What Does Sold As

Sellers list their homes for sale as-is when they dont want to do any repairs before closing. It means there are no guarantees from the seller that everythings in working condition. If you buy an as-is home and later find major problems, youre responsible for the repairs.

As-is sellers still need to meet federal and state minimum disclosure standards, which include telling you about things like lead paint.

As-is doesnt always mean broken beyond repair. There are many reasons why a seller might list a home as-is even with minor or no issues. The seller may be in debt and not have the money to pay for repairs. The seller might not have time to wait for contractors to finish a major job. There are also plenty of non-repair-related reasons why a seller might list a home as-is.

Find a pro to help.

Find a top-rated painter to help give your home a fresh look on HomeAdvisor.

How Does Mortgage Recasting Work

The specifics can vary by lender, but here are the steps you can expect:

- Make a payment. Youll need to make a large lump-sum payment to a lender typically a minimum of $5,000, though check the fine print to make sure. This money goes toward your loans principal balance and reduces the amount you owe.

- Lender reamortizes your Amortization is a fixed repayment schedule that includes both the principal and interest. You pay back your loan over a set amount of time. Lenders may provide an amortization chart showing you how your payments will change throughout the lifetime of your loan. Once you make a lump-sum payment, the lender will then adjust the repayment schedule to reflect your new monthly dues. Theres an example amortization chart further down the article if you want to see a breakdown of how to calculate a mortgage recast.

- Servicing fees. Many lenders charge a servicing fee for loan recasting. They typically arent more than a few hundred dollars, but for specifics youll want to contact your lender. Rocket Mortgage® charges $250 for a mortgage recast.

Again, recasting only lowers the amount you pay each month, it doesnt reduce your mortgage term.

The Cost Of Bridge Loans: Average Fees And Bridge Loan Rates

Bridge loans can be a handy option to get you out of a jam, but you will pay for that convenience. Thats because the interest rate is higher than with a conventional loan. While interest rates can vary, lets look at the implications of having a bridge loan with an interest rate thats 2% higher than on a standard, fixed-rate loan.

On a $250,000 loan that has a 3% interest rate, you might be paying $1,054 for a conventional loan, an amount that would rise to $1,342 with a bridge loan that had a 2% higher interest rate.

The reason for high interest rates on bridge loans is because the lender knows you will only have the loan for a short time. That means that they arent able to make money servicing the loan, as in collecting your monthly payment over the long term. They have to charge more interest upfront to make it worth their while to loan you the money at all.

In addition, youll need to pay closing cost and fees, as you would with a traditional mortgage. That likely includes administration fees, appraisal fees, escrow, a title policy, notary services and potentially other line items that your lender will explain.

And finally, youll pay an origination fee on the loan, based on the amount youre borrowing. With each point of the origination fee you will typically pay about 1% of the total loan amount.

For an estimation of what your bridge loan might cost, try this bridge loan calculator that lets you consider different scenarios.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Who Should Use Rocket Mortgage

Rocket Mortgage was created by Quicken Loans to allow buyers to conduct the entire mortgage transaction online. You can reach out to an agent on the platform if youre not comfortable inputting your financial data online or if you have questions. Rocket Mortgage uses bank-level encryption to protect any data transmitted on its platform so you can apply and manage your mortgage right from home.

