No Down Payment: Va Loans

The VA loan is a no-down-payment mortgage available to members of the U.S. military, veterans, and surviving spouses.

VA loans are backed by the U.S. Department of Veterans Affairs. That means they have lower rates and easier requirements for borrowers who meet VA mortgage guidelines.

VA loan qualifications are straightforward.

Most veterans, active-duty service members, and honorably discharged service personnel are eligible for the VA program. In addition, home buyers who have spent at least 6 years in the Reserves or National Guard are eligible, as are spouses of service members killed in the line of duty.

Some key benefits of the VA loan are:

- No down payment requirement

- Below-market mortgage rates

- Bankruptcy and other derogatory credit information does not immediately disqualify you

- No mortgage insurance is required, only a one-time funding fee which can be included in the loan amount

In addition, VA loans have no maximum loan amount. Its possible to get a VA loan above current conforming loan limits, as long as you have strong enough credit and you can afford the payments.

Get Started On Your First

If youre ready to get serious about buying a house, talk to a mortgage advisor about your first-time home buyer loan options. Theres a wide range of programs available and its important to find the loan that meets your needs best. This will make it easier to qualify and should reduce your mortgage costs, too.

Ready to get started?

How To Get A Mortgage

There are a variety of mortgages available to first-time buyers, so its important to find the one that fits your needs and budget. Lenders offer different types of deals, including fixed-rate loans, adjustable-rate mortgages , and home equity loans.

Fixed-rate mortgages offer borrowers a set interest rate for the entire duration of the loan. ARMs have an interest rate that adjusts periodically, based on LIBOR rates. Home equity loans allow you to borrow against the value of your home, which can provide a boost to your cash flow if you need it.

Before applying for a mortgage, be sure to calculate your monthly payments and take into account any extra costs associated with your loans, such as escrow or property taxes. You can also ask friends and family members for their opinion before making a decision.

Also Check: What Does Refinance Auto Loan Mean

Low Down Payment: Homeready/home Possible

The HomeReady mortgage is special among todays low- and no-down-payment mortgages.

Backed by Fannie Mae and available from nearly every U.S. lender, the HomeReady mortgage offers below-market mortgage rates, reduced private mortgage insurance costs, and innovative underwriting for lower-income home buyers.

For instance, the HomeReady program lets you use boarder income to help qualify, and you can use income from a non-zoned rental unit, too even if youre paid in cash.

HomeReady home loans were designed to help multi-generational households get approved for mortgage financing. However, the program can be used by anyone in a qualifying area, or who meets household income requirements.

Freddie Mac offers a similar program, called Home Possible, which is also worth a look.

Home Possible is a little less flexible about income qualification than HomeReady. But it offers many similar benefits, including a minimum 3% down payment.

Should You Apply For A Usda Rural Development Loan

Consider applying for a USDA Rural Development loan if:

- Your home is located in an eligible area: To qualify for a USDA loan, your property must be located in an eligible rural or suburban area.

- Your home is your primary residence: USDA loans must be used to purchase a primary residence, not a second property or vacation home.

- You are a lower-income earner: Your income should be relatively low for your region. You can use the USDAs income eligibility calculator to determine whether you qualify.

- You have a credit score of at least 620: When applying for any mortgage, the higher the credit score, the better. Though lenders may be more lenient about credit scores for borrowers of USDA loans, your loan terms will be better with a good credit score.

- Your debt-to-income ratio is below 41 percent: Lenders want to see a reasonable debt-to-income ratio from their borrowers, so they know the borrowers will pay back their loan. If your credit score is higher than 680, you may still be able to qualify with a higher debt-to-income ratio.

Don’t Miss: Is Student Loan Refinancing Worth It

Calhfa Home Buyer Requirements

Here is a list of home buyer eligibility requirements to help you understand whether or not you qualify for these loans.

