How To Lower A Debt

You can lower your debt-to-income ratio by reducing your monthly recurring debt or increasing your gross monthly income.

Using the above example, if John has the same recurring monthly debt of $2,000 but his gross monthly income increases to $8,000, his DTI ratio calculation will change to $2,000 ÷ $8,000 for a debt-to-income ratio of 0.25 or 25%.

Similarly, if Johns income stays the same at $6,000, but he is able to pay off his car loan, his monthly recurring debt payments would fall to $1,500 since the car payment was $500 per month. John’s DTI ratio would be calculated as $1,500 ÷ $6,000 = 0.25 or 25%.

If John is able to both reduce his monthly debt payments to $1,500 and increase his gross monthly income to $8,000, his DTI ratio would be calculated as $1,500 ÷ $8,000, which equals 0.1875 or 18.75%.

The DTI ratio can also be used to measure the percentage of income that goes toward housing costs, which for renters is the monthly rent amount. Lenders look to see if a potential borrower can manage their current debt load while paying their rent on time, given their gross income.

How To Calculate Your Debt

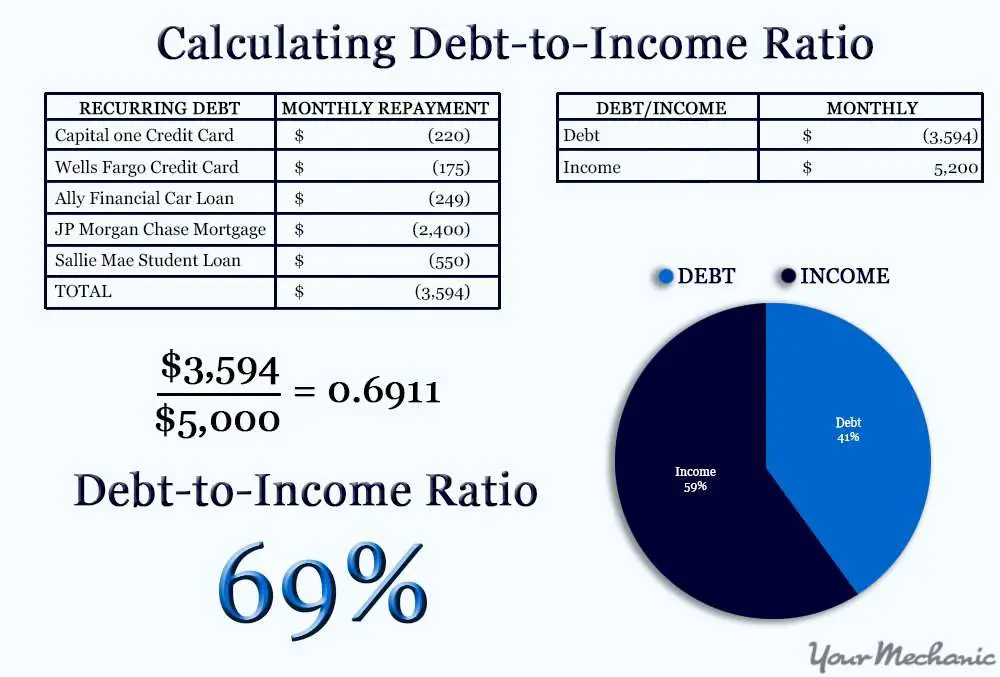

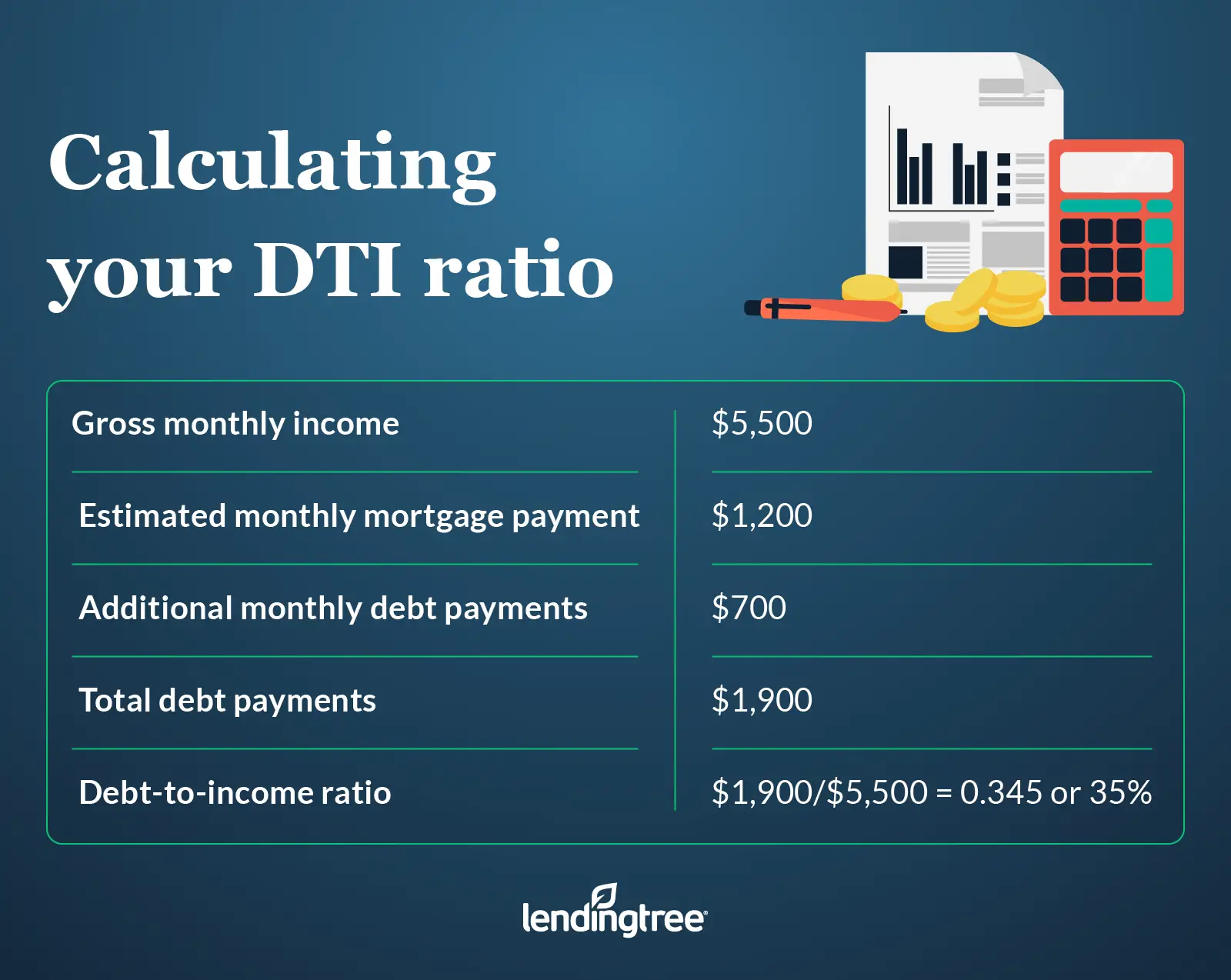

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, you’d then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, you’d take 0.3 and multiply it by 100, giving you a DTI of 30%.

What Should Your Debt

In general, the lower the DTI ratio, the better. Many lenders require a DTI of 43% or below for a home equity loan. This ensures that you wont overextend your finances and end up owing more than you can pay. This helps create healthy debt and income habits.

If your DTI is higher than 43 percent, it might be best to work on reducing it before you try to acquire an HEL. You can lower your DTI in a few ways, the easiest of which is paying down debts, such as credit cards, and reducing or eliminating additional monthly debts.

Your DTI looks at monthly payments, not your total amount of debt, so one solution may be to prioritize the reduction of debt by focusing on the highest monthly payments first. Paying down debt that doesnt change its monthly amount based on the total owed doesnt help in the short term, but it is a great part of a long term strategy for reducing debt and making the most of your home and its value.

Your DTI looks at monthly payments, not your total amount of debt, so one solution may be to prioritize the reduction of debt by focusing on the highest monthly payments first. Paying down debt that doesnt change its monthly amount based on the total owed doesnt help in the short term, but it is a great part of a long term strategy for reducing debt and making the most of your home and its value.

