Ways To Help Strengthen Credit Scores To Buy A House

If your credit scores need work before you buy a house, consider these ways to help improve your scores:

- Make on-time payments. FICO and VantageScore both say your track record of making on-time paymentsâyour payment historyâcan be a significant factor in determining your credit rating. You could use email reminders or calendar alerts to remind yourself. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. And interest can add up and cost you more money in the long run. Interest can even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

Minimum Fico Scores: Different Loan Types

You can find much information about minimum credit score requirements for different mortgage products, such as a FHA loan or a Conventional loan. Even so, the minimum score required will vary between lenders and also be affected by your overall personal situation.

Other loan products such as auto loan or personal loans vary greatly between lenders. One thing to keep in mind is that a lower credit score will affect the rates and fees that you pay. If you have a poor or bad credit score then the chances are very high that you will not qualify for a loan, or pay a very expensive prices.

The New York Federal Reserve publishes quarterly data about Household Debt and Credit. According to their 2017 Quarter 4 published in February 2018:

The median credit score of newly originating borrowers declined slightly for mortgages, to 755 from 760. For auto loan originators, the median score increased to 707 from 705.

How Do Credit Scores Affect Interest Rates

A high credit score can save you thousands of dollars in interest over the life of your mortgage loan. Why? Your credit score represents your overall credit history, and lenders consider it a key indicator of how likely you are to repay your mortgage. It’s based on your credit report, including the following factors below.

-

Payment history

-

Accounts in use

Let’s consider an example. Say you’re financing a $250,000 loan over 30 years. Interest rates may vary based on your FICO score. You could be looking at monthly mortgage payments as low as $1,228 or as high as $1,472.

Also Check: Best Place To Get Student Loans

The Minimum Credit Score Needed To Qualify For A Home Loan

Now you know what your credit score takes into account, you need to know how high it should be for a home loan. The short answer is, it depends on what kind of loan you want.

In general, the higher your credit score is, the better. With most conventional loans, a credit score of 620 or higher, youll be able to get the best home loan interest rates.

If you have a lower credit score though, that doesnt mean that you cant get a loan. There are some loans out there that require you to have a credit score of just 500, so you have options.

There are other home loans out there that will require you to have a higher credit score. For example, if youre taking out a jumbo loan, youre taking out a loan thats outside of the maximum agreed limits.

Because of this, the loan is considered to be high risk. Thats why lenders want to issue these loans to people with credit scores of 700 or higher.

Benefits Of An Fha Loan

The reason why FHA loans are so popular is because borrowers that use them are able to take advantage of benefits and protections unavailable with most traditional mortgage loans. Loans through the FHA are insured by the agency, so lenders are more lenient. Here are a few benefits you can enjoy with an FHA loan:

- Easier to Qualify While most loans exclude applicants with questionable credit history and low credit scores, the FHA makes loans available with lower requirements so its easier for you to qualify.

- Competitive Interest Rates You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Lower Fees In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

- Bankruptcy / Foreclosure Just because you’ve filed for bankruptcy or suffered a foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a substitute form.

Don’t Miss: What Does Pre Qualified Loan Mean

Whats The Lowest Credit Score To Buy A House

Across the industry, the lowest possible credit score to buy a house is 500. But theres a limited number of mortgage lenders that allow such low scores and their interest rates will typically be higher.

The most common loan type for bad credit borrowers is an FHA loan. The Federal Housing Administration technically allows FICO scores between 500 and 579 with a 10% down payment. But most FHA lenders stick to the agencys higher threshold of a 580 score with 3.5% down since its less risky for the lender.

Private lenders might also offer non-qualified mortgage programs that are not backed by any government agency and can have more lenient rules. These programs might allow credit scores as low as 500, though interest rates on non-QM loans tend to be substantially higher than those on conforming and government-backed loans. So its typically better to go with an FHA loan or another standard home loan program if you qualify.

What Is The Minimum Credit Score To Buy A House In 2022

The minimum credit score for buying a home in 2022 hasnt changed, but with interest rates inching up, the impact of a credit score on the cost likely will.

Its tough to overstate the importance of credit scores to a mortgage loan application theyre one of the top things lenders consider, Tabitha Mazzara, director of operations at mortgage lender MBANC, said.

A credit score shows lenders how well you manage credit. The more of a credit risk you are , the higher interest rate a lender will charge.

