Which Age Group Is More Likely To Miss Payments

The serious consequences of failing to make on-time payments make high student loan burdens a major stressor. However, having large amounts of education debt doesn’t necessarily correlate with difficulty repaying it . To determine which age groups are genuinely struggling with their education debt, we must consider default rates and delinquency amounts by age.

According to the U.S. Department of Education, the total amount of delinquent student debt owed by each age range was lowest for the most overdue loans. Borrowers aged 35-to-49 had the highest amount across all categories, with their $15.5 billion owed for the 3190 days delinquent category being the highest overall. Close behind this group was the 25-to-34 age range, owing $12 billion for the same period.

However, the third-lowest group owed slightly over half as much as its predecessor within this time frame. At $0.05 billion, the lowest overall amount was owed by 24-and-younger borrowers with debt payments that are 361+ days delinquent.

This Is How Student Loan Debt Became A $17 Trillion Crisis

- College graduates are drowning in debt but it didn’t have to be this way.

- Steadily, tuition increases have outpaced incomes forcing families to rely on student loans to help foot the bill.

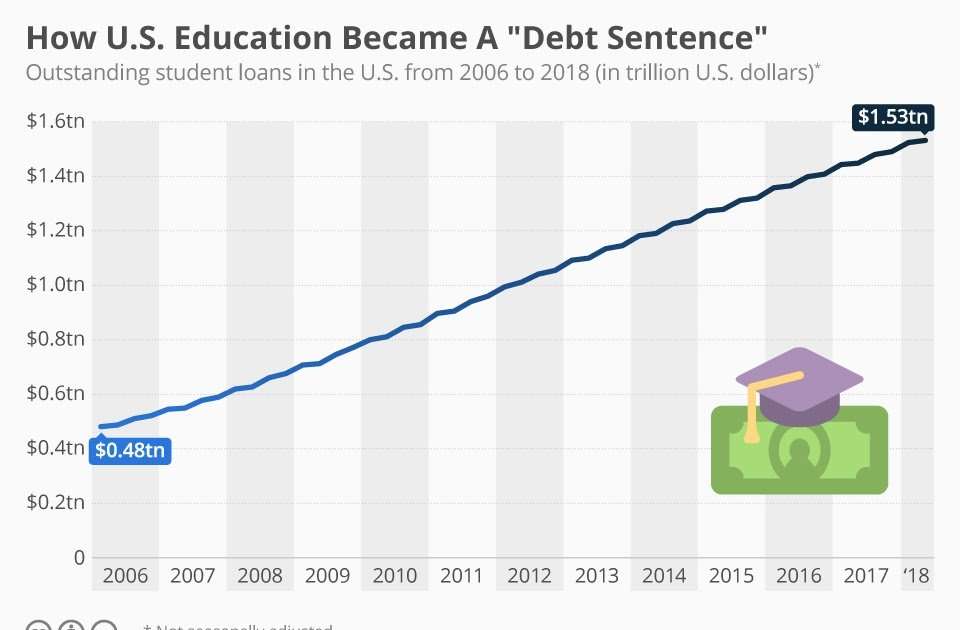

- At this pace, “outstanding student loan debt could topple $3 trillion by 2035,” according to one expert.

For decades now, the country’s outstanding student loan debt balance has only trended in one direction: Up.

Today, around 44 million Americans owe a combined $1.7 trillion for their education. But it didn’t have to be this way.

Legislation like the GI Bill, the National Defense Education Act, and Higher Education Act of 1965 paved the way for greater access to college and enrollment grew while costs remained low.

But, eventually, deep cuts in state funding for higher education paved the way for significant tuition increases and pushed more of the costs of college onto students.

These days, tuition accounts for about half of public college revenue, while state and local governments provide the other half. But a few decades ago, the split was much different, with tuition providing just about a quarter of revenue and state and local governments picking up the rest.

Over the 30 years between 1991-92 and 2021-22, average tuition prices more than doubled, increasing to $10,740 from $4,160 at public four-year colleges, and to $38,070 from $19,360 at private institutions, after adjusting for inflation, according to the College Board.

More from Personal Finance:

Which Age Group Has The Most Borrowers

The number of borrowers per group is one of the most important contextual pieces of information to have. After all, if one age range has a higher debt burden than another and has more borrowers, then it’s safe to assume that the higher amount is at least partially the result of more people taking out similar amounts of debt.

According to Federal Student Aid, the largest group of borrowers was 25-to-34-year-olds, at 14.9 million as of 2021. Close behind them were 35-to-49-year-olds, a group comprised of approximately 14.4 million borrowers during that same year. The third-largest was noticeably lower, with 7.6 million 24-and-younger borrowers. The smallest amount was the 62-and-older group at 2.4 million. Notably, the 25-to-34 years old category was the only one to be lower than the amount reported in 2017, with a difference of 0.4 million borrowers.

