First Republic Bank Personal Line Of Credit

Getting a personal line of credit with First Republic Bank means your funds could be used for several purposes, such as refinancing student loans, buying or refinancing a car, paying for small home expenses, etc.

First Republic Bank’s personal line of credit permits you to make interest-only payments during a two-year draw period. If you would like to make principal payments during the draw period, you can, but it is not necessary. The two-year draw period precedes your repayment period, which is when you would make payments that go towards your loan principal and interest.

Before deciding on a personal line of credit, familiarize yourself with student loan benefits such as forbearance, deferment, and forgiveness. Opting for a personal line of credit could mean relinquishing some of those perks.

First Republic Refinance Rates & Fees

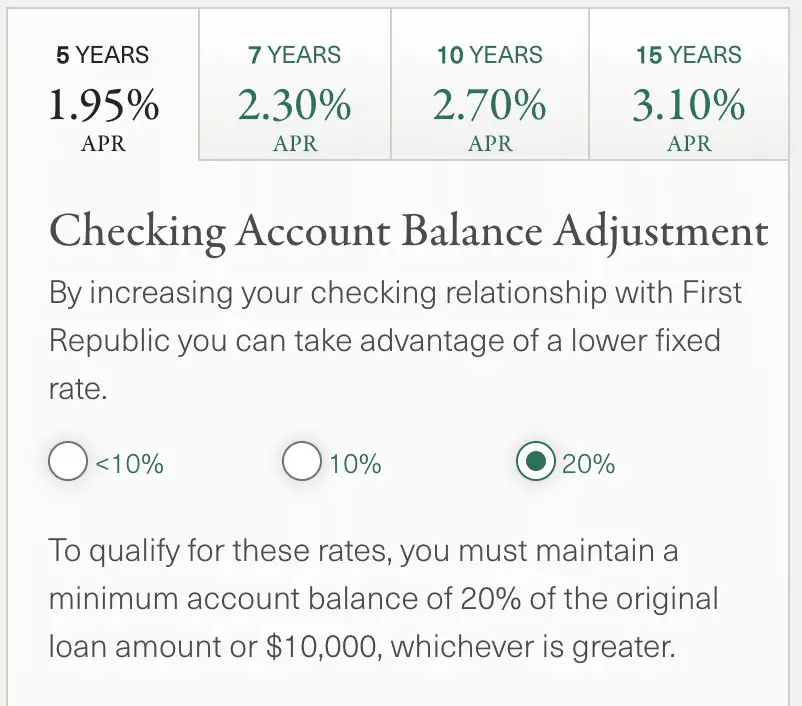

First Republics fixed rates start between 2.95% and 9.25% 14.25% is the maximum fixed rate. Lowest rates always include a 2.00% interest rate reduction for maintaining automatic payments and direct deposit with a First Republic ATM Rebate Checking Account, a 0.50% reduction for depositing and maintaining a deposit balance of at least 10% of the approved loan amount into that checking account, and an additional 0.25% for depositing and maintaining a deposit balance of at least 20% of the approved loan amount into the checking account .

In 2022, First Republics lowest available fixed rate for new loans has risen 31.1% while its highest starting fixed rate is up 48.0% . The maximum fixed rate possible has increased 26.7% .

Refinance Loan Rates| 7, 10 or 15 Year | 2.95% 9.25% |

Additional information about First Republic refinance rates:

- Checking your rate with First Republic does not affect your credit score. To determine eligibility, they perform a soft credit inquiry instead of a hard credit check .

- First Republic does offer a discount for setting up auto-pay with a First Republic checking account: 2.00% interest rate reduction.

- Additional rate reductions include 0.50% for depositing and maintaining a deposit balance of at least 10% of the approved loan amount into that account, plus an additional 0.25% for a deposit balance of at least 20% of the approved loan amount into the account.

- No variable rates.

- Borrowers pay interest only on draws for the first two years.

The Fine Print On Refinancing

Regardless of the rationale behind the checking account held with the bank and the associated compensating balance, we felt the decision to choose First Republic Bank as our refinancing lender served us well.

