We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

What Is Car Loan Negative Equity And How Does It Happen

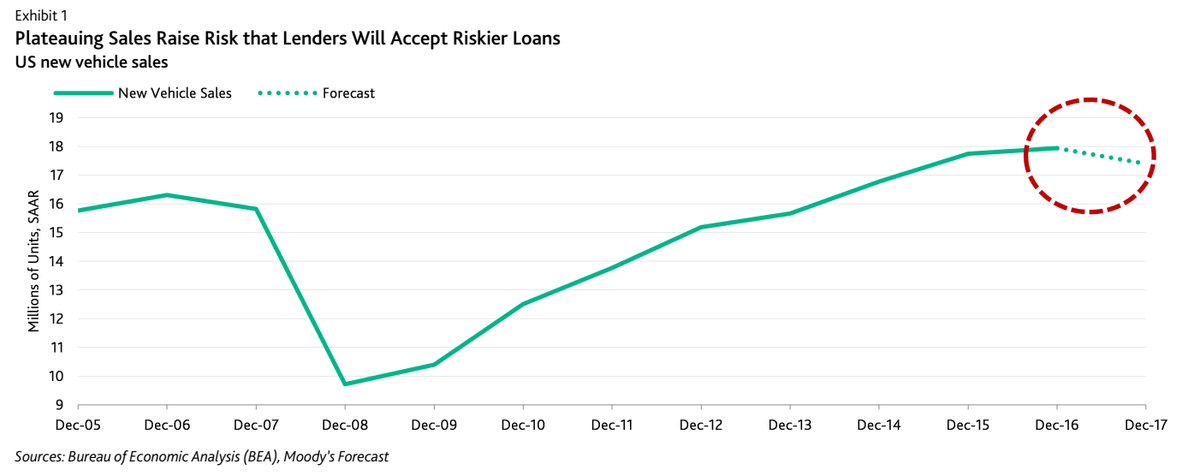

Negative equity on a car loan is when you owe more to the car finance lender than what your vehicle is currently worth. The first thing to note about negative equity is that you didnt necessarily make a bad car loan decision: vehicles typically lose 20% of their value during their first year on the road. Couple that with a long-term finance deal and you have the makings of a shortfall in value.

Negative equity is really only an immediate problem if you want finance to upgrade your car. Depreciation slows down markedly after the first couple of years so, in many cases, negative equity either lessens or disappears entirely during the latter stages of a car loan. There are a few car loan factors that make negative equity more likely:

Car Loan Repayment Plans

A car loan is a type of financing that you can apply for through select lenders and dealerships across Canada. This financing exists to make a new or used vehicle more affordable over time through recurring payments with interest.

Depending on the policies of the lender you apply with, what kind of vehicle youre looking at, and how strong your finances are, this payment plan can last several years and, when necessary, be adjusted to suit your needs.

Generally, the majority of lenders and dealerships can offer you various payment frequency options, such as:

- Monthly

- Semi-monthly

- Weekly

- Bi-weekly

Although the length, frequency, and overall cost of your plan will be arranged in advance, many lenders will also permit you to make accelerated payments so that you can pay down your debt faster through larger or more frequent installments. Just make sure you read your contract, as some lenders will charge a prepayment penalty.

Read Also: What’s Better Home Equity Loan Or Line Of Credit

Refinance Your Auto Loan To Lower Your Rate

High interest rate on your auto loan? Have you improved your credit score since then? By refinancing your auto loan, you could potentially get a lower interest rate, save money on your monthly payment, and use those savings to pay down your loan.

Much like option #1, you can take advantage of the new refinance offer to pay down the principal on the new loan. If the consumer has time to plan their exit from the current vehicle, says Douville, then I always suggest principal reductions either in a lump sum or in every payment. For example, if your payment is $430 monthly, then pay $450. The $20 will go to the reduction of principal every month, if there are no late fees or past due amounts currently, and may fit better into the persons budget.

Keep in mind that if your LTV is too high, you may have a hard time finding a lender that will refinance your auto loan. It becomes more difficult to qualify if you have an LTV ratio over 125. If you have bad credit, the lender may require an LTV under 125, making it even harder to qualify.

