The Air Force College Loan Repayment Program

Simply put, airmen dont get the same treatment their army and naval counterparts receive. Under the CLRP, air force personnel only receive `$10000 as lifetime benefits for military student loan forgiveness. To add to the sting, youll have to meet the same criteria as sailors and soldiers if you want to benefit from CLRP as air force personnel.

Hence, if you decided to enlist in the military simply to enjoy for the benefits you can enjoy in its student loan forgiveness packages , then youll be better off joining another branch. The reasons being, quite obvious because you will go through the same stringent requirements yet get very little benefits.

Earn Your College Degree Through The Green To Gold Program

The Green to Gold Program identifies enlisted Soldiers with leadership potential and helps them pay for college and earn the degree needed to become an Officer. Through ROTC, candidates will attend college or graduate school, complete Army Officer Commissioning requirements, and compete for Officer assignments.

Specialized Training Assistance Program

STRAP provides a $2,466 monthly stipend throughout a participants residency. In exchange for STRAP benefits, participants serve one year in the Army Reserve for each six months of stipend they receive.By integrating STRAP benefits with the Army Reserve Healthcare Professionals Loan Repayment Program incentive, participants will receive an additional $250,000 for student-loan repayment.

Recommended Reading: How To Reuse Va Loan

So Your Loans Arent In Good Standing

We wont deny it, most of the military student loan forgiveness programs and other packages offered by the government are only available to borrowers with loans that are in good standing. This implies that your account must be in repayment status because youve been making your payments on time.

However, should the unthinkable happen, and your loans end up in default, delinquency, or worse, you get a wage garnishment, then youll need all the resources you can get to help reverse these situations.

Nevertheless, we hope with this guide, the worse will have been prevented, and you can secure yourself one of the military student loan forgiveness packages. These packages become very relevant once you realize that they can help avoid future incidences of default or delinquency. Even a wage garnishment that can mercilessly eat away at your paycheck can be kept at bay.

On the other hand, if your loans have already defaulted and you feel you cant get them back into good standing anytime soon, even with military student loan forgiveness, then you might have only one choice left. In such a case, we highly recommend you think about attempting a Federal bankruptcy discharge.

Established in 1986, Forget Student Debt strives to get justice for their clients. we believe in a good and honest fight, and we will not stop at anything.

Head Office

How Does It Work

The payments are made once a year for six years, with a maximum annual payment amount of $7,500 or 15% of your total loan balance. The payments are made directly to the Student Loan Creditor. You must have existing student loans upon enlistment/re-enlistment in order to qualify, and all of your loans must be in good standing .

Each year you must certify your loan status and submit paperwork to our SLRP Manager, Mr. Imhoff, who will then submit your loans for an annual payment.

You can check the status of your loans by going to the National Student Loan Data System website here:

Also Check: How To Apply For Student Plus Loan

Accelerated Promotion For Education Program

The Accelerated Promotion for Education Program allows college students to enter the Army at a higher rank and pay grade. A student with 24+ college semester hours may join as a Private instead of the usual entry rank of Private . A student with 48+ college semester hours may join as a Private First Class . A student with a bachelors degree may join as a Specialist . Each of these levels translates to a promotion with a higher pay grade.

Servicemembers Civil Relief Act

The Servicemembers Civil Relief Act applies to anyone on active-duty, whether or not you serve in a war zone. This act limits creditors to charging no more than a 6% interest rate on most any debt held by a servicemember, including education loans.

Also, SCRA prohibits servicemembers from facing collection actions. Collection agencies are forbidden from filing collection lawsuits against servicemembers on active-duty or within the 90 days after your service ends.

The federal government automatically applies the 6% interest rate limitation to eligible borrowersâ accounts without a borrowerâs request. However, the government also has a form to fill out if you think you should qualify and havenât automatically benefitted.

If you consolidated your federal loans after your active-duty began, your Direct Consolidation Loan might not be eligible for any SCRA debt relief.

SCRA applies to:

- All private student loans held by servicemembers

- All loans or debt incurred by a servicemember

- Loans disbursed before active-duty began

Your loan servicer should check to find your name on an authorized military database. If you are listed, you automatically benefit from SCRA. You donât have to do anything.

To qualify, your loans must be disbursed on or after August 14, 2008. Contact your loan servicer for information about SCRA eligibility.