But if our experience does not convince you alone, perhaps you have a more data-driven outlook- as you should when it comes to making a financial transaction like this.

First Republic Bank showed themselves as the low-cost leader in a crowded market, even with the additional checking account requirement. They want your business now and hope to upsell you on more products and services as you progress in your career and build your personal brand.

You May Like: Can You Put 20 Down On An Fha Loan

First Republic Student Loan Refinance: What You Need To Know

If you are a student loan borrower with excellent credit and high income living near a branch office, refinancing your student loan with First Republic Bank might make sense for you.

First Republic has competitive interest rates, but the approval process is highly selective, hence the need for excellent credit.

In general, youll need to have a credit score in the upper 700s or higher in order to qualify for student loan refinancing. Youll also need to have finished college and owe at least $40,000 in student loans.

For those with a graduate or post-secondary degree, loan amounts start at $25,000. On top of this, First Republic considers borrowers who have at least two years of employment in the same industry. This is viewed as evidence of income stability.

How Do I Contact First Republic

Their goal with this product is to get you to become a banking customer. So you can also only start the loan process via a private banker.

Luckily, we have a private banker, and you can reach out to him here: Eric Peterson at 338-1505 or by email here: [email protected]. Make sure you mention The College Investor to get your $300 bonus!

You can also start the process here: First Republic Bank Personal Line of Credit.

Recommended Reading: Is Paypal Business Loan Good

How To Refinance Student Loans With First Republic Bank

To refinance your student loans with First Republic Bank, you need to first open an ATM Rebate Checking account. The minimum opening deposit for this checking account is $500, and it incurs a $25 monthly fee if you fail to maintain a minimum monthly average balance of $3,500.

To open an account at First Republic Bank, you will need to meet with one of the bankers at one of its branches in these cities:

- California: Los Angeles, Newport Beach, Palo Alto, San Diego, San Francisco, Santa Barbara

- Connecticut: Greenwich

- New York: New York City

- Oregon: Portland

- Wyoming: Jackson

After opening a checking account, you can then work with a private banker to apply for a First Republic Bank personal line of credit.

What Kind Of Mortgage Can I Get With First Republic Bank

The company recommends contacting one of its representatives, called relationship managers to discuss your loan options. The loans found on its site encompass a mortgage lenders standard variety, minus government-backed loans such as VA, FHA or USDA.

Fixed-rate mortgage: Considered a conventional loan, this type of mortgage has an interest rate that doesnt change for the duration of the loan term. Most of the time, this type of mortgage is offered in 15-year or 30-year terms. Many borrowers like this type of loan because its easier to budget month-to-month as the payment wont change. If youre planning on staying in your house long term, it is a popular option.

Adjustable-rate mortgage : Unlike fixed-rate loans, your monthly payments will change with an ARM. Why its appealing is because the introductory period is offered at a lower interest rate than a fixed-rate loan. After that initial period expires, your interest rate changes every year, going up or down depending on the market. If your interest rate rises, you could pay more over the life of the loan than a fixed-rate mortgage.

Interest-only: With this type of mortgage, you pay only the interest that accumulates on your loan balance for a limited period. After that, you begin to pay the principal as well as interest.

Single-family co-op and condo loans: For folks looking at city properties such as condos, you can choose from fixed or ARM loans with flexible repayment terms.

You May Like: When Can You Use Your Va Loan

Bottom Line: Is First Republic Right For You

First Republic has a top reputation for student loan refinancing and for customer service. There are a few things to keep in mind with First Republic student loan refinancing.

Remember, First Republic caters to borrowers with good to excellent credit and high incomes. Typically, First Republic borrowers have FICO scores of at least 750, and work experience in the same field for at least 2 years.

First Republic also wants to see strong, stable monthly income and cash flow that is sufficient to cover your life expenses and any other debt obligations. First Republic also likes to see that you have significant savings. Finally, First Republic wants to ensure that you make all your student loan payment each month on-time.

