What Are The Disadvantages Of An Unsecured Loan

A secured loan may sound good, especially if you need a larger amount, but it can have some serious downside.

Some of the disadvantages include:

- You could lose your collateral if you default on your loan.

- Secured loans may have some restrictions, like a minimum balance on the bank account you use as collateral, or lack of flexibility on what you can use the money for.

- The may be longer since the value of your collateral needs to be considered.

Forms Of Unsecured Loans

Unsecured loans come in different shapes and sizes. Each form has a unique feature, purpose and functionality. The three main forms of unsecured loans are listed below.

Debt Consolidation Loan

This type of loan allows individuals to consolidate various debts into one single loan. For example, if you have multiple credit cards with high interest and overdue utility bills, you can combine them using a consolidation loan. The loan is used to pay off the outstanding debts, then the borrower is responsible for repaying the consolidation loan. The advantage to the borrower is the interest rate on a consolidation loan is typically lower than other debts and they only have to worry about one monthly payment.

Revolving Loan

A revolving loan is a flexible form of financing that allows the borrower to access money up to a specified limit. The borrower only pays interest on the amount uses and can make payments to regain access to their full limit. A line of credit is the most common explain of this type of financing.

Term Loan

A term loan is the most traditional form of unsecured financing. The lump sum of the loan is provided to the borrower upfront, then the borrower is responsible for making regular, scheduled payments, plus interest, to repay the debt. This is a popular financing structure for secured loans as well.

How To Qualify For An Unsecured Loan

While it is challenging to qualify for an unsecured loan, if you know what is expected of you, it can be easier to prepare. Creditworthiness is the main thing lenders consider, however, there are other considerations too. Below are common items that lenders consider for unsecured financing approval.

- . To qualify for an unsecured loan, a credit score of 650 or higher is often required. If your credit score is below 650, do your best to boost it before you apply to better your odds of approval.

- . Credit is important, but lenders will also want to know that you have cash flow available to make payments. Often, this means regular and steady income.

- Payment History. Lenders will definitely consider your previous payment history. How an individual has managed debt in the past is one of the best ways to determine how they will handle debt in the future.

- Co-Signer. Using a co-signer is not the regular process used by unsecured financing lenders, but it can help to have someone back the loan. A co-signer agrees to repay the debt if the primary borrower defaults, this can make the lender feel more comfortable about extending debt.

In addition to the above, you will also need to be the age of majority in your province or territory. When you apply, youll need to provide government-issued identification and documents showing your proof of income.

Have you ever thought about the true ?

Recommended Reading: What Car Loan Can I Afford Calculator

What Are Unsecured Loans

An unsecured loan is one that doesn’t require collateral or a security deposit. With an unsecured loan, instead of pledging assets, borrowers qualify based on their credit history and income. Lenders do not have the right to take physical assetssuch as a home or vehicleif borrowers stop making payments on unsecured loans. You promise to repay, but you dont back up that promise by pledging collateral.

- Alternative name: Signature loan

- Alternative name: Good faith loan

An unsecured loan generally comes in three forms:

- Personal loans

- Student loans

- Unsecured credit cards

Personal loans are available from banks, credit unions, and online lenders, and can be used for any purpose you see fit. Private student loans and those through the Department of Education are typically unsecured. The majority of credit cards available are also unsecured. Even though you might not think of credit cards as loans, you borrow money when you spend with them.

How To Qualify For An Unsecured Personal Loan

Your creditworthiness can be particularly important when you’re applying for an unsecured personal loan because the lender is offering you the money based solely on your promise to repay the debt.

Generally, your application will be evaluated based on:

- Your credit history: Lenders use your credit reports to learn how long you’ve been utilizing credit and whether you’ve paid your bills on time. If you’re not sure what your credit history looks like, you can check your Experian credit report for free.

- Your credit scores: Lenders also consider your credit scores and may have a minimum credit score requirement. If your scores don’t fall in the good to excellent ranges, consider trying to improve your credit scores before applying if you don’t need a loan right away.

- Your debt-to-income ratio: Your DTI ratio shows how your monthly income compares to your monthly bills. Lenders want to make sure you have enough income to cover your bills and repay the loan. Increasing your income and paying down debts can improve your DTI.

