Fha Loan Vs Conventional Loan: Which Is Right For You

FHA loans are commonly compared to conventional home loans to determine which will best fit your situation.

When you meet with your Mortgage Coach at Dash Home Loans, well look at various types of loans available to you. Well help you compare FHA loans to conventional loans as well as others that are applicable in your situation. Our Mortgage Coaches are experienced and will provide in-depth information, but as youre researching loans yourself, here are a few differences to keep in mind:

- The minimum credit score for an FHA loan is 500. For a conventional loan, it is 620.

- Down payments for FHA loans are 3.5%, at least. For conventional loans, it is typically 3% to 20% depending on the lender.

- Loan terms for FHA loans are 15 or 30 years, while conventional loans offer 10, 15, 20, and 30 year loans.

- You have to purchase mortgage insurance with FHA loans, but not with most conventional loans.

- Conventional loans can be more restrictive with what is allowed to be used for gifts for down payment. One hundred percent of your down payment can be a gift with an FHA loan regardless of the down payment percentage. However, there are restrictions here too. If your credit score is below 620 and you get an FHA loan in NC, SC, or another state, you may need to pay at least 3.5% of the down payment yourself.

Introduction To Fha Loans And Fha Construction Loans

A traditional FHA loan is a mortgage loan thats backed by the Federal Housing Administration to a homebuyer. In contrast to many loan options, FHA loans are great options for anyone with a less-than-stellar credit background. FHA loans are also notable for the fact that they typically come with low down payment options.

FHA construction loans are also intended for homebuyers with subpar credit and tighter-than-average budgets. But heres the crucial detail that sets FHA construction loans apart from their traditional counterparts: FHA construction loans are specifically designed for homebuyers who want to build or drastically renovate a property.

Option #: You Make The Repairs

Again, this is not an ideal way to handle the problem. You could spend a lot of money and effort, then the sale could fall through.

But buyers do sometimes pay for minor repairs just to get the house eligible for financing, and it has worked. Just take caution with this approach.

If you as the buyer are a licensed contractor, you may even be able to do some repairs yourself. It goes without saying you need to clear it with both agents and the seller before you try to gain access to the home or make any repairs to the home.

You May Like: What Is The Commitment Fee On Mortgage Loan

How Do I Get An Fha Loan

To get an FHA loan, you must meet some requirements:

- You must pay mortgage insurance: FHA mortgages require you to pay Upfront Mortgage Insurance Premium and an Annual MIP. Your UFMIP can be rolled into your mortgage or paid during closing while the Annual MIP is paid each month.

- You must work with an FHA-approved lender: A lender like Assurance Financial is not only qualified to offer you a home loan but can also walk you through the application process.

- You must have steady work: Since FHA mortgages rely less on stellar credit, lenders place more emphasis on employment. You may need to show you have worked with your current employer for at least two years or that your employment history is steady.

- You must be purchasing a home: FHA loans are not intended for investment properties.

- Your home must be approved: You need an appraisal from an FHA-approved appraiser, and your home must meet certain requirements.

- Your loan must meet certain limits: You can only use this type of financing to cover about 115% of the median home price for your county. The FHA publishes the limits for each area, so you can see how much of a home loan you may qualify for.

Aim Higher Than The 580 Minimum Credit Score

You need a FICO score of 580 for the FHA to insure your loan with a 3.5% down payment, but every lender has its own requirements. Many will require a score above 580.

The closer your score is to 640, the more likely you are to get approved and the better your terms will be.

Improving your credit score before finalizing your loan will help buyers qualify for the lowest possible interest rates, de Jong said. Buyers can improve their credit by paying down debt and making on-time payments for credit cards and auto loans.

Youll typically need to have at least two lines of credit for example, a student loan and a credit card.

If youre not sure where you stand, check your credit score for free to find out if you need to improve it before applying for a mortgage.

You May Like: Va Loan For Modular Home And Land

How Much Is Fha Mortgage Insurance

Conventional mortgages require at least a 20% down payment, or the buyer has to pay mortgage insurance. If you have that much for a down payment, chances are youll be better off pursuing a conventional loan.

With the FHA, there is a one-time upfront premium of 1.75% of the amount of the loan. If you are borrowing $200,000, youll get whacked with an extra $3,500 bill when you close your loan.

Then theres an ongoing mortgage insurance premium that is collected every month. That amount differs for every loan and depends on the amount and length of the loan, and your loan-to-value ratio. The LTV is calculated by taking the amount of the mortgage lien and dividing it by the appraised value of the house. For instance, if you borrow $100,000 to buy a $110,000 house, the LTV is 91.6% .

Determining the exact MIP payment gets pretty complicated. Fortunately, there are plenty of MIP calculators available on the Internet. For example, if a buyers down payment is less than 5%, the premium is .85%. So, if a person bought a $200,000 house and put down a 3.5% down payment, the LTV is 96.5%. Their mortgage insurance would cost about $1,700 a year.

