A Guide To Private Mortgage Insurance

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Its a myth that you need to put down 20% of a homes purchase price to get a mortgage. Lenders offer numerous loan programs with lower down payment requirements to fit a variety of budgets and buyer needs. If you go this route, though, expect to pay for private mortgage insurance . This added expense can drive up the cost of your monthly mortgage payments and, overall, makes your loan more expensive. However, its almost unavoidable if you dont have a 20% or more down payment saved up.

Private Mortgage Insurance

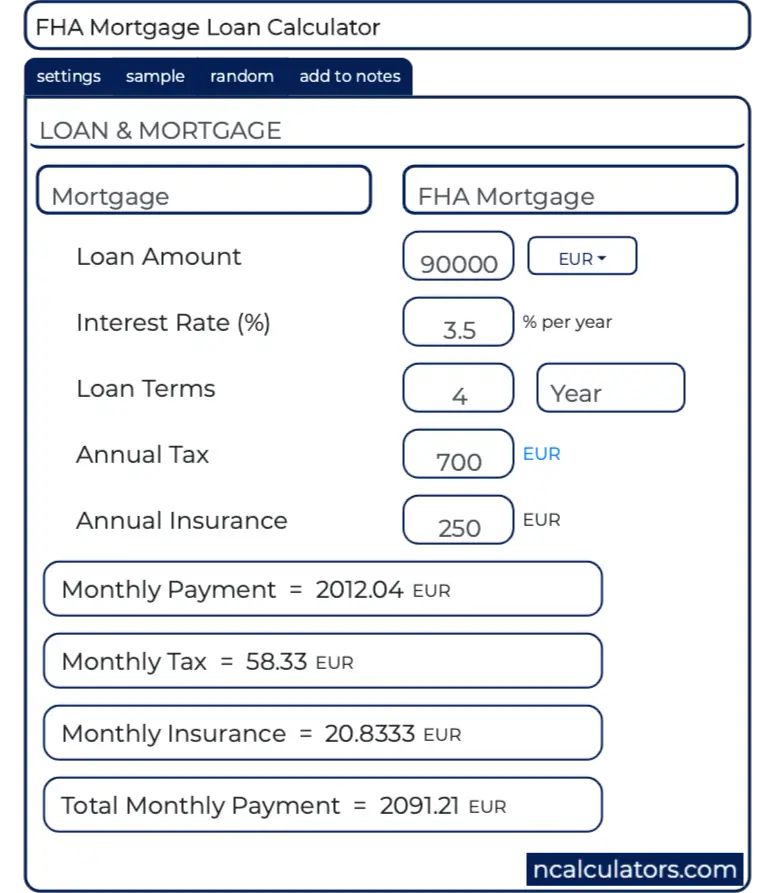

How Is Fha Mortgage Insurance Calculated In 2022

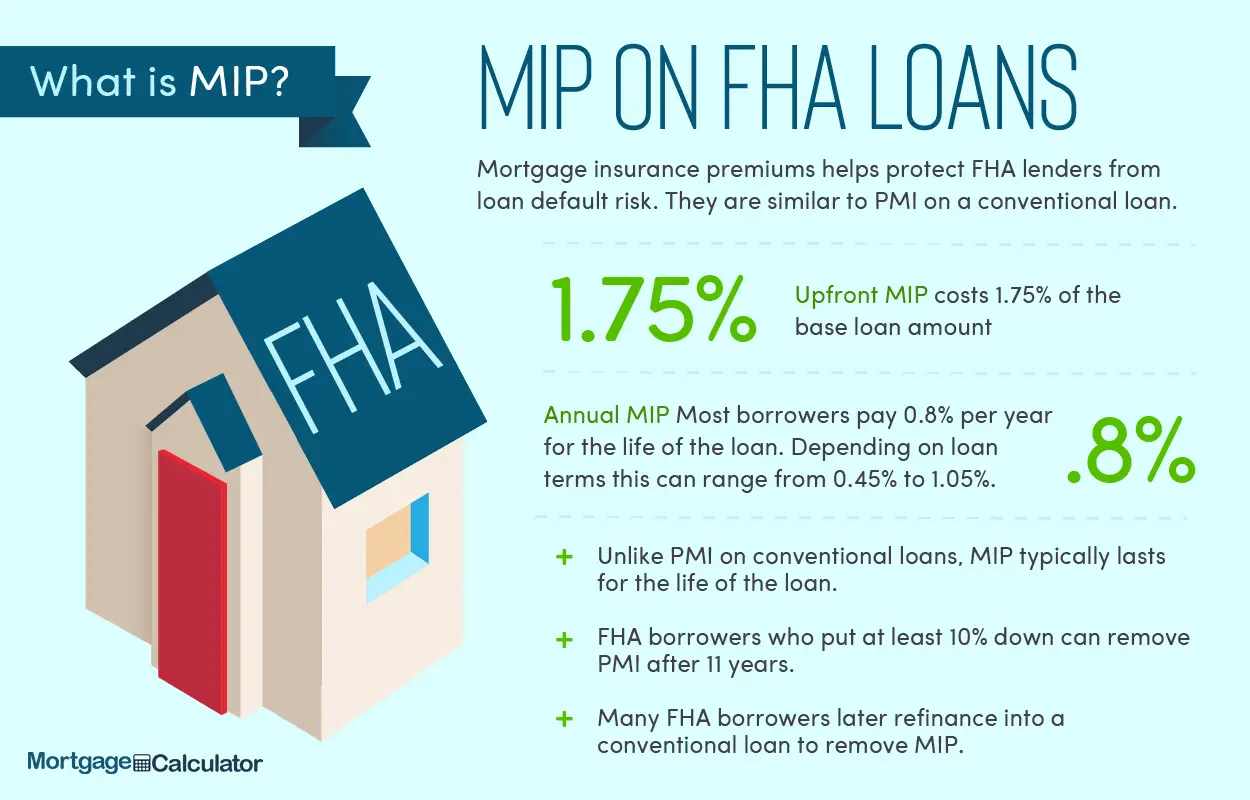

There are two components to FHA mortgage insurance or MIP. The first is the upfront mortgage insurance premium of 1.75% of the loan amount. That needs to be paid at closing.

As an example, if your purchase price is $243,500 and your loan amount is $235,000, then your upfront mortgage insurance premium at closing will be $4,112.50

The upfront mortgage insurance premium needs to be paid on all FHA loans except the following:

- FHA Streamline Refinances

- Loans on Indian lands

- Loans on Hawaii Home Lands

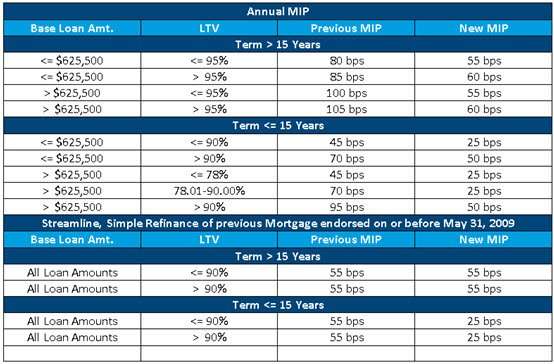

The second portion is the annual FHA mortgage insurance premium which is divided by 12 and added to your monthly mortgage payment. The calculation of this payment will vary based upon the loan amount and your down payment amount or loan to value ratio .

Example: Loan amount of $235,000 + 96.5% LTV + 30 yr fixed loan

- $235,000 X .85% = $1,997.50

- $1,997.50 Divided by 12 = $166.46

- $166.46 is added to your monthly mortgage payment

You can see from the chart below, the loan amount is less than $625,000, the LTV is greater than 95% and the mortgage term is greater than 15 yrs. So, the rate used for the MIP calculation is .85%

Total FHA Mortgage Insurance Premium in the example above = $4,112.50 plus $166.46 per month

Tip the more money you put down on the home, the lower your MIP rate will be that is used to calculate your monthly insurance premium. This could save you a lot of money over the life of your loan

How To Calculate Your Pmi Cost

The PMI calculator starts by asking for the price of the home you want to buy and your anticipated down payment amount to calculate a down payment percentage. If this percentage is under 20%, its likely that youll have to pay for private mortgage insurance.

With this and other loan details, the calculator estimates your monthly PMI cost. The calculator also estimates the total amount youll pay for mortgage insurance until you have 20% equity and can get rid of PMI.

Follow these steps to use the calculator.

Enter the amount you plan to spend on a home. For the most accurate results, enter the amount for which youre already pre-qualified or been preapproved, but you can also enter your best guess of how much you can afford.

