Typical Closing Costs With A Mortgage

- Lender fees such as admin/underwriting/processing and origination charges

- Third-party costs like home appraisal, home inspection, and notary fee

- Title and escrow fees

- Prepaid items

Closing costs include things like the loan origination fee, mortgage points, credit report fee, home inspection fee, appraisal fee, loan processing fee, application fee, title insurance and escrow fees, and so on.

Theres also the potential for recording fees, courier fees, wire fees, subescrow fees, endorsements, and more.

So its clear there are a lot of fees, and based on the number of said fees, the price tag can certainly add up pretty quickly.

This is why it doesnt make sense to serially refinance your mortgage, just like it doesnt make sense to buy and sell a home over and over and pay costly real estate agent commissions.

The costs can be quite substantial, and it takes time to recoup those costs via a lower interest rate, assuming you execute a rate and term refinance.

Close At The End Of The Month

One of the simplest ways to reduce closing costs is to schedule your closing at the end of the month. This way you will be saving up on a lot on the prepaid interest which otherwise will be charged.

For instance, if you choose to close on the beginning of the month, say June 3rd, you will be paying prepaid interest for the rest of the month at closing. However, if you schedule it on June 29th instead, you will only have to pay one day of interest.

Are Closing Costs Included In A Mortgage

Mortgage Q& A: Are closing costs included in a mortgage?

There seems to be a great deal of confusion when it comes to closing costs and mortgages, so lets clear the air and make sense of it all.

Simply put, home loans come with closing costs, similar to how most products and services come with associated fees.

No one works for free, even if it doesnt hit your pocket directly.

The interest alone isnt enough for lenders to originate mortgages, and a lot of hands are involved, so every party must get paid to participate.

Theres no way around that, but how you pay is certainly up to you.

Recommended Reading: Capitol One Autoloans

What Do Closing Costs Include

Closing costs are the expenses over and above the property’s price that buyers and sellers usually incur to complete a real estate transaction. Those costs may include loan origination fees, discount points, appraisal fees, title searches, title insurance, surveys, taxes, deed recording fees, and credit report charges.

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

Recommended Reading: Loaning Signing Agent

Is There A Tax Benefit To The Down Payment Gift

No, not really. As a matter of fact, the gift-giver could incur an extra gift tax from the IRS if they were to go over the annual exclusion amount for a gift.

In short, as long as you dont gift more than $15,000 as an individual, or $30,000 as a joint tax-filing couple, you will not be hit with a gift tax.

What Are Closing Costs

Closing costs are fees paid to cover the property, insurance and mortgage costs incurred by your lender while processing your loan, like home appraisal and title insurance costs.

Lenders are required by law to provide a Loan Estimate within 3 business days of receiving your application. The estimate provides a detailed list of what you can expect in closing costs. This document is a TILA-required lender disclosure that provides a good-faith estimate of the cost of the loan.

Additionally, youll receive a Closing Disclosure 3 business days before you close, which will provide you with the actual costs of the mortgage and give you time to question any discrepancies before closing.

Recommended Reading: Fha Loan Refinance

What If I Cannot Afford The Va Home Loan Closing Costs

No doubt, closing costs can be expensive. But you can reduce your VA home loan closing cost in several ways.

The fourth option may be your best one. You do not have to rely on the seller for a credit, which most wont give in this market. Likewise, closing cost assistance programs are hit and miss. But most lenders can give a credit on most transactions by simply giving you a slightly higher interest rate. In some case, you can receive thousands of dollars from a lender credit by taking a 0.25% higher rate. Ask your lender for specifics on your loans.

Down Payment Vs Closing Costs: Is There A Difference

Yes your down payment and closing costs are distinct pieces of the total homebuying upfront expense. The down payment is the money you contribute to the cost of the house youre buying, and your mortgage loan makes up the rest.

Related reading: FHA Loan Down Payment: Guide to 3.5% Down Homebuying

The closing costs largely cover your lenders expenses and third-party fees that are essential to the transaction.

For instance, you might see a title search fee on your closing cost estimate. The title company researches the previous ownership and certifies there are no outstanding claims against the property.

Youll also pay an appraisal fee. This is required by the lender to verify the homes value and ensure that the home is in safe and livable condition.

There are many such aspects to the process, and your closing costs cover those expenses.

You May Like: Usaa Used Auto Loan Rates

What Is Mortgage Insurance And How Do I Get Rid Of It

Mortgage insurance is an extra payment that a borrower is required to pay monthly in addition to the mortgage payment they owe their lender. It is designed to protect the lender if the borrower stops making payments and defaults on the loan.

For the time being, the only way that you can really avoid paying mortgage insurance is to make a down payment of 20% or more toward the home purchase.

How Much Are The Closing Costs

You also need to factor in how much those closing costs are and what your monthly payment will be with them rolled in. If you’re not careful, they could put you above your lender’s loan-to-value or debt-to-income thresholds, which might mean paying for private mortgage insurance or, in some cases, getting stuck with a higher interest rate. Both of these equal extra costs — and a slimmer profit margin to boot.

