Loan Processor Job Description: Everything You Need To Know In 2022

Loan Processor Job Description

What is a loan processor?

A loan processor, also termed a mortgage processor, is responsible for processing your loan by preparing mortgage application files and other required paperwork.

Loan processors ensure proper assembling, administering, and processing of loan applications before getting approved by the loan underwriter.

To get a detailed overview of loan processor duties and responsibilities, you can check out loan processor job descriptions in 2022. It will show you all the modern loan processing skills and methodologies required to grow as a successful mortgage loan processor.

Here you will get answers to the following questions:

To get a loan processor job in 2022, you will need a job-winning loan processor resume along with your educational degree and certifications. Hiration has simplified the resume-building process with its AI-powered Online Resume Builder. This digital tool comes with an auto-suggest feature to help you through the resume-building process.

Loan Processor Duties & Responsibilities 3

- Orders supporting documentation, such as appraisals, verification of employment, verification of deposits, etc.

- Evaluates loan applications for reasonableness and, if needed, escalates files for further evaluation

- Communicates with Loan Officer and borrower to obtain missing documentation

- Reviews files for completeness prior to submission to Underwriting

- Obtains documentation needed to clear conditions, if required

- Submits approved files to Closing

- Prioritizes work flow so loans close on time

- Communicates with title company, appraiser, and other vendors as required

- Provides excellent customer service to borrower, loan officer, vendors, and other interested parties

- Prepares and sends approval and denial letters. Directs client to Loan Officer or other Licensed employee to clarify and or answer any questions

- Records data on the status of loans, including number of new applications and loans approved, canceled or denied

- Files are already generated when they come across the Processor’s desk.

- Ensuring accuracy and completeness

Loan Processor Requirements & Skills 1

- High School Diploma or GED equivalent

- At least 2 years of relevant work experience

- Excellent written and verbal communication skills

- Highly adaptable team player

- Extremely organized, Strong attention to detail

- Has worked in Empower or other Mortgage Loan Applications and has managed multiple loan officer relationships