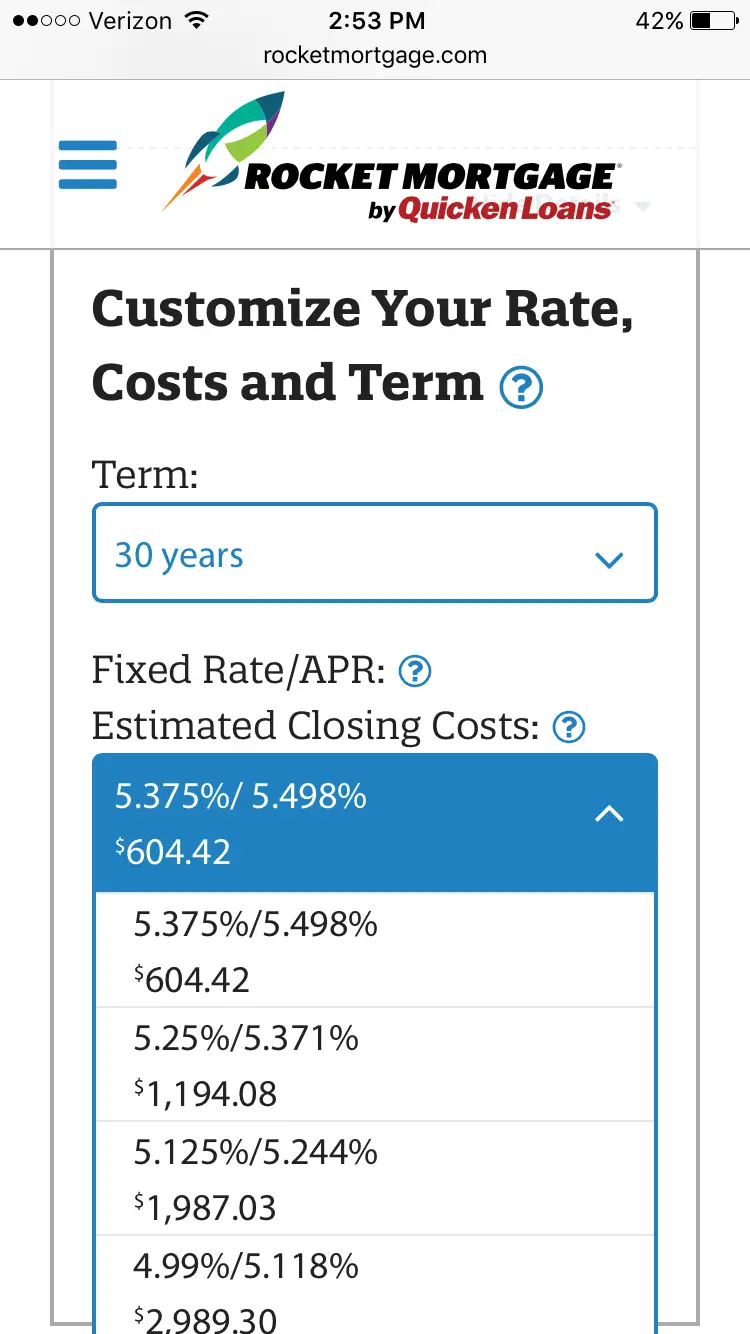

Rocket Mortgage Rate Transparency

If youre trying to get an idea of what prevailing interest rates are, you wont find sample national rates on the Rocket website. For that, you’ll need to head over to QuickenLoans.com. There, you’ll find a page listing common loans and interest rates.

For rates customized to your situation, create a Rocket Mortgage account and provide some information to get a personalized rate, but remember, viewing those rates may involve a hard credit inquiry.

You may find that the bouncing between Rocket Mortgage and Quicken Loans throughout the loan process to be a little jarring at first. It’s likely that Rock Holdings, the parent company of Rocket and Quicken, will phase out the Quicken name eventually. They’ve been paying for the Quicken naming rights for years while the Rocket name has gained marketing momentum.

For more information on the loan process behind the scenes, see NerdWallet’s Quicken Loans review.

More from NerdWallet

Recommended Reading: Does Va Loan Work For Manufactured Homes

What Can I Expect My Closing Costs To Be

If you want to estimate how much youll need to bring to the closing table, it depends on whether youre buying or refinancing.

If youre buying a home, plan to have at least 3% of the purchase price for a down payment and between 3% and 6% of the purchase price for closing costs. Check out our closing cost estimator to see what that could look like for you.

If youre refinancing with Rocket Mortgage, you might not need to pay out of pocket to close your loan. In many cases, we may automatically roll all your closing costs into your loan to make refinancing more affordable.

Reasons The Rocket Mortgage Actually Decreases Mortgage Risk

It’s a new tool for a new era

While many frowned after seeing Quicken Loans $5 million Rocket Mortgage commercial, Urban Institute housing and mortgage expert Laurie Goodman says the ad simply markets a new technology that allows consumers to originate mortgages more efficiently.

In fact, Goodman said in a blog post for the nonprofit think tank that a few components of the app could reduce the risks in lending and make it easier for people with less than perfect credit to get a mortgage.

Here are 4 reasons why she believes Rocket Mortgage will help the industry, for the full story, visit her blog on Urban Wire.

1. Borrowers can give lenders easier access to bank information

Even though it has mortgage in its name, its actually a tool that collects information such as accessing bank statements, pay stubs, and tax returns. This tool reduces the risk of a crisis and not increasing it by actually helping lenders get the correct spelling and verify the accurate income.

2. Approvals might be less prone to human error

What is significant about the Rocket Mortgage is not that one can get approval in eight minutes, but that automating the process can help ensure compliance and reduce risks. In this way, its really the anti-crisis tool.