Thats not chicken feed. And heres the real rub:

With conventional mortgages, you dont have to pay mortgage insurance once your LTV reaches 78%. In other words, once your balance is down to $156,000 on that $200,000 house, youre off the MIP hook.

With FHA loans you are almost never off the hook.

Fha Mortgage Insurance Rates 2020

FHA requires both upfront and ongoing monthly mortgage insurance fees. For most borrowers, the upfront fee 1.75% of the loan amount and 0.85% yearly.

The upfront mortgage insurance is usually financed into the loan amount, but it can be paid in cash at closing of the loan. The yearly premium is paid in monthly installments with each mortgage payment.

For instance, a $250,000 loan would require $4,375 in upfront mortgage insurance, resulting in a $254,375 total loan amount. In addition, the borrower would pay $177 per month in FHA mortgage insurance.

FHA mortgage insurance rates are determined by loan amount, loan term, and the loan-to-value. Here are current FHA monthly mortgage insurance rates. Keep in mind that the yellow box represents the vast majority of all FHA loans.

|

Original loan term more than 15 years |

|

Loan amount |

|

0.45% |

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Fha Loan Down Payments

Your down payment is a percentage of the purchase price of a home and is the upfront amount you put down for that home. The minimum down payment youre able to make on an FHA loan is directly linked to your credit score. Your credit score is a number that ranges from 300 850 and is used to indicate your creditworthiness.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans. A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them.

Note that cash down payments can be made with gift assistance for an FHA loan, but they must be well-documented to ensure that the gift assistance is in fact a gift and not a loan in disguise.

Why Work With Dash Home Loans For Fha Loans

Dash Home Loans offers FHA loans in NC and FHA loans in SC. When you apply for an FHA loan with us, our team will go to work to help you find the best rates available to you. Well discuss each type of FHA loan, what the qualifications are, and help you understand the options available based on your unique situation.

When you apply, we can give you an idea of how much of a home loan you qualify for as well so you have a better idea of just how much house you can afford. If you already have a home with a specific purchase price in mind, our team can use an FHA loan mortgage calculator, to provide insight into what your estimated monthly payment will be.

But most importantly, applying for an FHA loan from Dash means youll experience a simpler, easier mortgage process with the best support available. Skeptical? Check out our reviews.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

How To Apply For An Fha Home Loan

The first step in applying for an FHA home loan is to contact an approved FHA lender. FedHome Loan Centers is an approved broker for all types of government loan products including FHA insured loans.

One of our Government Loan Specialists can assist you every step of the way. An FHA loan is considered one of the easiest type of real estate loans to qualify for because it usually requires a low down payment and the borrower is allowed to have less-than-perfect credit.

FHA loans are not just for single family properties. You can also use an FHA loan to purchase or refinance a duplex, triplex, fourplex or condominium as long as the borrower will be occupying one of the units. FHA loans are not for investors or for the purchase of a vacation home.

In order to get the process rolling, you will need to provide your Loan Specialist with the following basic information:

- Borrower Address

- Social Security Number

- Employment Info

- Current Paystub

- Banking Statement

- Information about other real estate owned

- Federal W2s

- Federal Tax Returns , Income Statement and Business Balance Sheet

- Certificate of Eligibility ad DD-214

- Pay for a credit report and FHA appraisal of the property

To qualify for an FHA loan, generally you must be able to satisfy the following criteria:

You Might Not Get Approved If You Have Lots Of Debt

FHA loan officers wont approve your loan if theres a good chance you wont be able to afford the mortgage and your other debt, such as car and credit card payments.

A good rule of thumb is that your mortgage payment shouldnt be more than 31% of your income before taxes. Your mortgage payment PLUS your other monthly debt payments usually cannot be more than 41% of your income, though in certain cases you can get approved if your debt obligations total 50%.

You May Like: Does Va Loan Work For Manufactured Homes

How To Qualify For An Fha Loan

You’ll need to satisfy a number of requirements to qualify for an FHA loan. It’s important to note that these are the FHA’s minimum requirements and lenders may have additional stipulations. To make sure you get the best FHA mortgage rate and loan terms, shop more than one FHA-approved lender and compare offers.

It’s important to note that lenders may have additional stipulations.

Fha Property Requirements: Which Homes Qualify For A 35% Down Loan

FHA loans are among the most solid mortgages in the market. Low down payment, low credit score requirement, and relatively low interest rates. Plus, unlike some home loan programs, theres no upper income limit on who can qualify and FHA loans can be used anywhere in the country.

But if youre considering an FHA loan for your home purchase, you need to know all of the criteria particularly the FHA property requirements.

To qualify for this low down payment loan, the house you buy must pass an FHA appraisal. And FHA property standards are a bit stricter than, say, conventional loan programs.

That doesnt mean theyre impossible to meet. In fact, most homes will pass the FHA appraisal just fine. But it helps to understand the FHA property requirements before you start your house search so you can focus on seeing properties that are likely to qualify.