Links & contact info:

Recommended Reading: What Kind Of Mortgage Loan Should I Get

The National Guard Student Loan Repayment Program

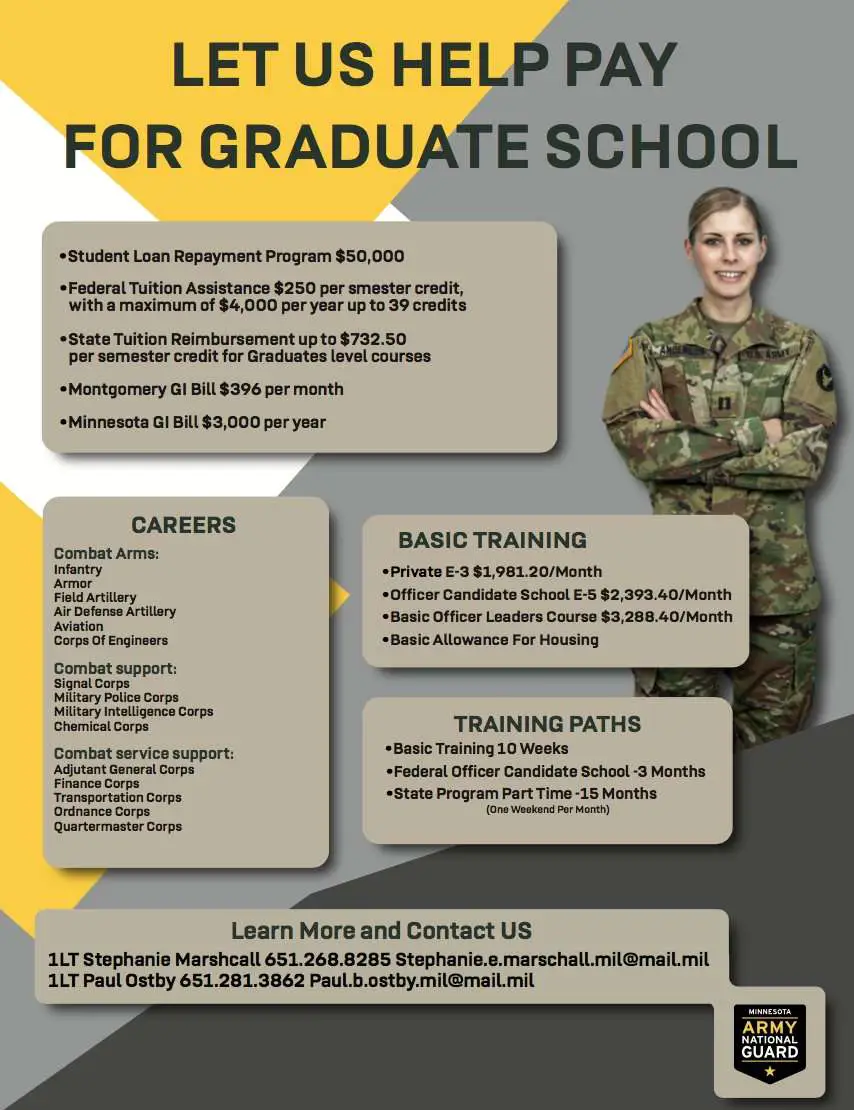

To qualify for the National Guard Student Loan Repayment Program, you must score 50 or higher on the Armed Services Vocational Aptitude Battery, enroll with eligible jobs through the Guard, and enlist for at least six years of service. The max amount you could receive in federal principal student loan repayments is $50,000, and you could earn up to $7,500 annually.

Eligibility For Student Loan Repayment Programs

To be eligible for the student loan repayment program you must:

- Sign up for an original active-duty enlistment of at least 3 years with a qualifying specialty, or contract as an Officer candidate

- If enlisting in the National Guard, you must enlist for at least 6 years

- Have a qualifying ASVAB score.

- Have a student loan that is not in default. The loan must have been made prior to entry on active duty.

Only certain loans qualify, currently this includes:

- Stafford Student Loans

- Federally Insured Student Loans

- Supplemental Loans for Students

- Parents Loans for Undergraduate Students

- Consolidated Loan Program Loans

Don’t Miss: How Much Can I Borrow Va Home Loan

Military Student Loan Forgiveness Programs

There are a few student loan forgiveness programs you may qualify for as a member of the Armed Forces:

- National Defense Student Loan Discharge: If you served in an imminent danger or hostile fire area for at least a year, you may qualify to have a portion of your student loan debt discharged.