Some lenders focus on specific types of borrowers, such as those with high incomes and excellent credit or those who’ve had credit troubles in the past. But even within the same group, each lender may have its own criteria for evaluating an application.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Which Type Of Personal Loan Is Best For You

To figure out which type of lender and loan is best for your needs, shop around, apply for prequalification for a few loans, and compare the offers you receive from different lenders. Rates and terms can vary substantially, so shopping around could help you find a lower interest rate or fees, and save you money to help you pay off your loan sooner.

If you have a savings account, CD or other asset that your lender will accept as collateral, you might want to apply for a secured loan, because your interest rate and APR would likely be lower.

If you dont have an asset that your lender will accept, or youre not willing to risk losing an asset that you have, you can apply for an unsecured loan.

When To Consider Secured Loans And Lines Of Credit

The primary advantage of a secured loan or line of credit is that you can generally gain access to more money, because you’re backed by the security of your assets.

Since secured lending products require collateral, the approval process can be longer as the collateral must be processed and verified. This initial due diligence can be worth the extra effort since you’ll benefit from lower interest rates. Large home renovations and debt consolidation are two instances in which you may elect to use a secured loan or line of credit.

Unlike smaller renovations, you may want to go through the process of obtaining a secured lending product when you’re looking at more extensive changes to your home. A secured line of credit would give you access to a larger credit limit with a lower interest rate, that you could access on an ongoing basis for large projects.

If you have outstanding debts, a personal loan secured by your current assets can help you consolidate debts into one loan. With lower interest rates than most credit cards, a personal loan can help you manage your monthly payments. A secured line of credit also offers convenient access to low-interest funds to help consolidate and pay down existing debts.