Also Check: How To Reduce School Loan Debt

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

To Adequately Prepare For Retirement You Have To Know How Much Income You’ll Need During This Phase Of Your Life

Renting means following the rules, not being able to decorate and having restrictions on pets. A personal loan calculator is a free too. If you’re looking for a loan to renovate your home or pay down another debt, you might have an opportunity to use the equity you’ve already invested in your home. Read on to learn more about home equity loan requirements and answer your hom. To adequately prepare for retirement, you have to know how much income you’ll need during this phase of your life. Comparing interest rates and deciding if monthly payments are affordable can make your head spin, but there are valuable resources that can help. The ratio helps both you and lenders determine how much house you can afford. Keep reading to learn how to calculate your house value. Here’s a look at how to modify your home loan. Buying a house gives you the freedom to do what you want and build a lif. Starting a new loan is a very big decision. Elevate your bankrate experience get insider access to our best financial tools and content. You’ll need to determine your estimated annual income needs so that you can work towards your total savings goal while you’re.

Starting a new loan is a very big decision. A home equity loan is a financial product that lets you borrow against your home’s value. When you purchase a home and take out a mortgage, you might not realize that the interest rate you pay on this type of loan can change.

Read Also: How To Transfer Car Loan To Another Person

What Is Included In Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, credit card debt, and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

How Do You Calculate The Debt

The;debt-to-equity ratio;shows the proportions of equity and debt a company;is using to finance its assets;and it signals the extent to which can fulfill obligations to creditors, in the event a business declines.

A low debt-to-equity ratio indicates a lower amount of financing by debt via lenders, versus funding through equity via shareholders. A;higher ratio indicates that the company is getting more of its financing by borrowing money, which subjects the company to potential risk if debt levels are too high. Simply put: the more a company’s operations rely on borrowed money, the greater the risk of bankruptcy, if the business hits hard times. This is because minimum payments on loans must still be paideven if a company;has not profited enough to meet its obligations. For a;highly leveraged;company, sustained earnings declines could lead to financial distress or bankruptcy.

Also Check: Can I Get Home Equity Loan On Investment Property

What Is An Ideal Ldr

Typically, the ideal loan-to-deposit ratio is;80%;to 90%. A loan-to-deposit ratio of 100% means a bank loaned one dollar to customers for every dollar received in deposits it received. It also means a bank will not have significant reserves available for expected or unexpected contingencies.

Regulations also factor into how banks are managed and ultimately their loan-to-deposit ratios. The Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and the Federal Deposit Insurance Corporation;do not set minimum or maximum loan-to-deposit ratios for banks. However, these agencies monitor banks to see if their ratios are compliant with section 109 of the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 .

Improving Your Dti Ratios

If you are looking over your finances and realize that you have a bit too much debt to qualify for a home, there are some things you can do to lower your debt-to-income ratios and put you in a better financial position.

The easiest solution is to pay off as much debt as you can. The tried-and-true method of starting with the smallest balance and paying it off, then moving to the next largest balance, will help you to pay down your bills and give you some satisfaction during the process.

Another option is to add to your income. This could be something drastic like looking for a better-paying position at a different company but doing the same work you are doing now. Or it could be as simple as working a few hours of overtime per week at your existing job.

You can also add to your monthly income by taking on a 2nd part-time job. Keep in mind, if you get a part-time job and wish to use that revenue in your DTI calculations, you will need to have the job for a couple of years before the lender will consider the income.

A third idea is to add another person to the loan. FHA, along with Fannie Mae and Freddie Mac, have non-occupying co-borrower loan options that allow for a borrower to be on the loan if the borrower does not plan to live in the home. Your lender can provide you with the details for the various types of loans and the down payment requirements for each mortgage.;

Keep in mind that cosigner debt counts against you for the debt-to-income ratio calculation.

You May Like: Will I Qualify For Fha Loan

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

To calculate your debt-to-income ratio, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out.; For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

Evidence from studies of mortgage loans suggest that borrowers with a higher debt-to-income ratio are more likely to run into trouble making monthly payments. The 43 percent debt-to-income ratio is important because, in most cases, that is the highest ratio a borrower can have and still get a Qualified Mortgage.