- NMLS / Certification is an added advantage

- Problem solving abilities

- Able to work overtime as business needs dictate

Also Check: How Many Americans Have Student Loan Debt

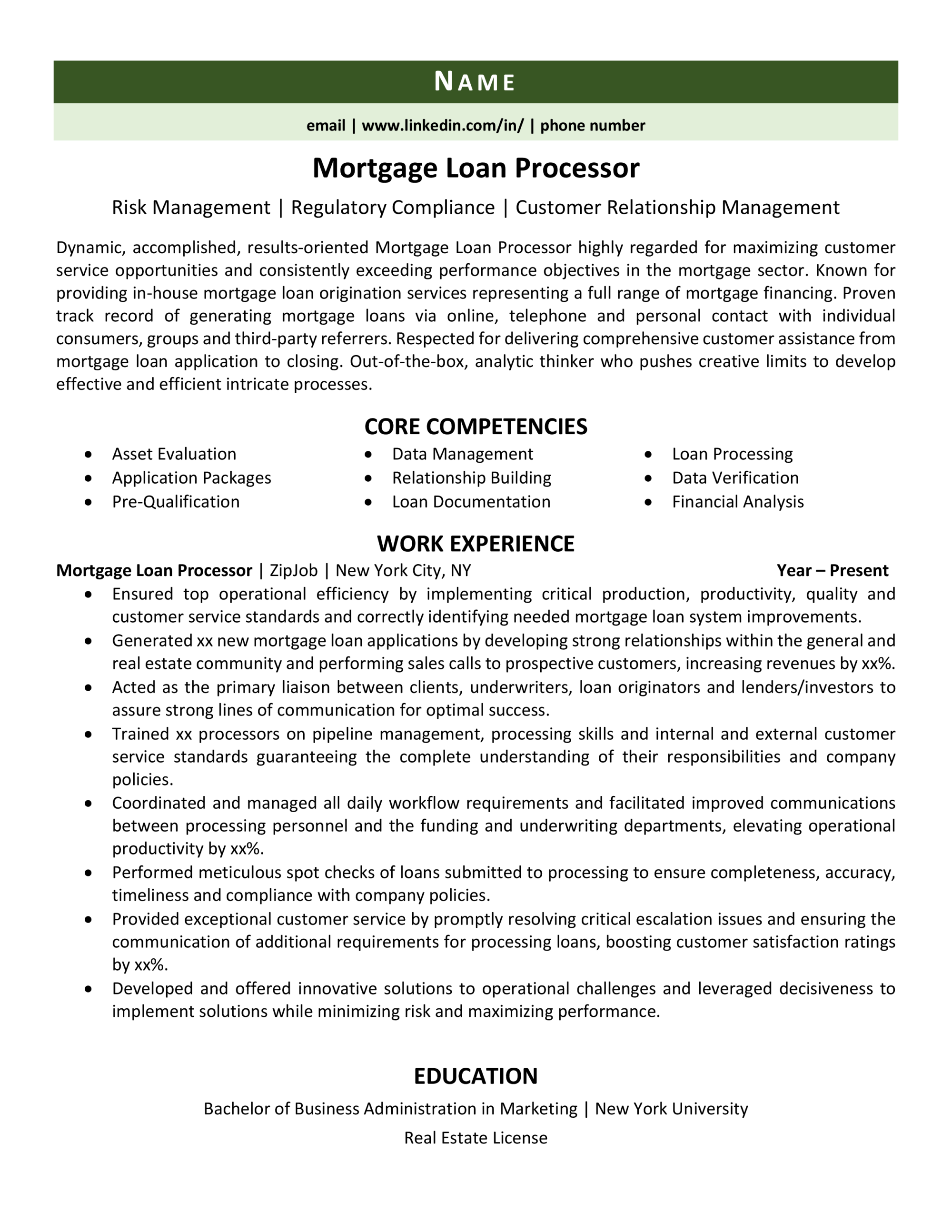

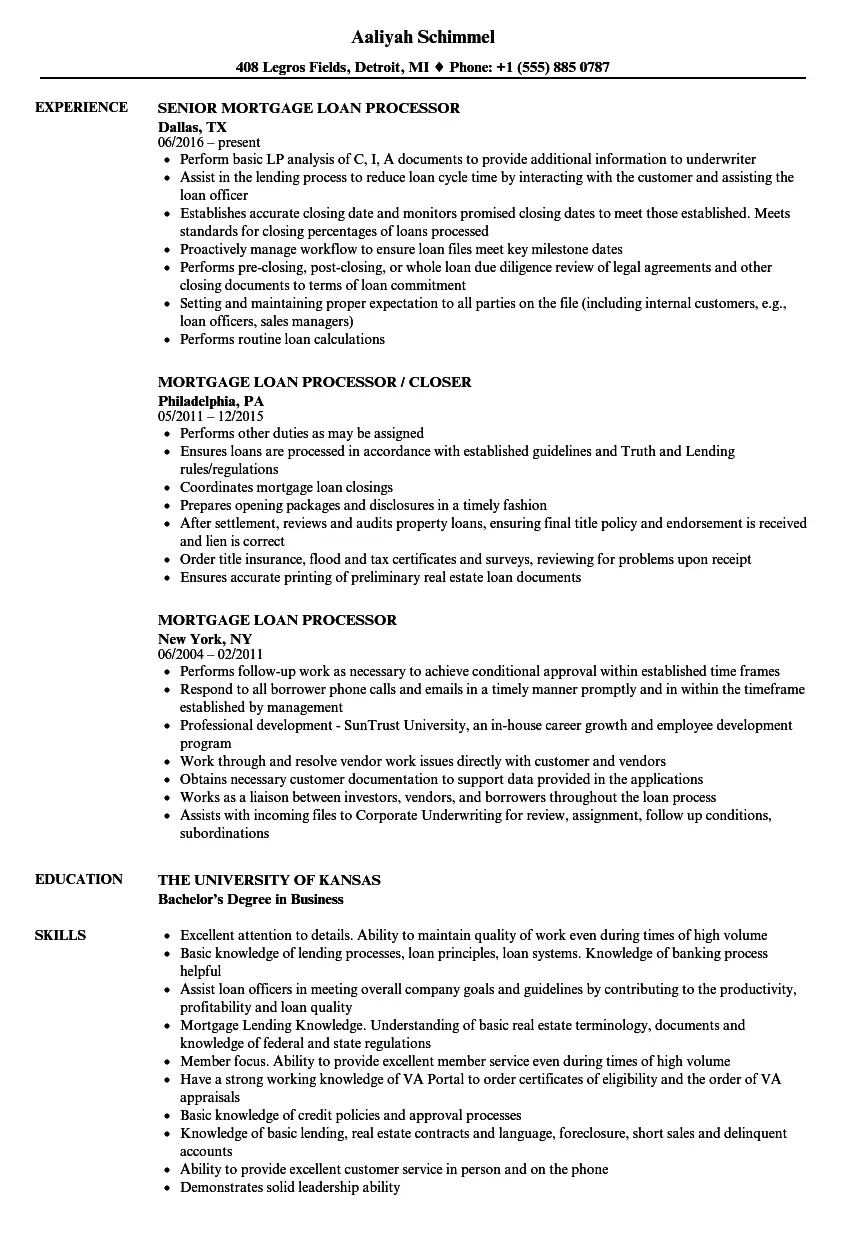

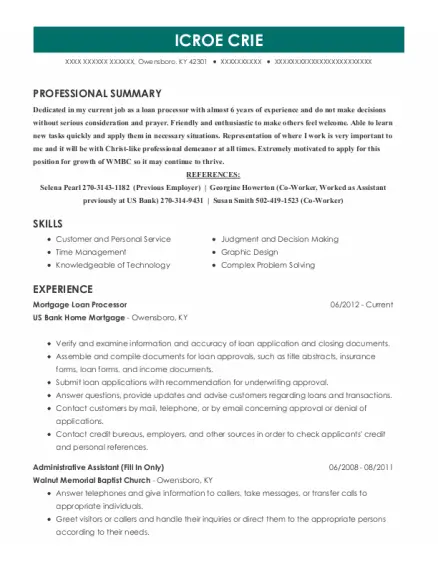

Mortgage Loan Processor Job Description Example

This Mortgage Loan Processor job description template will help you save time, attract qualified candidates and hire best employees.

Are you an experienced Mortgage Loan Officer looking for an opportunity to advance your career?

If you are a highly organized communicator capable of making sound decisions while maintaining composure in a fast-paced environment, we have a perfect job for you!

We are looking for a reliable Mortgage Loan Processor to process loans and provide a high level of customer service.

What Are The Daily Duties Of A Loan Processor

Once a Loan Processor receives a file from a Loan Officer, they begin by organizing their file and noting any missing documentation. They track down employment verification details, bills, bank statements and identification information. Loan Processors might contact lawyers and clerks to track down additional details that are essential for processing the loan application. They communicate with the Loan Officer about additional missing information before proofreading the final forms and sending them to the Underwriter. At the end of the process, Loan Processors review the loan contract for errors and noncompliance issues.

Read Also: Is Appraisal Required For Home Loan

Mortgage Processor Skills And Qualifications

Those who are successful in mortgage processor careers typically possess certain key skills. When evaluating candidates resumes and conducting interviews, look for the following qualifications:

- Effective oral and written communication skills to ensure a smooth flow of information between the mortgage officer and the underwriter

- Organizational skills to ensure mortgage files and closing documents are complete and simple to use

- Multitasking skills to keep track of multiple loan applicants information at one time

- Knowledge of mortgage financing to seek supporting information for applications and preparing documents

- Understanding of banking and finance regulations needed to ensure compliance with federal and state laws

- Analytical skills to evaluate credit histories and spot potential errors

- Computer skills to use e-mail, spreadsheets, underwriting software, customer relationship management programs and other software

