Low Down Payment: Conventional Mortgage

Conventional 97 loans are a little more restrictive than standard conventional loans, because theyre intended for first-time home buyers who need extra help qualifying.

If you dont meet the guidelines for a Conventional 97 loan, you can save up a little more and try for a standard conventional mortgage.

Conventional mortgages are the most popular loan type in the market because theyre incredibly flexible. You can make a down payment as low as 5% or as big as 20% or more. And you only need a 620 credit score to qualify in many cases.

Plus, conventional loan limits are higher than FHA loan limits. So if your purchase price exceeds FHAs limit, you might want to save up 5% and try for a conventional loan instead.

Conventional mortgages with less than 20% down require private mortgage insurance . But this can be canceled once you have 20 percent equity in the home. So youre not stuck with the additional fee forever.

How Much Home Can I Afford

The amount of home you can afford is a complicated question. Although your lender will determine how much they are willing to lend you, thats not necessarily how much your monthly budget can afford.So, take some time to comb through your budget to determine what size mortgage payment you can comfortably afford. From there, use one of the many calculators to help you determine an ultimate purchase price based on the currently available annual percentage rate you expect.

Tim Lucas

Editor

Popular Types Of First Time Home Buyer Loans To Consider

First time home buyers have a few options when it comes to loans. However, as a first time home buyer, you are probably new to home loan types and could use some guidance. Here are some of the more popular first time home buyer loans to consider.

30 Year Fixed Rate Mortgage

A 30 year fixed rate mortgage offers consistency specific to the interest rate of your loan. The rate will not change throughout the 30 year term of the loan, so it allows you to better estimate and plan your monthly mortgage expenses, which can be very helpful to the first time home buyer.

15 Year Fixed Rate Mortgage

A 15 year fixed rate mortgage offers the same stability as a 30 year fixed rate mortgage but just a shorter time period. If you can afford to pay more each month, a 15 year fixed rate mortgage often offers better interest rates, which can also be good for the first time home buyer.

VA Loan

A VA loan can be obtained without a down payment and does not require PMI , although it does require payment of a Guarantee Fee unless exempt. This is a great option for veterans who are purchasing their first home.

FHA Loan

FHA loans give the flexibility of buying a home with a lower down payment and credit score, which is something first time home buyers can benefit from.

Recommended Reading: What Is The Minimum Credit Score For Usda Loan

Fha Loans: For Buyers With Lower Credit Scores And Limited Savings

Federal Housing Administration loans are popular among first-time home buyers since they offer lower credit score and down payment requirements. They often have more flexible lending requirements than conventional loans. Even with a weaker credit score, you may only be required to put 3.5% down. Keep in mind, putting less down could result in a higher interest rate.

All FHA loans require mortgage insurance. It protects the lender against any loss if you fail to pay your mortgage. A mortgage insurance premium includes an upfront fee and a monthly cost . You may be able to roll the upfront fee into your mortgage if you dont have enough cash on hand to pay the upfront fee. But, your loan amount and the overall cost of your loan may increase.

Va Home Loan Qualifications

- Must be either an active-service member of the military, veteran, or spouse of veteran who died

- A minimum lengh of service of 24 months in most cases

- Minimum credit score in the low- to mid-600 level, with some exceptions

- Home must meet Minimum Property Requirements as determined by the VA

Benefits of a VA loan include no down payment requirement, no mortgage insurance, flexible credit guidelines and low fixed interest rates. It’s also a lifetime benefit you can use multiple times. Birk says VA loans have “helped generations of veterans become first-time buyers, building generational wealth in the process.”

There’s technically no borrowing limit, but the VA limits the amount it guarantees to your lender if you default on the loan.

Even though the VA doesn’t require a down payment, the individual lender may require one.

Important: VA loans don’t allow borrowers to waive a home inspection or appraisal. There are also limits to the kind of property you can buy and its condition.

Recommended Reading: How Soon Can Refinance Car Loan

How To Buy A House With No Money

A no down payment mortgage allows first-time home buyers and repeat home buyers to purchase property with no money required at closing, except standard closing costs.

Other options, including loans from the FHA, Fannie Mae, and Freddie Mac, allow you to buy with just 3% or 3.5% down. And there are grants and loans that could cover your down payment requirement.

Thanks to these programs, home buyers no longer have to save for years to buy a home. Many are ready to buy and simply dont know it yet.

In this article

Truist: Community Homeownership Incentive Program

The bottom line: Truist’s Community Homeownership Incentive Program mortgage is affordable thanks to its low down payment requirement with no PMI, but it doesn’t have as many attractive additional features as some of the other loans on this list.