Read Also: Stilt Loan Calculator

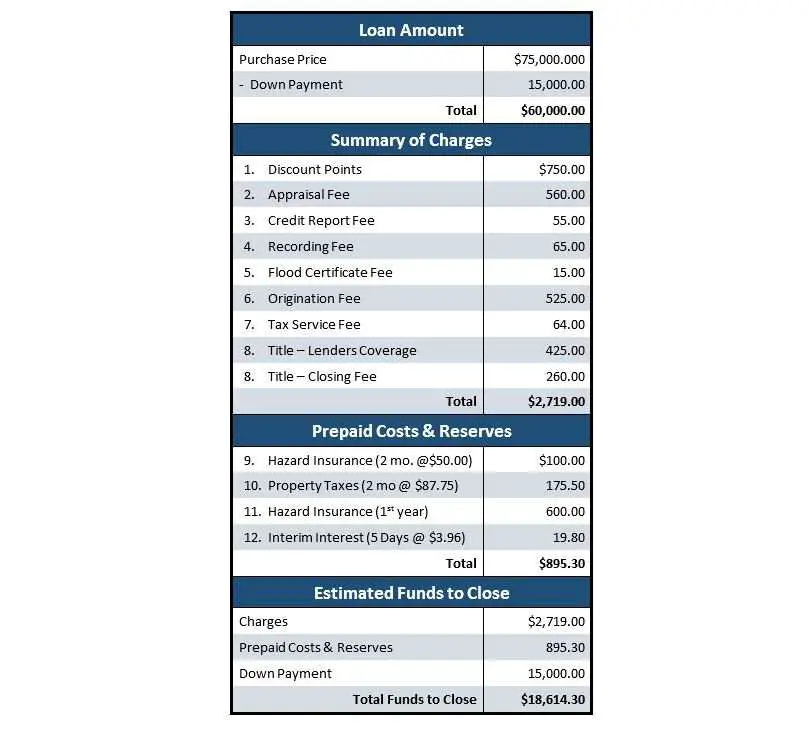

Are Closing Costs Based On The Loan Amount Or The Purchase Price

Closing costs can be flat rates and charges are calculated off of the purchase price. Because each state and local municipality has their own specific set of charges, they can vary one to the next. Your lenders charges and other fees are typically based off the loan amount.

For instance, a $200,000 purchase price will usually require a 3.5% down payment. Some lender fees due at closing may be based off of loan amount and other county and state fees will be based off the full purchase price. 3.5% is a typical FHA loan down payment and closing costs will include a private mortgage insurance payment in addition to other related fees.

What Is The Closing Process Of A House Like

The closing is the last step in the purchase and financing of a home. The closing, also called an agreement, is when you and all other parties sign the documents necessary to complete a mortgage transaction. Once the closing is complete, you are legally obligated to pay the mortgage.

Recommended Reading: Usaa Car Loan Interest Rates

Rolling Closing Costs When You Refinance

If youre refinancing an existing home loan, its often possible to include closing costs in the loan amount.

As long as rolling the costs into your mortgage doesnt impact your debttoincome or loantovalue ratios too much, you should be able to do it.

- As an example, lets say your new loan amount is $200,000, excluding closing costs

- If your home is valued at $250,000, your LTV is 80%.

- If your maximum approval is 80% LTV, or youre just wanting to stay at or below the 80% mark in order to avoid paying private mortgage insurance , you may not be able to roll the closing costs back into your loan

But if your loantovalue ratio is low enough, taking on a small extra loan amount might not make too much of a difference.

Rolling Closing Costs Into Fha And Va Loans

FHA and VA loans have some unique features and fees that require additional consideration when deciding if you want to roll your closing costs into the loan. You should discuss all features of the loan program with your lender to make sure you fully understand your obligations as a borrower.

FHA loans require the borrower to pay an upfront mortgage insurance premium . The UFMIP is generally 1.75% of your loan amount, and it can be rolled into the loan amount. There is one caveat: FHA loans require a minimum 3.5% down payment, not counting your closing costs. This means if you’re borrowing $100,000, you are required to pay at least $3,500 toward your down payment in addition to your closing costs.

VA loans require the borrower to pay a VA funding fee, which can be financed. This fee goes directly to the Department of Veterans Affairs to help cover losses and keep the loan guarantee program viable for future generations of military homebuyers. The amount of your VA funding fee will depend on your type of service and whether this is the first time you are obtaining a VA loan.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

You May Like: How To Get A Loan Officer License In California

Options For Paying Loan Closing Costs

Closing costs can quickly add up when you buy a house, usually running between 3% and 4% of the purchase price. For example, if youre buying a property with an $80,000 mortgage, your total closing costs would be between $2,400 and $3,200.

While you can pay your closing costs out-of-pocket, there are also other options to use to pay loan closing costs that allow you to keep more cash on hand:

- Personal funds to pay closing costs

- Lender credit to pay some or all of the costs

- Seller credit can be negotiated as part of the purchase contract to pay for closing costs

In addition to these three choices, the fourth option is to include closing costs and loan fees in the mortgage balance, then pay them off as part of your monthly mortgage payment. Next, lets take a detailed look at how and why investors include closing costs in a loan.