- Time management skills to comply with all deadlines

The Top Mortgage Processor Skills

|

Skill |

Why its important |

|

Communication |

|

|

Organization |

Mortgage Processors collect a huge quantity of data and usually handle more than one loan application at the same time. Therefore, Mortgage Processors need to have amazing organization skills in order to keep every detail and data in order. |

|

Attention to Detail |

Attention to detail is another essential skill for Mortgage Processors and it refers to their ability to quickly spot and detect any mistake, error, miscalculation, or inconvenience in the loan or applicant documentation. Great attention to detail is a skill that makes a difference between a good and average Mortgage Processor. |

|

Negotiation |

Mortgage Processors use their proper negotiation skills to gain and keep clients. Loans and information may change quickly, and Mortgage Processors need to convince and ensure borrowers that the loan is still a good idea and fulfill their satisfactory level. |

|

Research Skills |

Financial records and information could be a very broad and difficult topic. As a Mortgage Processor, you should have great research skills in order to investigate and learn about any detail that you are not familiar with, and therefore complete your task thoroughly. |

Don’t Miss: How Long Does It Take To Get Student Loan Money

Want To Use This Job Description

Mortgage Loan Processor Job Responsibilities

The job responsibilities should be the most in-depth section of a job description. Creating a thorough list is essential when writing a mortgage loan processor job description. A detailed overview of responsibilities helps potential employees to understand what your company expects of the person who fills the position. There are several ways you can ensure the right candidates find your description.

As you write the list of responsibilities, consider which tasks are most important to the job and list them first. It is also important to use keywords when possible. For example, if the employee will use a specific type of software, use the name of the software as a keyword and put it near the beginning of your bulleted list. You should also use strong action verbs when describing each responsibility. This makes it easier for applicants to imagine themselves in the position and performing relevant tasks. You may also consider using links to video, audio or written content that further describes the position outlined in the mortgage loan processor job description.

This list of mortgage loan processor job responsibilities will help you begin writing your own:

Mortgage Loan Processor Job Specifications

Consider these common mortgage loan processor job specifications as you write your own list:

Loan Processor Requirements & Skills 9

- Proficient in computer applications including LOS , Desktop Underwriter, GUS, Outlook, Word, Excel, Adobe and PowerPoint

- Ability to work under strict time deadlines

- Detailed-oriented, possess time management skills

- Demonstrated ability to interact effectively with mortgage center, regional and corporate personnel, as well as with realtors, builders, sellers and title companies

- Minimum high school diploma, college degree preferred

- Minimum 2 years loan processing experience

- Excellent computer skills â will train on company system

- Experience with conventional, jumbo, government loans

- Ability to work in remote environment with loan officers, production staff, underwriters, attorneys, title companies and borrowers

- Possess excellent customer-service skills

You May Like: Is My Loan Fannie Mae

Job Description Of Loan Processor

Various companies usually need a highly intellectual and skilled Loan Processor to undertake individual and company loan assessments and evaluations. Loan Processors operate as a bridge between the expanding financial institution and prospective customers, executing loan package documentation preparation, credit investigation, and client evaluations.

The primary responsibility of a job applicant in this role will be to assist eligible clients in obtaining loans timely and professionally while maintaining the organizations integrity. The successful candidates exhibit a thorough understanding of relevant regulations and rules. In addition, these candidates should have great interpersonal and communication skills and strong attention to detail.

Envisioning Of A New Reality For Your Marketing Business

Simply put, MyOutDesk equips entrepreneurs & marketing agencies owners with tools, strategies, and virtual employees and when combined, businesses have a competitive edge and find growth while efficient systems and processes are put in place.

MyOutDesk proudly provides additional free business growth guides, books, and strategy calls.

See what we are about, and schedule a free consultation with us. Well take the time to learn more about your business and offer solutions to foster top talent and lower operational costs for your company.