- First-time home buyer: In most cases, to qualify for a loan you must be a first-time home buyer. If youve bought a home in the past, that does not necessarily mean you dont qualify. Youre considered a first-time home buyer if you havent owned a home in the three years prior to applying for a loan.

- You must have a minimum of 660 for a conventional low-income-rate loan, and a minimum credit score of 680 for a conventional standard-rate loan.

- Acceptable debt-to-income ratio: Your debt-to-income ratio, which compares the amount of money you owe to what you make, cannot exceed 45% for automated underwriting, or 43% for manual underwriting.

- Income cap: Your earnings cant exceed CalHFAs income limits, which are based on the specific area you are looking to buy in.

- Nationality: You must be a U.S. citizen, permanent resident, or qualified alien.

- Complete a home-buying course: You must complete a home-buying counseling course and present a certificate of completion. A course can be taken online, or in person through a HUD-approved housing counseling agency.

Note: Meeting these qualifications is no guarantee youll qualify for a loan, because each CalHFA-approved lender may have additional borrowing requirements.

Questions To Consider Before You Buy

Your first step is to determine what your long-term goals are and how home ownership fits in with those goals. Perhaps youre simply looking to transform all those wasted rent payments into mortgage payments that give you something tangible: equity. Or maybe you see homeownership as a sign of independence and enjoy the idea of being your own landlord. Also, buying a home can be a good investment. Narrowing down your big-picture homeownership goals will point you in the right direction. Here are six questions to consider:

Recommended Reading: Is It Worth It To Refinance Car Loan

Fannie Mae Homeready Loan

- Minimum credit score: 620

- Minimum down payment: 3%

- Other requirements: Complete homeowner education course

For lower-income borrowers, the HomeReady Mortgage program could help. This loan program is similar to the Freddie Mac Home Possible program, but it’s easier to qualify for. The HomeReady Mortgage program requires only 3% down and a minimum credit score of 620. You will also have to complete a homeownership education course. Unlike the FHA loan, this program does not place geographical restrictions on mortgage limits. You can also use grants and gifts from nonprofit organizations, churches or family members to help fund your down payment, and no minimum personal funds are required.

You’ll also need to purchase PMI if your down payment is under 20%, but you can cancel your mortgage insurance once you reach 20% equity in your home.

Native American Direct Loans

The NADL program helps Native American veterans and their spouses purchase a home on Native American trust lands. Your tribal organization must participate in the VA direct loan program, and you must have a valid Certificate of Eligibility.Unlike VA loans, where the lender provides the funds, the VA is the lender for the NADL home loan program. There are credit and income requirements, but these loans don’t require a down payment, there are limited closing costs, and there’s no need for PMI.The VA funding fee may be required for NADL loans.

Also Check: Can I Include Closing Costs In My Fha Loan

Who Will Guide You Through The Homebuying Process

A real estate agent will help you locate homes that meet your needs and are in your price range, then meet with you to view those homes. Once youve chosen a home to buy, these professionals can assist you in negotiating the entire purchase process, including making an offer, getting a loan, and completing paperwork. A good real estate agents expertise can protect you from any pitfalls that you might encounter during the process. Most agents receive a commission, paid from the sellers proceeds.

How Can I Create A Smart Homeownership Budget

Homeownership comes with more costs than your monthly mortgage paymentyou may also need to account for paying homeowners insurance, private mortgage insurance, closing costs, and HOA fees.

FHA loans require private mortgage insurance , no matter how much you put down. Annual premiums usually fall between 0.8% and 1% of the purchase price depending on how much the loan is and your down payment.

Conventional loans dont require private mortgage insurance if you can put down 20% or more.

Recommended Reading: Fifth Third Bank Auto Loan Login

Which Loan Is Best For First

The majority of first-time home buyers use 30-year fixed-rate mortgages backed by Fannie Mae or Freddie Mac to purchase their first home but that doesnt make it the best loan for first-time buyers. Mortgages are not one-size-fits-all. Get pre-approved and let your lender advise you on which mortgage loan is best for you.

