Who Can Apply For Usda Home Loans

- Those who meet income restrictions

- Those who will personally occupy the dwelling as their primary residence.

- Individuals who are US Citizens, US Non-Citizen National, or Qualified Aliens

- Those who have the legal capacity to incur the loan obligation

- Those who have not been suspended or debarred from participation in federal programs

- Those who demonstrate the willingness to meet credit obligations in a timely manner

- Those who are to purchase property that meets all program criteria.

Our Usda Loan Process

Assurance Financial understands it can be daunting to apply for a home loan â especially if you have never applied before, or if you have been rejected for financing in the past. Fortunately, USDA loans can be easier to qualify for.

If you like the idea of living on a farm or in a more rural area and would be interested in applying for a loan backed by the USDA, Assurance Financial may be able to help. With us, you can apply online for a quote on a mortgage in just 15 minutes or you can apply by speaking to a person. We can pre-qualify you by looking at your credit score and other details.

When you find a rural property you like, you can fill out a full loan application with Assurance Financial. We are USDA mortgage and construction loan lenders who can handle your application from start to finish in-house. We do not outsource underwriting and other processes.

Processing your application involves appraisal and underwriting. We then make a decision about your application. If you are eligible for a mortgage and we can fund your mortgage, the next phase of the process involves signing with a notary and funding and closing the mortgage. At that point, you can start planning your move and packing your boxes.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: Capital One Auto Loans Rates

Upcoming Eligible Usda Map Changes

USDA had slated changes to its eligibility maps for October 1, 2015. However, according to a source inside USDA, map changes had been postponed.

According to the source, eligibility maps are now reviewed every three to five years. The last review happened in 2014.

USDA runs on a fiscal year of October 1 through September 30. This is why most big changes to the program happen in October. For this reason, watch for a geographical boundary change on October 1, 2020.

Changes are more likely in 2020 and 2021. The reason: The 2020 census. USDA bases its maps on these US-wide population counts that happen every 10 years. Since the USDA has not made major changes to maps since the year 2000, its becoming more and more likely that big updates will happen soon.

Why Usda Rural Development Has A Mortgage Program

Providing affordable homeownership opportunities promotes prosperity, which in turn creates thriving communities and improves the quality of life in rural areas. This program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe, and sanitary dwellings as their primary residence in eligible rural areas. Eligible applicants may build, rehabilitate, improve, or relocate a dwelling in an eligible rural area. The program provides a 90% loan note guarantee to approved lenders. This reduces the risk of extending 100% loans to eligible rural home buyers.

Recommended Reading: Usaa New Car Loan Rates

How Does A Usda Loan Work

USDA loans apply when you’re buying a house in a rural area. Usually, the USDA issues loans for homes that are 2,000 square feet in size or less and that have a market value below their areas’ respective loan limits . The USDA tends to favor loan applicants who have the greatest need for assistance — meaning, candidates who are in need of safe housing, are unable to secure a conventional loan, or have an adjusted income at or below the low-income limits for where they live.

What Exactly Is A 100% Usda 502 Guaranteed Loan

The single-family housing, USDA 502 Guaranteed program is a government-insured mortgage for families living in qualified rural locations in the United States. However, dont let the word Rural confuse you as many suburbs even have eligible locations.

The goal of the USDA program is to help our rural communities expand by making homes more affordable through no down payment and moderate credit requirements. This is one of the last zero down payment loans available for non-military homebuyers in the U.S.

This is especially good for first-time home buyers and public service workers like Teachers, Firefighters, and Police Officers that want to purchase a home but have limited savings. Many of these buyers find it difficult to save the down payment often required by FHA and Conventional loans.

Listed below are just a few benefits of a USDA mortgage:

Please click the USDA Benefits page above to dig in and learn more about this great government-backed program. 100% financing, low mortgage interest rates, and affordable property values make this a great time to purchase your new home. The USDA Blog here is also a great resource to read about the latest program updates.

We encourage home buyers to contact us 7 days a week with any questions about the USDA application or loan pre-approval process. To fast track your request, please fill out the quick Info Request Form on this page and our affiliate will contact you today. You can also call the number at the top of this page.

Read Also: Fha Loan Limits Harris County

Do I Qualify For A Usda Home Improvement Loan And Grant

The USDA also runs the Housing Repair Loan & Grants program to help very-low-income individuals restore or improve their homes in USDA-designated areas. Eligible borrowers 62 or older can use grants of up to $7,500 to remove hazardous or dangerous material from their homes.