Minimum down payment: 3%

Requires PMI? No

Flexible credit requirements: Specific credit requirements for this loan aren’t listed, but Truist does accept non-traditional credit in some circumstances from borrowers who don’t have a credit score. Income limits may apply.

To qualify for a Community Homeownership Incentive Program mortgage, you’ll need to contribute at least $500 of your own funds at closing. The remainder of your down payment can come from other acceptable sources, such as a gift from a family member.

Don’t Miss: How Much Is Federal Student Loan Interest

Good Neighbor Next Door

Are you a pre-K 12 teacher, emergency medical technician, firefighter or law enforcement officer? You can take advantage of the Good Neighbor Next Door program sponsored by the Department of Housing and Urban Development .

The Good Neighbor Next Door program offers a generous 50% off select HUD properties. The properties available are foreclosures and are very affordable, even without the discount. You can view a list of available properties on the HUD program website.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Fifth Third Bank Auto Loan Login

How Do I Apply For Down Payment Assistance

The first step is to determine which down payment assistance program you are eligible for. For example, you might only find first-time homebuyer programs in your state. Once you find a program, the application should be readily available for you to fill out. Be prepared to provide extensive information about your income.

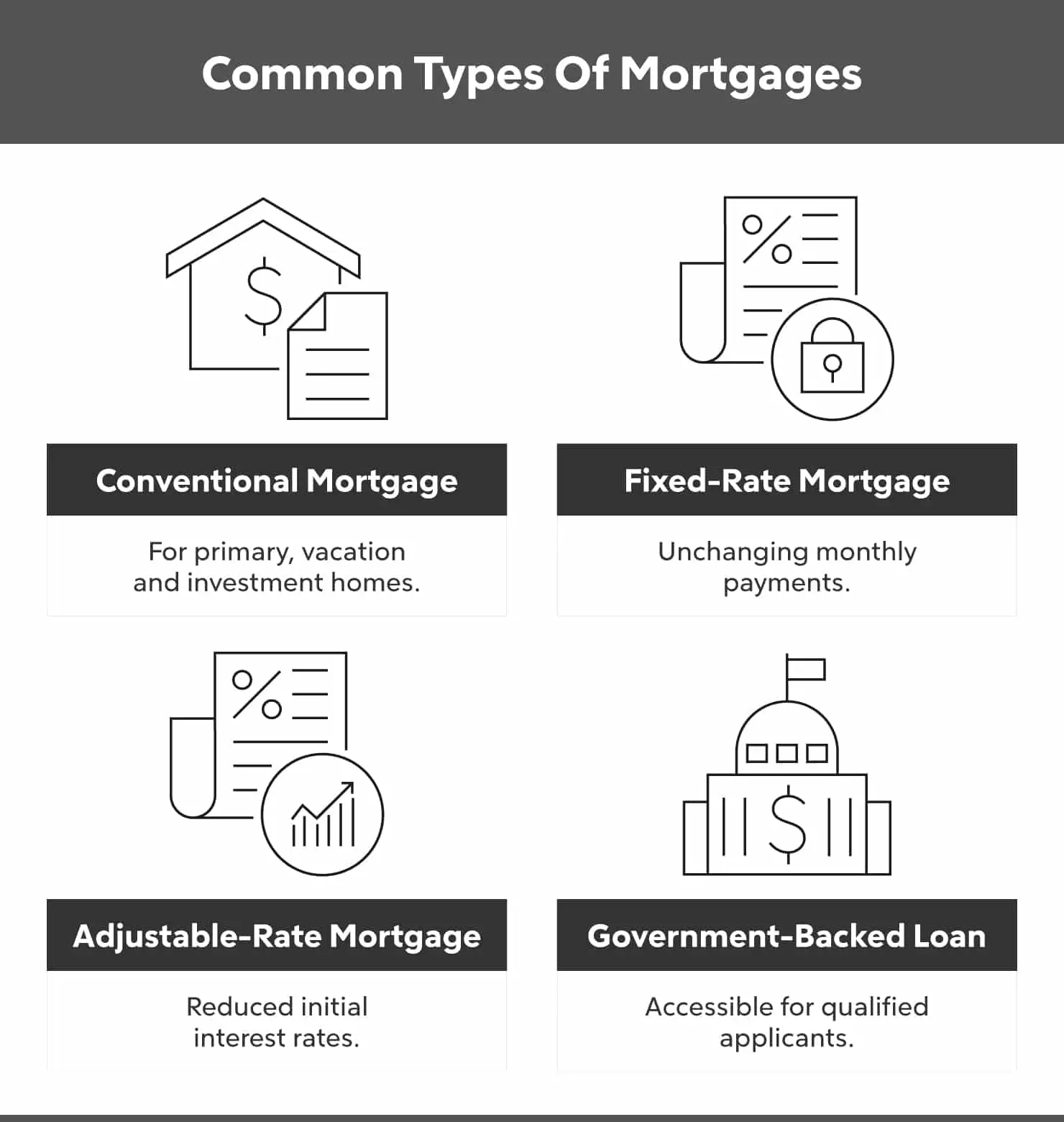

Types Of Mortgage Loans For Home Buyers

If youve never bought a home before, you might be surprised to learn that theres more than one kind of home loan available to finance your purchase. Thats good news because no matter who you are and what your situation is, you can probably find a mortgage that fits your needs.

While these choices may seem overwhelming at first, you dont have to figure them out all by yourself. Your Amerifirst loan officer will be happy to sit down with you, explain the differences, and point you toward the options that make the most sense for you. In the meantime, lets look at some of the most popular solutions.

Listed below are four common types of mortgage loans for homebuyers today: conventional, government-backed mortgages, fixed and adjustable, and interest-only loans.

Read Also: How To Get Loan For Credit Card Debt

Usda Loans: For Buyers With Lower To Moderate Incomes In Eligible Rural Areas

United States Department of Agriculture loans are mortgages guaranteed by the U. S. Department of Agriculture. A USDA loan can be a good option for home buyers on a budget that are flexible about where they live. They offer zero down payment loans with low interest rates and typically have more flexible credit requirements than conventional mortgages.

To be eligible for a USDA loan, the home must meet certain requirements. It must be your primary residence in a rural community with a population of less than 35,000. Rental properties and vacation homes do not qualify.

The Conventional 97 Loan

