What Is My Advice Regarding Idr Plans

Some cases may differ depending on the factors that affect your eligibility for income-driven plans. But I strongly advise you to choose PAYE or REPAYE plan. Just remember that you aim to benefit as much as possible from Public Service Loan Forgiveness. And as you are already aware, making payments without analyzing the situation can deprive you of the PSLF benefits.

In PAYE and REPAYE plans, you will have to pay 10% of your discretionary income for your loan debts. And you will have to make these payments for 20 and 25 years respectively. It means you can pay less for a duration of ten years when being in the PSLF program. To make things more transparent, just think that you are enrolled in the PAYE plan right when you start working at a PSLF qualifying work. If you do this, instead of making monthly payments for 20 years, you will have to make the same amount of payments for ten years. As a result, you will benefit immensely from the PSLF program.

Watch For Letters Email With Next Steps

Borrowers should be sure to read all letters and emails from their servicer, Buchanan said. “We don’t send communications for no reason, and it’s important to know if there is any action you need to take.”

Expect to have to set a new password to login into your new account and to update your banking details, and perhaps your debit card information, if you’re enrolled in automatic payments.

Since so many borrowers pursuing public service loan forgiveness complain that their number of qualifying payments have been undercounted, you’ll want to check your payment count before the transfer to MOHELA if you still have time, said higher education expert .

“Download a list of all of your qualifying payments,” he said, and then compare it to the payment count after the transfer.

“If they are different identify the source of the discrepancy,” Kantrowitz added. You’ll want to communicate that to MOHELA as soon as possible.

Take Advantage Of Public Service Loan Forgiveness

The U.S. Department of Education has implemented temporary changes to the Public Service Loan Forgiveness program that make it easier for federal student loan borrowers to receive credit for past periods of repayment that would otherwise not qualify for forgiveness. These changes end on Oct. 31, 2022.

Millions of non-profit and government employees have federal student loans and may now be eligible for loan forgiveness or additional credit through the temporary changes, known as the Limited PSLF Waiver. But they must apply before the deadline.

This means some borrowers will need to consolidate and/or submit a PSLF form the single application used for a review of employment certification, payment counts, and processing of forgiveness on or before Oct. 31, 2022, to have previously ineligible payments counted. After Oct. 31, 2022, normal PSLF rules will apply.

The new PSLF website pslf.gov includes a simple, 3-step eligibility tool as well as more information on the program. Borrowers can also read about the temporary changes at studentaid.gov/pslfwaiver.

Also Check: Is Quicken Loans Rocket Mortgage

What About The 10

Although the 10-year Standard Repayment plan is eligible, if you were to stay on this plan, your loans would be paid in full by the time you made all 120 qualifying payments. If you are seeking PSLF and you are currently on the Standard Repayment plan, you should switch to an IDR plan as soon as possible.

Federal Loan Payment Forbearance

Federal student loan borrowers seeking PSLF don’t need to make payments until the extended automatic forbearance expires on Dec. 31, 2022. As long as you’re still working full-time for an eligible employer, those months of nonpayments will count toward the 120 payments needed to qualify for PSLF.

In other words, if you have not made payments since March 2020 and won’t make another until December 2022, you are still 33 months closer to forgiveness.