How To Calculate Your Fha Loan Closing Costs

Sometimes, an FHA loan can give you the opportunity to buy a home when you otherwise wouldn’t get approved for a mortgage loan. The appraisal process is also slightly more complicated than for conventional home loans. Since your home must meet FHA property requirements, the appraisal may be more expensive. Besides these expenses, your closing costs will include the typical costs listed above.

Since there are many factors making each home purchase unique, many facts are included when determining the closing costs for your FHA loan. Luckily, the amount of your closing costs isn’t a secret that you have to wait to be revealed on closing day. Here’s what to expect with your FHA loan closing costs.

- Loan Estimate: Within 3 days of applying for a loan, your lender must send you a Loan Estimate which will explain details about the terms of your loan and estimated closing costs.

- Closing costs calculator: Using a closing cost calculator can provide an estimate of your potential closing costs.

Also Check: Fha Loan Refinancing Options

Ask The Seller To Pay Closing Costs

If closing costs are the only thing preventing you from completing your purchase, the seller may agree to pay for some or all of them. FHA rules allow the seller or another third party to pay up to 6% of the property sales price toward closing costs or other prepaid expenses. Consider asking for any seller assistance during the contract negotiation.

What Is A Down Payment

A down payment is a payment made in cash at the onset of the purchase of an expensive good or service. It represents a percentage of the purchase price and is not refundable if the deal fell through because of the purchaser.

That said, a down payment is not the whole amount that will need to be settled with your title company at the time of your closing. In fact, you may elect to pay closing costs too.

Recommended Reading: Fha Loan Limit Texas

Extra Tips Just For Refinancers

If youre refinancing a home loan, youll have to pay closing costs all over again. But you do have some special money-saving opportunities. Here are two:

If your home has been appraised recently, you can probably skip the cost of having it appraised again as part of the closing process. Ask your lender for an appraisal waiver. If you cant waive the appraisal altogether, you may be able to save money by opting for an automated appraisal instead of a full appraisal.

Ask for a re-issue rate when you re-up your title insurance for a refinance.

Down Payment Interest Savings Example

Taking out a loan for $250,000 would leave you with a mortgage-only payment of $1,342 per month. Over the life of that loan, if you paid your mortgage on time and put nothing else toward the loans principal, you would end up paying $483,139.

We will now run the numbers with a 5%, 10%, and 20% down payment.

Depending on which down payment you make, you would save $24,157, $48,313, or $96,627, respectively. That is almost a 100% return on your investment.

Also Check: How Much Do Loan Officers Make In Commission

Prepaid Daily Interest Charges

You prepay interest on your loan from the day your loan closes to the end of the month. For example, if you close on the 15th of the month, then you prepay 15 days of interest in advance. If your loan funds at the end of the month, this charge will be small. Basically, if you close near the start of the month and you have a big loan amount, then the charge may be substantial.

Higher Chance Of Offer Being Accepted

This one may be a little more mythical than numerical, but it still carries weight. When faced with the decision between two offers on their home, where the only difference is the amount of the down payment, a seller is much more likely to choose the offer with the higher down payment. This is because the buyer putting down more looks more credible in the sellers eyes and is less likely to have problems throughout the loan process.

This is even more true when looking to purchase a home in a competitive market at a competitive price point.

Don’t Miss: Pre Approved Auto Loan Usaa

What Is Included In Closing Costs

When your closing costs are due

How to know what your monthly mortgage payments will be

What the most common itemized closing costs mean

If youre thinking about buying a home or refinancing an existing mortgage, you need to think about closing costs. Its easy for first-time buyers to overlook the importance of closing costs with so much focus given to saving for the down payment. The truth is all real estate transactions come with closing costseven if youre refinancing or buying a home in cash. Every purchase of a home comes with fees, insurance, taxes, and administrative costs, no matter how you choose to pay. The same holds true for refinancing a mortgagethe home may not be new for you, but the mortgage is for the lender.

If youre getting a mortgage, closing costs can range between 2%5% of the loan amount. And generally speaking, the higher the amount of the loan, the lower the percentage of closing costs youll need to pay. This is because a number of closing costs are fixed.

Closing costs fall into 3 main categories: lender fees, third-party fees, and prepaid items . Some lender fees are avoidable, Better Mortgage doesnt charge lender fees. Collectively these 3 categories cover fees, insurance, taxes, and all the administrative costs needed to process the loan.

Theres a lot to take in, so well start with an overview of the 3 main categories, then well dig into the specifics.

Lender points or credits

Third-party fees

Prepaid items

When Are Closing Costs Paid

Closing is the point at which the propertys title transfers to the buyer from the seller. Closing costs are also paid at this time.

However, if you opt to finance your closing costs or to secure a no-closing-cost mortgage, then you will effectively pay for your closing costs or for the lenders recouping of your closing costs over the years of your loan term.

Also Check: Usaa Prequalify