How Are Student Loan Payments Applied

When you make a payment on your student loans, your lender or servicer will apply your payment in a certain order. Your monthly payments will be applied to any outstanding interest first, and any amount left over will be applied to your principal balance. This is always the order of things.

You may have heard of techniques to pay down your debt fast, and many of them involve paying more than your minimum monthly payment in order to have those payments applied to your outstanding principal balance.

When you make an overpayment , you will need to let your servicer know how to handle the payment. If you have multiple loans and want the extra payment to be applied to a particular loan, you will need to spell this out in your instructions. Also, if you want the extra amount to go to your principal balance without advancing your due date, say so. If you do not specify this, your servicer may just advance your payment due date automaticallybasically that means that your overpayment will go towards to your next payment due.

Loan Places In Dallas Tx

1. DALLAS, TX | Quick Short-Term Payday Loans Near Me Company nameAddressZip codePhone numberAll American Dallas400 N. Ervay Street # 13270575212 9473616Easy Payday Loans400 S Record St75202 3403498Ez Money Payday Loans9734 N Central Expy75231 2658181View 419 more rows Personal Loans in Dallas, TX Atlas Credit Store

When Do Unsubsidized Loans Accrue Interest

Direct unsubsidized loans are also student loans offered by the federal government and are available to undergraduate and graduate students regardless of financial need.

Direct PLUS loans, often referred to as parent PLUS loans or grad PLUS loans, are another unsubsidized loan option. Parent PLUS loans are for the parents of undergraduate students, while graduate PLUS loans are for professional and graduate students.

The interest on both direct unsubsidized and direct PLUS loans begins the day you receive the funds. Unlike with direct subsidized loans, however, you are responsible for all interest charges on unsubsidized loans, from the moment you take out the loan until the day you pay it off.

You don’t have to make monthly payments on direct unsubsidized loans while enrolled at least half-time or during the grace period. PLUS loan recipients also have the option to delay payments until the loan recipient graduates, is no longer a student at least half-time or leaves school.

