How To Refinance A Car Loan With Bad Credit

Even if your credit score has gone up, if its still under 640, getting the best rates on an auto refinance is unlikely. There may be, however, some cases in which refinancing may be beneficial:

If auto loan rates have gone down While new-car rates are different from refinance rates, you may have some wiggle room. If your goal is a lower monthly payment If your main refi driver is decreasing your monthly payment, this may mean extending your loan term. The downside is that this will extend the life of your debt, and youll therefore pay more in interest as well.

If youre determined to refinance your car loan despite a spotty credit history, follow the steps outlined above. It may make sense to check out competing offers on a marketplace website such as LendingTree or rateGenius. You may also be able to get a better deal with a lender that allows you to add a co-signer to your loan.

Also Check: Does Applying For Personal Loan Hurt Credit

How Does Refinancing A Car Work

There are two main ways to refinance your car: traditional and cash-out refinance.

Traditional auto refinance

Refinancing a car generally means taking out a new loan to pay off the balance on your existing auto loan, ideally for a lower rate. Since your original loan is replaced by a new financial obligation, you gain a new APR and new term length.

As an added bonus, your car insurance premiums are likely to go down as well. If youre looking to change insurers, you can also check out our list of the best car insurance companies.

Cash-out auto refinance

A few auto refinance companies also offer cash-out auto refinances, in which your new loan covers your existing balance and provides an additional amount of money. While a cash-out refinance may have lower interest rates than other options, such as personal loans or credit cards, your monthly payments will go up. This type of loan also has a higher risk of going upside-down.

Unique Features Of Ally Auto Refinance

Though some features may vary based on the lender, most of the basic details covered by the Ally Auto refinance process are as given below.

- Pre-approval with soft inquiry: Borrowers with poor credit can go through the pre-qualification process to determine if theyre eligible. This will involve a soft credit inquiry which will not affect your credit score.

- Ally auto refinance credit score: You will need a credit score above 520 to qualify for Ally Bank auto refinance rates.

- Loan terms: Ally auto refinance loan terms range from 36-72 months. The minimum loan term of 36 months is longer than the average of 24 months.

- Co-signers allowed: Ally Bank allows refinancing by adding co-signers to your loan. It also allows co-borrowing.

- Large loan amount refinancing: Ally will refinance loans ranging from $5000 to $100,000

- Auto refinancing APR range: You can access rates ranging from 3.74% -16.5%. The APR offered to you will depend on several factors like your credit score, loan term, co-signers, etc.

- Ally Bank does not charge any prepayment or origination fees

- No discounts with automatic payment: While some firms offer a discount of up to 1% through the autopay option, Ally Bank does not offer it.

- Vehicle model, age, and mileage restrictions: Ally Bank will refinance vehicles within 10 years old, with mileage below 120,000.

Read Also: What Is Home Loan Insurance

What Do You Need To Qualify For Ally Auto Finance

Ally Auto Finance does not have or does not disclose a minimum annual income eligibility requirement. Ally Auto Finance only considers borrowers who are employed. Note that borrowers can add a cosigner to either meet eligibility requirements or qualify for lower interest rates.

The Military Lending Act prohibits lenders from charging service members more than 36% APR on credit extended to covered borrowers. Active duty service members are eligible to apply for a loan via Ally Auto Finance. Their rates fall within the limits of The Military Lending Act.

Permanent resident / green card holders are also eligible to apply.

To qualify, applicants may need to provide the following documentation:

- Recent pay stubs

- Proof of citizenship or residence permit

When Might Refinancing Not Make Sense

Interest rates aside, if youve almost paid off your balance, you may want to ride out your financing to the end of your term. While you could potentially save a little each month, it may not be worth it to refinance depending on the work and cost associated. Some institutions charge a pretty sizeable application or documentation fee, but it varies by lender or institution.

Lenders are also less likely to offer refinancing options if you owe more than the car is worth. This can happen when your car loses value at a faster rate than youve been paying down the balance. This is usually the result of having a low monthly payment because of a longer term.

You also might want to hold off on refinancing your car if youre planning on making any major purchases in the near future, like another car, a house, or anything that would require applying for credit, to avoid any potential changes to your qualifying credentials.

And you might want to skip out on refinancing completely if your existing auto finance package has prepayment penalties. While uncommon, some lenders do impose a fee when the car is paid off ahead of schedule which could make refinancing cost more than its worth.

Read Also: Is It To Late For Ppp Loan

How To Refinance A Car Loan

Once youve weighed your options and decided a refinance of your current loan is the way to go, follow these simple steps.