MyOutDesk can save you up to 70% on employment costsClaim a free business strategy consultation & Grow Virtual Guide

Did You Know? MyOutDesks origin story is set during the last global financial crisis of 2008. Yes, thats right our business started by scaling businesses with virtual assistants during a recession! Our first client in 2008 went from five to seventeen VPs with a completely revamped organizational model in short order, and he told MyOutDesk, Our virtual professionals have shaved $250,000 off our monthly overhead.

Claim a free business strategy consultMyOutDesk can save you up to 70% on employment costClaim a free business strategy consultation & Grow Virtual Guide

Also Check: Do Reserves Get Va Loan

Personalising Your Mortgage Processor Job Description Advise

The hiring process and recruiting new employees to fill your key roles requires a degree of personalisation if you are to attract the best employees in a competitive employment market. The right person for a crucial role or more senior roles will likely have other employers targeting them. As your job description will be the first point of contact, you need to nail your pitch and provide the best possible service.

When creating your bespoke description and advert, you should cover and promote these points:

Job title:This should accurately reflect the role and include keywords that top talent might be using to search for jobs.

Job duties: The day to day duties, such as administrative tasks, which vary depending on the company and inform the candidate if they can complete the role.

Technical skills: These are the hard skills required through training, such as proficiency with Microsoft Office.

Soft skills: These include the interpersonal skills and general abilities the right candidates will possess. For example, the competency to prioritise multiple tasks, handle customer queries and customer complaints, work alone, or build a good relationship with coworkers.

The companys culture: Highlighting your company culture and values ensures employees thrive and find outstanding job satisfaction. Candidates that are not the right fit wont waste their time completing the application process, meaning you can focus on qualified individuals and hire in a more timely manner.

Loan Processor Requirements & Skills 6

- Knowledge on reading and understanding appraisals, titles and credit reports

- Basic business math to calculate income, assets, taxes and monthly insurance

- Understand rules regulations, policies and/or procedures along with investor guidelines

- Ability to ‘pre-underwrite’ the file assuming what conditions will be needed prior to the file being underwritten by the underwriter requirements

- Demonstrated interpersonal, organizational and time management skills

- Use basic/business math to solve problems

- Speak clearly, concisely and effectively listen to, and understand, information and ideas as presented verbally

- Laws governing access to public and private records

- Follow written and/or oral instructions

- Use the telephone in a professional and courteous manner

- Strong computer skills

- Adaptability to a fast paced environment

- Minimum of 4-5 year experience as Loan Processor is required

- Maintain a production average of 3-4 mortgage loan decisions per day

Also Check: What Is Conventional Loan Mean

The Bottom Line: Mortgage Loan Processors Help You Reach Closing Day

Just like underwriters and loan officers, mortgage processors are a crucial part of the mortgage process. Working with a mortgage processor can help you get everything in order for underwriting and keep your application on course for closing.

Ready to get your financing in order? Get approved now to start the process.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Mortgage Loan Processor Job Description

- Collect required documentation from applicants and follow up on missing items

- Ensure that all customer files are complete and in compliance with regulatory agencies and internal policies

- Make recommendations for procedural changes to increase efficiency

- Assists with special projects as requested and perform additional duties as required

- Process files from opening through closing of each loan

- Analyze borrower Federal Tax returns to determine qualifying income

- Resolve real estate loan servicing issues, inquiry or request on the loans serviced at the credit union loan that are being sub-serviced on behalf of the credit union

- Understand and comply with mortgage industry regulations

- Review all new loan applications within 72 hours of receipt of file to ensure compliance with all investor agency/federal compliance guidelines

- Update loan files, the mortgage computer system, and the tracking system as information is received

- Ability to deal tactfully and effectively with customers fellow employees

- Forms and Reports completion

- Bachelor’s Degree preferred

- You must have computer proficiency and be technology knowledged

- You must take direction well and you must get along well with others

- You must have outstanding punctuality

- Monday – Friday 8am – 5pm plus overtime as needed

- Minimum five years of Mortgage Loan Processing experience

Don’t Miss: What Size Mortgage Loan Can I Qualify For

What Is A Mortgage Loan Processor

A mortgage processor, also known as a mortgage loan originator or loan processor, sets up the borrower with the proper documents for the loan program they want to use. They guide the borrower through the first step of loan processing. Once the paperwork is finalized, the mortgage processor then passes it through to the underwriter.

