How Much Can You Afford To Spend On A Car Nerdwallet

NerdWallet recommends spending no more than 10% of your take-home pay on your monthly auto loan payment. So if your after-tax pay each month is $3,000, you

Theres no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home

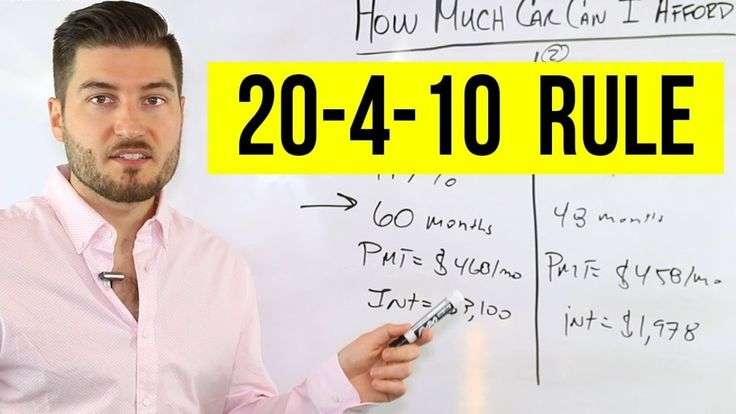

Jul 12, 2021 According to this rule, when buying a car, you should put down at least 20%, you should finance the car for no more than 4 years, and you should Compare car loan offers · The three rules of car financing · Shop for car insurance

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

Dont Miss: How To Apply For Direct Loan

Auto Loan Affordability Calculator An Example

Lets use our example from above. Lets say you can afford a monthly car payment of $270 per month. Lets also assume that you plan to finance this vehicle over 60 months or 5 years. Lets assume you have excellent credit and quality for an interest rate of 2% and that you are planning to put $3,000 down on your new vehicle. Using our auto loan affordability calculator, we estimate that you can afford a vehicle priced at $18,404. The amount of your auto loan would be $15,404 because you are putting $3,000 down. To demonstrate the impact of changing some of the assumptions, lets assume that you are willing to finance the car for 7 years instead of 5. Assuming you still want a monthly payment of $270 and are putting $3,000 down, having a longer auto loan term , allows you to shop for a car with a sticker price of $24,148.

Determining how much of a vehicle you can afford is a personal decision and is different for all of us. Our easy to use auto loan calculators can help you estimate your price range as well as analyze the impacts of different assumptions like term, down payment and interest rate.

You May Like: How Much To Loan Officers Make

Is It Ok To Finance A Car

Your personal finance situation will dictate if it is okay for you to finance a car. Keep in mind, your car will depreciate in value while you are making payments. New cars depreciate 20 to 30% in the first year. Therefore, your car may be worth less than you owe on the car.

Again, this will all come down to your personal budget if you can make the payments. Personally, I would avoid taking on additional debt. What would happen if you lost your job tomorrow?

You should also factor in the cost of your car payments when building your emergency fund. Remember, losing your job is hard, but it is even harder when you have a car payment. Failure to repay your car loan may result in repossession of your car.

Your car tends to depreciate in value very rapidly. The more you drive your car, the further away from the original value your car gets. Your car loses value quicker, the newer it is.

Imagine, purchasing a car from a dealer for $25,000. Youve been driving the car for one year and lost your job. Youve decided that you cannot make the payments and want to sell your car.

Unfortunately for you, cars depreciate 20 to 30% in the first year. You owe the bank $24,000, but the car is now only worth $18,000. Its a bad situation to be in, but it happens all the time.

How Much Car You Can Afford Credit Karma

Nov 18, 2020 The rule of thumb among many car-buying experts dictates that your car payment should total no more than 15% of your monthly net income,

Apr 27, 2021 When browsing your options, keep in mind that financial experts will typically tell you to spend less than 10% of your monthly take-home pay on

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

How To Calculate How Much Car You Can Afford

A vehicle is often one of the most expensive purchases people make, so its critical to determine whether you can make the monthly payments on an auto loan before you commit to a specific car. There are several factors to consider when calculating how much car you can afford, including your monthly cash flow and the way lenders view your creditworthiness.

Recommended Reading: Loans Without Proof Of Income

Check For Decrease Apr

A lowered APR may help you save money eventually. The greater the portion rates, the more cash you might expend on the car. Including, some drive loan providers may offer a 3per cent APR. But if credit score rating unions like Arkansas government Credit Union typically supply reduced costs, using the lower APR can save you money on your car finance. Doing your research for costs makes it possible to see a much better price on your auto loan.

The reduced the APR the reduced the monthly payment would be. If youre inquisitive observe exactly how different APR rate make a difference to the payment per month, Arkansas government provides you with an auto loan calculator you should use receive an estimation.

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Recommended Reading: Mlo Endorsement To A License Is A Requirement Of

Set Your Target Price And Shop Around

Once youve done your due diligence on what exactly you can afford and have a preapproval letter for a loan, now you can confidently pursue a range of vehicles within your target price. Fortunately, most of the initial car shopping can be done online at home.