You must meet the following requirements to qualify for a USDA home improvement loan or grant.

- Be unable to obtain affordable credit elsewhere

- Have a family income ranking below 50% of the median income in your area

- For grants: be age 62 or older and unable to repay a repair loan

Usda Loans Have Been Cheaper Since 2016

On October 1, 2016, USDA reduced its monthly fee from 0.50% to 0.35%. Your monthly cost equals your loan amount or remaining principal balance, multiplied by 0.35%, divided by 12.

Additionally, the upfront fee fell from 2.75% to just 1.00%. This is a good opportunity for home buyers to get lower monthly payments with this loan program.

Read Also: Usaa Used Auto Loan Rates

Usda Home Loan Qualifications And Requirements

To qualify for a USDA loan, you:

- Do not have to be a first-time homebuyer

- Do not have to be employed in the agricultural industry, even though the Department of Agriculture backs the loans

- Must be a U.S. citizen or an eligible noncitizen

You are required to maintain an escrow account with your lender. The lender will use this account to pay the taxes and insurance on your loan.

About The Usda Rural Housing Mortgage

The Rural Development loans fullname is the USDA Rural Development Guaranteed Housing Loan. However, theprogram is more commonly known as a USDA loan.

The Rural Development loan is sometimes calleda Section 502 loan, which refers to section 502 of the Housing Act of1949, which makes the program possible.

This program is designed tohelpsingle family home buyers and stimulate growth inless-populated, rural, and low-income areas.

That might sound restrictive. But in fact, 97% of the US map is eligible for USDA loans, including many suburban areas near major cities. Any area with a population of 20,000 or less can be eligible.

Yet most U.S. home buyers, even those who have USDA loaneligibility, havent heard of this program or knowlittle about it.

This is because the USDA loanprogram wasnt launched until the 1990s. Only recently has it beenupdated and adjusted to appeal to rural and suburban buyers nationwide.

Many USDA-approved lenders dont even list the USDAloan on their loan application menu. But many offer it.

So if you think youre eligiblefor a zero-down USDA loan, its worth asking your shortlist of lenders whetherthey offer this program.

Don’t Miss: Usaa Used Auto Loan

What Is Rural Credit

USDA home loans can be obtained through rural credit. Rural credit is how the United States Department of Agriculture assists low-income and middle-class households to purchase a home that is habitable, spacious, equipped, and allows them to live a decent, suburban life. There are a few requirements for the program that do not apply only to the borrower/applicant, but also to your home. must both meet the eligibility criteria to be eligible for funding.

Who Is A Good Candidate For A Usda Loan

The ideal candidate for a USDA loan has the following qualities:

A credit score of at least 640

Employment for at least two years

A debt-to-income ratio no greater than 41%

A need of a safe and sanitary primary residence

Looking to live in a USDA-designated rural area

Tried and failed to obtain a reasonable loan through other sources

Read Also: Usaa Vehicle Refinance

What Are The Rates For Usda Direct Loans

Fixed-interest rates for USDA direct loans are based on the propertys market value at mortgage approval or closing whichever is lower. Rates can sink to as low as 1% depending on your circumstances. The payback period usually stretches to 33 years, but it can extend to up to 38 years for very-low-income borrowers who cant afford the former.

The maximum mortgage amount depends on your ability to repay the loan as well as any applicable subsidies or repayment assistance. The USDA determines this factor by examining your employment, financial and credit history. However, you cant borrow more than the loan limit for the area you plan to live in.

How To Apply For A Usda Loan

The process for securing a USDA loan is very similar to the conventional loan underwriting process. However, there are a few extra steps required for getting a USDA loan to confirm eligibility, as well as some potentially unique documentation items, like well tests, that are unique to rural property.

Don’t Miss: Usaa Car Calculator

Tips For Getting A Usda Loan

- Do your research. Qualifying for a USDA loan boils down to your income and location. So look up USDAs website to see where its designated areas are and what the income limits are in those locations.

- Applying for a USDA loan requires extensive documentation so be sure to have a mortgage preapproval checklist at hand.

- Before you house hunt, even with a USDA loan, its a good idea to know how much house you can afford. This process will help you figure out which rates you can manage.