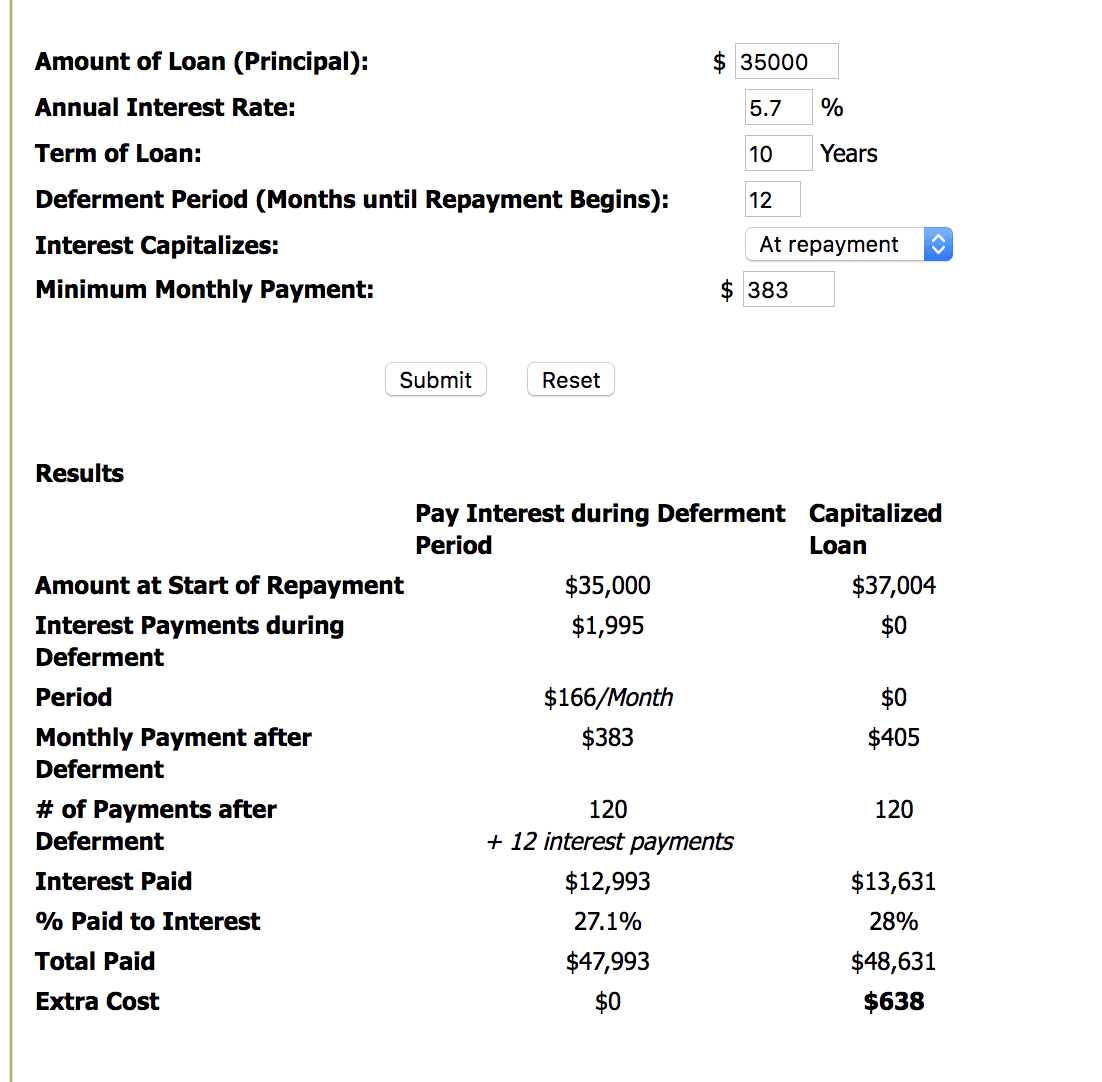

That said, paying at least the interest on an unsubsidized loan before you are required to begin making monthly loan payments can save you a significant amount of money. That’s because the accrued interest will be “capitalized,” or added to your original principal amount, once the grace period ends. At that point your loan will begin accruing interest on the new loan amountthe principal plus the capitalized interest.

You May Like: Can You Use A Va Loan For Investment Property

How Does Student Loan Interest Work

When you borrow money from a bank or other financial institution, youre using their money to fund something you want. For the privilege of using their funds, lenders will then charge you interest.

Student loan interest is no different. While interest rates are commonly lower on student loans than on credit cards or other unsecured debt, they are rarely 0%. That means if you borrow $10,000 for school, unless youre able to pay it back in full the same day, you will end up paying back more than $10,000.

This is worth exploring further, so lets dive into some of the details, such as:

When Does Interest Start For Private Student Loans

Private student loans are loans offered by banks, credit unions and other providers to help students with education expenses. As with federal student loans, private student loan interest typically begins accruing when you receive the loan funds.

The terms you receive on a private student loan will depend on the lender, and the interest rate can be fixed or variable. A fixed rate stays the same for the entire loan, while a variable interest rate can change over time.

Many private loans require you to begin making payments while you are in school, but others may allow you to defer payments while you are enrolled. Check your loan agreement or call the lender directly to learn more about how they charge interest and when payment is required.

Don’t Miss: Usaa Auto Loan Approval

Consensus Reached To Reduce Student Loan Interest Capitalization Events

The Biden administration has acknowledged the problems associated with student loan interest capitalization, as it can lead to more extreme balance growth. When capitalization occurs, borrowers see balances rise faster as interest accrues on interest, said the Department of Education in a statement accompanying proposed changes. Interest capitalization is not a common practice across other consumer financial products.

Choose An Interest Rate Option Temporary Covid

You have 2 interest rate options to choose from for your Canada Student Loan:

- a floating interest rate equal to the prime rate, or

- a fixed interest rate of the prime rate + 2%

The prime rate comes from the rates of the 5 largest Canadian banks. The highest and the lowest prime rates are removed, then an average of the remaining 3 is used.

Interest rates can change as the prime rate varies. Please log in to your NSLSC account for more information about the current interest rates.

Your student loan has a floating interest rate by default. You can change to a fixed interest rate at any time after you enter repayment. If you switch to a fixed rate, you can not change back to a floating rate. To choose a fixed interest rate anytime during your repayment period, contact us.