The Covid-19 pandemic and restrictions on businesses forced many car dealerships to revamp and improve their websites from just listing inventory and generating leads to the entire process of selecting a vehicle, securing financing and completing the transaction.

This enables buyers to shop local dealers online for new or used cars without ever leaving their homes. There are also online aggregator websites like cars.com, cargurus.com, carfax.com and others that help you search and often complete transactions. These searches also allow you to look nationally, not just nearby, and dealers will sometimes list the fee to transport to you if you purchase the car online.

App-based companies like TrueCar, Carvana and Vroom have digitized the process, including financing with multiple lenders and features like a seven-day test drive.

Birchwood Credits Car Loan Calculator And How It Works

If youd like a better estimate of your car payments, you can try our online Car Loan Calculator. This tool will help you estimate your bi-weekly or weekly payments based on vehicle cost, loan duration and your credit score.

When it comes to car loans, three important numbers are taken into consideration:

- The principal, or the total cost of the vehicle including taxes, loan administration fees and add-ons/special features.

- The loan term, or the length of time payments will be made on your loan. Terms typically range from 36 to 72 months.

- The interest rate, which is the percentage the lender charges you to borrow money.

These three numbers are represented in our Car Loan Calculator to give you estimated payments so you can budget for the car you want .

You May Like: Which Bank Is Best For Construction Loan

Consider All Car Expenses

Don’t forget, when you’re trying to figure out the size of the car loan you can really afford, to factor in other costs. You’ll need car insurance. If you’ve been paying only liability or you’ve been using other transportation, be prepared for the cost of full coverage insurance. Find out what it will be on the car you’re looking at and figure that into your new cost. Also, if you can make a larger down payment, you can cut your monthly car loan payments and make a new car more affordable.

Determine Your Fuel And Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you’ve chosen. Even though it takes a little work to come up with these estimates, you shouldn’t overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up others might have a higher cost to insure.

The EPA’s Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you’re interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you’re OK.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Start With Your Bank Or Credit Union

Traditional lenders like a bank or a credit union are a great place to apply for a car loan because they often have lower rates or special deals for the customers who already bank with them. You can also get a preapproval letter from your bank or credit union before you start looking for a car, which will give you a better idea of what you can afford.

Its a competitive market among lenders, so try to get at least two to three quotes from different lenders. It also helps your negotiating position.

This is especially true if you already are a customer at the bank or credit union and have a good track record of borrowing from that institution. They can do a quick assessment of your financial history and credit profile since they already have it in their system. If all goes well, they can give you a letter saying how much money you are approved to borrow, which you can use to buy a car or negotiate with other lenders for a better deal.

Shop For Car Insurance

Keeping your monthly payment under 10% of your gross income is the most important thing. Thats whats going to keep you from feeling pinched and stretched. Here are some of the top insurance providers on the market today that are operating in your local area. Find the policy that best suits your needs.

How do you know if youre paying too much for insurance?

can help you find out. Either provide a link or PDF of your existing insurance policy and Gabi will shop around for a better deal. If you like the quote youre offered, you can move forward and start saving money. In fact, Gabi customers save $961 on average per year.

If you prefer to work with an agent, can help you save money. If youre an excellent driver, this insurer may be a great option for you. Sign up for Drivewise and earn as much as 25% back for every six months you go without an accident.

Those who have multiple types of insurance may want to look at . You can save big by bundling your auto policy with your renters, homeowners, or condo insurance. Their website makes it easy to get a quick quote to find out if you can save money by switching to them.

Related: Tips for Saving on Your Car Loan

Also Check: Car Refinance Rates Usaa

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Your Monthly Payments Should Be Less Than 10

To get the best car you can realistically afford given your salary, we recommend your monthly payment should be less than 10-15% of your earnings after taxes . If you dont know this number off hand, you can calculate it using neuvoos Canadian income tax calculator.

Lets walk you through some examples.

Say you make $45,000 gross per year and you live in Manitoba. Your yearly net pay after tax deductions comes to roughly $33,843. This is your take-home pay.

15% of your total take-home pay comes to $5,076.45, which equals $423.04 per month. This means if you make $45,000 a year, you can spend around $423 per month on car payments. Keep in mind, this doesnt include a down payment and if you had one, that number would change. That 15% also doesnt include car insurance, gas or routine maintenance. This is where the 20% rule comes into play.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Priced Car Can I Afford

A budget between 10% and 50% of your annual income is what you could reasonably expect to spend on a car. When youre cruising ad pages for that new ride, keep a budget in mind that fits you and your lifestyle. This is the most important bit of information to have with you while you shop for a new car.

How Much Car Can I Get For $500 A Month

Recommended Reading: The Mlo Endorsement To A License Is A Requirement Of

When Did Singapore Import Water From Malaysia

As part of the cross-Causeway water supply agreement, Malaysia and Singapore signed four agreements. First signed in 1927, it has no legal effect today. Singapore imports water from Malaysia under three other agreements signed in 1961, 1962, and 1990. About half its water demand is met by this arrangement.