What You Should Do Between Now And Aug 31

Pentis recommends first to “contact your federal loan servicer to confirm your ongoing eligibility for the pause and discuss options for handling repayment once the moratorium ends. If your servicer is not especially helpful, take on the research yourself or work with a certified student loan or credit counselor at an accredited nonprofit counseling agency.”

If you decide to work with a student loan counselor or agency, it’s important to ensure they’re fully certified as there are many student loan forgiveness scams.

-

Annual Percentage Yield

-

No monthly maintenance fee

-

Maximum transactions

Up to 6 free withdrawals or transfers per statement cycle *The 6/statement cycle withdrawal limit is waived during the coronavirus outbreak under Regulation D

-

Excessive transactions fee

-

Yes, if have an Ally checking account

Terms apply.

Borrowers Believe President Biden Will Extend The Payment Pause And Interest Waiver Again

According to a CNBC student loan survey conducted in January 2022, 29% of borrowers believe that repayment will resume on May 1, 2022, 26% believe the President will extend the payment pause again, 28% believe some student loans will be forgiven and 14% believe that all student loans will be forgiven.

More than two-thirds of survey respondents want President Biden to forgive some or all student loans, with 34% supporting forgiveness of all student loans and 35% supporting targeted forgiveness to borrowers based on need. A quarter do not want President Biden to forgive any student loans. This aligns closely with a survey conducted here last year as well.

There is a sharp divide according to political affiliation, with only 19% of Republicans supporting forgiveness of all student loans, compared with 43% of Independents and 46% of Democrats.

There are also divisions based on demographics:

- More women than men support student loan forgiveness .

- Black and Hispanic survey respondents are more likely to support student loan forgiveness than White and Asian respondents .

- Younger respondents are more likely to support student loan forgiveness .

- Low-income respondents earning less than $50,000 are more likely to support student loan forgiveness than middle-income respondents earning $50,000 to $99,999 or high-income respondents earning $100,000 or more .

- Borrowers who owe more student loan debt are more likely to support student loan forgiveness than borrowers who owe less .

How Can I Qualify For A Deferment

Deferment is available under several different circumstances, including when:

- you’re enrolled at least half time in a post-secondary school

- you’re a parent who received a Direct PLUS Loan or an FFEL PLUS Loan

- you’re enrolled in an approved graduate fellowship program

- you’re disabled and enrolled in an approved rehabilitation training program

- you’re unemployed or unable to find full-time employment

- you’re experiencing economic hardship or serving in the Peace Corps

- you’re on active duty with the military, or have been on active duty within the past 13 months, in connection with a war, military operation, or national emergency, or

- you’re receiving treatment for cancer. You may also receive a deferment for six months after treatment ends.

Also Check: What Is Usda Home Loan Program

Will Student Loan Forbearance Be Extended Again

7 min read

Nearly 43 million student loan borrowers have enjoyed a break from their payments for more than a year. But thats scheduled to change starting Oct. 1, when federal student loan payments are set to resume.

Most borrowers say they arent ready for that to happen. A recent survey of more than 23,000 student loan borrowers found that 90% arent prepared for payments to start up again.

The country may be on its way to economic recovery, but millions of borrowers are no better off than they were during the pandemic. That has many wondering whether President Joe Biden will extend federal student loan forbearance again. The answer: a big, fat maybe.

How To Apply For The New Student Loan Forgiveness

According to the Biden administration, the application to receive the newly announced forgiveness would be available no later than the end of the year.

But in some cases, an application might not be necessary.

Nearly 8 million borrowers may be eligible to receive relief automatically because relevant income data is already available, said the Department of Education.

As a result, anyone with federal student loans will want to monitor their balances and keep an eye out for more news.

As noted above, the level of forgiveness available will depend on whether or not you received a Pell Grant. Also be aware that loans not directly held by the federal government, such as Federal Family Education Loans , might not be eligible.

Recommended Reading: How Do I Find Out My Student Loan Balance

Why Student Loan Payment Pause Should Be Extended

Progressive Democrats in Congress, including Senate Majority Leader Chuck Schumer and Sen. Elizabeth Warren , have lobbied the president to extend the student loan payment pause beyond May 1, 2022. . Federal student loan payments have been paused since March 2020, when Congress passed the Cares Act and provided historic student loan relief. The U.S. Department of Education estimates that more than 40 million student loan borrowers collectively have saved $5 billion a month as a result of this temporary student loan forbearance. . Here are some reasons why the student loan payment pause should be extended:

- state of the economy

Midterm Elections Are Coming

With the November midterm elections right around the corner, the president may be hesitant to address the divisive student loan situation. Biden supported canceling at least $10,000 of federal student loan debt during his 2020 presidential campaign, but Democrats and Republicans have remained divided on whether student loans should be forgiven on a large scale.