Read Also: Army Student Loan Repayment Program

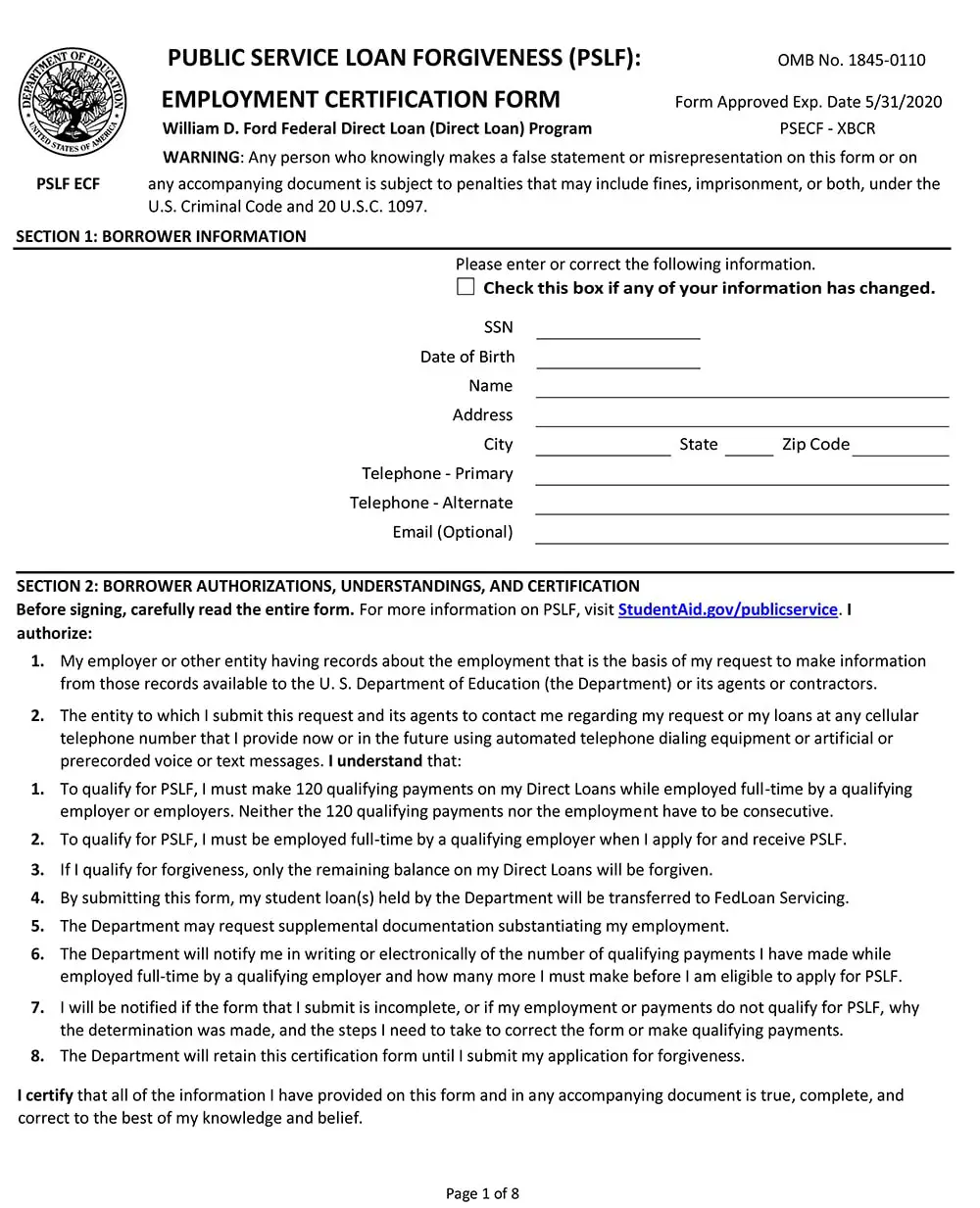

Submit Your First Pslf Form

The PSLF form is a form both you and your employer must complete for us to verify that your loan payments were eligible and that you made the payments during periods of qualifying employment. We recommend you submit your first PSLF form after you are confident you:

- Have qualifying loans

- Work full-time for a qualifying employer

- Have made some qualifying payments

Once your qualifying employment is approved, we will begin tracking your progress towards completing the 120 qualifying payments each time you submit a new PSLF form. All PSLF forms will be reviewed for eligibility under both the PSLF/TEPSLF programs.

We recommend that you submit a PSLF form annually. This will help you track your progress in the PSLF/TEPSLF program, and ensure that any repayment or employment missteps are caught sooner rather than later.

Reconsideration For Pslf Applications

Beginning April 2022, borrowers whose applications were rejected for PSLF and Temporary Expanded PSLF can request a reconsideration online at studentaid.gov. Anyone who thinks their application should be reconsidered can submit a request.

You’ll be able to submit one or more reconsideration requests of your application to certify employment or payment determinations. You won’t need to provide more documentation with your request, but you might have to provide more information following its review. There was no deadline provided.

You still must meet payment and employment requirements under the law, which includes the current waiver that would count previously ineligible payments.

To figure out if you need a reconsideration of your employer, you can use the PSLF Help Tool. If your employer isnt eligible, consider supplying documentation as to why the not-for-profit organization you work for should qualify.

Federal Student Aid did not indicate how long it would take to review each submission. Make sure your studentaid.gov account has the most up-to-date contact information so you can receive correspondence. More information about reconsideration of payment counts and employer qualifications are available on the student aid site.