Use the repayment estimator to see how interest rates affect your monthly payment.

If you have a provincial part to your loan, it may be under a different interest rate. Contact your province for your current rates.

Recommended Reading: Stilt Loan Requirements

Variable Vs Fixed Student Loan Interest Rates

When shopping for student loans, you might find that some variable interest rates are lower than the fixed student loan interest rate. But there are advantages to having a stabilized rate. Consider that if the life span of your loan is 15 years, a lot can happen to interest rates in that time. This makes it difficult to predict monthly loan payments.

Because of this, many lenders provide a cap on variable interest rates to assure that even in the most volatile markets, your interest rate and loan bills wont skyrocket.

For a more detailed look at how variable and fixed interest rates differ, see:

How Interest Accrues On Student Loans

The interest on your student loan begins to accrue on the first day we disburse your loans funds to you or your school. It continues to accrue until youve paid off your loan. The interest rate for your loan is listed in your disclosure documents and billing statement. This is the same for both Federal Direct Loans and private student loans.

Don’t Miss: Fha Loan Refinance

How To Reduce Capitalization On Student Loans

You can lower your Total Loan Cost if you pay your interest before the capitalization period. Two of these periods are the end of your separation or grace period and the end of your graduate school deferment. If youve chosen the interest repayment option for your student loans, your interest shouldnt capitalize, since youve paid it as it has accrued throughout school.

Alternatively, if youre making fixed payments or deferring payments until after school, try to make small additional payments. Or try to pay all or some of your accrued interest before your separation or grace period ends and interest capitalizes. These actions can help you avoidor at least lowerthe amount of capitalized interest after youre out of school, and every little bit helps.

Heres Exactly How Student Loan Interest Works

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *

You May Like: How Much Car Can I Afford For 300 A Month

Find Out How Much This Totals Each Month

Take this figure and multiply it by the number of days since your last payment. If you are making monthly payments, this should be 30 days.

For example: $1.60 x 30 = $48.00

The typical monthly payments for a person who owes $20,000 with 3% interest using a 10-year fixed-interest repayment plan is about $193. This means that $48 of this payment would be going towards interest while the remaining $145 would go towards repaying the principal.

This math shows just how significantly interest can impact your monthly student loan payments and millions know just how much those payments impact their finances. Even before the pandemic hit and unemployment spiked, more than 20% of student loan borrowers were behind on their payments.

Don’t miss:

How To Choose A Student Loan And Repayment Plan

If youre trying to choose between student loan providers, there are few things you should consider, including:

- Interest rates

- Loan eligibility requirements for you or your cosigner

- Repayment terms, such as number of years, options for paying while in school, penalties for early repayment, and grace periods after youre no longer in school

- Options for forbearance if you cant pay for some reason

- The lenders reputation

If youre looking for a private student loan, its important to make sure that youre working with a lender that doesnt issue predatory loans, that is, loans with terms that are likely to put the borrower deep into student loan debt and maybe even into default.

Your student loan repayment plan should be reasonable and aligned with what you can reasonably handle upon graduation. Your loan amount should align with your financial need – try not to take out more than you reasonably need for your education.

Check out our picks for the best deals on private student loans.

Recommended Reading: Capital One Car Note

How Much Can I Borrow

The maximum amount you can borrow each academic year depends on your grade level and dependency status. See the chart below for annual and aggregate borrowing limits. You may not be eligible to borrow the full annual loan amount because of your expected family contribution or the amount of other financial aid you are receiving. To see examples of how your Subsidized or Unsubsidized award amount will be determined. Direct loan eligibility and loan request amount must be greater than $200 for a loan to be processed.

If you are a first-time borrower on or after July 1, 2013, there is a limit on the maximum period of time that you can receive Direct Subsidized Loans. This time limit does not apply to Direct Unsubsidized Loans or Direct PLUS Loans. If this limit applies to you, you may not receive Direct Subsidized Loans for more than 150 percent of the published length of your program. See your financial aid adviser or for more information.