First Republic may be right for you if you like having a full-service experience, complete with a personal banker. You will have access to First Republic, which offers other types of personal financial products such as small business loans, wealth management and mortgages as well. You will meet with a personal banker to complete your student loan refinancing application, and your personal banker can answer any questions that you may have.

To qualify for student loan refinancing with First Republic, you need to live near a physical First Republic branch. Therefore, you must be a resident of San Francisco, Palo Alto, Los Angeles, Santa Barbara, Newport Beach, San Diego, Portland , Boston, Palm Beach , Greenwich or New York City.

Does First Republic Operate In My Area

First Republic only offers mortgages in California, Massachusetts, Connecticut, New York and Oregon. Almost 90% of all real estate loans are within 20 miles of a First Republic branch. Most branches are located in California . First Republics other branches are in Portland, Oregon Palm Beach, Florida Wellesley, Massachusetts Boston, Massachusetts Greenwich, Connecticut and New York, New York.

Read Also: How Long To Close Home Equity Loan

First Republic Bank: Who Are They

First Republic Bank is a private American company that offers personal and business banking, wealth management, investing, and lending services in California, New York, and multiple other locations.

The company specializes in providing banking services to low-risk, high net worth clientele. In terms of student loan refinancing, First Republics low rates mostly benefit graduates who are on firm financial footing. First Republic Bank offers student loan refinancing at low rates for borrowers who have excellent credit and meet a number of other requirements.

You can use a First Republic student loan refinance loan to refinance private loans, federal loans, or both. But keep in mind that if you refinance your federal loans with a private lender like First Republic, youll lose eligibility for federal programs like income-driven repayment and loan forgiveness.

To review student loan refinancing, as well as the difference between federal loan consolidation and private loan refinancing, click here:

- Minimum refinance amount of $25,000.

- Strict eligibility requirements, including where you live and how much you earn.

Below, well break down these pros and cons to give you a better idea of what to expect from First Republic student loan refinancing.

First Republic Bank Student Loan Program Is Actually A Personal Loan

First Republic Bank now offers its student loan refinancing program as a personal loan, NOT a qualified education loan.

For most borrowers, that will not matter. The student loan interest deduction can only be taken for qualified educational debt, but most people who qualify to refinance with First Republic will earn too high of an income to qualify for this tax deduction.

Also Check: What Is The Max Va Loan Entitlement

How Does First Republic Compare

Since First Republic actually offers personal lines of credit rather than refinance loans, they’re loans are far more flexible than you’ll find with most student loan lenders. You also can take advantage of up to two years of interest-only payments.

However, limited state availability will make First Republic a non-option for many student loan borrowers. And even if you happen to live in one of the areas with this product is available, you’ll need to deposit at least 20% of your loan amount into a First Republic ATM Rebate Checking to get the bank’s lowest-available rate.

That means if you want the lowest APR on a $30,000 loan, you’ll need to deposit at least $6,000 with First Republic and maintain that balance until your loan is paid off. That’s a pretty hefty capital requirement that you won’t have to deal with to qualify for the best rate with most other lenders. Here’s a closer look at how First Republic compares:

| Header |

|---|

| READ THE REVIEW |

Requirements Of First Republic Bank Student Loan Program

Lets be frank, with interest rates this low, this student loan refinancing product is probably designed to break even. I seriously doubt theyre making a ton of profit from this.

Rather, I think theyve designed this awesome refinancing deal to win other parts of your business and develop a banking relationship.

To get this deal, there are a few catches that I would live with if I needed to refinance. Youll have to make the decision whether these requirements are too much or not if its the right product for you.

- You have to open a bank account with First Republic Bank and keep at least 10% of the approved loan amount in that account. Thats a big requirement, and if youre not there yet, remember you can always refinance with another lender while youre building up your savings.

- That account has to be set up for direct deposit as well as automatic payments.

- You must live in one of their service areas. Check out a complete list of locations.