Enter a down payment amount. This is the amount of cash you plan to pay upfront for the home.

Enter an interest rate. If you dont yet have a personalized interest rate quote from a lender, click the link underneath the entry field to see todays average mortgage rate and use it as an estimate.

Enter a mortgage insurance rate. When shopping lenders, ask for their typical PMI rates. If youre not sure what your mortgage insurance rate will be, choose a rate somewhere in the middle of the typical range 0.58% to 1.86%.

Enter a loan term. The 30-year term is the most common, especially among first-time home buyers. With a 15-year mortgage, you’ll pay off the loan faster and pay less interest, but have higher monthly payments.

Don’t Miss: Can You Use The Va Loan To Buy Land

Getting Rid Of Fha Mortgage Insurance Method #: Refinance Out Of It

Canceling FHA mortgage insurance is also possible by refinancing into a conventional loan. Refinancing to a conventional mortgage is often the quickest and most cost-effective way to do it especially if mortgage rates have dropped since your original loan. And it can be the only way to do it if you opened your FHA loan on or after June 3, 2013, when FHA mortgage insurance became non-cancellable.

With todays rising home values, homeowners might be surprised how much equity they have. With a refinance, you can use your homes current appraised value rather than the original purchase price.

Replace FHA mortgage insurance with conventional PMI

Conventional private mortgage insurance, or PMI, has to be paid for just two years, then is cancellable. Converting your FHA mortgage insurance to conventional PMI is a great strategy to reduce your overall cost. Conventional PMI is usually much cheaper than FHA mortgage insurance, and you can cancel it much more easily.

You can often refinance into a conventional loan with as little as 5% home equity.

When your new conventional loan balance reaches 78% of the homes value, you can cancel conventional PMI. Some lenders and servicers will even let you cancel when you reach 80% of your homes current value.

Get rid of FHA mortgage insurance today with a loan that doesnt require PMI

Canceling FHA MIP with a VA Loan

Upfront Mortgage Insurance Premium

FHA UFMIP is the easiest to understand. It is a lump sum premium that is financed into your FHA loan. FHA UFMIP is 1.75% of your FHA loan amount. Consider the following:

- You are buying a $150,000 home and making the minimum 3.5% down payment .

- Your BASE FHA loan amount is $144,750 .

- FHA UFMIP is 1.75% of $144,750, which equals $2,533.

- Therefore, your FHA loan amount will be $144,750 + $2,533 = $147,283.

As you can see, FHA UFMIP does not impact your cash needed to close or savings required to obtain an FHA loan. FHA UFMIP is financed into your FHA loan.

You May Like: Usaa Car Loan Refinance

Fha Debt To Income Ratio Chart

This chart will indicate what DTI is acceptable based upon your credit score. This also talks about some compensating factors that may be needed to qualify for the higher DTI levels. Keep in mind this is just a basic guideline and it would be best to discuss your personal scenario because you still may qualify despite what this chart says.

| Minimum Credit Score |

How Much Does Pmi Cost

PMI rates on average can range from0.55% to 2.25% of the original loan amount. At those rates, for a $300,000 30-year fixed rate mortgage, PMI would cost anywhere from $1,650 to $6,750 per year, or approximately $137.50 to $562.50 per month. PMI can be paid upfront or it is included in the monthly mortgage payments.

Also Check: Capital One Auto Loan Approval

Can You Cancel Fha Mortgage Insurance

You cant cancel or remove FHA mortgage insurance, but you can refinance into a private loan with no insurance.

You can refinance into a new loan and put 20% down to avoid the monthly insurance expense, says Speakman.

Unlike FHA mortgage insurance, private mortgage insurance can be removed in a few additional ways, but reaching that 20% equity benchmark, or refinancing, are the main routes.

are a great vehicle for people to enter the housing market and take that next step to home ownership, says Speakman. But at a certain point, it might make sense for those people to refinance so that they can get around some of these insurance requirements if theyre financially able to do so.

Private Mortgage Insurance Companies

MGIC Mortgage Guaranty Insurance Corporation

MGIC is a subsidiary of MGIC Investment Group and it provides private mortgage insurance to lenders of home mortgages across the U.S. The company offers primary coverage and pool insurance. Primary coverage gives the opportunity to people to become homeowners with less than 20% down payment and protects the lender against default. Pool insurance covers losses that are bigger than claim payments in the case of default. MGIC currently operates in all the states of the U.S., Puerto Rico, and Guam. MGIC is one of the largest private mortgage insurance companies which has more than 20% share in the market of PMI providers.