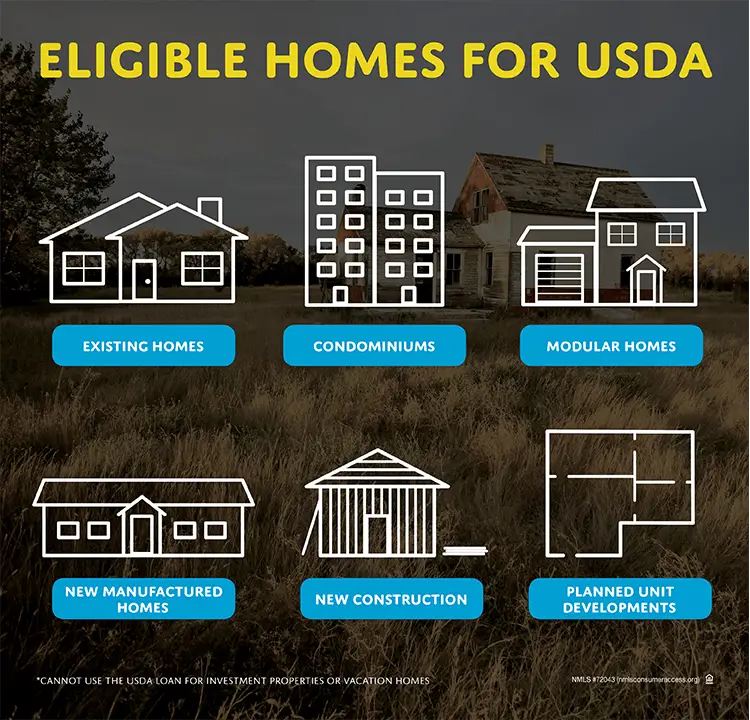

What Type Of Property Is Eligible For A Usda Loan

Homes purchased with USDA loans must be located in eligible rural areas. The USDA defines these areas as open country or any town, village, city, or place, including the immediate adjacent densely settled area, which is not part of or associated with an urban area.

The population requirements differ depending on the characteristics of the property, but the maximum population limit for any USDA loan is 20,000. Even if youre buying in a town that has a lower population than that, you wont qualify for a USDA mortgage if the area is within a metropolitan statistical area . It also must be in an area with a serious lack of mortgage credit for lower and moderate-income families, according to the USDA website.

The easiest way to find out if a home is in a USDA-eligible area is to check the USDA website here.

Don’t Miss: Usaa Pre Qualify Home Loan

Learn More About Usda Loans From Your Community Mortgage Lender

Since 1919, BTC Bank has provided personal customer service to local communities in Northwest Missouri. We have a rich history of helping our customers become homeowners and we can help you, too. To explore the benefits of USDA loans and verify your eligibility, visit a BTC Bank branch near you or contact us today. Our friendly mortgage lenders are waiting to serve you at 12 convenient locations in Albany, Beaman, Bethany, Boonville, Carrollton, Chillicothe, Gallatin, Maysville, Osborn, Pattonsburg, and Trenton, MO and Lamoni, IA.

What Is The Usda Loan Program

A few months ago, I sold my home and moved across the country. When I sat down with a real estate agent to discuss the possibilities, one of the most encouraging things she told me was that our home met the requirements for the USDA loan program. Due to the nature of the USDA loan program, this was a selling point for our home especially since comparable homes for sale in our neighborhood didnt qualify.

Read Also: Stilt Loan

Purpose Of The Usda Loan

The USDA loans purpose is to provide affordable homeownership opportunities to low-to-moderate income households to stimulate economic growth in rural and suburban communities throughout the United States.

These rural development loans are available in approximately 97% of the nations landmass, which includes over 100 million people according to the Housing Assistance Council.

