Decide How Much You Need To Borrow

If youre looking to take out a loan, the first step is to research what type of loan is best for you. Consider factors such as how much money you need to borrow, the Annual Percentage Rate and how much you can afford to repay.

Unsecured or personal loans may go up to £25,000, depending on the lender. Your eligibility will depend on your individual circumstances and the lenders criteria.

Secured loans can go up to around £100,000 but bear in mind that you must use an asset as collateral, meaning your property could be repossessed if you fall behind with payments .

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Do I Need Conditional Approval

Most people at an open house arenât looking to buy that particular house. Theyâre doing their homework, getting a sense of the market. Theyâre dipping a toe in . But with loan conditional approval, youâre in a different camp. Youâre the real deal. Youâre showing real estate agents and vendors youâre serious and someone to negotiate with.

Conditional approval also keeps your feet on the ground. You know exactly how much you can affordâand donât waste time drooling over houses outside your budget.

Don’t Miss: How To Write An Appeal Letter For Loan Modification Denial

How To Avoid Denial Of A Pre

Lenders may decline pre-approval applications for any reason. Some common ones are:

- You havent supplied the proper documents for validating your income

- You have a low credit score

- You have too many inquiries on your credit report

Just because youve been pre-approved before doesnt mean you will be again. Lenders have strict eligibility criteria, and youre not guaranteed to receive a loan even if youve been pre-approved.

What else to watch out for

Always be wary of a lenders reputation. Check customer reviews and the lenders website, and never agree to a loan from a lender that you dont trust. It may seem obvious, but there are scams out there that look legitimate.

Some disreputable lenders will even send postcards in the mail or forward an email that mimics a real lender. Confirm that these pre-approval offers are real before proceeding with a loan applicationespecially if it asks for your personal information.

What Are The Benefits Of Pre

If you’re looking to purchase a house but you’re not sure how much you can spend, it’s difficult to know where to begin. You might find a property that seems perfect, but have no idea whether it’s a realistic option for your budget.

If a lender pre-approves you for a loan, they will do so for a specific amount, so you can focus your house hunting on the properties you can afford. Which might mean that you have to forget about that beachside mansion with tennis court and pool, but the whole process will be a lot easier. It also means that, if you’re bidding at an auction, you’ll have a maximum bid in mind.

For example, you may be looking at two different properties: one valued at $550,000 and one valued at $700,000. If you’re pre-approved for a home loan of $550,000, the more expensive house may be outside your budget, unless you contribute more of your own funds.

Pre-approval can also make you a more attractive buyer to a potential seller, as it indicates that you’re serious about purchasing the property and that your offer is less likely to be withdrawn due to a lack of financing.

Also Check: How To Get An Unsecured Loan With Bad Credit

How Does The Pre

The pre-approval process works in one of two ways. You can get pre-approved on a loan, either by:

We explain how to approach the lender to make an enquiry:

What Does Mortgage Pre

Mortgage pre-approval is a commitment from a lender to provide you with home financing up to a certain loan amountbasically, the stamp of approval that you have the money, credit history, and other credentials to buy a home up to that price.

Lenders will do a full review of income, assets, and credit in order to issue a pre-approval, says Sarah Valentini, president and co-founder of Radius Financial Group.

You May Like: How To Calculate Bank Loan

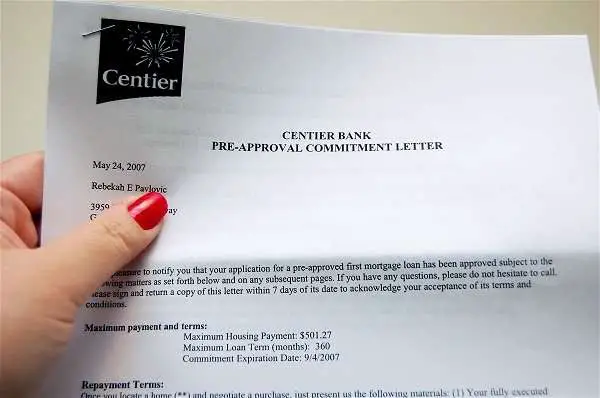

What Does A Preapproval Letter Include

A preapproval letter includes your name, the price of the home you gave when requesting the preapproval, the loan amount youre preapproved for and the expiration date of the preapproval. Some lenders also include conditions related to the preapproval in the letter, such as it only applying to a single-family home instead of multi-family property.