Compare Auto Refinance Rates

What Does Negative Equity Mean

Negative equity is when your car is worth less than the money you owe. For example, if you owe the finance company £5000 but the value of your car is now only £4000, then you would have £1000 of negative equity on your car finance.

Most car finance contracts balance out after a while because the cars value decreases at a slow rate as you pay off your loan.

Don’t Miss: How To Convert Fha Loan To Conventional

Where Can I Get An Auto Loan

Several types of lenders make auto loans, including car dealers, major national banks, community banks, credit unions and online lenders. You may get a particularly good deal from a lender you already have an account with, so check their rates first. Compare auto loan rates across multiple lenders to ensure you get the lowest APR possible.

How To Get Out Of A Negative Equity Car Loan

The good news is that it is possible to get out of a negative equity car loan. You can employ one or more of these strategies to pay off your debt quicker and get on the right side of negative equity:

Read Also: Does The Va Loan Cover New Construction

Tips For Avoiding An Upside

The best way to avoid a car loan that you cant afford is to not get one to begin with. Do your research before you buy a car to make sure you understand the cost of options, financing, taxes and best value on the make or model that you want.

That research may make it clear that your best option is buying a used car. Late-model used cars with low mileage make good financial sense. The original owner will have paid the price for depreciation in the first year, so the purchase price should be at least 20% off the original cost.

Dont just look at the overall price tag when you buy consider how much the car loan will cost you a month, including interest, taxes, possible added gas costs if its a bigger, less efficient model, and more. Thats the figure that has an impact on your day-to-day budget.

If you buy new, use the 20-4-10 rule 20% down payment 4-year loan and the monthly car payment plus insurance isnt more than 10% of your gross income. If you cant make those numbers work, start looking at used cars instead.

Whether buying a used car or a new one, the following tips can help you avoid an upside-down car loan:

Do Dealerships Pay Off Negative Equity

Dealerships may tell you that they will pay off your negative equity, but it is unlikely. Typically, dealerships will add the value of your negative equity onto your new loan.

This means that if you owe $5,000 but your car is worth $2,000, then the difference of $3,000 will be added to your new loan total. Check out this article if you want to learn more about how to trade in and refinancing vehicles works.

Going in with the right tools will help you talk the dealership into a deal that works in your favor.

Read Also: What’s The Lowest Auto Loan Rates

How Do I Calculate A Car Payment With Interest

To determine your car payment with interest, you would first shop around with different banks and lenders. That way, you can find the best interest rate you can qualify for based on your credit history and other factors. Using our car payment calculator, you can add interest and the tool amortizes the amount and provides an estimate of what you can expect your car payment to be with interest factored in.

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Recommended Reading: How To Qualify For Fha Loan In Ga

Whats A Good Ltv For A Car Refinance Loan

While every lender will have their own guidelines for approvals, a loan-to-value ratio over 125% will make it harder to get approved for refinancing. Others will offer refinance loans to borrowers with LTVs over 125% but may require a higher credit score, lower DTI, or other condition in order to lessen the risk to the lender because a high LTV is seen as a high risk.

Bottom line, if you can get your LTV below 125%, youll increase your chances of getting approved for an auto refinance loan.

Negative Equity Car Finance

If you want to buy a vehicle but your current car is in negative equity, you can still get a new finance deal. We explain all you need to know in our guide.

Zuto is a credit broker, not a lender. Our rates start from 7.9% APR. The rate you are offered will depend on your individual circumstances. Representative Example: Borrowing £7,000 over 48 months with a representative APR of 19.3%, the amount payable would be £205 a month, with a total cost of credit of £2,831 and a total amount payable of £9,831.

Don’t Miss: What Loan Company Is Easiest To Get

What Is Negative Equity On A Car

When the amount you owe on your auto loan is greater than the vehicle’s value, you have a negative equity car loan. Many people refer to it as being upside down on your car loan. Cars decrease in value the minute you drive them off the car lot. A new car can possibly lose 20% of its value in the first year. With the rapid depreciation, it is easy to owe more than your car is worth if you used financing.