Read Also: What Are Good Loan Companies

Public Service Loan Forgiveness For Federal Student Aid

Public Service Loan Forgiveness is, without a doubt, the most popular and effective Federal Student Loan Forgiveness Program out there. The proposed 2020 budget announced by President Trump in March of 2019, may bring about significant changes to the federal student aid program.

Through this article, it aims to familiarize readers with the brass tacks of PSLF. The article will also discuss how and why you should get enrolled in the program as soon as possible.

Why is Public Service Loan Forgiveness that significant? Well, PSLF provides complete federal loan forgiveness advantages in exchange for being eligible for a work in public service. In other words, this program enables you to clear your federal student loan debt by working in a public service sector for ten years. Bear in mind that these fields may include nursing, Government positions, teaching, etc.

In a nutshell, Public Service Loan Forgiveness Program is the best method for getting free of your federal student loan without repaying a cent back.

About The Public Service Loan Forgiveness Program

The Public Service Loan Forgiveness Program is a federal program created for those in public service jobs, offering the opportunity to have their federal loan balances forgiven after 120 qualifying monthly payments.

The University of California is a qualified employer for the PSLF program. Generally, many full-time UC employees who otherwise qualify may be eligible to apply their months of employment towards PSLF.

To ensure as many eligible UC faculty and staff as possible can take advantage of this program as possible, this page will be updated regularly with news and resources.

