the business over a year and then adding back any non-cash expenses plus interest paid on other existing debts. This cash flow will then be compared to the annual principal and interest payment requirements on all your current loans as well as the loan you are requesting. Lenders refer to this ratio of cash flow to debt service as the Debt Service Coverage ratio.

For privately-owned businesses, lenders may also consider global cash flow, and will perform a similar type of cash flow analysis for any other businesses of the owner, as well as an analysis of the owners personal income and expenses.

A lender may adjust cash flow by taking out non-reoccurring sources of income and adding the businesss non-reoccurring expenses. The lender will need to understand your business and discuss its financials with you so that they can identify what unique situations or events may exist or have occurred.

Why We Chose Fundbox

Similar to BlueVine, Fundbox is an invoice financing solution created to help small businesses have more consistent cash flow. Since its inception in 2013, Fundbox now offers lines of credit as well.

Fundbox offers relaxed borrower qualifications, making it ideal for less established businesses. To qualify, you must have a credit score of 500 or above, and you must use compatible accounting or invoicing software or a compatible business banking account. Funding is also fast you can qualify for a line of credit up to $100,000 in just minutes and receive funds in your bank account as quickly as the next business day.

Why We Chose Ondeck

OnDeck, one of the first online lenders, offers fast approval for lines of credit and short-term business loans. Although OnDecks fees can get a little pricey, the service is a convenient and quick way for businesses to access up to $500,000. OnDeck is also very transparent about its rates and fees. Eligible OnDeck applicants usually receive funding 24 to 48 hours after their initial application.

In addition to being a good choice for businesses that want fast access to funding, OnDeck is also a good choice for businesses that may not qualify for financing elsewhere. Minimum requirements include a personal credit score of 600, been in business for at least 12 months, and annual revenue of $100,000 or more. OnDeck also works with business owners in over 700 industries, with very few industries excluded from borrowing.

You May Like: How Can You Get Rid Of Student Loan Debt

What Are Cash Flow Loans

A cash flow loan is essentially a fast and easy loan thats used more for day-to-day cash needs than long-term needs: think commercial rent, payroll, utilities, and simple supplies. When your company needs a little extra cash flow for the month, its best to stay clear of a traditional bank loan. The time-consuming approval process is filled with documentation and several lending decisions, which could prevent your business from getting the cash it needs in a timely manner.

Unlike other types of lending, such as SBA loans, a cash flow loan is backed by the borrowers personal or business cash flow. In other words, individuals or companies are expected to pay back the loan with incoming funds. So if youre a company with strong cash flow and few assets, this type of loan can provide a large funding amount. But keep in mind that financing future revenue can be a risky move. And unless youre clairvoyant, the future is hard to predict.

By signing up I agree to the Terms of Use.

Business Credit Vs Personal Credit

When applying for a business loan, lenders will look at your business credit score as well as your personal credit score. While these two scores are different, both measure creditworthiness and the ability to pay back loans.

Based on your individual credit profile, your FICO credit score can range from 300 to 850. Your business credit score, on the other hand, is usually measured from zero to 100.

Since most business lenders require you to have solid personal credit to qualify, consider improving your credit score before applying for a loan.

You can improve your credit on your own at no cost or pay for help from the best credit repair companies.

If you need financial assistance now and dont have time to work on credit repair, take a look at our selection for the best loans for bad credit.

Also Check: Negative Equity Car Loan Calculator

What Is Cash Flow

Whether youre looking for funding for your business or just want to manage it effectively as possible, cash flow is critical.

Cash flow is whats left after you pay all your normal daily expenses. From a lending perspective, cash flow represents the total net amount of cash available to the business for servicing debts, as well as growing the business assets.

A lender will prepare a cash-flow analysis that demonstrates this over a specific period . Your businesss cash flow tells a lender how much debt your business can successfully handle and how much is left to be reinvested into your business.

Maintain A Business Accounting System

One of the best ways to stay organized and on top of your business’s current cash position is by using TD Online Accounting. This can be a low cost way to help you get paid faster, by allowing your customers to pay you via credit card or funds transfer. It can also help you save time and money by eliminating paper invoices.

Read Also: What Is Apr Rate On Home Loan

Get Access To Capital Using A Line Of Credit

When you have a problem with cash flow, one of the first solutions to consider is a business line of credit. A credit line can act as a stopgap since you can draw against your credit line as needed to cover operating expenses or unexpected costs. For example, you can write checks from your credit line to pay suppliers, make tax payments or cover a surprise equipment repair.