FHA loans are the largest mortgage assistance program in the country, and a borrower can get one with a credit score as low as 500, as opposed to the 620 minimum usually needed for a traditional mortgage. The interest rate charged, however, is up to lenders. The average FHA interest rate fluctuates above and below the traditional average, depending on the housing market.

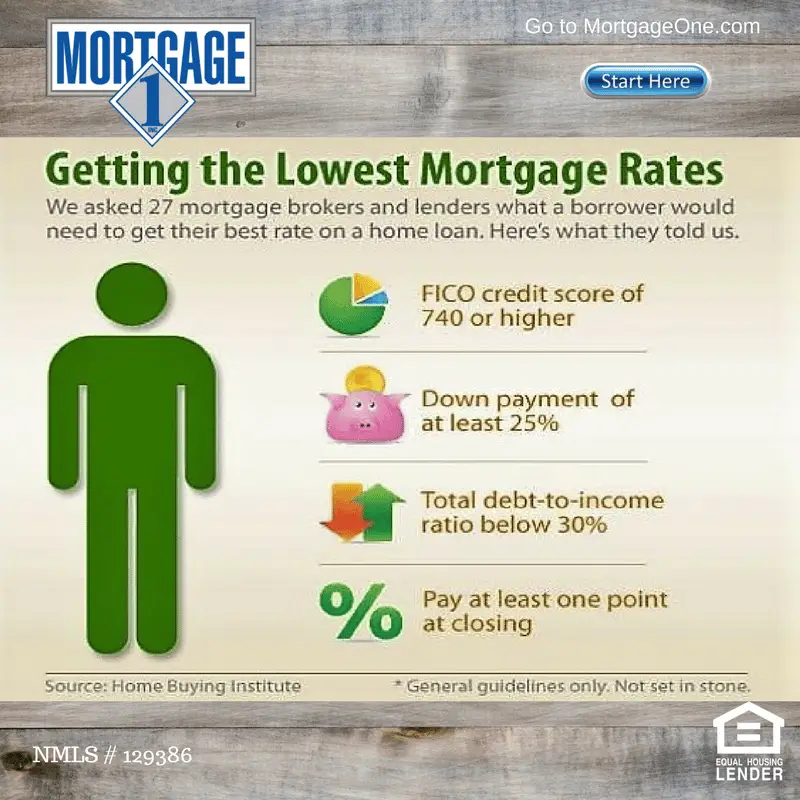

No matter what type of loan, credit score makes a difference. Borrowers with a credit score of 740 or higher were paying less than 2% interest at one point in 2021, and in 2022 pay around 3%, depending on the lender. A credit score between 640 and 679 is around 4% or higher. Traditional borrowers, regardless of credit score, paid an average 3.72% interest at the end of January 2022, while FHA borrowers paid 3.69%.

Recommended Reading: What Bank Has The Lowest Home Equity Loan Rates

Tips To Improve Your Credit Report Before Home Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates. Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or cost-effective ways to get your scores increased. And this can be a much more effective route than going it alone.

What Is The Minimum Credit Score Requirement

Minimum Credit Score Requirements

The following table describes the minimum credit score requirements.

| Transaction Type | Minimum Credit Score |

|---|---|

| Manually underwritten mortgage loans |

The requirements are published in the Eligibility Matrixand are based on the representative credit score for the loan and the highest of the LTV, CLTV, or HCLTV ratios, as applicable. The minimum representative credit score that applies to eligibility and pricing of the loan: 620 fixed-rate loans |

|

The minimum credit score that applies to eligibility of the loan casefiles is: 620-fixed-rate loans and ARMs For loan casefiles with one borrower, DU will use the representative credit score to determine whether the minimum 620 credit score requirement is met. For loan casefiles with more than one borrower, DU will determine whether the minimum credit score requirement is met using:

In instances where DU uses the average median credit score for the eligibility assessment, the representative credit score must still be provided at time of delivery. This may result in the delivery of loans with representative credit scores less than 620. |

Also Check: How To Get Bike Loan

Collections And Federal Debts

Lenders may have a maximum allowable threshold for derogatory credit, which can include collection debt. Those caps can vary by lender and other factors.

Borrowers who have defaulted or are delinquent on any federal debt may need to be on a repayment plan with a history of on-time payments. In addition, lenders might not move forward with a VA loan until you’re cleared from a federal debt database known as CAIVRS.

Talk with a loan specialist if you have defaulted or delinquent federal debt.