Radian Guaranty Inc.

Radian Guaranty Inc is the primary subsidiary of Radian Group. The subsidiary is in the business of providing private mortgage insurance to lenders and offers various mortgage, real estate, and title services. Radian Guaranty Inc. provides PMI on first-lien mortgage accounts and pool insurance. Currently, Radian works with more than 3,500 residential lenders to make homeownership possible for Americans. Its revenues account for half of the total revenues of its parent company.

Essent Guaranty Inc.

National Mortgage Insurance Corporation

Recommended Reading: Aiq Ellie Mae

Can The Fha Up Front Mortgage Insurance Fee Be Financed

The upfront FHA mortgage insurance fee can be financed or rolled into the loan. This a huge benefit for those who dont have very much saved for closing costs. Here are some of the features or rules around financing the FHA up front mortgage insurance fee:

- The fee must be paid in cash or financed

- The fee cannot be split by financing some of it and paying cash for the rest. It is one or the other

- Financing the fee does not impact your DTI or reduce the loan amount that you qualify for.

- The upfront fee is not considered to be part of the minimum down payment amount

Financing the FHA up front mortgage insurance fee means you will be paying interest on it for the life of the loan.

Tip negotiate with the sellers of the home to have them cover this cost at closing.

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Don’t Miss: Is Prosper Com Legit

Who Can Fha Refinance Loans

You can refinance an FHA loan Back to the traditional loan If the minimum requirements are different from traditional mortgages FHA Require. If your credit score improves to the least 620 in the time after you apply for the loan FHA loan You may be eligible for delivery loan Itâs time to advocate for the price tag.

Recommended Reading: What Percent Down Payment To Avoid Mortgage Insurance

What Is The Fha Loan And How Does It Work

FHA mortgage home loan thats backed by the government and insured by the Federal Housing Administration Although FHA loans require monthly mortgage insurance premiums, loan requirements are generally more flexible than traditional loans and the eligibility process. home loan thats backed by the government and insured by the Federal Housing Administration .

Recommended Reading: What Credit Agency Do Mortgage Lenders Use

Don’t Miss: Used Car Loan Usaa

Choose A Different Government Loan Type

If you really want to avoid MIP payments, you may want to consider another type of government loan.

You may be buying a home in a rural area and have a median FICO®Score of 640 or higher. In that case, why not consider a USDA loan? Unlike an FHA loan, USDA loans dont require a down payment. You also dont need to pay PMI or MIP with a USDA loan. Instead, you pay a monthly guarantee fee thats less expensive than the FHA monthly premium.

On the other hand, you might want to consider a VA loan if youre a current or former member of the armed forces or a qualifying spouse. To qualify for a VA loan, youll need a median FICO®credit score of at least 620 and a DTI ratio of 60% or less. Theres no down payment requirement for a VA loan. You also dont have to pay any type of monthly mortgage insurance on a VA loan. Instead, youll pay a one-time VA funding fee and the home must be your primary residence. Veterans receiving VA disability benefits and surviving spouses of veterans who passed in the line of duty or as a result of a service-connected disability are exempt from the funding fee.

Contact a Home Loan Expert to learn more about these FHA loan alternatives and to find out whether you qualify.

Two Ways To Reduce Fha Mip

- More down payment

- Shorter loan term

Remember the 2 charts above showing how much the monthly FHA mortgage insurance costs? Did you notice that higher down payments reduce the PMI? On the 20 30 year terms, putting down 5% or more reduces the PMI rate by .05%. Its not a lot, but it is a saving. On a 10 15 year term, a 10% down payment reduces the PMI by .25%.

The next option is shortening the loan term to 15 years or less. Also, notice in the second chart that the PMI rates decrease dramatically for these shorter terms. Although, to reach these lower mortgage insurance rates, a higher down payment and shorter-term may make the loan less affordable for many borrowers. Thats why most FHA buyers choose the lower 3.5% down payment and a 30-year term.