3. Automation may ease tight credit

4. Digital lending is here to stay

In its first-ever Super Bowl commercial, Detroit-based Quicken Loans created a 60-second TV spot, which showcases Rocket Mortgage, its fully online mortgage.

Recommended Reading: Does Va Loan Work For Manufactured Homes

How To Calculate Your Mortgage Recast

Your lender should be able to provide you with information, but its not a bad idea to calculate a mortgage recast yourself. The easiest solution is to use a mortgage recast calculator, but lets take a look at how you can calculate it manually.

What you need to do is to look at the date when you intend on making the lump-sum payment then lower your overall loan balance. Then youll need to calculate your monthly payment in the remaining years you have on your loan according to the new balance, using the same interest rate.

For example, you have a 30-year fixed-rate mortgage with a balance of $200,000 and a 4.99% interest rate. In this case, your monthly payment would be $1,072.43.

You decide to pay a lump sum amount of $40,000, which brings down your balance to $160,000. Now, your monthly payment goes down to around $870.81, lowering your payment $201.62 each month.

To check how much you can save, use our amortization calculator.

Consult A Trusted Real Estate Agent

As mentioned above, working with a local real estate agent can be a game changer when trying to buy and sell a home. An experienced real estate agent can help prepare your current home for sale and find potential buyers for it while also showing you new homes in your desired location. In some situations, real estate agents can even assist with finding temporary housing in between your moves, if needed.

Especially if youre buying and selling a home around the same time, its important to work with real estate professionals who have strong knowledge of the local market to ensure that your home is sold as quickly as possible.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Our Security And Privacy

At Rocket Mortgage, our mission is to help clients achieve their financial and homeownership dreams.

We extend that dedication to everyone’s privacy and data rights. That’s why we strive to be transparent about how we collect and use your information.

In that effort, we respect and aim to protect the privacy of anyone that visits or uses our website, mobile application, and other online products and services that link to this Privacy Policy .

When we collect information from you, we want you to know how its used and shared.

We demonstrate our commitment to fair information practices by adopting industry-leading privacy guidelines. Rocket Mortgage doesn’t share your info with outside companies for their promotional use without your consent.

Because of our business’s financial nature, our products aren’t designed to appeal to children under the age of 13. Therefore, we don’t knowingly attempt to solicit or receive any info information from children.

In this privacy policy, well explain how Rocket Mortgage, our sister companies and affiliate companies collect, share and use your information.

Data Collection And Data Sharing

Data Categories And How We Use Them

See what data categories we collect.

| Category |

|---|

We dont sell your data.

Your Privacy Rights

Some states are passing new laws providing citizens data privacy rights, while other states have not acted.

If you’d like to access, know about or delete personal data we’ve collected about you, please contact us.

Right To Know

Determining Your Down Payment Amount

However, when it comes to saving up for your down payment, you shouldnt necessarily shoot for average. The amount youll need is going to depend on multiple factors like:

- Your debt-to-income ratio

- The mortgage loan type you choose

- Your lenders specific requirements

- What grants and resources you can get

Your DTI is the amount of your gross income that goes toward paying on any debt youre holding. If youre putting a lot of your paycheck toward servicing debt , lenders may be concerned that you cant afford to pay your mortgage. Making a higher down payment could help your case because you wont have to borrow as much money to buy your home, making your monthly payments more manageable.

Your credit score can have a big impact on how much you need to put down. If you have stellar credit, a lender will be more likely to accept a lower down payment because youve demonstrated financial responsibility. Conversely, if you have marginal credit, a lender will be more likely to require a higher down payment because they see lending to you as risky.

Beyond your personal financial situation, the type of mortgage loan that you get will impact your required down payment . In addition, the specific lender that you work with may have its own rules regarding down payments, so youll have to inquire.

Also Check: What Do Mortgage Loan Officers Do

Should I Get A Loan Through A Mortgage Company Or Bank

Before buying a home, you will need to choose who youre going to work with through the homebuying process. This starts with your real estate agent, though your mortgage loan officer can be almost as important. They can advise you on refinancing or home equity loans if you already own a home. A financial advisor could also help you adjust your financial plan to meet your home loan needs. In either case, once you have a loan expert you can trust, you will likely rely on that person for years. In the meantime, lets compare the advantages of getting a loan through a mortgage company or a bank.