How Your Credit Score Can Impact Your Home Loan Application

When it comes to a successful home loan application, there are several factors a lender may take into consideration, including your income, savings, job stability and age. Another major factor is your credit history, which is encapsulated in your credit score. Your credit score can have an impact on your chance of approval, interest rate and deposit required.

Understanding your score is important if you’re looking to get a home loan or refinance an existing home loan and wanting to improve your chance of approval, it may even help you negotiate a better rate.

Recommended Reading: How Much To Put Down With Fha Loan

How Do I Check My Credit Score

There are several ways you can check your credit score for free. Some credit card companies offer free credit scores as a perk of card membership. If this is not an option for you, Credit Karma is a popular and free credit monitoring service you can consider.

If youre looking for a specific version of a credit score, you may have to pay for it. MyFICO offers a wide range of scores for varying prices. However, knowing where you stand could end up giving you the information you need to get a lower interest rate, so it could be well worth the investment.

Your Home Loan Options If You Have Poor Credit

Less than perfect credit? Its still possible to qualify for a mortgage loan. To start, you will need to know the mortgage options you might qualify for.

An FHA loan, for example, could be a good choice as its possible to get approved with a FICO score as low as 500. Or if youre an eligible veteran, you might also consider a VA loan, since there are no minimum credit score requirements.

If youre still having trouble getting a home loan with poor credit, you may need to delay your purchase and spend some time working on your credit score instead. This can mean a delay in achieving your home ownership dream but it could help you to get a mortgage loan with better terms in the long run.

Read Also: How To Cut Interest On Car Loan

Fha With 10% Down Payment

This isnt a special program. Instead, its a standard FHA loan that provides more credit flexibility with a larger down payment. FHA will accept a credit score as low as 500 with a minimum down payment of 10%. The larger down payment makes the loan less risky, and therefore less likely to go into default.

This is the closest thing there is to a mortgage for bad credit. Credit scores as low as 500 often have major derogatory information, like a recent bankruptcy, a pattern of consistently late payments, or even a series of collection accounts.

However, once again just because FHA will accept a credit score as low as 500 with the larger down payment doesnt mean all lenders will. If they consider your loan profile to be too risky, including your credit history, they may still reject the loan.

Also be aware that even if your loan is approved with a 10% down payment, the lender may still require you to pay off any past due balances, collection accounts, judgments, or liens.

What Is A Good Credit Score For Buying A House

A credit score thatâs considered âgoodâ or better may help you qualify for lower mortgage interest rates, according to the CFPB. And lower interest rates can help keep your borrowing costs low. The CFPB says people with credit scores in the mid-700s or beyond qualify for the best mortgage rates.

Lenders tend to look at credit scores in ranges and, as the CFPB notes, lenders award the best interest rates to people with the highest credit scores. Hereâs how FICO, for example, groups credit scores and how those scores might impact the rate you get:

- Exceptional: 800â850: People with exceptional credit scores have generally shown they pay back money as agreed and may qualify for the best interest rates.

- Very good: 740â799: This credit score range is considered above average. As a very dependable borrower, youâre likely to qualify for attractive loan terms.

- Good: 670â739: A credit score within this range can help you qualify for a loan, though interest rates may start climbing compared with someone with a higher credit score.

- Fair: 580â669: Although these borrowers have a below-average credit score, lenders typically still approve them for mortgage loans.

- Poor: 350â579: A poor credit score shows youâre a risky borrower, which may make it harder to qualify for a mortgage. Those who are eligible will likely pay higher interest rates.

Recommended Reading: How To Apply Ppp Loan

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You may qualify for a mortgage with a low credit score, youll just have to pay more for it.

What Other Factors Do Lenders Review

Your credit score is an important part of your loan application, but it isn’t the only factor that lenders consider. They also review:

- Income and debts: Most conventional lenders require a DTI of 43% or less. To determine your DTI, lenders divide your mortgage payment and recurring monthly debts by your monthly pretax income.

- Down payment: The larger your down payment, the better chance a lender will consider your application. While there are low down payment options at least a 20% down payment will also help you avoid paying private mortgage insurance. You can calculate this percentage by dividing your down payment by the lesser of the appraised value or purchase price.

- Assets: In some cases, lenders require you to have assets in reserve after closing on your loan so you can continue making your monthly mortgage payments. Most bank accounts, stocks and bonds count as assets.

- Work history: Most lenders prefer borrowers with steady employment. They may require you to have been on your current job or in your current job field for at least two years.

Also Check: How To Check Car Loan Balance