You May Like: Which Bank Is Good For Personal Loan

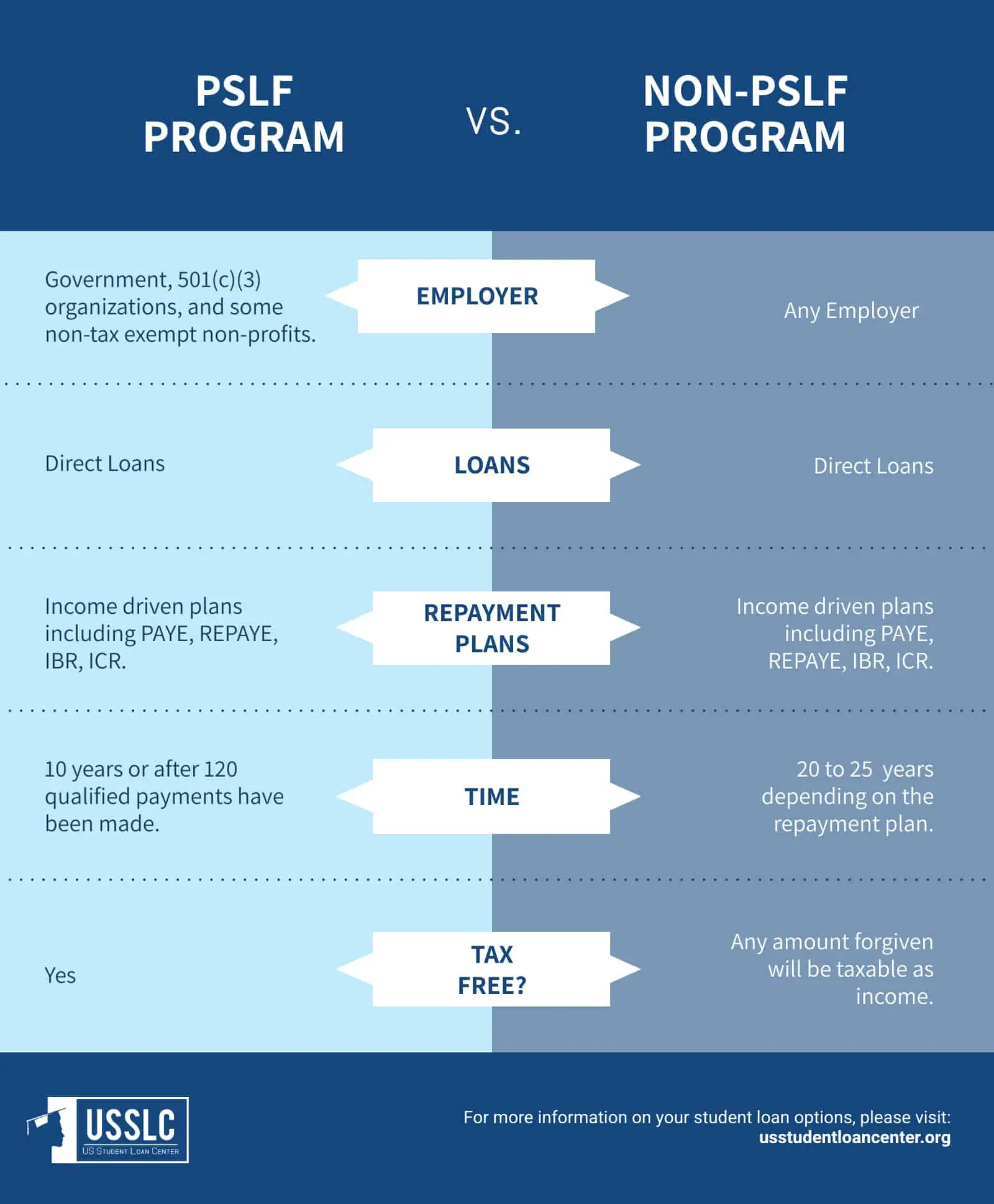

Check Your Repayment Plan

Only certain repayment plans qualify for PSLF. To get the most benefit from the program, you should switch to an Income-Driven Repayment plan if you’re not already on one.

To benefit from PSLF, you should consider one of the following IDR plans, which generally base your loan payments on your income, family size, and loan debt.

The IDR plans are:

- Revised Pay As You Earn

- Pay As You Earn

- Income-Based Repayment

- Income-Contingent Repayment

If you do not know what repayment plan you are on for your Direct Loans, visit StudentAid.gov and find out.

Deadline For A Second Chance At Relief

Borrowers pursuing the debt cancellation for public servants have been given the chance to get their timelines recounted if they were disqualified because of their type of loan or repayment plan. But that limited waiver could expire at the end of October.

As a result, borrowers should act now if they haven’t already, Kantrowitz said.

If you have either a Federal Family Education Loan or a Federal Perkins Loan, which don’t normally count for public service loan forgiveness but now temporarily do, you’ll need to consolidate those into direct loans with your servicer.

Certain periods spent in deferment or forbearance may now count.

Experts recommend applying for the relief even if you’re unsure if your previous payments will qualify under the new rules.

Read Also: Student Loan Interest Rate 2021

What Repayment Plans Can You Use

As mentioned earlier, to be eligible for the Public Service Loan Forgiveness program, your federal loan should be under one of the income-driven repayment plans. The plans include graduated payback, extended payback, income-based payback, income-contingent payback, pay as you earn , and revised pay as you earn .

What Should You Do Once You Are Eligible For Forgiveness

Once you make the last 120th payment, you should submit the PSLF application before the due date. Do not forget that you will have to be working for an eligible public service organization when submitting this application. You will also have to work in a qualified organization, and make 120 payments before even submitting this application. You will have to be working even after you submit. Unless the Federal Government will not provide you with forgiveness when they are in the process of reviewing your request. So, do not think of changing your workplace right away. You do not want to lose the entire benefit just because of a little impatience.

Recommended Reading: Where Do I Get An Fha Loan

How Do I Obtain The Employer Information And Signatures I Need

To meet the Oct. 31 waiver deadline, please submit your PSLF employer certification request to UCPath as soon as possible UCPath recommends submission no later than Friday, September 30, 2022. Due to the volume of requests, UCPath cannot guarantee processing within their usual timeline.

Helpful tips from UCPath to avoid delays:

- Complete page 1 of the form with borrowers information ONLY.

- Make sure you sign and date your PSLF form before submitting to UCPath. A physical signature is required digital signatures are not accepted.

- If you are or were classified as a variable paid employee, you must contact your campus location to complete the certification.

- Ensure you meet ALL PSLF eligibility requirements part-time employment does not meet the qualifications for loan forgiveness.

Will I Definitely Have To Pay Taxes On My Federal Student Loan Debt That Gets Canceled

Current law would tax Hoosiers that receive federal student loan debt cancelation. It would take legislative action to change that.

Rep. Greg Porter, D-Indianapolis, said he would file a bill to do just that in the next legislative session. Porter said he’ll draft a bill to “retroactively eliminate and nullify any state individual income tax” imposed on Hoosiers who receive student loan forgiveness.

“Many student borrowers have paid back their original loan amount and then some, but interest rates have kept them from paying off their debt and allocating that money toward buying a house, saving for retirement or starting a family,” Porter said in a statement. “The federal government and the vast majority of other states have correctly chosen not to tax student debt forgiveness. I can’t say I’m surprised Indiana has chosen to take a punitive stance on a policy meant to give working-class Americans relief, but there’s still time to change this.”

Porter said it is unfair to tax student loan debt relief when the state has a $6.1 billion surplus.