Using a business line of credit means you donât need to dip into your personal financial resources or stretch your cash flow when unique business opportunities arise. For instance, small business owner Chandra Franklin Womack used her line of credit to acquire a small engineering firm, expand its operations and immediately increase her bookings.

When comparing small business loans and lines of credit, you might want to consider things like:

- How much you can borrow

- Interest rates and fees

- How quickly you can get funding

How Much Can I Get For A Startup Business Loan

Startup business loans typically range from $1,000 to $250,000. However, the loan amount you receive depends on your and the business creditworthiness. Most lenders require businesses to have been in operation for at least six months to two years and meet minimum annual revenue requirements. Be sure to check with your desired lender to ensure your startup is eligible.

Recommended Reading: How To Find Interest On Loan

Cash Flow Lending Vs Asset

As we mentioned briefly above, cash flow lending differs greatly from asset-based lendingâwhich requires business assets to secure a loan with collateral .

Cash flow lending puts a higher emphasis on money owed and projected cash flow for the business, whereas asset-based lending puts an emphasis on the real property and other assets a business owns.

That said, some other key differences between cash flow lending vs. asset-based lending are:

- Time to fund: Cash flow loans typically offer the advantage of a speedy funding process, but there is also a tradeoff for this convenience.

- Cost: If you decide to pursue a cash advance loan, you can expect to pay much higher interest rates.

- Repayment: You can also expect shorter terms and a faster repayment schedule than you would with many asset-based lending products.

Invoice Factoring And Financing

Invoice factoring is the process of selling a business outstanding invoices in exchange for a lump sum cash payment. Invoices are sold to a third-party factoring company at a discount, so you wont get paid for invoices in full. And, once you sell an invoice to a factoring company, the factoring company assumes responsibility for collections.

However, this form of financing can be an effective way to access cash quickly without having to wait the 30 to 90 days customers usually have to pay invoices. For that reason, invoice factoring is a helpful strategy when you need short-term financing or help managing cash flow. In general, invoice financing amounts can extend up to $5 million with APRs between 10% and 79%.

Read Also: Which Bank Has Best Personal Loan Rates

Navigating The Realities Of Cash Flow Challenges And Fluctuations

Cash flow problems can happen at any time in a businesss life cycle. Many people assume that its always due to poor management, and in some cases, bad budgeting can lead to cash flow gaps. But more often, cash flow challenges are caused by an unexpected expense or unanticipated issue with day-to-day operations. A long-time customer is unexpectedly late with a critical payment, for example, or a key piece of your companys equipment breaks down and requires expensive repairs. And in the most devastating cases, disaster can strike at a level you never anticipated and thats difficult to plan around.

For many businesses, positive circumstances can also lead to cash flow challenges. For example, a retailer might be offered a steep discount on inventory if they pay in advance, or a construction company might have the chance to sign a lucrative contract if they can access staff and equipment immediately. To take advantage of opportunities, businesses often need to have capital on hand to invest in marketing, discounts, tools and other areas.

Cash flow loans, such as short-term business loans, can help businesses make investments to grow, take advantage of opportunities or successfully stay afloat when an unexpected expense or crisis occurs.

Cash Flow Loans For Small Business Owners: Prepare For The Unexpected

- by Liz AltonLiz Alton is a freelance …more

Managing cash flow is one of the most important aspects of operating a healthy, growing business. Yet no matter how carefully you plan and manage your revenues and expenses, surprises can happen. Youll have to navigate these issues when they arise, and cash flow loans for small business owners can soften the blow. If youve experienced cash flow challenges, youre not alone: 41 percent of small business owners faced cash flow difficulties in the last year, according to Small Business Trends.

Consider the case of Allison, a bakery owner successfully in business for years. Her great reputation, delicious baking and careful management of her finances meant she could weather almost any storm. However, when high winds knocked over a large tree onto her bakerys roof, it did tens of thousands of dollars in damage to her property. Even with reasonable savings, she found that it would be nearly impossible to bridge the financial gap to begin repairs and get back to serving customers as quickly as possible especially when relying on insurance payments that could take several weeks, or even months, to receive. For Allison and other business owners looking for ways to deal with cash flow issues when the unexpected strikes there are options available.

Don’t Miss: Auto Loan With Bad Credit

How To Apply For A Fundbox Line Of Credit

You can apply online for Fundbox credit in two simple steps. Unlike a traditional business loan application, you will not have to complete any paperwork to get started, and you can get a decision in as little as minutes.

Applying is safe and secure and will not impact your credit score. Simply enter your business information and connect your business banking account to apply. If youre approved, you could receive fund as soon as the next business day.

Which Cash Flow Loan Is Right For My Business

With so many great options, it can be hard to know which is right for your business. When choosing a cash flow loan, ask yourself these questions:

- What is the purpose of the loan?