Pros And Cons Of Fixed Interest Rates

| Pros | |

|---|---|

| Lower-risk monthly payments are stable | Rates are typically higher than variable rates |

| While a variable rate can increase, a fixed rate cannot | While a variable rate can decrease, a fixed rate cannot |

| If you have a strong credit history, you can qualify for a lower fixed rate | The lowest advertised fixed rate may not be available if your credit is not strong enough |

You May Like: Do Loan Companies Verify Bank Statements

How Is Student Loan Interest Calculated

Student loan interest rates are expressed as an annual percentage rate. Federal rates are set by Congress each year. Because federal loans are set by the government, the rate you get will not change based on your personal financial circumstances. The amount you get, however, can be influenced by the household income reported on your Free Application for Federal Student Aid, or FAFSA.

Private student loan rates, however, are set by lenders based on financial market rates, typically with the London Interbank Offered Rate , a benchmark interest rate used as a reference for many types of loans.

The rate you get with a private student loan, also depends on a variety of factors, including your credit history, credit score and income. Lenders have their own models for calculating risk, so the rate you get can vary from lender to lender.

Federal Student Loan Interest And How It Is Calculated

With every federal student loan, interest rate information is a vital part of understanding exactly how much you will have to repay. You must also understand how student loan interest is calculated and what fees are associated with your type of loan. Student loan interest is calculated as a percentage of your unpaid principal loan amount. Here some federal student loan interest rate percentages for loans first disbursed between July 1, 2028 and before July 1, 2019:

- Direct Subsidized Loans/Direct Unsubsidized Loans for undergraduates: 05 percent

- Direct PLUS Loans for parents and graduate/professional students: 6 percent

- Perkins Loans: 5 percent

Direct Subsidized and Direct Unsubsidized Loan interest rate amounts accumulate daily, unlike credit cards, mortgages and other types of debt. They accrue student loan interest throughout each stage of the loan, beginning with the date of disbursement. You may be responsible for paying this accumulated student loan interest, depending on whether your loan is subsidized or unsubsidized. You will be responsible for paying unsubsidized loan interest rate amounts that accrue even when this type of loan is in deferment.

Related Article:Federal Student Loan Deferment

Also Check: Usaa Auto Refinance Calculator

Do Federal Student Loans Ever Compound Interest

There are some scenarios where your interest compounds on federal student loans. This is most common during student loan deferment periods where interest accrues on the amount you borrowed while youre temporarily not making payments. This means that once the deferment period is over, youll typically owe more money than you did when you originally requested the pause on loan payments, since that unpaid interest is added to your loan balance.

Unpaid interest can also accrue any time youre repaying your loans under an income-driven repayment plan and your monthly payment is less than the amount of interest that accrues each month. When unpaid interest is added to your balances owed in either of these situations, the act of increasing the loan balance is referred to as capitalization.

Your Student Loan Could Get Written Off Before Youre Done Paying

We cant stress it enough: very few students will ever pay back the full amount that they owe especially if you have a Plan 2 loan.

If theres even a half-decent chance of your loan being wiped before youve cleared it, you could be throwing money away if you make extra voluntary repayments.

You can never predict exactly how much youll earn in the future, but there are some useful rules of thumb. If you have the qualifications and drive to pursue a very high-paying career, paying off your loan early could save you money .

If not, dont put any spare cash towards extra Student Loan repayments put it to better use by building your own savings pot elsewhere.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

You May Like: Fafsa Entrance Counseling Quiz Answers

Subsidies For Specific Student Loans

Some student loans do not accumulate interest while the student is in school. For example, with Direct Subsidized Loans, the Department of Education pays your student loan interest for you while youre in school and during your six-month grace period.

Note that only undergraduate students are eligible for subsidized loans. And even undergrads will need to demonstrate financial need on their Free Application for Federal Student Aid to qualify. Subsidized student loans also have lower borrowing limits than other federal student loan options.

Some loans that are specifically designed for certain professional students may also offer this benefit. The Health Professions Student Loan Program is a prominent example. These loans do not begin to accrue interest until after the student has graduated and a one-year grace period has elapsed.

Student loan interest on other federal student loans

You wont receive the benefit described above on a Direct Unsubsidized Loan, PLUS Loan, or Direct Consolidation Loan. With these student loans, interest will begin accruing immediately, even if you arent required to make payments until after you graduate.

That accrued interest will be added to your balance once repayment begins. You can avoid this potential financial impact by making interest-only payments while youre in school.