Negative equity often happens if you don’t put enough money down. It also occurs if you put a lot of wear and tear on your car. The car’s condition can deteriorate and reduce the value. Long-term car loans that are six or seven years often lead to negative equity. The more time it takes to pay off your car, the more likely you are at risk for negative equity.

Should I Take Out Another Type Of Loan To Pay Off My Car Loan

Lets say youre in a real financial bind and need to take immediate action to keep your car. Taking out another type of loan like a personal loan, credit card, or home equity line of credit to pay off your car might be tempting, but it can have negative consequences.

Trade-in is always a better option than debt, advises Douville. Acquiring debt to pay down negative equity is not the best option unless the vehicle is unsafe to drive.

If youre behind on your loan payments, piling on more debt may only make the problem worse. You risk not only losing your vehicle, but also ruining your credit and defaulting on the other loans. And defaulting on your HELOC can lead to foreclosure of your home.

Also Check: How To Apply For Fha Loan

What Loan Term Length Should I Choose

Avoid stretching out your loan term to keep your auto loan payment as low as possible. Youll not only pay more in interest you may also end up having negative equity, meaning you owe more on the car than its worth, for an extended period of time. Choose the shortest loan term you can manage while balancing other expenses like housing, savings and repaying other debts.

How To Trade In Your Car When You Owe Money On It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Yes, you can trade in a car with a loan. But proceed with caution and make sure you not the dealer control the transaction.

If youre trading in a car you still owe money on, youre looking at one of these two situations:

-

You have positive equity. If your car is worth more than the amount you owe on your loan, youre in good shape. This difference is called positive equity and its like having money that you can apply toward the purchase of a new car.

-

You have negative equity. If your car is worth less than what you still owe, you have a negative equity car also known as being upside-down or underwater on your car loan. When trading in a car with negative equity, youll have to pay the difference between the loan balance and the trade-in value. You can pay it with cash, another loan or and this isn’t recommended rolling what you owe into a new car loan.

Well show you how to handle each of these situations. But first, a little background.

Recommended Reading: How Do Loan Payments Work

How To Avoid Negative Equity On Your Car

The best way to avoid going upside down on your auto loan is to do your research and assess your finances before you make a buying decision. If you want help with your auto loan in Canada, get in touch with us at MyRide! Our wide range of services include guiding first time buyers through the car financing process and helping car buyers repair bad credit with the right car loan.

You Placed Little To No Down Payment On The Initial Car Loan

If you placed no down payment or a small down payment on the car at purchase, you run the risk of having negative equity on the vehicle. A down payment of 20% is typically suggested because it generally puts you in a position of having positive equity on the vehicle. A smaller down payment will result in you falling behind on equity for your vehicle, which can leave you underwater on the auto loan shortly after purchasing.

Recommended Reading: How Do I Know If I Qualify For Fha Loan

What Is Negative Equity

Negative equity also referred to as being upside down is when you owe more on your auto loan than the vehicle is worth. While it isnt the worst-case scenario as a loan holder, it can make vehicle trade-in and future auto loan approval a challenge.

Take advantage of this calculator to understand your monthly payments so that you can best grasp how the amount you still owe would affect the total cost of your new loan. Consider making extra payments, increasing your down payment or even refinancing your loan before you buy something new in order to reduce the amount of extra interest you would pay.

Example Of Negative Car Equity

Imagine you took out a car loan years ago on a brand new vehicle for $20,000. Youve made payments on the vehicle over the life of the loan, and now you want to upgrade to a new model-year vehicle but you still have an outstanding balance on your existing auto loan.

You have an outstanding balance of $12,000 and the dealer says that they will purchase your old car from you, but Kelley Blue Book gives your car a market value of $10,000. This is an example of negative equity. You still have the option of purchasing the new car, but you will have to make up the difference in the amount owed to the bank.

You can decide to pay off the difference in cash or roll the negative equity into the new car loan. If the new car is $25,000 and you decide to roll the $2,000 into the new car loan, you would essentially take out a $27,000 auto loan for the purchase of the $25,000 vehicle.

You May Like: Fast No Credit Check Loan