7 steps to apply for an auto refinance

Heres a detailed list:

Ally Clearlane May Accept Credit Scores As Low As 580

Several top auto lenders have a minimum credit score in the 600s, but Ally Clearlane may approve you even if your credit score falls below that mark. You wont receive the best rates with a 580 credit score, so make sure refinancing will either lower your overall loan cost or make your monthly payment more manageable before you sign on.

Not sure Ally Clearlane is right for you? Compare your full range of car loan options to find the best financing for your needs.

Read Also: How To Lower Student Loan Payments

Where To Apply For Refinancing

Banks and credit unions are usually the best options when it comes to refinancing your vehicle. Online lending companies are also a viable alternative, and some even specialize in auto refinancing. However, online lenders rarely offer the competitive interest rates that are available from traditional banking institutions. Moreover, dealing one on one with a bank or credit union in your community typically makes the entire loan process easier. You can speak with a loan officer directly, and go over all aspects of your refi agreement before you sign the contract. You will also have direct access to customer support throughout the life of your loan.

As with any car loan, you will want to investigate a few different lenders in order to find the best deal that is available. Compare and contrast three to four different refinancing offers, and pick the one the best suits your financial needs at the time. Remember, refinancing a vehicle is simply paying off one loan with another, and you do not want to rush into any agreement that you dont fully understand, or that you are not completely comfortable signing.

Ally Bank Auto Loan Application Requirements

Youll need to apply for an Ally auto loan through the dealership where youll be buying your car. To streamline the process, make sure that you have all the standard documents and information that auto loans require:

- Personal information, like your mailing address, email address, and Social Security number

- Income information, including your annual gross income and contact information for your current employer

The dealership will also need to supply information about the vehicle youre buying, but you should decide how much youll want to finance and what monthly payments you can afford.

If youre just starting the car shopping process and havent found a vehicle you want to buy, Allys monthly car payment calculator can help. This calculator allows you to change the finance amount, APR, and loan term to see what your monthly payments will be like in different situations. It can help to give you a sense of what size and type of car loan fit into your monthly budget. Then, you can focus your vehicle search on cars that you can afford.

Recommended Reading: Mortgage Loan Processor Job Description

When Can You Refinance A Car Loan

Your current deal isnt great

Thanks to global shipping issues and high demand, and if you didnt do some careful comparison shopping between lenders or dealerships when you bought your car, your loan may not have the best repayment terms or rates.

For instance, if your current APR is around 20-25%, you might be able to get a better offer by shopping around. This is particularly true if your loan is two years older or more, as many loans with high APRs charge most of the interest amount during that time period.

Your credit score has gone up

An improved will likely give you access to much better repayment terms and lower interest rates.

Your current loan payments are too high

Whether youve lost your job or your budget changed, a refinance can lower your monthly payment by extending the loans term length. This does mean youll pay more in interest over the long run, but sometimes that may be the least bad choice.

Checking Current Ally Car Loan Rates

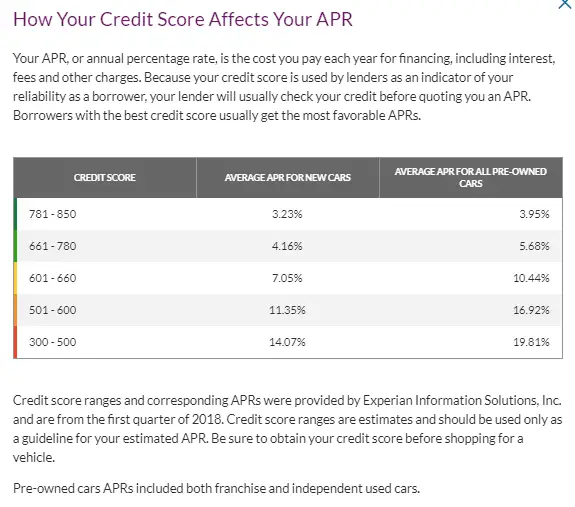

First you want to check out the interest rate chart we put this one below to give you an idea of what the chart looks like

| Dates | |

|---|---|

| 4.08% | 4.48% |

The above chart gives you an idea of the starting interest rate based on the term of a loan. As you can see, the longer time you plan to take to pay the loan off, the higher the rates become.

While the monthly premiums will be lower if you select a longer payoff period, you are going to end up paying much more interest.

Read Also: Does Applying For Home Loan Hurt Credit

Best Bank For Refinancing Your Ally Financial Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

How Does Ally Loan Work

Ally Financial auto loans are only offered through dealerships at brands like GM, Chrysler, and Mitsubishi. The only way you will be able to get an Ally Financial/Auto Loan would be through one of their network of dealerships.

