How To Request An Increase In The Illinois Sba Eidl Loan

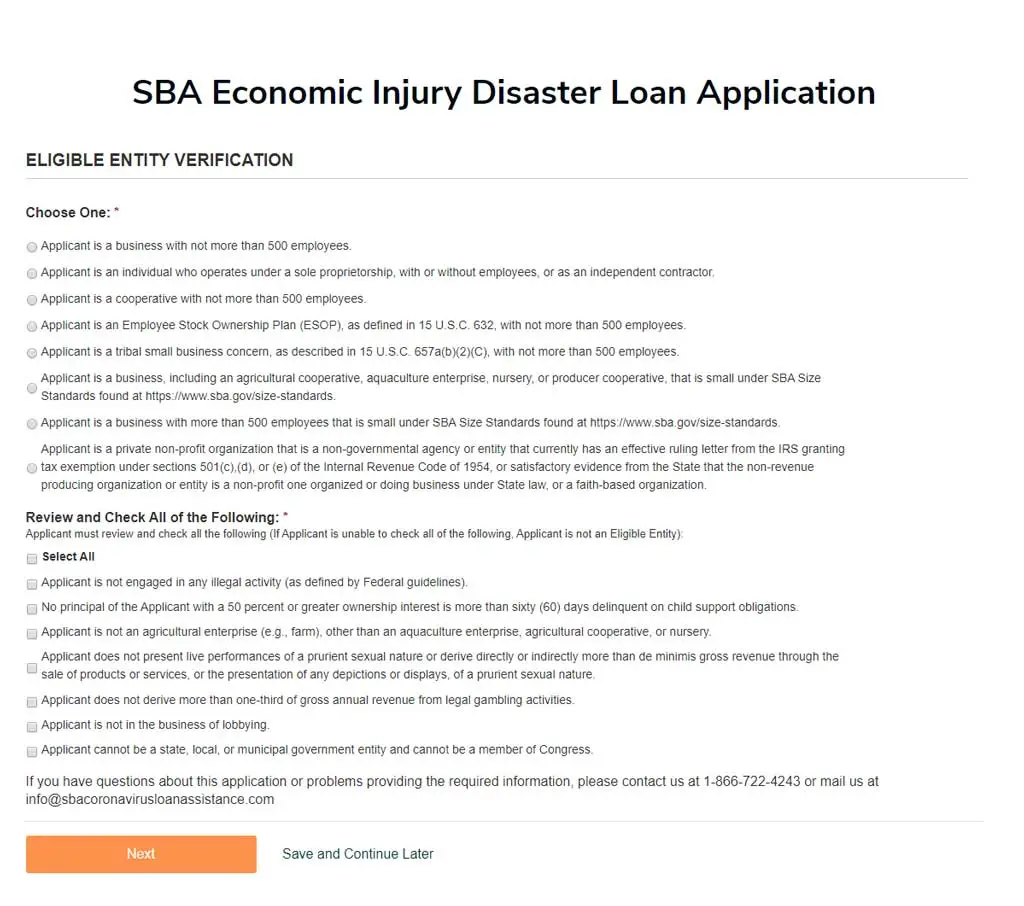

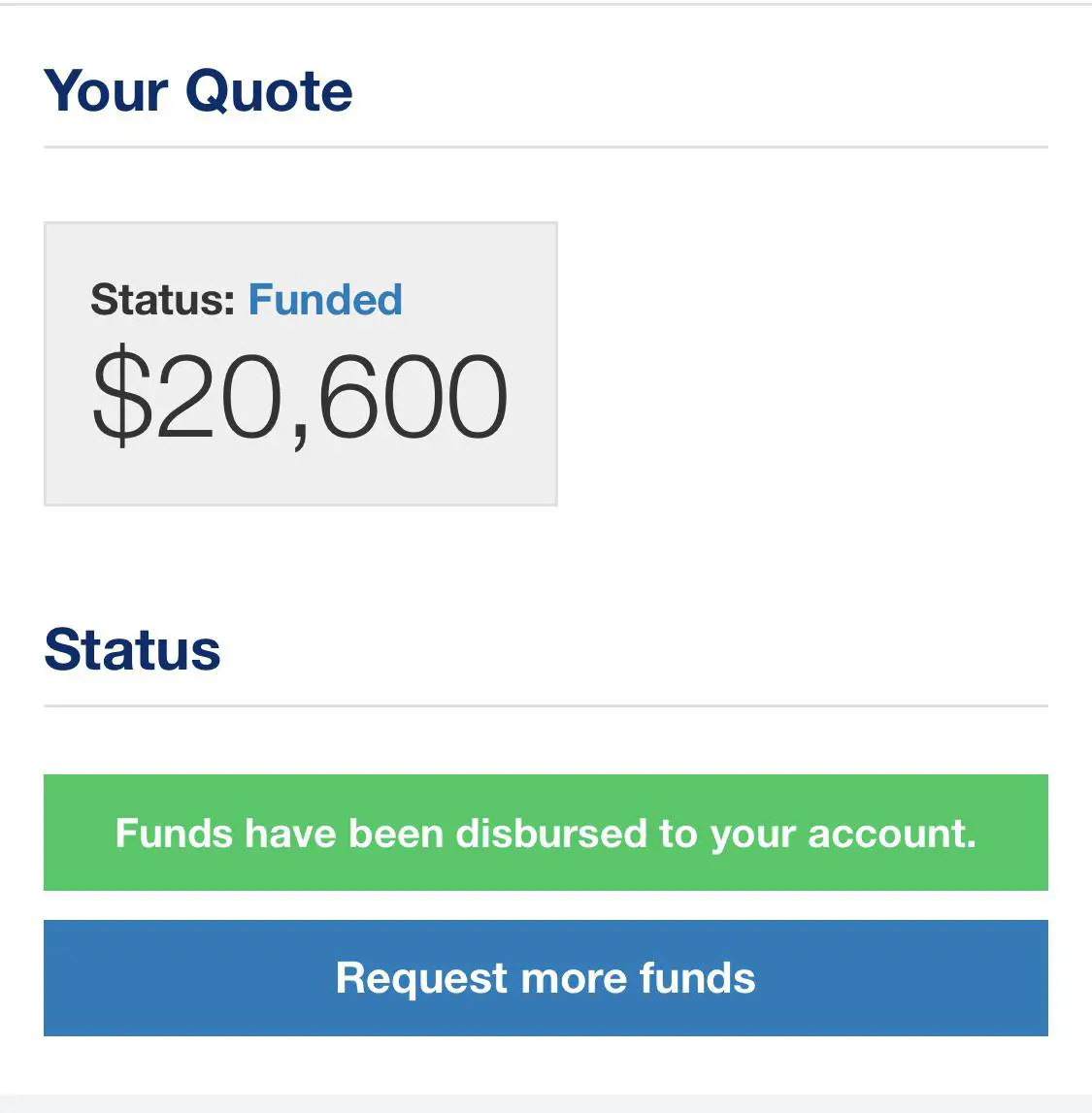

Once you log into the Illinois SBA online EIDL portal, you may or may not see a button titled Request an Increase or Request more funds. If you do not see that button, an EIDL increase must be done manually and in letter form.

If you dont see the button to increase the loan amount, you can directly reach out to SBA by email and request a loan increase.

Send an email to with the subject line EIDL Increase Request for . Make sure to include all the necessary information such as application number, phone number, etc. in the body of the email.

You will receive a confirmation email for your Illinois SBA EIDL loan increase request saying Thank you for contacting the Covid EIDL Increase Team. Your request has been received and will be processed in the order it was received.

It may take several weeks before you receive a response from Illinois SBA.

What If I Didnt Accept The Full Amount I Was Approved For Can I Get The Full Amount Now

If the applicant accepted the loan for less than the full amount originally offered, they have up to two years after the date of the loan note to request an increase to get additional funds, even after the application deadline of Dec. 31, 2021.

If an applicant declined the original loan offer, the loan offer is considered to be withdrawn. Applicants can request a reacceptance within 6 months of the original offer, even after the application deadline of Dec. 31, 2021.

How To Apply For An Eidl Loan Increase

Update May 6, 2022: EIDL loan funds have been exhausted. You can no longer request loan increases at this time, but you can read on to get more acquainted with program in case it ever comes up again.

If youâre a small business owner struggling to stay afloat because of COVID-19, you may be eligible for borrower-friendly funds from the government.

The federal government created several programs to help small businesses recover from the economic impact of the virus throughout the pandemic. COVID-19 Economic Injury Disaster Loan is one of them.