Some proponents have called on Biden to cancel upwards of ,000 in student loans per borrower, whereas opponents have shut down the idea of broad student loan forgiveness entirely. Soaring inflation has become another complicating factor, with broad student loan forgiveness having the potential to increase the buying power of a significant number of Americans at a time when policy makers are looking to tamp down consumer demand.

Restarting student loan payments two months before an election would be political suicide, according to higher education expert Mark Kantrowitz. Other than the political considerations, there is no valid justification for a further extension to the payment pause and interest waiver, he says.

You May Like: Which Is Better Balance Transfer Or Personal Loan

Deferring Your Loans For An Internship Clerkship Fellowship Or Residency2

With an internship, clerkship, fellowship, or residency deferment, you wont have to make principal and interest payments while youre in your internship, clerkship, fellowship, or residency program. Your interest will continue to accrue , however, which will increase your Total Loan Cost. Any additional payments you can make during this period can help lower the Total Loan Cost.

If your request is approved, your student loan will return to the repayment option you initially chose . That means that if you were paying either interest-only or a fixed payment when you were in school, youll continue to make those payments throughout the deferment.

You can request a deferment if youre accepted into an approved internship, clerkship, fellowship, or residency program.

In order to be approved, the program must:

- Require you to have a bachelors degree as a prerequisite for acceptance.

Rehabilitate Any Loans In Default Before Collections Resume

The CARES Act promised an additional reprieve for federal student loan borrowers in default: a halt to collections and garnishments of wages and other monetary benefits. The Department of Education has also said it would refund $1.8 billion worth of recent seizures.

To avoid such penalties in the future, strategize how to get your loans out of default. Your options for federally owned debt include the following:

| What to know | |

|---|---|

| If you have the cash to do it, zero out your balance | Not practical for most borrowers |

You May Like: What Does Refinance Auto Loan Mean

Student Loan Servicers Were Told To Hold Off

The Education Department reportedly told student loan servicers this week to not send out billing notices to borrowers a sign it does not plan to ask borrowers to resume payments in the near future.

Because the student loan payment freeze was enacted under the CARES Act, loan servicers are required to give upward of six notices starting at least two months before payments are set to resume. The start of July was the two-month mark for the Aug. 31 deadline, but borrowers have yet to receive any information about the restart of repayment.

This suggests that the student loan payment pause and interest waiver will be extended, as there just wont be enough time to prep borrowers to resume making student loan payments, Kantrowitz says.

When Will Student Loan Payments Likely Resume And What Should Borrowers Do

Student loan payments will resume starting on Sept. 1, which leaves millions of borrowers waiting for word about whether they will have to begin repaying their student loans after a nearly two-and-a-half year break.

Because experts generally agree that the pause will be extended, its more a question of how long the pause will be extended. Farrington says a 60-day extension would put it right before the midterm elections, which seems politically too short. He says setting the deadline at the end of the year could be a possibility, but it might not be a good one given all the holidays.

I believe we will likely see an extension until Jan. 31, 2023, says Farrington. As to whether this will be the last one, its uncertain. I do think the administration is trying to extend the pause as long as possible so they can sort out any potential forgiveness plans or other student loan reforms.

Farrington adds that the president can continue to extend the pause as long as there is a state of emergency. As long as that continues to be extended, so can the payment pause, he says.

Right now is the time to assess your debt and find what forgiveness programs you are eligible for and if you arent eligible for forgiveness, you should identify what is the best and cheapest way to pay back your student loans, Aguilar says.

Don’t Miss: How Much Do Loan Processors Make Per Loan

Are Private Loans Included In The Executive Order

At this time, only federal student loans are included in the executive order, as according to Federal Student Aid, the Department of Education does “not have legal authority over private student loans.” According to NerdWallet, there is a total of $131.81 billion in outstanding private student loan debt. Out of that debt, there are 27.1 million people who are in repayment, 3.1 million who are in deferment, and 23 million who are in forbearance in 2020. However, if Biden decides to change this, he can do so with new legislation.