Read more of our other first-time home buyer tips.

Get pre-approved for a mortgage today.

Dan Green

Dan Green is a former mortgage loan officer and an industry expert. He’s appeared on NPR and CNBC, and in The Wall Street Journal, Bloomberg, and dozens of local newspapers. Dan has helped millions of first-time home buyers get educated on mortgages, real estate, and personal finance. Have mortgage questions? Ask Dan in the chat.

Financial Assistance For Down Payments Closing Costs And More In California

In addition to affordable loans, the California Housing Finance Agency also offers a variety of financial assistance programs that can be combined with their loans that help lower the costs of a mortgage even further.

More good news? Since this program will be considered subordinate or junior loans, the payments are deferred until their homes are sold, refinanced, or paid in full, says Tal Shelef, Realtor and co-founder of Californias CondoWizard. That makes your monthly mortgage payments more affordable.

Here are the options, who qualifies, and how the programs work.

Don’t Miss: How To Refinance Capital One Auto Loan

Estimate What You Can Afford

Use our handy mortgage calculator to determine the amount you can afford to spend on monthly payments based on your current income and expenses.

If you’re unfamiliar with mortgages, we have resources on first-time home buyer loans and a Mortgage Glossary that can help educate you on the home buying process.

If you are using a screen reader or other auxiliary aid and are having problems using this website please call Ext. 7100 for assistance.

If you received a letter from New American Funding and would like to be removed from our mailing list, please call .

New American Funding makes Customer Service our number one priority. We encourage you to call our Corporate Customer Service department at ext. 7100 between 8:00 am and 5:00 pm Pacific or email us anytime at for any complaint resolution you may have regarding the origination of your loan.

Corporate Office: 14511 Myford Road, Suite 100, Tustin, CA 92780.

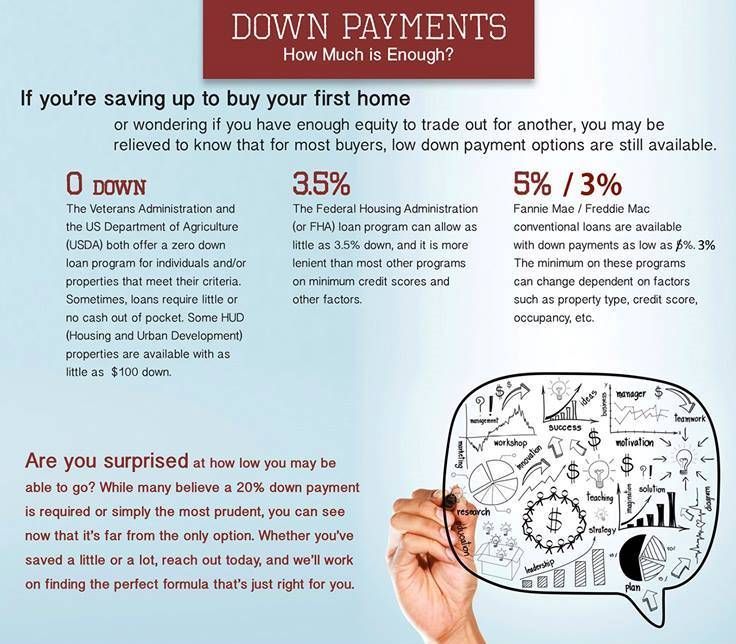

Home Buyers Dont Need To Put 20% Down

Its a common misconception that 20 percent down is required to buy a home. And, while that may have true at some point in history, it hasnt been so since the advent of the FHA loan in 1934.

In todays real estate market, home buyers dont need to make a 20% down payment. Many believe that they do, however despite the obvious risks.

The likely reason buyers believe 20% down is required is because, without 20 percent, youll have to pay for mortgage insurance. But thats not necessarily a bad thing.