There are some exceptions. For instance, a small creditor must consider your debt-to-income ratio, but is allowed to offer a Qualified Mortgage with a debt-to-income ratio higher than 43 percent. In most cases your lender is a small creditor if it had under $2 billion in assets in the last year and it made no more than 500 mortgages in the previous year.

Doing The Simple Math

Once you’ve calculated what you spend each month on debt payments and what you receive each month in income, you have the numbers you need to calculate your debt-to-income ratio. To calculate the ratio, divide your monthly debt payments by your monthly income. Then, multiply the result by 100 to come up with a percent.

Don’t Miss: How Is Mortgage Loan Amount Determined

Limitations Of The Ldr

The LDR helps investors to assess the health of a bank’s balance sheet, but there are limitations to the ratio. The LDR does not measure the quality of the loans that a bank has issued. The LDR also does not reflect the number of loans that are in default or might be delinquent in their payments.

As with all financial ratios, the LDR is most effective when compared to banks of the same size, and similar makeup. Also, it’s important for investors to compare multiple financial metrics when comparing banks and making investment decisions.

How To Lower Debt

The only way to bring your rate down is to pay down your debts or to increase your income. Having an accurately calculated ratio will help you monitor your debts and give you a better understanding of how much debt you can afford to have.

Avoid employing short-term tricks to lower your ratio, such as getting a forbearance on your student loans or applying for too many store credit cards. These solutions are temporary and only delay repaying your current debts.

Read Also: Who Should I Refinance My Car Loan With

Loan Company Criteria For Debt

Loan providers want to know how good you are making closes satisfy and the way very much residence you can actually give. The bottom your DTI, the significantly less debts that you owe and way more ready you payday loans in Lake City MN no credit check will be to make every month loan payments.

Loan providers give consideration to both your very own front-end proportion, the fraction of financial you only pay in relation to your earnings, whilst your back-end relation, which ways their full liabilities, contains financial spending, against your earnings. It could be useful to understand your purchasing and benefit make a difference to your personal future homeowning targets, too.

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

- Categories

Recommended Reading: How Do I Refinance My Sallie Mae Student Loan

Lock In Your Rates These Days I Encourage Here Creditors:

MoneyGeek score are actually based on our very own editorial professionals. The scoring pattern take into account a number of facts details for each and every monetary solution and service.

Least credit rating above financing; some other financing type or points may precisely manipulate least consumer credit score criteria.

MoneyGeek recommendations were dependant on our personal content teams. The scoring solutions consider numerous info information each financial item and service.

Minimum credit history at the top loans; other debt varieties or facets may selectively determine smallest credit score rating requirements.

MoneyGeek ranks were determined by all of our content employees. The scoring pattern account for multiple reports details for any monetary product and solution.

Least credit score rating over the top financing; more debt sorts or elements may precisely influence lowest credit history requirements.

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won’t see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you’re already ahead of the game. Knowing where you stand financially and how you’re viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Also Check: Can I Get Another Loan From Upstart

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Need Help To Lower Your Dti Ratio

Your DTI is an important tool in determining your financial standing. If youre struggling to come up with ways to lower your ratio or are looking for financial guidance, our expert coaches can help you. Contact us today to learn more about how our Debt Management Plans can help you take control of your debt payments.

About The Author

Melinda Opperman is an exceptional educator who lives and breathes the creation and implementation of innovative ways to motivate and educate community members and students about financial literacy. Melinda joined credit.org in 2003 and has over 19 years experience in the industry.

Recommended Reading: What Is Portfolio Loan In Real Estate

Monitor Your Credit For Free With Creditwise From Capital One

Monitoring your credit can help you understand more about how your financial habits impact your credit. And it can help you track your progress as you work to pay off debt and improve your credit score.;

can help. CreditWise is a free tool that allows you to access your TransUnion® credit report and VantageScore® 3.0 credit scoreâwithout hurting your score. And itâs free for everyone, not just Capital One customers.;

You can also visit AnnualCreditReport.com to learn how you can get free copies of your credit reports from each of the three major credit bureaus.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the;Centers for Disease Control and Prevention.;

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.