- Which type of loan is best for my business needs?

- Whats my credit score and monthly/yearly revenue?

- How much do I need to borrow?

- How quickly do I need the funding?

All of these factors will play a role in deciding which lender you should go after. If you need additional help or want to see even more financing options, check out our comprehensive small business loan reviews.

You May Like: $10 000 Dollar Loan Monthly Payment

Failure To Shop Around

Finding a lender can feel so daunting that it might be tempting to sign up with the first one that comes along. But blindly pursuing one loan provider without exploring your other options is a mistake. Take the time to research a variety of traditional and alternative lenders to find the best fit for your business.

Financial institutions in the community where you plan to do business are an ideal place to start looking for a business loan, according to Logan Allec, a CPA and founder of the personal finance site Money Done Right. Start with a community bank or credit union that is more invested locally, as they may have certain programs to be able to work with new local businesses.

The SBA also provides federal backing for some businesses to receive loans through partner financial institutions. This can be an excellent avenue to explore if you are having trouble finding a traditional lender for your business, Allec said.

Other alternatives to traditional lenders are online lending platforms, peer-to-peer lending sites, and your own network of friends and relatives. If you pursue this last option, Allec suggests working up an official, notarized agreement to avoid any misunderstandings or conflicts down the road between all the involved parties.

When shopping around, you can also request that each lender help you calculate the annual percentage rate of their loan offer.

Disaster & Pandemic Relief

During these unprecedented times, small businesses across the nation have been experiencing financial hardships. Maybe youve experienced a decline in sales since the start of the coronavirus pandemic, or maybe youve been dealing with increased costs, after supplying PPE and taking more extreme sanitation measures. If your company has been impacted by COVID-19, were here to help.

Don’t Miss: When Can You Use Your Va Loan

Improve The Invoicing Process

Invoicing can be one of the most tedious aspects of running a small business but itâs not a task you can avoid. Improving your process for invoicing can help to resolve cash flow problems by ensuring that your clients pay on time.

Some of the ways you can encourage faster payments include:

- Sending out invoices quicker

- Extending a discount to customers who pay early

- Changing your payment terms to include late fees or penalties

While youâre updating your invoicing process, you might consider reviewing individual client contracts.

For example, if you have a client who consistently pays late, you might add language to their contract that requires them to pay additional late fees and penalties. That could give them an incentive to pay on time. You could also reach out to individual clients to ask for input on how you can improve the invoicing process to make it easier for them to pay in a timely manner.

How To Apply For A Fundation Loan

The Fundation application process includes filling out an online application, documenting your businesss ID and finances, and speaking with a representative directly to see if youre a good fit for a Fundation loan. After talking to a rep, your application will go through to underwriting, and you may hear back in as early as 24 hours.

Recommended Reading: Are Home Equity Loan Rates Lower Than Mortgage Rates

Failure To Seek Expert Advice

When you apply for a business loan, lenders want to see that youve sought guidance from knowledgeable advisors.

Accountants can be an important source of advice for small business owners, according to Stephen Sheinbaum, CEO of Circadian Funding, which helps small and midsize businesses obtain working capital.

But there are many other places to find good people to talk to, such as the Service Corps of Retired Executives , a free mentoring service that is supported by the Small Business Administration, he said. SCORE connects you to retired businesspeople with experience in your market. This is important because they will know about the kind of capital that is most important to people within your industry.

Sheinbaum also recommends that business owners get financial advice from business networking groups and conduct research on the websites of the leading alternative funders, since many have detailed resource sections for small businesses about the many kinds of available capital and the best ways to prepare for funding.

Other resources that provide counseling, advice and financial assistance for new businesses include the regional and local offices of Veterans Business Outreach Centers and Womens Business Centers.

Cash Flow Loan Automatic Renewals:

To keep you in a loan cycle, some lenders will automatically renew a loan if it becomes past due. On the plus side, this would give you more time to pay, but the downside is youre now saddled with additional fees, interest, and a longer payment term, making it that much more difficult to catch up and climb out of debt. This is another tremendously important reason to thoroughly read a loan agreement before you sign anything.

Don’t Miss: How To Get Loan Officer License In California

Covering A Cash Flow Gap

For many companies, cash flow rises and falls with seasons. You might be flush during the winter holidays, but come summer, business may be slow. A cash flow loan can ensure you have the money to make it through to your busy season.

Also if you send clients invoices or tie up cash in inventory, you may not have the capital you need for your day-to-day expenses. Borrowing money can ensure that you can pay your employees and bills without worrying about a cash crunch.