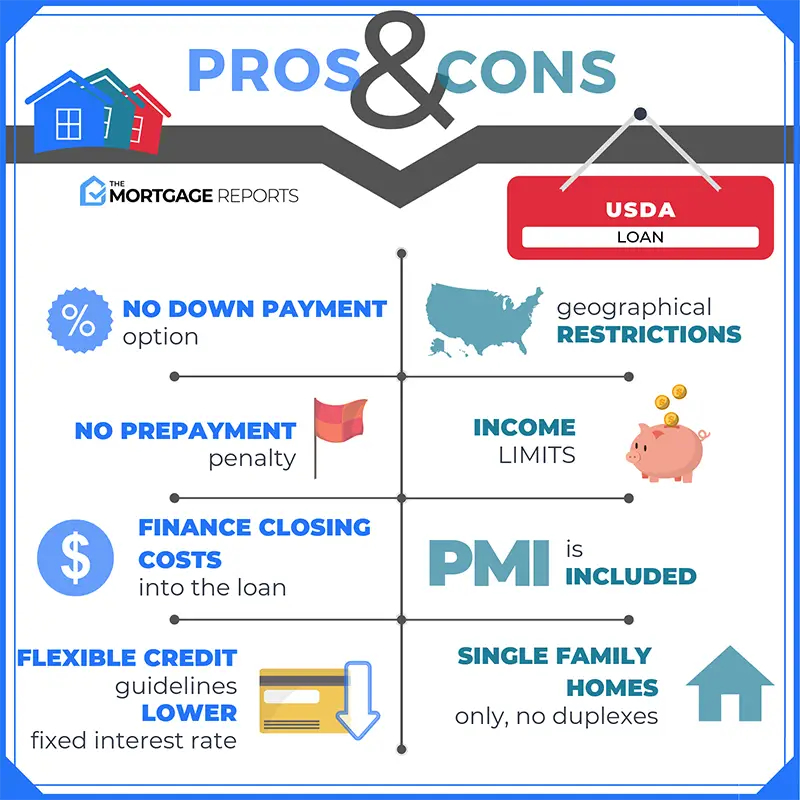

What Are The Pros And Cons Of A Usda Loan

If you know you can afford a monthly mortgage payment but are struggling to save the cash you’ll need for a down payment on your first home, consider the USDA Rural Development Loan.

Why? It can be a good option if you:

- have limited resources

- do not want to live in a large, urban area.

USDA loans are backed by the U.S. Department of Agriculture and are intended to help people living in low- to moderate-income households put down roots in certain rural and suburban locations. It makes sense, then, that the main requirement is that the property must fall within certain geographical areas, outside the city limits of major metropolitan centers.

As long as you qualify, you can build, rehabilitate, improve or relocate a dwelling as your primary residence in eligible rural areas. And you can borrow 100 percent of the appraised value. That means you do not have to come up with funds for the down payment, which can be a challenge for many homebuyers.

While the loans are backed by the U.S. Department of Agriculture, they don’t actually provide you with the home loan. You apply and receive your loan from approved lenders . The main benefit to you is that you can get low mortgage interest rates, even without a down payment. Be aware, however, that if you put little or no money down you will have to pay a mortgage insurance premium. The loan term is a 30-year fixed-rate mortgage.

Pros of the USDA Rural Development Loan

Recommended Reading: Becu Ppp Forgiveness

Usda Home Improvement Loan

The USDA Improvement Loan is for low-income families who want to make improvements to their existing home. These repairs are limited to things that will negatively impact the health and safety of the home. To qualify, the individual or family must have a family income 50% lower than your average area income. You also must be ineligible for any other types of home improvement loans or financing. If you’re 62 or older and you can’t afford payments, you can apply for a grant. A few things this program can be used to fix are:

- Flooring replacement or repair

- HAVC unit replacement or repair

- Roof and shingle replacement or repair

What Credit Score Do I Need For A Usda Direct Loan

Because USDA direct loans are typically geared toward very-low-income borrowers, applicants need to demonstrate at least an adequate credit history. Those with no official credit history can apply as well. However, theyd have to demonstrate a suitable financial standing with non-traditional credit sources such as timely utility payments.

Recommended Reading: Why Is My Car Loan Not On My Credit Report

Offering Usda Loans In Ok Ks Tx Ar & Al

Financial Concepts Mortgage is licensed to provide USDA loans in Oklahoma City, rural Oklahoma, Texas, Kansas, Arkansas, and Alabama. There is no maximum loan size with the USDA loan program. The amount youre able to borrow is limited by your households debt-to-income ratio. Our experienced team will help you determine the loan size you need and can qualify for.

Homebuyers May Qualify For A Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Don’t pay too much for your mortgage. Leverage our lender network to get a USDA loan at today’s historically low mortgage rates.

Also Check: Loan Options Is Strongly Recommended For First-time Buyers

The Usda Home Loan Program

The USDA loan program is one of the best mortgage loans available for qualifying borrowers.

Theres no down payment required, and mortgage insurance fees are typically lower than for conventional or FHA loans. USDA interest rates tend to be below-market, too.

To qualify for 100% financing, home buyers and refinancing homeowners must meet standards set by the U.S. Department of Agriculture, which insures these loans.

Luckily, USDA guidelines are more lenient than many other loan types.