On September 8, 2021, the U.S. Small Business Administration announced a change to EIDL. The updates include an EIDL loan increase and more flexibility when using the funds.

You can request an EIDL loan increase for up to two years after your loan date, or until the funds are exhausted. The SBA expects funds to run out by mid-April 2022, so now is the time to request that increase.

Note: Only businesses that already have an EIDL loan can request an increase. If you don’t have one, unfortunately the SBA is no longer accepting new applications for EIDL loans.

So, how do you apply for an EIDL loan increase?

Letâs find out.

Also Check: Is An Fha Loan Assumable

See Your Next Steps Below:

For over 2 years, the COVID-19 Economic Injury Disaster Loan program provided funding to help small businesses recover from the economic impacts of the COVID-19 pandemic. In that time, over 3.9 million loans totaling over $378 billion were approved across the country.

The program effectively ended the first week of May 2022. As of May 6, the SBA was no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications due to a lack of available funding.

As of May 16, the COVID-19 EIDL portal closed. Borrowers who need copies of their loan documents can still contact Customer Service at 853-5638. Please allow 3-5 business days to receive your materials.

Illinois Sba Eidl Loan Increase Request Guidelines

Here are some terms and rules when you apply for an Illinois SBA EIDL loan increase:

- 30-year term with a 3.75% fixed rate for business and 2.75% for nonprofits.

- SBA will record a UCC filing for a loan amount over $25,000.

- No real estate collateral is required for any loans below $500,000.

- May use funds to pay off other business loans or business debt.

Read Also: What Is Mortgage Loan Pre Approval

South Dakota Sba Eidl Loan Increase Request Guidelines

Here are some terms and rules when you apply for a South Dakota SBA EIDL loan increase:

- 30-year term with a 3.75% fixed rate for business and 2.75% for nonprofits.

- SBA will record a UCC filing for a loan amount over $25,000.

- No real estate collateral is required for any loans below $500,000.

- May use funds to pay off other business loans or business debt.

Check Your Eidl Loan Status By Phone

You can also find out the status of your EIDL loan application by phone. You can use this method if you submitted your application online or by mail. Call 1-800-659-2955 and ask for Tier 2. These reps can answer questions about the application process and your EIDL loan status. If you applied through the COVID-19 portal, the SBA will contact you, but you may be able to get answers by calling the toll-free number.

If you mailed in your application, this is the best way to find out your loan status, as you wont have a username and password to log onto the online portal. On the plus side, this method allows you to talk to an SBA rep that will answer your questions, even if these go beyond finding out your loan status. On the other hand, though, you may be stuck waiting on hold, as other business owners are also inquiring about the EIDL program and loan statuses.

Read Also: Is Loan Lease Payoff Worth It

Sba Eidl $2 Million Loan Increase Requests: Path To Approval

SAN FRANCISCO, CA / ACCESSWIRE / November 19, 2021 / The Small Business Administration Economic Injury Disaster Loan maximum amounts have changed numerous times since the inception of the popular COVID loan program in March of 2020. From the original $2 million, it was quickly reduced to $150,000 when millions of business owners were applying in droves. This past year it was raised to $500,000. Now, as of September 2021, it is restored back to the original $2 million maximum for those small businesses that qualify for this size EIDL loan.

Excited business owner receiving news of being approved for a $2 million SBA EIDL disaster loan. Image Credit: 123rf / Fizkes.

“For those small businesses and companies who have initially received 1st round EIDL funds, many do not realize you can do a loan modification or increase request for upwards of the current $2 million maximum,” said Marty Stewart, Chief Strategy Officer for Disaster Loan Advisors .

DLA is a strategic advisory firm that specializes in assisting small businesses and companies with SBA loan consulting for SBA EIDL loan increase requests and modifications, as well as EIDL loan reconsideration requests for those who have been denied.

When Did the SBA Increase the EIDL Loan Program Back to the Original $2 Million?

In September 2021, SBA Administrator Isabella Casillas Guzman announced major enhancements to the COVID Economic Injury Disaster Loan program.

Businesses that qualify are:

About Disaster Loan Advisors

CONTACT:

Need An Increase On Your Florida Sba Eidl Loan

Did you already receive a Florida SBA EIDL loan for your Florida business?

We can assist your business in requesting additional SBA EIDL loan funds through the increase request and loan modification process in Florida.