Who Sells Home Loans

You may have recently received a letter stating that your loan has been purchased by an investor. Usually, your investor will be one of the three government-owned or government-sponsored corporations that deal in mortgages: Fannie Mae, Freddie Mac and Ginnie Mae. Occasionally, a smaller, nongovernmental investor will be the one to purchase your mortgage.

Before we get into the why of mortgage investors, it may be helpful to first go over a few different terms.

You May Like: Usaa Used Car Interest Rates

Key Features Of The Rocket Mortgage Homepage

Here at Quicken Loans® were always looking for better ways to serve our clients. For more than 1.8 million clients whose loans we service were constantly improving our communication methods. We want you to get the information you need when you need it and in an easy-to-digest format. After all, simplicity is key.

To that end, weve redesigned our Rocket Mortgage® by Quicken Loans servicing homepage to make it easier to use. Although all of our webpages are constantly evolving, we focused on five key features with this iteration based on your feedback. We hope you like the changes. Check out more details below.

What Do I Do If I Dont Like My New Loan Servicer

You dont have any control over who your loan is sold to, which can be problematic if your loan is sold to a servicer that you dont like or trust for any reason.

If you dont like your new servicer, there is the option to refinance with a different lender, which will change the rate and term of your original loan. Refinancing is a good idea if you can secure a lower interest rate and/or more favorable loan term, helping you save money on your mortgage overall. If you wont be able to secure more favorable loan terms, it might not be worth refinancing just to get out from under your loan servicer.

Also Check: Genisys Credit Union Auto Loan Calculator

What Are The Minimum Down Payment Requirements

Minimum down payment requirements vary by mortgage loan type. Here are the current percentages:

- Conventional: 20% to avoid having to pay private mortgage insurance some lenders may go lower

- Federal Housing Administration : 3.5%

- United States Department of Agriculture : 0%

- United States Department of Veterans Affairs : 0%

While it may be tempting to just make the minimum down payment , making a larger down payment could really help you. Heres how:

- Get a lower interest rate youre a lower risk to the bank, so they may reward you

- Enjoy lower monthly payments youll owe less money overall, so each installment will be lower

- Avoid paying PMI on your conventional mortgage

- Be more competitive in a sellers market youll need to borrow less, which increases your chance of mortgage loan approval, which means a smooth sale for the seller

Should You Buy Or Sell First

There are several schools of thought when deciding whether to buy or sell a house first, and each person will have his or her own considerations. Some people say you should sell first so youre not stuck with two mortgages at the same time. Others say you should wait to sell later so youre not in between homes.

Also Check: Va Loan For Modular Home

Applying Online With Rocket Mortgage

-

It starts by clicking or tapping on one of the “Home Purchase” or “Home Refinance” buttons. You provide the usual contact information to sign in.

-

Answer a few more questions and soon you’re at the “See solutions” stage. This is where Rocket Mortgage pulls your credit data and reveals your loan choices. Customize your options by changing the term, the money due at closing or your interest rate or compare fixed- and adjustable-rate mortgages.

-

Once you’re satisfied with your loan choice, Rocket Mortgage verifies your qualifications and submits the application to an automated underwriting system.

-

Upon approval, you can lock your loan rate and, if necessary, get a preapproval letter.

-

Once the loan is at the underwriting stage, you and your mortgage team will use Rocket to manage outstanding tasks, e-sign paperwork, monitor the progress of your loan processing, and even schedule your loan closing.

Base Market Rates And The Federal Reserve

Dating back to its original mandate from Congress, the Federal Reserve is the central bank of the United States. This means it has a variety of responsibilities, including overseeing banks as a whole and setting certain financial policy regulations. But perhaps the most important role it plays from a consumer perspective is in the setting of short-term interest rates.

When the Feds Open Market Committee meets to determine what the Fed Funds Rate should be at any given time, it has a couple of key goals:

- Achieving maximum employment

- Maintaining stable prices

The Fed has a bit of a balancing act here, because those goals sometimes run in competition with each other. To achieve the highest possible rate of employment, you might choose to keep interest rates low, because cheaper borrowing can stimulate businesses to invest. This can lead to more hiring as well as more money spent on goods and services, which can have a knock-on effect and help still more businesses prosper.

However, if the cost of borrowing funds is too low, this also tends to mean that the money you have saved in the past is worth less than if higher borrowing costs made funds scarcer. If your money isnt worth as much, prices can go up quickly, as you need to part with more money to receive the same value.

Also Check: Usaa Refinance Auto Loan Rates