If youre simply looking for a low down payment option for your home loan, the Conventional 97 can be a smart choice. With these conventional loans, you need just 3% down to qualify.

Like FHA loans, they do require annual mortgage insurance. But you can actually cancel your private mortgage insurance after youve gained enough equity in the home.

On most FHA loans, by contrast, mortgage insurance is with you until you refinance into a different type of loan.

Read Also: Is Direct Loan Transfer Legit

Should I Put 20% Down

You can tap into a zero money down loan. But is it a good idea?

Traditionally, home buyers put down 20% on a home. With todays home prices, saving up for that kind of down payment is unrealistic for many. But if you have the funds available, putting 20% down can help you avoid costly PMI. Plus, a lower loan amount with the same loan term leads to lower monthly payments.

Six Strategies To Buy A House With No Money Down

If you want to buy a home with no money down, here are six strategies to consider:

- Apply for zero down loan: The USDA and VA loan programs offer zero-money down opportunities.

- Use a down payment assistance program: Many cities, states, and counties in the U.S. offer some type of down payment assistance. And there are nationwide programs, too. You just have to dig up whats available in your area.

- Use gift funds: You can receive gift funds from a family member, non-profit, church, employer, down payment assistance program, or other approved source. Most loan types let you use gift funds to cover the down payment and/or closing costs.

- Ask for lender credits: Lender credits mean that the lender covers your closing costs in exchange for a higher interest rate

- Ask for seller concessions: In this case, the seller would pay your closing costs. Seller concessions can be negotiated as part of your purchase contract.

- Get a second mortgage: If your first mortgage doesnt cover enough of the upfront funds needed, you may be able to get a second mortgage like a home equity line of credit and use that extra amount to cover closing costs.

Using one or more of these strategies, its possible that you could buy a home without putting anything down.

Verify your no-money-down mortgage eligibility here

Recommended Reading: How Much Home Can I Afford Va Loan

Main Types Of Home Loans

Last Updated on July 8, 2022 by Luke Feldbrugge

Before you study up on the types of home loans available, we always recommend determining how much house you can afford first. Once you know what you can afford to pay for a house, then you can focus on which loan type is best for you. This mortgage calculator is also a great tool to estimate your monthly mortgage payment. If you know what you can afford, the following will cover the four main types of home loans: Conventional loan, FHA loan, VA loan and USDA loans. Chances are you qualify for more than one type so spend a little time getting to know the pros and cons of each.

Low Down Payment First

Not everyone will qualify for a zero-down mortgage. But it may still be possible to buy a house with no money down by choosing a low-down-payment mortgage and using an assistance program to cover your upfront costs.