Schedule Your FreeDisaster Loan Consultation to see if we may be able to help your business with the SBA Increase Request Process in Florida.

You May Like: How To Cancel Student Loan Debt

Florida Eidl Loan Modification And Increase Request Strategy

For a complete SBA EIDL loan modification strategy on how to do an increase request to maximize your chances of receiving the maximum eligibility your Florida business qualifies for, please schedule a call with us directly.

In Florida, there are varying factors to consider if your increase request is under $500,000, or over $500,000. These are very important factors you should know to maximize your chances of getting a yes for your Florida company.

Contact us today to schedule a call with one of our SBA loan consultants to discuss the best strategy that will work for your business in FL.

How Does Getting A California Sba Loan Increase Working Capital

Getting the California SBA EIDL loan increase will allow you to get increased business financing. The new money plus your existing California SBA EIDL funds will give you more working capital.

You may use the increased funds for any business purpose such as increasing payroll for California employees, buying equipment, or increasing inventory.

You May Like: How Much Is Mortgage Insurance Fha Loan

How Does Getting A South Dakota Sba Loan Increase Working Capital

Getting the South Dakota SBA EIDL loan increase will allow you to get increased business financing. The new money plus your existing South Dakota SBA EIDL funds will give you more working capital.

You may use the increased funds for any business purpose such as increasing payroll for South Dakota employees, buying equipment, or increasing inventory.

Was Your Alabama Sba Eidl Loan Denied

Has your Alabama SBA EIDL loan been denied for your AL business?

We can assist you in filing for an SBAEIDL loan reconsideration appeal for your business in Alabama.

Schedule Your Free Disaster Loan Consultation to see if we may be able to help your business with the SBA Loan Reconsideration Process in Alabama.

Cover Image Credit: 123RF.com / Fizkes. / Disaster Loan Advisors.

Read Also: Where To Apply For Fha Home Loan

Was Your South Dakota Sba Eidl Loan Denied

Has your South Dakota SBA EIDL loan been denied for your SD business?

We can assist you in filing for an SBAEIDL loan reconsideration appeal for your business in South Dakota.

Schedule Your Free Disaster Loan Consultation to see if we may be able to help your business with the SBA Loan Reconsideration Process in South Dakota.

Cover Image Credit: 123RF.com / Fizkes. / Disaster Loan Advisors.

Illinois Eidl Loan Modification And Increase Request Strategy

For a complete SBA EIDL loan modification strategy on how to do an increase request to maximize your chances of receiving the maximum eligibility your Illinois business qualifies for, pleaseschedule a call with us directly.

In Illinois, there are varying factors to consider if your increase request is under $500,000, or over $500,000. These are very important factors you should know to maximize your chances of getting a yes for your Illinois company.

Contact us today to schedule a call with one of ourSBA loan consultants to discuss the best strategy that will work for your business in IL.

Don’t Miss: Your Application Is Being Processed Sba Loan

Mississippi Sba Eidl Loan Increase Request

Mississippi EIDL disaster loans have been approved over 33,130 small businesses and companies in the State of Mississippi amounting to over $2,129,947,456 in Mississippi EIDL loans processed as of 12/23/21. If your Mississippi business entity has already received a US Small Business Administration loan, you may be eligible for more COVID-19 Economic Injury Disaster Loan money from the EIDL program in Mississippi.

You can follow the process and request a Mississippi SBA EIDL loan increase, up to the current $2,000,000 maximum, based on your maximum eligibility from your 2019 tax return figures for your business in Mississippi.

Mississippi EIDL loans were previously limited to $150,000, and then raised to $500,000. On 9/8/21, the SBA increased the Mississippi EIDL loan limit from $500,000 to the current $2 million.

Was Your Florida Sba Eidl Loan Denied

Has your Florida SBA EIDL loan been denied for your FL business?

We can assist you in filing for an SBAEIDL loan reconsideration appeal for your business in Florida.

Schedule Your Free Disaster Loan Consultation to see if we may be able to help your business with the SBA Loan Reconsideration Process in Florida.

Cover Image Credit: 123RF.com / Fizkes. / Disaster Loan Advisors.

Recommended Reading: Does Paying Off An Auto Loan Help Your Credit

How Does Getting A Florida Sba Loan Increase Working Capital

Getting the Florida SBA EIDL loan increase will allow you to get increased business financing. The new money plus your existing Florida SBA EIDL funds will give you more working capital.