Also Check: How Do I Apply For Loan

How To Qualify For First

The requirements to qualify for a first-time home buyer grant depend on the down payment assistance programs available where you live.

Every state in the country has a housing finance agency, and all offer special programs for first-time buyers, says Anna DeSimone, author of Housing Finance 2020.

She explains that first-time home buyer assistance typically comes in one of two forms:

- First-time home buyer grants: Money towards your down payment and closing costs that does not have to be repaid

- First-time home buyer loans: Money towards your down payment and closing costs thats either repaid at a very low interest rate, or does not have to be repaid until you sell the home or refinance. First-time home buyer loans may even be forgiven if the buyer stays in the home a set number of years

DeSimone notes that agencies typically offer grants around 4% of the home purchase price. And many programs also provide additional assistance to cover closing costs.

Of course, whether or not you qualify for a first-time home buyer grant will depend on local guidelines.

Angel Merritt, mortgage manager with Zeal Credit Union, explains that each of these programs has different qualification requirements.

Typically, youd need a 640 minimum credit score. And household income limits may be based on family size and property location, says Merritt.

How Much Mortgage Do You Qualify For

Before you start shopping, its important to get an idea of how much a lender will give you to purchase your first home. You may think you can afford a $300,000 home, but lenders may think youre only good for $200,000 based on factors like how much other debt you have, your monthly income, and how long youve been at your current job. In addition, many real estate agents will not spend time with clients who havent clarified how much they can afford to spend.

Make sure to get pre-approved for a loan before placing an offer on a home. In many instances, sellers will not even entertain an offer thats not accompanied by a mortgage pre-approval. You do this by applying for a mortgage and completing the necessary paperwork. It is beneficial to shop around for a lender and to compare interest rates and fees by using a tool like our mortgage calculator or Google searches.

You May Like: Dept Of Education Student Loan Forgiveness

Down Payment Assistance Mortgages

Down payment assistance mortgages are loans that replace a home buyers typical cash down payment with borrowed money at favorable terms.

Access to down payment money at below-market mortgage rates is one form of down payment assistance. Instead of making a down payment using cash from a bank account, home buyers borrow money from a bank at 1 percent with ten years to pay it back.

Deferred mortgages are another form of home buyer down payment assistance.

A deferred mortgage is a loan that requires no repayment while you still live in the house that you bought. You repay the deferred mortgage only when you sell your home or refinance it.

For example, lets say you borrow $25,000 for a down payment using a deferred mortgage and choose to sell in five years because your homes value doubled. After your closing, you pay the $25,000 back to the lender and keep the rest of the profit for yourself.

Typically, down payment assistance mortgages are available through local foundations and municipal governments only. Theyre often limited to first-time buyers whose income falls below area averages and whose credit history shows a decent record of on-time payments. Learn more about down payment assistance programs.

Find out if youre eligible here.

Low Down Payment: Conventional Loan 97

The Conventional 97 program is available from Fannie Mae and Freddie Mac. Its a 3% down payment program and, for many home buyers, its a less expensive loan option than an FHA mortgage.

Basic qualification requirements for a Conventional 97 loan include:

- Loan size may not exceed $, even if the home is in a high-cost market

- The property must be a single-unit dwelling. No multi-unit homes are allowed

- The mortgage must be a fixed-rate mortgage. No adjustable-rate mortgages are allowed via the Conventional 97

The Conventional 97 program does not enforce a specific minimum credit score beyond those for a typical conventional home loan. The program can be used to refinance a home loan, too.

In addition, the Conventional 97 mortgage allows for the entire 3% down payment to come from gifted funds, so long as the gifter is related by blood or marriage, legal guardianship, domestic partnership, or is a fiance/fiancee.

Also Check: What Is My Auto Loan Credit Score

Here Are The Three Most Common Types Of Mortgages For First

There are also other types of mortgages available, but these are the three most common. To find out more about the different types of mortgages and how they might fit into your budget, please contact a qualified mortgage lender.