Also Check: What Is The Maximum Fha Loan Amount In Texas

Can I Refinance An Fha Loan

Yes. You can refinance an FHA loan to reduce or eliminate mortgage insurance, increase the size of your loan, or reduce or change your interest rate. Learn more at:

Still have questions? Read more about everything you need to know about FHA loans.

What Are Fha Minimum Standards

The FHA sometimes includes local building codes into its property standards during its inspections. It has an extra requirement as well. Certain parts of the home must be “durable.”

This rule applies to windows, doors, gutters, downspouts, kitchen cabinets, carpet, and paint. Building materials must be able to resist weather, rust, fire, and moisture. This includes insulation, caulking, joint sealants, doors, windows, and glazing panels.

The rule applies to outdoor wall finishes as well, such as siding and paint, gutters, downspouts, wood porches, and decks.

The home must be a single, marketable real estate plot. It must be safe, sound, and secure.” The home must be livable. This includes a continuous and sufficient supply of potable water, sanitary facilities, safe disposal of sewage, space, and working appliances. At least one bathroom must have a toilet, sink, shower, or bathtub. There must be adequate heating, hot water, and electricity.

Also Check: What Is An Rv Loan

Fha Loan Vs Conventional Loans

There are a few differences between FHA loans and conventional loans. Unlike FHA loans, conventional loans are not insured by a federal agency. The biggest difference between the two are their qualifications. FHA loans usually require a 3.5 percent minimum down payment and a minimum credit score that may vary by lender. Conventional loans vary when it comes to down payment, but may require a higher credit score and greater savings.

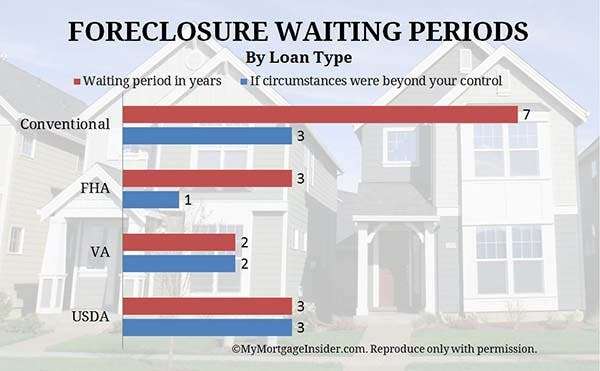

FHA loans dont require a certain income to qualify. For most mortgages, whether conventional or FHA, you must be at least three years removed from financial hardships related to foreclosures. The lender must see an improvement in your financial habits and will consider your credit score.

When it comes to FHA loans, there are down payment assistant programs out there to help you. Conventional loans, however, may not offer the same help. On top of this, conventional loans dont require mortgage insurance if your down payment is 20 percent or more. If your down payment isnt higher than 20 percent, lenders will usually require you to pay Private Mortgage Insurance . FHA loans will always require monthly Mortgage Insurance Premium regardless of the down payment.

Debt-to-income ratio is taken into consideration as well. Your debt-to-income ratio is the money you owe versus the amount of money you make. Both FHA and Conventional loans will look for a debt-to-income ratio of 43 percent or less.

Qualifying For The Fha Loan

Qualifying for an FHA construction loan is just like qualifying for any other FHA loan. The FHA requires the following:

- 580 credit score

- 28/36 debt ratio

- Stable 2-years of employment/income

Because of the risk this loan poses, though most lenders require higher credit scores and are a bit stricter with the debt ratio requirements. You may have to check with several lenders before you find one with terms that you can afford.

If you want to build a house, FHA financing may be an option for you. With their one-time close process, it certainly makes paying for new construction much easier. Because the process is more detailed, youll want the help of a third party to ensure that all aspects of the building and loan process go as smoothly as possible.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Can I Finance My Closing Costs

With an FHA loan, your closing costs usually cannot be financed into the loan amount. However, they can almost always be paid by the seller or the lender. FedHome Loan Centers can provide a lender rebate up to 2.75% toward your closing costs on a purchase transaction.

Your down payment doesnt have to come from your own funds either. The down payment can come as a gift from a family member, employer or approved down payment assistance group. FHA loans also allow for a non-occupant cosigner to help the borrower qualify for the loan.

Non-traditional credit sources such as insurance, medical and utility payments can be used to help build credit history if traditional credit is unavailable. With an FHA refinance, you can significantly lower your monthly payment with no out of pocket costs and may even be able skip a monthly payment during the process.

What They Are And Why They Exist

Terri Williams is an expert in mortgages, real estate, and home buying. As a journalist she’s covered the “homes” corner of personal finance for more than a decade, with bylines in scores of publications, including Realtor.com, Bob Vila, Yahoo, Time/Next Advisor, The San Francisco Chronicle, Real Homes, and Apartment Therapy.

The Federal Housing Authority provides mortgage loans through FHA-approved lenders. These loans are great for people who may not have perfect credit scores or a 20% down payment. But homes that qualify for an FHA loan must meet certain standards.

These standards exist for a few reasons. Some common problems can prevent a house from meeting the minimum standards for FHA loans.

You May Like: What Credit Score Is Needed For Usaa Auto Loan