Also Check: How To Lower Student Loan Payments

Q Is College Worth The Money Even If One Has To Borrow For It Or Is Borrowing For College A Mistake

A. It depends. On average, an associate degree or a bachelors degree pays off handsomely in the job market borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelors degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder. The payoff is not so great for students who borrow and dont get a degree or those who pay a lot for a certificate or degree that employers dont value, a problem that has been particularly acute among for-profit schools. Indeed, the variation in outcomes across colleges and across individual academic programs within a college can be enormousso students should choose carefully.

Q Are Student Loan Burdens Economically Handicapping An Entire Generation

A. More adults between 18 and 35 are living at home, and fewer of them own homes than was the case for their counterparts a decade or two ago. But these trends are mostly due to these folks entering the work force during the Great Recession rather than due to their student loans. Federal Reserve researchers estimate that 20% of the decline in homeownership can be attributed to their increased student loan debt the bulk of the decline reflects other factors.

Don’t Miss: How To Get Instant Loan Online

Public Service Loan Forgiveness Statistics

In October 2021, the U.S. Department of Education announced a new limited waiver to help student loan borrowers who work in public service get more access to student loan forgiveness. The introduction of this limited waiver changed student loan statistics for public service loan forgiveness, which makes comparisons to prior years more challenging. As of March 31, 2022, here are the latest public service student loan debt statistics:

Public Service Loan Forgiveness cumulative forms submitted: 1,175,672

Borrowers who submitted applications: 863,757

Including Public Service Loan Forgiveness , Temporary Expanded Public Service Loan Forgiveness and the limited waiver:

Borrowers whose student loans were discharged: 117,426

Total student loan balance discharged under PSLF: $7.9 billion

Average student loan balance discharged under PSLF: $67,592

Despite Cost Americans Still Opt For Higher Education

Higher education has long been considered the ticket to affluence and job satisfaction. The earnings premium for degree holders has grown steadily over the past several decades, and college graduates are more likely to become homeowners, according to the Federal Reserve Bank of New York. Among all Americans aged 25 and older, 58.9% have spent at least some time in college, and about 32.5% have earned a bachelors degree or higher. Younger Americans are more likely to prioritize going to college than previous generations. Among people aged 65 and older part of the baby boomer and silent generations 50% have spent some time in college, and 27% have a bachelors degree or higher. Among those aged 25 to 34 who would be considered millennials 65% have spent some time in college, and 36% have a bachelors degree or higher.

Recommended Reading: What Is The Maximum Subsidized Student Loan

Which Age Group Has More Generational Wealth

Generational wealth is a trickier factor to quantify, as it comprises several different elements. Generational wealth can take the form of gifts and pay for educational and/or medical expenses. Then there’s inheritance, which is when a person can receive a bulk of their family’s generational wealth en masse after a relative’s passing if they were included in the deceased’s will.

The main idea is that if a family has had more wealth across generations, their descendants will have greater financial resources outside of what they earn through their careers. The opposite is true, as those with less access to generational wealth may have to spend more of their earned income to support their still-living family members. The much heavier student debt burden faced by people of color stems mainly from America’s substantial generational wealth gap by race.

According to VoxEU, 19% of U.S. households surveyed between 20102014 reported receiving an intergenerational wealth transfer, the majority of which were in the form of inheritances. Individuals over 65 years old received the largest share of generational wealth transfer during this time frame, and those under 35 received the minor share38.4% and 4.6%, respectively.

Why Is Student Loan Debt Different Than Other Debt

What makes student loan debt different from many other kinds of borrowing is that it can have a multigenerational impact. If your parents take out loans from their retirement to pay for college or pay off their child’s student loans, it can impact their safety net for the future. In addition, student loans are essentially unsecured debt. Unlike a mortgage, where your home acts as collateral, you cannot recoup an education.

Most students will likely have to take out a student loan, as potential scholarships and/or parental financial assistance may not be enough to cover all expenses. What’s more, the amounts borrowed will likely continue to rise in the future, given that the cost of education has been steadily increasing.

Don’t Miss: How Long To Close Home Equity Loan

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Report: Student Debt Scams On The Rise

In late-2020, media outlets began reporting increased complaints about student loan debt scams. Such reports are not uncommon during desperate times , and as long as there is a student debt crisis, the scams will continue.

Common scams include promises of debt forgiveness, as well as bogus refinancing and consolidation offers that include excessive up-front fees .