The legislative session starts in January. Porter would need Republican support to get the measure passed, as the GOP has a supermajority in both chambers of the Indiana Statehouse. Huston said he expects “conversations to continue on this topic.”

Don’t Miss: Is Home Equity Loan Good Idea

Submit Your Pslf Form Annually

Because you have to make 120 qualifying monthly payments, it will take at least 10 years for you to become eligible for PSLF/TEPSLF. We recommend that you submit a new PSLF form annually. This will help you track your progress in the program. Each time we approve qualifying employment, we will update your count of qualifying payments.

KEEP IN MIND

- We encourage you to submit the PSLF form whenever you change jobs to ensure your employment is still eligible.

- If you do not periodically submit the PSLF form, then at the time you apply for forgiveness you will be required to submit a PSLF form for each employer where you worked while making the required 120 qualifying monthly payments.

Scams Increasing Following Bidens Federal Student Loan Forgiveness Decision

US President Joe Biden delivers remarks regarding student loan debt forgiveness in the Roosevelt … Room of the White House

The Washington Post via Getty Images

The good news is that loan forgiveness is here. The bad news is that so are loan forgiveness scams. The Biden administration plans to forgive $10,000-$20,000 in federal student loans for qualifying borrowers in the next few months. After months of deliberations, this is an excellent outcome for anyone struggling with student loans, especially the many borrowers who never completed a degree or credential.

Con artists and scammers are trying to exploit the media buzz around loan forgiveness. The Better Business Bureau has already received hundreds of complaints about scams targeting student loan borrowers. If you type student loans into their scam tracker site, you get over 1,200 results.

Scams harm people hoping for some relief from their debt, so here are some tips to avoid falling prey to student loan scams.

Recommended Reading: What Kind Of Car Loan With 600 Credit Score

What Counts As A Government Employer For The Pslf Program

Any U.S. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. This includes employers such as the U.S. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts .

A government contractor isnt considered a government employer.

You can visit our Public Service Loan Forgiveness Help Tool, which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

What Jobs Are Eligible For Public Service Loan Forgiveness

When it comes to PSLF, your role isnât important for forgiveness your employerâs status is the determining factor. Whether youâre a lawyer, security guard, accountant or marketer, you can qualify for PSLF as long as your employer is an eligible nonprofit organization or government agency. If youâre a full-time servicemember with AmeriCorps or the Peace Corps, your term also counts as qualifying employment.

Labor unions, partisan political organizations and for-profit organizations are not eligible employers for PSLF.

Read Also: How Do I Check Student Loan Balance

What Are Some Scam Red Flags To Watch For

The biggest red flag for scams is someone asking for a processing fee or advanced payment to help you complete your application. There is no application fee for President Bidens loan forgiveness proposal. There will be some paperwork for many people, but anyone asking you to pay to apply is trying to steal your money. There are legitimate private companies that the U.S. Education Department contracts with loan servicers, for example but they will never charge you a fee for helping to provide information about your loans. You can always check whether a company works with ED by looking at the Federal Student Aid site on avoiding scams.

Scammers might also try to get private information like your social security number or bank information. If you get a call that seems to be legitimate, it is always best to verify the information with the federal agency in charge of the program.

If you come across a scam, you can help shut them down by reporting it to the BBB scam tracker above. The more people report scams, the easier it becomes to shut them down.

Request A Temporary Military Suspension

To request a temporary suspension of your service obligation based on your active duty status:

1. Access and complete the form.

View Form completion options

2A. Submit both a copy of your military orders and your military identification with your completed Suspension/Discharge Form

NOTE: Please make sure that any orders you submit include the dates of your active duty status.

2B. Have a Commanding or Personnel Officer complete Section 4 of the Suspension/Discharge Form, indicating the dates of your service.

NOTE: As an alternative to filling out Section 4, your Commanding or Personal Officer may forward separate documentation that includes all of the information requested on the form.

If you have been granted a Power of Attorney for or are representing a service member and you need to request a temporary suspension of the service member’s service obligation period, download, complete, and return the . Don’t forget to include the service member’s name and account number . You will need to submit a copy of both the service member’s military orders and military identification with the Suspension/Discharge Form, or have the service member’s Commanding or Personnel Officer complete Section 4 of the form. Please make sure that any orders you submit include the dates the service member is in an active duty status. Keep in mind that if we don’t already have record of your POA status, we will also need a copy of the service member’s POA document.

Read Also: Small Loan For Bad Credit