Also Check: How Many Aer Loans Can I Have

What You Should Know

- If you put less than a 20%down paymenton your conventional mortgage, you are required to pay for private mortgage insurance

- Private mortgage insurance protects the lender in the case that you are not able to make yourmortgage paymentsand thus default on the loan

- PMI rates range, on average, from 0.55% to 2.25% of the original loan amount

- Your PMI premiums can be removed once you build 20% equity in your home

- There are different types of PMI, which include borrower-paid mortgage insurance, lender-paid mortgage insurance, single premium mortgage insurance, and split-premium mortgage insurance

- Government-backed loans such as FHA-loans require mortgage insurance premiums

How The Pmi Calculator Works

NerdWallets PMI calculator uses your home price, down payment, mortgage interest rate, mortgage insurance rate and loan term to estimate the cost of PMI.

Many borrowers dont mind paying PMI if it means they can buy a house sooner. But if the added cost of PMI pushes you over your monthly budget, you may want to shop in a lower price range or postpone homebuying until your financial situation improves.

Read Also: What Credit Score Does Usaa Use For Mortgage

What Costs Are Built Into A Monthly Fha Mortgage Payment

NerdWallets FHA loan calculator considers the following costs when estimating your monthly FHA loan payments:

-

Principal. This is the amount you owe on the loan what you borrowed minus your down payment. For example, if you buy a $250,000 home and put down 10% , the principal would be $225,000.

-

Interest. This is the cost of borrowing the money from a lender, expressed as an annual percentage.

-

Property taxes. Annual taxes assessed by a government authority on your home and land are often collected as a part of your payment and paid through an escrow account.

-

FHA mortgage insurance. This is a cost built into FHA loans. Youll make an upfront premium payment at closing, while ongoing premiums are factored into your monthly payment.

-

Homeowners association fee. If you’re buying a house, townhome or condo that is governed by a homeowners organization, you may have to pay monthly or annual dues that cover upkeep and improvements to shared amenities.

What Counts As A Net Tangible Benefit

The FHA will not allow a Streamline Refinance unless it produces a Net Tangible Benefit. This is to protect borrowers against unscrupulous loan offers.

Such benefits can include a rate drop of at least 0.5%, a switch from adjustable to fixedrate financing, or a shorter loan term.

However, FHA guidelines can be complicated. For example, if you switch from an adjustablerate mortgage to a fixedrate loan, a higher mortgage rate is allowed.

For details and specifics, speak with loan officers and compare FHA Streamline refinance offerings.

Recommended Reading: Can Mortgage Lenders Verify Bank Statements

What Is A Mortgage Point

Some lenders may use the word “points” to refer to any upfront fee that is calculated as a percentage of your loan amount. Point is a term that mortgage lenders have used for many years and while some points may lower your interest rate, not all points impact your rate. Mortgage points can be found on the Loan Estimate that the lender provides after you apply for a mortgage.

Enter The Zip Code Where You Plan To Buy A Home Currently The Ufmip Rate Is 175 Of The Amount Of Your Fha Loan

How to calculate monthly mortgage insurance premium. If youre interested in buying a home Private Mortgage Insurance and learning more about how to. For example assuming a 1 percent MIP on a 200000 loan with only 5 percent down payment 195000. FHAs Annual Mortgage Insurance Premium MIP The annual premium is divided by 12 and that amount is added to the borrowers monthly mortgage payment.

On the previous example the UFMIP is approximately 4200. Divide by 12 and round to nearest cent for Monthly MIP. Multiply the loan amount by the mortgage insurance premium rate for the annual.

The FHA upfront mortgage insurance premium is 175 of the loan amount. To calculate the rate takes the rate of insurance and multiply it by the value of the loan. The most common way for mortgage insurance to be paid is as a monthly premium rolled into your mortgage paymentMany buyers do not realize that there is also an option to pay the premium as a single lump sum upfront called single-payment mortgage insurance.

Determine the monthly payment Divide this number by 12 for 12 months then add the number to the monthly mortgage payment to see what your total monthly payment will be. Upfront MIP 175 Annual MIP. Of that approximately 170 is the monthly mortgage insurance premium.

UFMIP is equal to 175 of the loan amount. Since March 17 2017 the followingCMHC premiumsapply in most situations. 53080 1 00225 5191198 round to 51912.

Monthly Fixed Expenses Budgeting Budget Planning Budget Calculator

Don’t Miss: How Long Does It Take Sba To Approve Loan