The U. S. Department of Education warns that they will never ask you for your FSA ID password. Your FSA ID is like an electronic signature, which you use to sign legally binding documents electronically. Never give your FSA ID password to anyone or allow anyone to create an FSA ID for you.

If you suspect you have been scammed, complete the following steps in order:

You May Like: What Is The Best Bad Credit Car Loan Company

What Are Plus Loans

These are federal direct loans that are made to parents of dependent undergraduate students, as well as to graduate or professional students enrolled in school at least half time. PLUS loans don’t have a cap on the amount that can be borrowed, but you can’t borrow more than the cost of attendance at the specific school youor your child, if you’re the parentare attending. This kind of loan does have drawbacks, so research them carefully.

The Average Monthly Student Loan Payment

The average monthly student loan payment was $393 in 2016 , which is like buying the newest Apple Watch every two months. That puts the average monthly payment nearly 55% higher than it was a decade ago.

Student loan payments have increased more than two-and-a-half times faster than the rate of inflation. If the typical $227 monthly bill student loan borrowers received in 2005 had kept pace with consumer prices, the cost would only have risen by 22.9% to $279. Paying off student loans is significantly more challenging today than it was in the past, but there are strategies borrowers can use to cut their interest rates and lower their monthly payments.

Don’t Miss: How Long For Personal Loan Approval

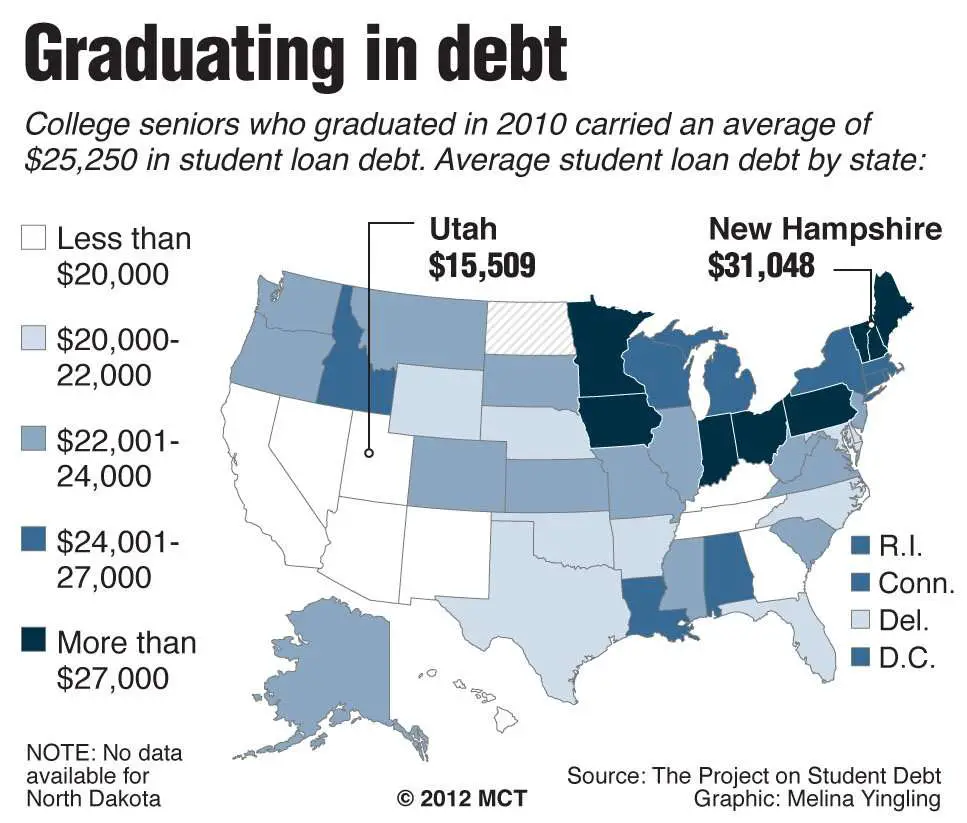

Average Student Loan Debt By State: How Have The Numbers Changed Over Five Years

For the past decade, weve been hearing about the United States massive student loan bubble, with some experts saying the $1.5 trillion in total student loan debt that Americans owe spells doom for the economy, while others declare the fear to be overblown.

With so much emphasis placed on the jaw-dropping nationwide numbers, statistics on how much recent graduates owe state-by-state are often overlooked. This is too bad, though, because the variance in graduate debt by state, and how those numbers have shifted through the years, is one of the more interesting facets of the student loan issue in America.

We looked at the Institute for College Access and Success annual student debt reports the definitive compilation of student loan data from 2017 and 2012 for a closer examination on how the average debt amassed by graduates in each state has fluctuated over the years.