Will Student Loan Repayment Ever Actually Resume Again Probably Not For Awhile Heres Why

US President Joe Biden addresses trades leaders at the Washington Hilton Hotel in Washington, DC, on … April 6, 2022.

AFP via Getty Images

Last week, President Biden announced another extension of the ongoing pause on student loan payments and interest accrual.

For over two years, student loan repayment has been suspended and interest has been frozen. The relief first codified by Congress through enactment of the CARES Act in March 2020 was supposed to last just six months. But President Trump, and then President Biden, issued multiple short-term extensions. Bidens most recent extension to August 31, 2022 added yet another four months to the pause.

But theres reason to believe that student loan payments wont actually restart even in September. And theres a pretty good chance that the payment pause will be extended yet again, perhaps to the end of the year or beyond. Heres why.

Recommended Reading: What The Highest Apr For Car Loan

Tell Me More About Income

The rules are complicated, but the gist is simple: Payments are calculated based on your earnings and readjusted each year.

After making monthly payments for a set number of years usually 20, sometimes 25 any remaining balance is forgiven.

Theres a confusing assortment of plans available, and there may even be a new one coming, though probably not for a while. For now, the alphabet soup includes PAYE, REPAYE, I.C.R., and I.B.R. .

Monthly payments are often calculated as 10 or 15 percent of discretionary income, but one plan is 20 percent. Discretionary income is usually defined as the amount earned above 150 percent of the poverty level, which is adjusted for household size. PAYE usually has the lowest payment, followed by either I.B.R. or REPAYE, depending on the specific circumstances of the borrower, said Mark Kantrowitz, a student aid expert.

Theres a dizzying variety of rules. Consider spousal income.

REPAYE has a marriage penalty, while I.B.R. and PAYE will use just the borrowers income if they file a separate return, joint income if they file a joint return, he said. REPAYE, he said, uses joint income regardless of tax filing status.

Got all that?

But they remain a more manageable solution for many borrowers.

Enrolling in I.D.R. now is a great next step, particularly if you lost your job during Covid, or your spouse lost their job and you are experiencing a drop in income, said Mike Pierce, executive director of the Student Borrower Protection Center.

Figure Out How Much You Owe

It may have been a while since youve checked in on your federal student loan account. If youve graduated since loan repayments were paused, you may never have checked it.

The first step to preparing for loan payments to start again is to figure out exactly how much you owe. You can use the governments free resource for learning about repayment based on where you are in the process.

Remember The White Houses student forgiveness program is expected to go into effect in the next few weeks. If you are single and make under $125,000 or married and your household makes less than $250,000, then you will likely see a $10,000 reduction to your balance .

However, for borrowers with large amounts of student loan debt, loan forgiveness wont likely wipe out all of their debt. While the amount you owe might seem daunting even after loan forgiveness, its better to face the issue head-on and look at the big picture.