Stay In Touch With Your Broker

Stay reachable, in case your mortgage broker has any questions about your documentation. This means avoiding vacations or business trips where you wont have access to email or phone. If you arent available, they may make assumptions about your intent, and reject your mortgage pre-approval. If you absolutely must leave town, make sure to inform your mortgage broker in advance.

Recommended Reading: How Much Is The Loan Interest Rate

What Do I Need To Submit For A Pre

Youll need to provide the following information when you apply for loan pre-approval:

- Your name, date of birth

- Your contact details, including your address, phone number and email

- Your employment details, including your current employer and income

- Your financial details, including your expenses and debts

Lenders provide pre-approvals based on your application. If its inaccurate or missing details, a lender wont be able to offer you pre-approval. Be sure to take the time to gather the necessary documents so that your application is as accurate as possible before you begin.

Now Lets Break It Down

- Anticipated purchase price: The maximum amount you may be able to borrow. Be sure to consider your own comfort level when it comes to what you can afford. A general guideline is to not spend more than 30 percent of your gross monthly income on all housing expenses, including:

- Homeowners insurance

- Utilities

- Maintenance

- Private mortgage insurance

- Homeowners association fees

The last part of the pre-approval letter will likely vary from lender to lender, so make sure you understand what your pre-approval is based upon.

Pre-approval can help set you up for a smooth home buying experience, as well as give your offer a little extra leverage and you a bit more confidence.

Don’t Miss: How To Take Out Equity Loan

Apply For A Mortgage Pre

Most Canadians think the first step in the home-buying process is to contact a realtor and start looking at homes. This isnt correct. The first thing you should do is apply for a mortgage pre-approval. After all, if you find a home you like, youll want to move quickly. Being pre-approved for a mortgage removes an extra step in the process.

Being pre-approved also helps you know how much you can afford to spend. You can get a good estimate of how much you can afford with our mortgage affordability calculator. However, the hard limit will always be how much the bank will approve you for a mortgage pre-approval gives you that.

How long does it take to get a mortgage pre-approval? It can be done within an hour if you have your documentation together. Get in touch with a mortgage broker near you to get started.

Which Lenders Tend To Give Unreliable Pre

Our mortgage brokers always request your pre-approval to be fully assessed by the bank.

If for some reason a full assessment isnt possible, they will advise you that your pre-approval isnt completely reliable.

There are several lenders who frequently give unreliable pre-approvals:

- St George Bank: St Georges pre-approvals dont always go to their credit department and almost never go to their Lenders Mortgage Insurer.

- Westpac Bank: Westpacs pre-approvals are system-generated and dont go to their credit department.

- Suncorp Metway: Suncorps pre-approvals go to a file owner but not to a credit officer for formal assessment. Their credit department often disagrees with the pre-approval that was issued by the file owner.

- ANZ Bank: ANZ branches often give on the spot pre-approvals that arent reliable as they havent been to the credit department for assessment.

- NAB: NABs pre-approvals generally dont go to their credit department for approval they are often just an assessment of the customers borrowing capacity.

- Rams Home Loans: Rams doesnt offer pre-approvals, only a confirmation that you appear to be able to afford the loan.

- On the spot pre-approvals: All major banks offer on-the-spot pre-approvals which arent reliable. You must request a full assessment from their credit department!

Read on to find out how you can get your loan fully-assessed by the bank.

Recommended Reading: What Is My Student Loan Payment Going To Be

How Long Does It Take To Get Preapproved

Depending on the mortgage lender you work with and whether you qualify, you could get a preapproval in as little as one business day, but it usually takes a few days or even a week to receive and, if you have to undergo an income audit or other verifications, it can take longer than that. In general, if you have your paperwork in order and your credit and finances look good, its possible to get a preapproval quickly.

Major Issuers Generally Offer Pre

Many major credit card issuers and some smaller ones offer pre-qualification on their websites. The issuer typically asks for personal information, including your name and address and some or all of your Social Security number. It uses that information to run a “soft” check of your credit, which is one that doesn’t affect your credit scores.