Also Check: Arvest Construction Loans

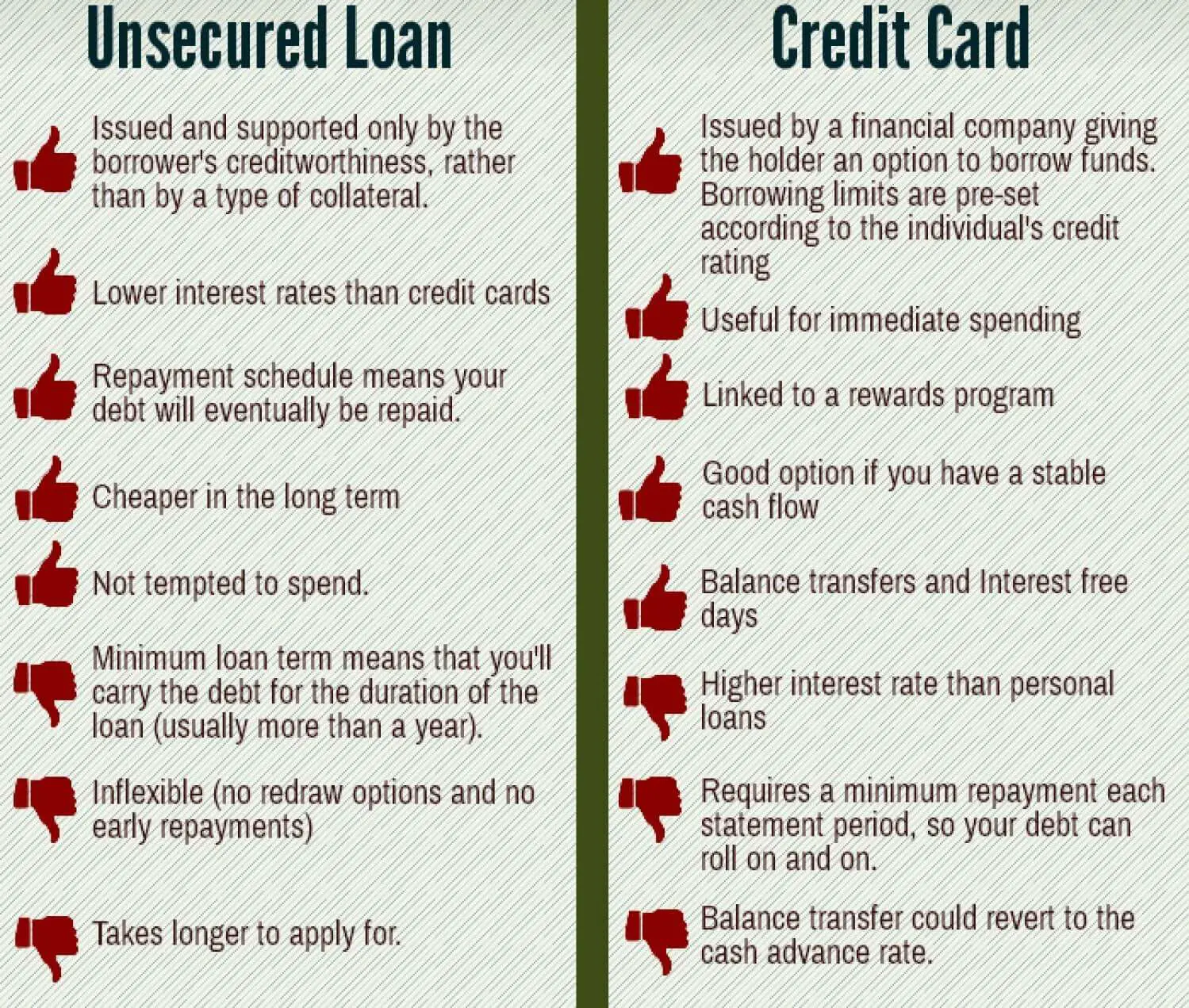

Pros And Cons Of Unsecured Loans

From the borrower’s perspective, the main advantage of an unsecured loan is the decrease in risk. If you receive an unsecured loan and can’t make payments, you don’t risk losing your assets you just put your credit score at risk. For people and businesses with unsecured loans, there is also a chance that your debt will be discharged if you file for bankruptcy.

Since unsecured loans don’t require any collateral, the lender takes on more risk, which generally translates to higher interest rates and less favorable terms. While unsecured loans may be less risky for the borrower, it’s important to know how much more it could cost you over its duration. You may find that putting an asset down as collateral is more beneficial than the extra money you’ll pay in interest.

Secured Vs Unsecured Loans: Which Loan Should I Pay Down First

If youve got both a secured loan and an unsecured loan, and youre wondering which to pay down first, the secured loan, if often the better choice since it is tied to your property. If you dont make the payment on your businesss delivery truck, for example, someone is going to come for the keys.

That said, the interest rates on an unsecured loan can be quite high. Sometimes, giving up the secured assets to keep from going bankrupt is simply the better option if you dont have an alternative. If you have multiple loans and are uncertain about how to proceed, your business accountant or financial advisor may be able to help.

Recommended Reading: Does Va Loan Work For Manufactured Homes

If Youre Thinking About Applying For A Personal Loan You Should First Understand The Difference Between Secured And Unsecured Personal Loans

The difference could affect how likely you are to get approved for a personal loan, the interest rate youll get, and whether youll have to risk some property to get the loan. Lets look at how both work as well as some things you should know in order to decide which type of personal loan is right for you.

What Is The Disadvantage Of An Unsecured Loan

The primary disadvantages of an unsecured loan include:

- You may have to pay the loan back over a shorter period of time, though this depends on the lender. Discover Personal Loans, for example, offers loan terms from 36 to 84 months.*

- No collateral might mean that you pay a higher interest rate because the risk may be greater to the lender. A strong could offset this disadvantage.

- It may be harder to get approved without collateral if you need a larger amount for debt consolidation. Again, your personal credit score and profile contribute here as well.

Discover Personal Loans understands that paying off credit cards and consolidating other high-interest debt can be challenging. Thats why weve made the process of applying for a personal loan as simple as possible check out our application checklist and tips, too.

Read Also: Get A Loan Without Proof Of Income

How To Compare Loan Options

It can be difficult to compare options for personal loans without knowing the total cost of the loan. You can calculate the total cost of the loan by multiplying the payment amount by the number of payments in your term.

Suppose you want to get a personal loan for $2,000. Assume the interest rate is 19.99% on a monthly payment plan. You may be offered various monthly payment options, which include interest and other fees.

For example, you have the following monthly payment options:

- option 1: $185 per month for 12 months

- option 2: $75 per month for 36 months

- option 3: $53 per month for 60 months

Lenders may extend the duration of the loan to lower your monthly payment. This comes at a cost because youll pay more interest over time. When you compare the total cost of the loan, its easier to know which option is best for you.