- I would expect they will want to talk to you about mortgage, business lending, lines of credit, possibly wealth management, and other services they provide.

- Youll need a high credit score

Keep in mind that theres no requirement to use other First Republic Bank products or services. I could live with an occasional email pitch in exchange for rates 1% to 2% lower than the market.

You might be able to satisfy that cash requirement by involving a spouse or family member as a cosigner.

Recommended Reading: How To Find The Best Loan Rates

Does First Republic Student Loan Refinancing Charge An Origination Fee

No, First Republic Student Loan Refinancing does not charge a loan origination fee.

A loan origination fee is what some lenders charge for processing, underwriting, and funding a loan. Typically fees range from 0.5% to 5% of the loan amount. Whenever possible, go with lenders that dont charge origination fees.

Why Refinance Student Loans

Carrying these large student loan balances can only amount to considerable stress on your financial and mental well-being.

Understanding how this debt affects your health, lifestyle, and general life trajectory, you might want to learn about how student loan refinancing works and some major reasons for considering this path.

Also Check: If You File Bankruptcy: What Happens To Your Car Loan

Refinancing Your Student Loan Through First Republic Bank

If you are a student loan borrower with excellent credit and a high income living near a branch office, refinancing your student loan with First Republic Bank might make sense to you.

The First Republic has competitive interest rates, but the approval process is highly selective, hence the need for excellent credit.

On the whole, to qualify for student loan refinancing, youll need to have a credit score in the upper 700s or higher.

Youll also need to have finished college and owe at least $40,000 in student loans.

On top of this, First Republic considers borrowers who have at least two years of employment in the same industry. They viewed this as evidence of income stability.

Basic Information: Rates, Terms, Fees, & Limits

First Republic Bank student loans offer low, fixed interest rates between 1.95 and 3.95 percent to borrowers who refinance .

These are exceptionally low rates compared with other refinancing lenders and competitors.

Though, there are other rates to keep in mind. For certain applicants, First Republic offers rates between 6.95 and 8.95 percent.

They offered these two clients who cannot maintain automatic payments through the First Republic checking account. There are more details on this in the downside section.

As I have said before, refinancing applicants must have no less than $40,000 in student loan debt, and applicants can only refinance up to a maximum of $300,000.

CSN Team.

First Republic Student Loan Refinancing

The First Republic provides one of the most competitive student loan refinancing products out there.

If perhaps you have a strong credit score and strong income, consider using the First Republic to refinance your student loans.

Their services are amazing and they offer a simple product, with ultra-low rates and no fees.

The companys major goal with this product is to get you to become a banking client so to get the lowest rates.

You also need to create a checking account at the bank. However, you can also only begin the loan process through a private banker.

You May Like: Variable Vs Fixed Rate Student Loans

3 Enroll In A First Republic Atm Rebate Checking Account W/minimum Deposit Balance

To receive these best-in-class rates and a 2.00% prepayment rebate, the Borrower must meet and maintain the following criteria:

We opted to maintain the 10% deposit balance in the account to shave 0.50% off of our final rate.

Rate Discounts For Large Checking Account Balance And Direct Deposit

Your interest rate could reflect three discounts:

First Republic would of course like you to keep a lot in the checking account for the duration of the loan. However, in my discussions with First Republic reps, thats only required for three years.

Keeping 20% of your original loan amount in your checking isnt possible for everyone. Thats why the best bang for your buck is keeping 10% of the loan amount in checking instead of 20%. You get a 0.50% discount off your interest rate, which is more than the extra 0.25% discount you get for keeping 20% of the loan amount in checking.

Recall that the risk is that you could lose the additional 0.50% plus 0.25% rate reduction. Even without that discount, the fixed rates are better than the major national lenders.

The only real way the loan could jump way up to rates above those offered by national lenders is if you closed your First Republic ATM Rebate Checking Account prior to the loan being paid off in full. Obviously, once the loan is gone youre under no obligation to keep the account around unless you want to.

You May Like: How Much Can I Borrow In Student Loans