- Veterans Total and Permanent Disability Discharge: If youve been deemed permanently disabled due to a service-connected disability, you may qualify to have all of your student loans discharged.

- Public Service Loan Forgiveness: The Department of Educations primary forgiveness program is available to military members who work for a government agency or eligible non-profit organization while making 120 qualifying monthly payments and meeting other requirements. If you meet all the requirements for PSLF, your full balance will be forgiven.

Are Slrp Benefits Taxable Income

Unfortunately, yes, your Army college loan repayment program benefits are counted as taxable income.

However, you wont ever actually get any of the money thats provided as LRP for your debt, because the Federal Government sends payments directly to your lender, and it witholds 28% of what it would have paid out on your behalf each year for distribution to the IRS.

So, while LRP benefits do count as taxable income , you wont have to make any out of pocket payments to account for them.

And thats a huge benefit, because most other forms of student loan forgiveness do require you to include them as taxable income on your annual tax return, and to pay the IRS a percentage of the benefits you received.

If youre looking at other forms of student loan forgiveness, and wondering how theyll compare to the Army LRP program, then please make sure to visit my page about Student Loan Forgiveness and Taxable Income Laws.

And if youre concerned about tax liabilities, or if you already have tax problems of your own, then please consider visiting my new website, Forget Tax Debt, where I offer advice, tips and tricks for decreasing your outstanding tax debt, covering topics like Settling an IRS Tax Debt, Applying for IRS Tax Debt Forgiveness Benefits, and Avoiding IRS Phone Scams.

Don’t Miss: What Are The Current Commercial Loan Rates

National Guard Student Loan Forgiveness

The National Guard Student Loan Repayment Program pays up to $20,000 of a service members student loans. Youll need a score of 50 or higher on the ASVAB to qualify. Youll also need to serve in an eligible MOS.

The Army will pay 15% of your outstanding student loan balance or $1,500, whichever is greater. And the National Guard will pay this amount for each year of service.

Healthcare Professionals Loan Repayment Program

This program pays up to $250,000 for repayment of education loans to physicians in certain specialties who serve in an Army Reserve Troop Program Unit, an Army Medical Department Professional Management Command, or the Individual Mobilization Program. Payments are made annually with a cap of $40,000 for each year of satisfactory service.

Also Check: Can I Loan Audible Books

Student Loan Refinancing Options With Lantern

how student loan refinancing worksdisadvantages of refinancing student loansrefinancing federal student loansfind and compare student loan refinance optionsThe tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

Interest Waiver For Those At Dangerous Posts

Anyone deployed to an area that qualifies for imminent danger or hostile fire pay is entitled to have all interest waived on their federal student loans, so long as they were first disbursed on or after Oct. 1, 2008.

The Department of Education uses a data-matching system to identify service members who qualify for this benefit, so it should be applied automatically. But if you think youve been passed over for this key waiver, contact your servicer once you get the chance, and your interest charges can be thrown out retroactively.

You May Like: How To Get Personal Loan From Chase Bank

Attention To Taxable Incomes

As if the requirements and eligibility criteria arent enough put offs, your standard military loan forgiveness programs have another significant drawback. The funds you receive from the program is part of your annual taxable income. Hence, you will have to report it to the Internal Revenue Service. As a result, youll be paying taxes on every penny you receive as benefits from any military student loan forgiveness program.

When you consider the total sum of taxes youll have to pay, its a substantial amount. In case you receive $10,000+ for yearly benefits, its crucial to include the tax liabilities in the deal ahead of time. The military student loan forgiveness program attracts major tax liabilities.

Fortunately, the CLRP programs come with a great advantage. They are set up so that beneficiaries dont receive their benefits in check, or cash. Instead, your student loan lender receives the funds directly from the Federal Government. You may deem this a major drawback.

However, the government covers your tax liability such that, it withholds 28% of your benefits and sends that directly to the IRS.

College Loan Repayment Program For Navy Reserves

Just as CLRP offers some benefits to army reserves, reserve sailors also get some benefits. However, its nothing like what their army counterparts receive. Neither is it anything close to what their active-duty counterparts enjoy. For reserve sailors, the maximum benefits they receive is about $10000. Believe it or not, this is the total loan forgiveness fund made available to navy reserves.

In this case, too, naval personnel only become beneficiaries of the program after completing their first year of service successfully. However, things differ from their active-duty counterparts in the sense that reserves need to sign up for longer service, per the eligibility requirements. To be specific, the minimum length of time you must sign up is six years.