Table 1: Example of the total cost of personal loan with different terms| Option | |

|---|---|

| 60 | $3,180 |

Table 1 shows the longer you take to pay off your loan, the more expensive it will be. The amounts are approximate and have been rounded to the nearest dollar.

Types Of Unsecured Debt

Also Check: How Long For Sba Loan Approval

Consider Lendingclub When Comparing Your Options

With over 3 million members served since 2007, LendingClub is the nations largest online lending marketplace and offers access to credit with flexible amounts up to $40,000, lower interest rates, no pre-payment penalties, and fast funding. We treat our members the way wed want to be treated with clear terms, fixed rates, and repayment plans that our members can actually afford.

Auto Repossession Overage Balances

If you miss enough payments on your auto loan, your lender likely will repossess your car. The lender then sells the car to recoup what you owed. If your car has lost value faster than youve repaid the loan, its possible the funds from the sale will not cover the entire amount you owe. The difference, called the auto repossession overage balance, is your responsibility. Since your lender has already confiscated the only asset to which it is entitled, this debt is unsecured.

Read Also: Refinance Auto Loan Usaa

Do You Need Great Credit To Get An Unsecured Loan

No. There are several personal loan lenders that specialize in loans to consumers with average credit scores. For example, personal loan lenderAvant accepts borrowers with poor credit and higher. Other lenders such as Upstart and Lending Point also accept borrowers with so-so credit scores.

To be clear, you aren’t likely to get a single-digit interest rate on your unsecured loan unless you have good credit. However, personal loans can still be great financial tools for borrowers with less-than-excellent credit scores.

Alternatives To Personal Loans

For discretionary expenses, consider cheaper alternatives than personal loans.

A 0% APR credit card can be one of the best ways to borrow money, particularly if you pay the balance back within the cards introductory period. This period can last up to 18 months, and no interest will be charged on your purchases.

You need good to excellent credit above 690 FICO to qualify for a 0% card.

A personal line of credit is another alternative. These are most commonly offered by banks and are a hybrid between a loan and a credit card. Like a loan, a lender will need to approve your application, but like a credit card, you draw only what you need and pay interest only on the amount you use.

A line of credit is ideal for borrowers who arent sure what their total borrowing need will be. Those with good or excellent credit have the best chance at getting approved at the lowest rates.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How Do Lenders Assess Creditworthiness

Both types of credit loanssecured and unsecuredcreate fodder, for better or worse, for your credit score. Financial lenders report your payment history to the credit bureaus. If youre looking to avoid blemishes, beware of late payments and defaults.

If you default on a secured loan, of course, the lender may repossess whatever you bought with the loan , or, if it was a house, foreclose on it. Those dont look good on your credit score, either, by the way. So although the terms of your secured loan might seem generous, especially with interest rates nearing all-time lows, these should still be considered high-risk loans.

There are five criteria, known as the Five Cs, that financial institutions often look for in determining the merit of the borrower on the basis of the persons financial history and resources. Weve covered them in more detail here, but here they are in brief.

Advantages And Disadvantages Of Unsecured Loans

Though unsecured loans arent tied to assets like houses and cars that can be seized if the loan isnt repaid, they are hardly without risk. Failure to pay can severely damage an individuals or business credit rating commonly measured as a FICO score making it difficult to obtain credit again for a substantial amount of time.

Unsecured loans offer borrowers a reserve to buy things quickly, or pay off debts that become due, but they often come with high interest rates, and the terms can be tricky. , for instance, allows borrowers to make small minimum payments over long periods of time, but interest rates are usually much higher than those attached to secured loans. Lenders charge the higher rates to compensate for risk if you default, they cant take an asset to cover their losses.

For people who pay off debt on schedule, unsecured loans have tremendous advantages. They allow borrowers to improve their credit rating quickly, which can mean bigger credit lines and lower interest rates on revolving debt. If lenders see a good repayment history, they are far more likely to offer more credit at favorable terms.

Unlike home loans, interest paid on unsecured loans isnt tax deductible. For that reason, many homeowners opt for home equity lines of credit that allow them to borrow against the equity in their homes, often using a cash card. Of course, that isnt without risk: if a borrower fails to make required payments, the lender can foreclose on the borrowers home.

Also Check: What Credit Score Is Needed For Usaa Auto Loan