If you want to go this route, here are a few of the best low-money-down mortgages to consider.

You May Like: How Do Loan Payments Work

How Can I Fund A Down Payment

A down payment is a major expense. You can fund it by building up savings in a savings or checking account. If you are selling an existing home, you could use the proceeds from that sale as a down payment on your new place. Other options include down payment assistance programs, gifts from family, or borrowing from your retirement accounts.

Conventional 97 Loan Benefits For First

- Buy with just 3% down

- Mortgage insurance is cancellable

- No upfront insurance fee

- Minimum 620 credit score

Conventional loans also dont require an upfront insurance fee, which can save you money on your closing costs.

Finally, conventional loans arent an option if you have poor credit.

Youll need at least a 620 credit rating to qualify for a conventional loan, so if your scores below that, an FHA mortgage may be a better choice.

Read Also: How Do I Pay My Huntington Auto Loan

More Specific Home Buyer Grants

–USDA

The USDA’s Rural Housing Repair Loans and Grants program provides loans and grants to very low-income homeowners to repair, improve, modernize, or to remove health and safety hazards in their rural dwellings. Some USDA loans can be repaid over 20 years at a fixed 1 percent interest rate. Grants of up to $7,500 may be arranged for recipients who are 62 years of age or older and can be used only to pay for repairs and improvements to remove health and safety hazards. Loan/grant combinations may be arranged for applicants who can repay part of the cost. Go to for more information.

–Mortgage Credit Certificate

Many states have their own version of the MCC, which basically provides you a dollar for dollar deduction off your federal income taxes, up to $2,000. If you don’t owe any federal taxes, however, the deduction won’t do you any good. By reducing your potential federal income tax liability, you may have more net spendable income to apply toward your monthly mortgage payment. Be sure to consult your tax advisor.

Go to for more information.

–Good Neighbor Next Door

The Good Neighbor Next Door program, sponsored by the Department of Housing and Development, provides housing aid for law enforcement officers, firefighters, emergency medical technicians and pre-kindergarten through 12th-grade teachers.

What Is The Average Down Payment For A House

Historically, average down payments for home mortgages have fluctuated in step with home prices, interest rates, and other factors. For decades, the national average for a down payment on a home hovered somewhere around 20%. But down payment averages have dropped over the past decade. As of 2021, the average down payment for first-time buyers is roughly 12%.

Remember that a borrowers financial situation affects their down payment. For example, a first-time home buyer with little or no money in their bank account might choose a zero-down USDA loan. However, this loan option comes with upfront and monthly fees that drive up the monthly payment.Another first-time buyer with adequate savings might choose to put 20% down or more, to keep monthly payments low.

In any case, buyers shouldnt follow the crowd when it comes to down payments. They should look at their own situation and discover whats best for them.

Recommended Reading: Can I Pay My Loan Off Early

Fha Loan Benefits For First

- Minimum down payment requirement is 3.5%

- Low interest rates

- Lowest credit score requirements of any mortgage program

To qualify for a 3.5% down payment, youll need a credit score of at least 580. But if you can put 10% down, your score can be as low as 500.

FHA also provides flexible income guidelines. You dont have to make a lot of money to qualify.

The big downside of FHA loans is that they require mortgage insurance. This comes as both an upfront fee at closing and then an annual mortgage insurance premium, which is spread out across your monthly payments.

But for many, mortgage insurance is a small price to pay to get out of renting and start building home equity.

How To Buy A House With No Money Down

There are programs that make it possible to buy a home without a down payment, like USDA and VA loans.

Not sure which loan is right for you? It all depends on eligibility.

While FHA loans are available to just about everyone who meets the lending criteria, you need military service history to qualify for a VA loan and you need to be buying in a rural or suburban area for USDA.

Additionally, there are a few other ways to reduce or eliminate your upfront costs for a home purchase.

Don’t Miss: Can I Refinance An Upside Down Car Loan

Homepath Ready Buyer Program

Fannie Mae offers first-time home buyers the chance to buy a foreclosed property for as little as 3% down with their HomePath® program. You can even apply for up to 3% of your closing costs back through the program as well. Fannie Mae homes sell in as-is condition, so you may have to repair a few things before your new place is move-in ready. However, closing cost assistance can help make it more possible to cover these expenses.

The HomePath® Ready Buyer program is only available to first-time buyers who want to live full-time in a house that theyre looking to purchase. You’ll need to take and pass Fannies Framework Homeownership course before you close.

Take the first step toward buying a house.

Get approved to see what you qualify for.