Recommended Reading: How To Get An Aer Loan

% Interest On Active Duty

Your federal student loans could qualify for a 0% interest rate during your deployment. Youll need to have been deployed to an area of hostility and received special pay in order to qualify. Note that this benefit only applies to Direct Loans or the portion of a Direct Consolidation Loan that was used to repay loans that were taken out on or after October 1, 2008.

The 0% interest rate is available for as many months as you serve in an area of hostile fire, up to a maximum of 60 months. Once again, the 0% interest rate can be applied retroactively. Even if youre no longer serving in a hostile area, its not too late for you to apply for this benefit.

Note that many private lenders offer active duty military deferment as well. If you have private student loans, its worth checking with your lender to see if this one of the benefits they provide.

Note that thanks to the Heroes Act waiver, active duty service members also arent required to submit an annual employment certification form for income-driven repayment plans. So even if your income goes up, your monthly payments can stay the same until youve finished your deployment.

Amount Of Funds Provided By Clrp

The total amount of funds youll receive isnt fixed. It largely depends on the branch of the military that you decide to enlist. However, there is a cap on the maximum amount any military personnel can receive under this military student loan forgiveness program. This amount is about $65,000.

Talking about CLRP, the sum of money you are entitled to receive depends partially on your duty-status. Those in active service can receive two times the amount reserve personnel receive.

Below, youll find the breakdown according to status:

- Reserved enlistees can receive up to 15% forgiveness of their loans. The outstanding principal balance of these enlistees loans will be covered for every year of their service.

- Enlistees in active duty can obtain up to 33.33% to cover the principal outstanding of their loan. This money specifically caters for each year they complete in service.

However, here is the catch about CLRP benefits the program doesnt make all the funds available to you at a go. Rather, you receive a third of the payment to cover your outstanding debt every year.

Do not forget, however, that the case isnt on year 1 instead, in year 2, its 1/3 of the original amount, etc. Hence, each year sees a decline in the amount of money you receive from the military student loan repayment policy. This is explained by the fact that the balance due is of the outstanding or remaining student loan debts.

Read Also: How To Pay Off Fha Loan Early

Healthcare Professionals Loan Repayment Up To $240000

Army Medical Department officers in the Medical and Dental Corps can receive the Healthcare Professionals Loan Repayment Program up to $240,000 for certain specialties by agreeing to a six-year service commitment with the Guard .

Physicians Assistants, Physical Therapist, Social Workers, and Clinical Psychologists may qualify for loan repayments up to $25,000 per year with a $75,000 lifetime cap.

Active Duty Health Professions Loan Repayment Program & Healthcare Professionals Loan Repayment Program

Who Its For: Active duty & reserve officials in the United States Army Medical Corps, Allied Health Corps, Dental Corps, Nurse Corps, or Veterinary Corps.

How to Apply: Go to the bottom of the Army Healthcare Professional Benefits page and select Locate a Recruiter or Request More Info to get more details.

What Loans Qualify: Most federal and private loans.

How Much?: For active duty members, up to $40,000 per year, for a total of $120,000. For reservists, up to $50,000 total over the course of three years.

Anything Else I Should Know?: As noted above, youll need to follow up directly with a recruiter or other military information source to find out whether this option matches your situation. When you speak with them, make sure you find out exactly what steps youll need to follow, and make sure to write them down and set reminders for any follow-up tasks necessary.

Recommended Reading: Is The Loan Forgiveness Program Worth It

How Public Service Loan Forgiveness Applies To Military

Public Service Loan Forgiveness means that your remaining balances are forgiven after you make 120 monthly payments on a qualifying federal repayment plan. Essentially, you consolidate your federal student loans using a program like Income-Based Repayment, and then after you make payments for 10 years. All of the debt that remains gets erased from the books without any penalties or credit damage.

One important thing to note is that Public Service Loan Forgiveness only applies if you are currently employed for the public good and continue to be employed in public service for that entire 10-year span. If you leave the service, youre no longer eligible.

Student Loan Forgiveness For The Army

Members of the United States Army have multiple different student loan repayment assistance programs to consider, including:

Army Student Loan Repayment: Active Duty

Army Reserve College Loan Repayment Program

Prior Service Soldier Loan Repayment Program

National Defense Student Loan Discharge

Health Professions Loan Repayment Program

Public Service Loan Forgiveness

Perkins Loan Cancellation

Read Also: How To Eliminate Pmi Insurance On Fha Loan