Mortgage Processor Job Description

Mortgage processors administer loan applications for the purchasing of real estate. Their primary responsibilities include interviewing loan applicants, assisting applicants in choosing the right mortgage option, and approving or rejecting loans.

- Completely free trial, no card required.

- Reach over 250 million candidates.

Recommended Reading: How To Pay Off Car Loan In Full

Other Skill Sets Requirements & Qualifications

After getting a degree, it is also essential to have certifications from specific discipline-related courses and programs. These programs cover detailed topics in loan processing such as counseling, approval, underwriting, appraisal, and other loan processor duties.

Certifications can be obtained from courses and programs in several institutions however, it is vital to get an official certificate from the National Association of Mortgage Processors . Three levels of certifications can be obtained from the NAMP

- The Certified Purple Processor : Loan processors earn this certification badge after completing a minimum of twelve hours of basic loan processing and advanced loan processing.

- Certified Master Loan Processor : Loan processors earn the CMLP badge after completing 24 hours of training in basic loan processing, advanced loan processing, underwriting basics and processing FHA loans, and processing VA loans.

- The Certified Ambassador Loan Processor : Loan processors earn the CALP badge after completing 18 hours of training in addition to the CMLP certification. This additional training includes the FHAs rehab program, tax returns analysis, and fraud detection and prevention.

To get a certification at any level, participants must pass background checks and clear examinations with a minimum grade of 85 percent.

Fundamental Loan Processor Job Duties

The loan processor responsibilities can differ in different companies. However, the fundamental duties of a loan processor move around these points:

- Examine all the reviewed loan applications

- Conduct thorough background research on loan applicants

- Examine every non-financial and financial criterion

- Conduct applicant interviews to examine their loan eligibility

- Maintain a strong relationship with clients

- Prepare amount repayment plans

- Give green flag to eligible candidates

- Regularly update records

Recommended Reading: How To Calculate Student Loan Interest Per Month

Can A Mortgage Loan Processor Work Part

Mortgage loan processors typically work full-time from Monday to Friday. However, some employers offer the job on a part-time work basis. If you work remotely, you could spend some of your productive hours on other jobs, provided you arent overloaded with your primary job as a mortgage loan processor.

What Are The Average Vacation Days Of A Mortgage Loan Processor

Some loan processors work on weekends, although that is uncommon. Depending on your company, you are entitled to all your usual employee benefits like the general company holidays, sick leave, annual leave, and some other time off. However, all these are firm-specific. If you were applying to any firm as a mortgage loan processor, it would be best to check out their employee policy first.

Read Also: How To Return Ppp Loan

Requirements For Loan Processor

- To be considered for a position as a Loan Processor, you must have a bachelors degree in finance or a related discipline.

- The candidate should have a minimum of two years experience working as a loan processor or in a related function.

- Loan processes and closing procedures should all be well-understood by the candidates applying for a job role as a Loan Processor.

- Working knowledge of banking software and Microsoft Office is also necessary for the position of Loan Processor.

- The hiring team considers candidates with outstanding communication and interpersonal skills for a position as a Loan Processor.

- These individuals should also be able to multitask and have excellent time management skills.

Mortgage Processor Experience Requirements

The amount of experience needed to proficiently complete mortgage processor job duties varies. If you represent a small financial institution or mortgage company, you may wish to consider all applicants with the necessary training and education. Larger companies and institutions that produce a high volume of loans may prefer candidates with at least one year of previous work experience as a mortgage processor.

However, if you have one or more seasoned processors already on your team to serve as trainers and resources to new hires, candidates may not need prior experience to succeed.

Also Check: How To Lower Your Monthly Student Loan Payments