Examining the data, we find an intriguing contradiction: while the average amount of college graduate debt has increased by a double-digit percentage in over half of the 50 states, over 80% of states witnessed no increase or a reduction in the proportion of recent graduates with debt.

How do we make sense of this? Well, tuition costs continue to rise, which explains why students would be compelled to take out larger loans, but the latter figure is something of a mystery. Fewer students are borrowing, yet the ones that do borrow are borrowing more.

Lets take a look at the map:

Where Did The Money Go

Although a majority of college students attend public two- and four-year institutions, about half of outstanding student debt is held by people who went to private schools. Among those private schools, for-profit colleges account for 17 percent of the debt while private nonprofit universities account for another 34 percent.

People who attended for-profit colleges were more likely to struggle to repay their loans than others, according to the Federal Reserve. Fed economists say high costs and low returns to for-profit enrollment generate worse student debt and repayment outcomes. They found more than one-fourth of borrowers who attended for-profit schools were behind on payments, compared with 10 percent who went to public institutions and 5 percent who attended private not-for-profit institutions.

Don’t Miss: Can You Add To Your Home Loan For Renovations

Size Of Student Loan Debt By Age

The first factor to consider is the actual size of each group’s debt burdens. As it’s functionally impossible to visually represent the loan amounts of each U.S. citizen, there are two ways we can analyze this data.

Comparing the average student loan debt by age group provides a rough estimation of which generations have the highest debt burdens on an individual level. Meanwhile, the total amount owed by each group gives us a better understanding of which generations have taken on the most student loan debt.

Based on data from the office of Federal Student Aid, at $44,312, 50-to-61-year-old borrowers had the highest average student loan debt in Q4 2021. The 35-to-49-year-old cohort was close behind at $43,210 on average. The 24-and-younger group owed the least student loan debt, at $14,430 on average. This is unsurprising, given that the majority of borrowers who fall within this age range haven’t had much time for interest to accumulateor to complete graduate school.

When looking at total student loan debt by age, at $622.2 billion in Q4 2021, 35-to-49-year-old borrowers owed the most significant amount. The second-highest amount belonged to the 25-to-34 demographic, which owed $500.2 billion in total as of this same period. At $97.8 billion, the smallest amount of total student loan debt belongs to the 62-and-older group.

Student Loan Forgiveness Statistics And Facts

If you have student loan debt, we know youre probably curious about any federal initiatives to forgive or cancel student loan debt. Here are a few of the key facts and figures to know in 2022.

#16 How much student loan debt has been forgiven under the Biden administration?

So far, the Biden administration has canceled around $25 billionin student loan debt. Unfortunately, this is still only a small fraction of the overall student loan debt.

Read more about how President Joe Bidens administration has addressed student loan debt so far.

#17 Will Biden ever cancel all student loan debt?

No one knows for sure. But it doesnt look like Biden will cancel all student loan debt. However, there is a chance hell cancel $10,000 of student debt per borrower. You may also be able to get some of your debt canceled through student loan forgiveness programs.

#18 What is student loan forgiveness?

Student loan forgiveness is when a borrower is no longer responsible for repaying their student loans. There are a few different ways that you can have your student loans forgiven.

One way is by enrolling in an income-driven repayment plan. With one of these repayment plans, the federal government will forgive all or part of your student loan debt if you make on-time payments for a certain number of years.

Read more about your options for student loan forgiveness programs.

#19 What were the recent changes to the Public Service Loan Forgiveness program?

You May Like: What Car Loan Will I Be Approved For

Demographics Of Loan Holders

Surprisingly, its not just those in younger age groups that struggle with debt.

- Of people with student debt, only 37.5% are below the age of 30. The other 62.5% are older than 30.

Unsurprisingly, minorities are disproportionately affected by student debt.

- 77% of black students took out a federal loan to pay for higher education compared to the 60% national average for all students.

- The average debt upon graduation is also higher for black students. In 2012, for example, their average debt was $29,344 compared to the national average of $25,640.

- Troubles dont end after successfully securing a job after graduation: among workers with a bachelors degree or higher, black households still earn 23% less than the median for the overall population.

- Examining students that began college in 2003: 50% of black students have ceased student loan repayment and defaulted on their loans within 12 years due to financial insecurity .

The problem of debt is especially acute for women.

- While women account for 56% of undergraduates nationwide, they hold almost two-thirds of the total student debt .

- Not only are women more likely to take on debt, but their average debt is also $2700 greater than a mans.

- Women also take longer to repay their debt, resulting in more total interest. This is partially due to the gender pay gap women make on average 26% less than men, resulting in less discretionary money to pay off debts.