You may use the increased funds for any business purpose such as increasing payroll for Florida employees, buying equipment, or increasing inventory.

Virginia Sba Eidl Loan Increase Timeline

For new Virginia EIDL applications, the deadline expired on December 31, 2021. However, if you already received EIDL funds for your Virginia business, you can still do an increase request in 2022, or until the COVID EIDL funds run out.

If your Virginia business had been declined, you can still go through the reconsideration process within 6 months after the date of the decline letter to request reconsideration, even if it is already past the deadline of 12/31/2021. The ERCin Virginia is a tax credit program for your VA business that does not expire until 2025.

The SBA will continue processing applications after the deadline, including increase requests and reconsiderations. This means six months from the date of decline for reconsiderations and 30 days from the date of reconsideration decline for appeals unless funding is no longer available.

There are many small business owners confused about the December 31st deadline. The only businesses that needed to worry about that deadline were the ones who had never applied for the SBA EIDL COVID loan program before, said Marty Stewart, Chief Strategy Officer for Disaster Loan Advisors .

Many companies that are in the process of loan modification increase requests, or reconsideration appeal requests within six months of receiving a decline letter from the SBA, will continue well into 2022 until the EIDL funding eventually runs out, continued Stewart.

Don’t Miss: How To Transfer Home Loan From One Bank To Another

What Youll Need To Check Your Eidl Loan Status

What youll need to check your EIDL loan status varies based on how you contact the SBA.

If you call in, you wont have a username or password, so youll need to provide additional information. If you applied online, have your application number ready. You may also need to verify additional information, such as the name of your business, federal tax ID, and/or your legal name.

If you email the SBA, make sure to provide your legal name and your application number . You may also be required to submit additional information, such as your business name, federal tax ID, or other identifying information.

Business Line Of Credit

A business line of credit is a flexible financing option that extends your working capital to cover just about any business-related need. The best part is that youll only pay interest on the portion of the funds you borrow, so if you only end up dipping a little bit into your line of credit, then youll only owe a little bit.

You can hold on to a business line of credit as a disaster-prevention or recovery tooleither way, its a great financing alternative to have in your back pocket.

Dont Miss: What Are Payments On 30000 Car Loan

You May Like: Rates For Refinancing Student Loans

What If I Didnt Accept The Full Amount I Was Approved For Can I Get The Full Amount Now

If the applicant accepted the loan for less than the full amount originally offered, they have up to two years after the date of the loan note to request an increase to get additional funds, even after the application deadline of Dec. 31, 2021.

If an applicant declined the original loan offer, the loan offer is considered to be withdrawn. Applicants can request a reacceptance within 6 months of the original offer, even after the application deadline of Dec. 31, 2021.

Dont Miss: Federal Student Loans Vs Private

Mississippi Sba Eidl Loan Increase Request Guidelines

Here are some terms and rules when you apply for a Mississippi SBA EIDL loan increase:

- 30-year term with a 3.75% fixed rate for business and 2.75% for nonprofits.

- SBA will record a UCC filing for a loan amount over $25,000.

- No real estate collateral is required for any loans below $500,000.

- May use funds to pay off other business loans or business debt.

Also Check: Can I Use Personal Loan For Education

How To Request An Increase In The South Dakota Sba Eidl Loan

Once you log into the South Dakota SBA online EIDL portal, you may or may not see a button titled Request an Increase or Request more funds. If you do not see that button, an EIDL increase must be done manually and in letter form.

If you dont see the button to increase the loan amount, you can directly reach out to SBA by email and request a loan increase.

Send an email to with the subject line EIDL Increase Request for . Make sure to include all the necessary information such as application number, phone number, etc. in the body of the email.

You will receive a confirmation email for your South Dakota SBA EIDL loan increase request saying Thank you for contacting the Covid EIDL Increase Team. Your request has been received and will be processed in the order it was received.

It may take several weeks before you receive a response from South Dakota SBA.

Washington Sba Eidl Loan Increase Request Guidelines

Here are some terms when you apply for an Washington SBA EIDL loan increase:

- 30-year term with a 3.75% fixed rate for business and 2.75% for nonprofits

- SBA will record a UCC filing for loan amount over $25,000

- No real estate collateral is required for any loans below $500,000

- You cant invest the money in an interest-bearing bank account

Read Also: How To Calculate Va Loan Amount