Don’t Miss: What Is An Unsecured Loan

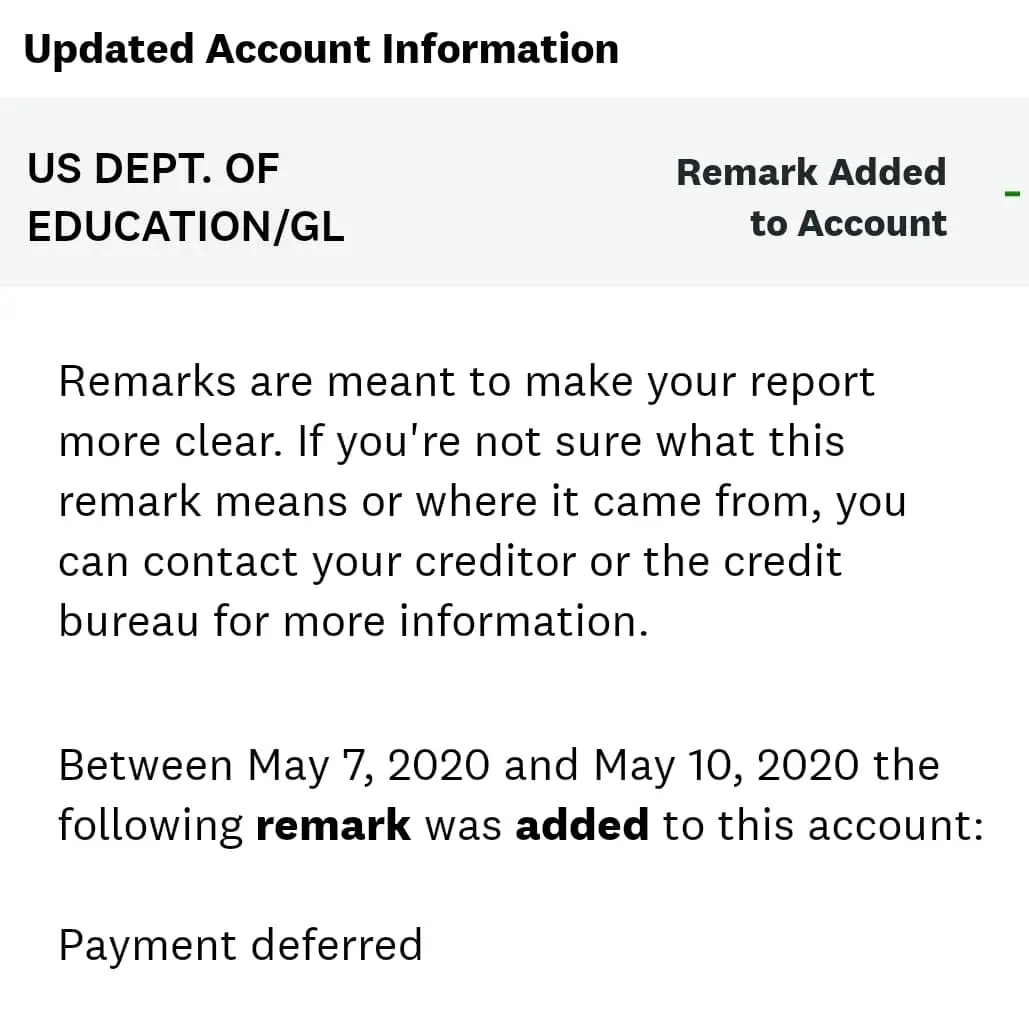

Timeline: Federal Student Loans During The Covid

This article presents a timeline of recent events related to student loans and takes a look at whats to come for student loan borrowers.

Since the start of the pandemic, the federal student loan system has been in a constant state of flux. Two presidents and Congress have put loan repayment on hold and stopped the accumulation of interest to help borrowers weather the economic fallout from COVID-19. In addition, the U.S. Department of Education has undertaken massive new initiatives to address some of the failures of the Public Service Loan Forgiveness program and income-driven repayment , which the department estimated could bring millions of borrowers closer to forgiveness. Meanwhile, four of the companies that serviced student loans under contract with the department announced that they would no longer participate in the federal student loan program, meaning the borrowers assigned to them must be transferred to other servicers.

The emergency measures provided much-needed relief to borrowers, but the frequent changes also caused confusion. And there are likely more announcements to come as President Joe Biden decides whether to extend the student loan relief measurescalled the payment pause by the Education Department and the national emergency forbearance by student loan servicersas well as how to carry out a plan to cancel some amount of student debt.

Will The Student Loan Payment Freeze Be Extended Again

The pause on federal student loan payments is slated to expire on Dec. 31, 2022, with payments expected to resume on Jan. 1, 2023. Nothing is set in stone, but in his announcement, Biden said he was continuing the moratorium “one final time” to the end of the year.

In addition, private servicers of federal student loans have lobbied to end the payment moratorium this year.

Read Also: How Do Loan Modification Programs Work

Biden Administration Extends Student Loan Payment Pause Through End Of January

The Biden administration is giving Americans a “final extension” on the suspension of their student loan repayment that will last until January 31, 2022, the Education Department announced Friday.

The pandemic-induced extension includes loan repayments, interest and collections. As recently as Thursday, the department had no updates on the status of the pause that was scheduled to end on September 30.

“The payment pause has been a lifeline that allowed millions of Americans to focus on their families, health, and finances instead of student loans during the national emergency,” Education Secretary Miguel Cardona said in a statement. “As our nation’s economy continues to recover from a deep hole, this final extension will give students and borrowers the time they need to plan for restart and ensure a smooth pathway back to repayment.”

The Education Department says it will begin to notify borrowers about the extension soon. The student loan repayment pause began under the Trump administration, as the pandemic surged, and President Biden had extended it on his first day in office.

A group of Democratic lawmakers to extend the pause in June, in a letter signed by more than 60 members of Congress. They wanted him to allow Americans to suspend their student loan payments for a longer period of time through March or whenever employment reaches pre-pandemic levels.