In some cases, you’ll be able to see not only the card you pre-qualify for, but also the exact terms of the offer such as the credit limit and interest rate before you apply. These kinds of pre-qualfications are more specific and detailed and may even amount to a preapproval, but you still have to formally apply for the card.

If you decide to apply for the card based on that information, the issuer will go ahead and run the hard credit check. It will likely ding your score, but you’ll have more assurance of approval.

You can also make your own best guess about whether youll be approved for a card by considering your credit score. Some credit cards are available only to those with excellent credit, or good to excellent credit.

Also Check: Can I Use The Va Home Loan More Than Once

Simple Tips To Secure A 175% Mortgage Rate

Secure access to The Ascent’s free guide that reveals how to get the lowest mortgage rate for your new home purchase or when refinancing. Rates are still at multi-decade lows so take action today to avoid missing out.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

What Should I Do Once Ive Submitted My Application

Once youve submitted your home loan application, you should make sure it has adhered to bank policy.

To do this you can ask your mortgage broker or the lender:

- Did the credit department accept my application?

- Has the lenders mortgage insurer approved my application?

- What are the conditions of approval?

- Can I satisfy the conditions before I make an offer on a property or when going to auction?

- Can I bid at auction in the knowledge my loan will be approved?

Please be aware that interest rates and lending policies are subject to change.

If they do, even a formal pre-approval may no longer be vaild.

Be sure of current rates and policies before going to auction, preferably the same day or as close as possible.

The lenders will most likely not notify you of this unless you ask.

To find out more about this, see our page on or contact us here at Home Loan Experts.

You may or call and speak with one of our specialist brokers on 1300 889 743.

You May Like: When Interest Starts On Education Loan

Learn More About The Benefits Of Prequalification And Preapproval

As you look for a home, you may be asked to get prequalified or preapproved. Before you start, its important to understand the difference.

When you want to talk to a lender to establish a general range of home prices, you can get prequalified, which is simply a lenders estimate of what you could potentially borrow.

This can be completed easily and conveniently online, in person, or over the phone in just a few minutes with basic information like your income and expected down payment.

When you want to give yourself a competitive edge over other buyers in the market, you can get preapproved. Having a preapproval lets sellers know that you already qualify for the home financing which greatly increases your chance of having your offer selected.

Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay stubs, bank statements and tax returns.

The lender will then use these documents to determine exactly how much you can be preapproved to borrow.

Once youre preapproved, youll have 90 days to find a home you love. Then you can lock your rate and complete your application.

Whether you choose to get prequalified or preapproved, you will have a better sense of whats in your price range and can hunt for a house with confidence.

When To Get A Preapproval

The best time to get a mortgage preapproval is before you start looking for a home. If you dont, and you find a home you love, itll likely be too late to start the preapproval process if you want a chance to make an offer. As soon as you know youre serious about buying a home that includes getting your finances in home-buying shape you should apply for a preapproval.

If youre following mortgage rates, you can to determine the right time to strike on your mortgage with our daily rate trends.

You May Like: How To Refinance An Avant Loan

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

What You Should Know About The Pre

The following process is for when you’re seeking a pre-approved personal loan:

Please note that if you have received communication from your current bank that you’ve been pre-approved for a personal loan, then this process does not apply to you. Your bank has used information available to determine whether you may be eligible for one of their products.

In many cases, pre-approvals take place online within just a few minutes. This is because it may be an automated process, and the lender and their credit assessment team/insurer has not evaluated the pre-approval. It is not a formal loan approval. For this reason, the lender is under no obligation to approve your loan once you submit the completed application. Be aware that on-the-spot approvals are often nothing more than indications.

You May Like: How To Apply For Federal Loan Forgiveness

On The Spot Approvals

There are many lenders who advertise pre-approvals online or via the branch, in as little as 30 minutes.

The reality is that this is a sales tool used by lenders to get people to apply for a home loan.

These applications arent sent to the lenders credit department for full assessment, and because of that, they are effectively worthless.

Dont assume that a bank manager knows all credit policies of the bank that they work for.

They are sales staff, their job is to bring in new mortgage applications, not to assess them.