If you have just received a loan offer from My Ally Auto then the first step is to get some competing rates.

Getting an Ally Auto Loan is like doing your grocery shopping at 7/11, it is going to cost you a lot more money!

Any of those auto lenders can give you a pre-approval letter that you can use to buy your new or used car today.

Regardless of which lender you choose, you will need to take the following steps to receive a car loan.

Also Check: Can I Get An Investment Property Loan With 10 Down

Positive Ally Financial Auto Loan Reviews

While less-favorable Ally Financial auto loan reviews outnumber upbeat reviews, there are positive customer experiences. Here are two of them:

I bought my car and paid it off with no issues. I was never late with a payment, so I had no reason to deal with customer support except for account setup. She was super nice. Loved the website and iPhone app as well. Easy to use. I would definitely use them again.

Stacey B. via Trustpilot

We have Ally for almost two years. No issues, and payments are easy on their website. We just bought another vehicle through them, and they set up the account in one page for both, making it easier.

Leslie R. via Trustpilot

How Can You Get Pre

Pre-approval with any company â including Ally Financial â is granted based on many factors like credit score & utilization ratio. How can you boost your credit score if it’s a little low? Check your credit reports and, if you find any inaccurate items, partner with a reputable company like Credit Glory to dispute them.

Read Also: Can I Buy Two Houses With Va Loan

Ally Auto Refinance Review Introduction

If youve been looking out for great refinancing deals for your car loan and wondering, Does Ally refinance auto loans? – well, this review is for you! Ally auto refinance is an accessible option for borrowers with poor-to-fair credit scores who want quick refinancing and a 100% online application process.Ally Bank refinances existing car loans through Ally Clearlane, a part of the larger Ally Financial Inc. The advantage of choosing Ally Bank Auto Refinance is that is focussed only on auto loan refinancing or refinancing for lease buyouts no auto purchase loans. That means you get a clutter-free application process from dedicated refinance experts.The Way.com Refinance team has studied all the features and offerings in this Ally auto refinance review. The following breakdown will help you decide whether to choose Ally for refinancing or if you should look elsewhere for other offers!

Specialty Vehicle & Heavy Duty Truck Financing

For business owners who maintain vehicle fleets, Ally finances more than standard sedans. Below are some of the vehicles Ally underwrites for commercial use, along with some of the available terms:

- New and used cars

- Heavy-duty trucks, vans, and other commercial vehicles with special business equipment

- Financing agreements up to 75 months

- Financing for vehicles up to 6 years old or with 700,000 miles, depending on collateral

Also Check: What’s The Best Auto Loan For Bad Credit

Types Of Personal Loans Offered By Ally

Ally personal loans are only available to customers of certain service providers, like doctors and contractors. You wont be able to apply to Ally directly, but rather youll need to apply through a company that offers financing with Ally. If youre approved for a loan, funds will also go directly to your service provider. Ally offers personal loans for the following purposes:

- Medical treatments and procedures: These include audiology, cosmetic, veterinary, dental, fertility, and orthopedic treatments and procedures through a healthcare provider.

- Auto services: These include repairs, modifications, and collision services.

- Home improvements: These include windows, doors, flooring, roofing, siding, plumbing, electrical, HVAC, and pool repair.

You wont be able to use an Ally loan to make a large purchase, consolidate debt, or pay for educational expenses. If you want flexibility with your personal loan funds, you might be better off with another lender, since Ally pays providers of specific services directly.

Which Is The Best Lender To Refinance With

The higher your credit scores and the stronger your finances, the more choices youll have. Apply to multiple lenders to see what new interest rate you can qualify for. Comparing several offers gives you the best chance of finding the lowest rate.

Keep in mind that rate shopping can also lead to being contacted by multiple lenders, especially if you use a service that compares offers for you. Consider opening a new email account and getting a free Google Voice phone number that you can check separately.

Most lenders use what is known as a soft credit check that gives you a rate estimate but does not hurt your credit score. If you apply to more than one lender that requires a full application and hard credit check, credit scoring formulas tend to treat multiple inquiries in a short time period as a single event. For most FICO formulas, for example, that period is 45 days.

Don’t Miss: How To Get Out Of Underwater Car Loan

How To Make Your Payments

Ally offers numerous ways for you to make your car loan payments for your convenience:

- Use Ally Auto Mobile Pay, available for iPhone and Android, to schedule payments.

- Set up one-time or automatic recurring payments online.

- Mail a payment by check to Allys processing center.

- Make a one-time online payment with a credit card.