% Reduction From Gross Receipts

California conforms to the federal gross receipts test requiring a 25% or greater reduction in gross receipts and will therefore follow the rationale of this related federal guidance.

For additional information, visit Section 311 of the Consolidated Appropriations Act , 2021, RTC section 17131.8), and Small Business Administration guidance.

Where Does Payroll Tax Fit In

Theres another kind of tax we havent talked about yet: payroll taxes.

Payroll tax is usually handled by your payroll provider, if youre using a company like Gusto, ADP, or QuickBooks to run payroll. Payroll taxes are paid by two sourcesthe business and the employees themselves through withholdings. So on top of what you pay the IRS as the business owner, youre also responsible for withholding the right amounts from your employees paychecks and paying their portion of the taxes on their behalf.

If you have received PPP funds, you are allowed to use the money for both the salaries of your employees and the employee taxes that you would normally withhold and send to the IRS. You cant, however, use these funds to cover the business portion of the taxes that go toward things like FICA and Medicare.

What May Happen Next And What About Business Owners

Congress could enact additional legislation in direct response to the IRS. Identical bills have been introduced in both the Senate and House of Representatives, titled the Small Business Expenses Protection Act of 2020. The law would amend section 1106 to leave undisturbed the tax deductions for business expenses paid with forgiven PPP loan proceeds. If such clarifying legislation is not passed, then it remains to be seen who, if anyone, will defy the IRS by deducting the expenses and take the challenge to court. Any court deciding the issue will undoubtedly look to congressional intent.

Also Check: Va Manufactured Home Loans

Does A Forgiven Ppp Loan Become Taxable Income

After the passage of the CRRSAA into law in December 2020, Congress made clear that a forgiven PPP loan is completely tax-exempt and is not taxable income.

As of December 2020, businesses now have the opportunity to take out a PPP loan and obtain the Employee Retention Tax Credit for both 2020 and 2021.

Is Ppp Loan Forgiveness Taxable Income

In this 4-minute read:

- Is the PPP loan taxable after its been forgiven?

- Are expenses for the PPP loan deductible with loan forgiveness?

- State-by-state listing for PPP forgiveness tax rules

The Paycheck Protection Program has helped tons of small businesses stay afloat over the course of the global coronavirus pandemic. And so long as your business met the basic requirements for loan forgiveness, your loan could even be fully forgiven. But are their tax implications to a forgiven PPP loan?

Womply has made email marketing truly automatic for busy small business owners and all types of independent contractors. Learn more, plus get free reputation monitoring and customer insights when you sign up for Womply Free!

Also Check: Genisys Loan Calculator

What If My Lender Denies Loan Forgiveness Or Approves Only Partial Forgiveness

If the lender does not forgive the loan, or only partly forgives it, the borrower must pay the balance due before the loan matures. Interest accrues during the time between the disbursement of the loan and SBA remittance of the forgiveness amount to the lender, if any. The borrower is responsible for paying the accrued interest on any amount of the loan that is not forgiven. .

What Should Business Owners Do Now

Congress failure to act before tax filings begin could set up a fight between taxpayers and the IRS. While business owners should seek and rely upon the advice of tax advisers and legal counsel, they are likely to face tough choices. A business might forgo the deductions and simply pay the tax. Another option would be to take the disputed deductions but file a Form 8275 Disclosure with the IRS, relying upon the statutory language and congressional intent to contradict the IRS stated position. This should not be done without professional guidance and may set up a deficiency lawsuit in U.S. Tax Court or a federal district court one with the potential to garner national attention.

In the meantime, we should expect that many business owners will delay filing until the last possible moments. In any event, business owners should proceed with caution and should not proceed without competent guidance from professional advisers and counsel.

Also Check: How To Transfer Car Loan To Another Person

Timing Considerations: Basis And At

Loan forgiveness increases tax basis, at least in the context of pass-through entities .

For these entities, the deduction for otherwise deductible expenses paid from PPP loan proceeds may be limited by the borrowers tax basis or amount at risk. It all depends on the timing.

Assume a partner or S corporation borrower with significant PPP expenses and a small tax basis in the business. The borrower received the loan and incurred the expenses in 2020, along with other items of income and expense that affect tax basis in the business for the year. However, the loan was not forgiven until 2021.

That means the borrower may have a timing problem. The tax basis in the business doesnt increase until 2021 while the PPP expenses are deductible in 2020. If the total amount of expenses is larger than the borrowers tax basis, those expenses are limited in 2020 to the amount of tax basis before forgiveness.

It can require a fairly complicated analysis.

The takeaway? If you generally have a small basis in a pass-through entity, it is important to examine the tax year of the PPP debt forgiveness and allowable deductions. When will the forgiveness be considered tax-exempt income for purposes of calculating tax basis? And when will the expenses be deductible?

This timing issue may also impact the purchase/sale of the partnership or S corporation.

How Does The Ppp Loan Program Work

The PPP emergency loan program, part of the CARES Act, has been authorized to distribute hundreds of billions in forgivable loans to small businesses. The program initially had $350 billion allocated in March and another $320 billion authorized in April after initial funding was exhausted. In December 2020, Congress provided another $284 billion for new and second-draw PPP loans for businesses. These loans are issued by private lenders and backed by the SBA. The primary purpose of PPP is to keep workers on payroll and fill in gaps regarding rent, utilities, mortgage interest, supplier costs, personal protective equipment and related expenses.

Also Check: How To Find Your Student Loan Number

Two Final Comments To Close

A couple of comments to close.

First, the tax accountants whove thought about this? They have a hack they hope works to make payments to partners tax free. Treating the payments as distributions. That may work. But taxpayers and their accountants probably want to plan for the possibility it doesnt.

Note: If you want to know how distributions and special allocations work, you might find this other blog post useful: Salvaging Partnership Section 199A Deductions.)

Second, you know what we really need? Some additional guidance from the IRS. And soon. Ideally before people start to apply for PPP loan forgiveness.

Irs Reporting Of Economic Impact Payments And Ppp Loan Proceeds

Along with 160 million other Americans, you probably received an economic impact payment, economic stimulus payment, stimulus check, etc. . In addition, if you own a business, you may have also received a loan under the popular Paycheck Protection Program . With the 2020 tax filing season opening on Feb. 12, you may be wondering if you are going to be paying more this year in taxes. Fortunately, both programs result in great tax results. This article explains why.

The experience IRS tax resolution attorney at Columbus, Ohio based Porter Law Office, LLC helps individuals and businesses across the U.S. If you have any questions about an IRS tax problem, contact our office today.

You May Like: Aer Loan Balance

We Expect Our Ppp Loan To Be Fully Forgiven Does Our Small Business Have To Pay Income Tax On The Forgiven Amount

No. Under the COVID-related Tax Relief Act of 2020, no deduction is denied, no tax attribute is reduced, and no basis increase is denied by reason of the exclusion from gross income of the forgiveness of an eligible recipient’s covered loan. This applies for tax years ending after March 27, 2020. Note that the COVID-related Tax Relief Act of 2020 applies only to federal income taxes. While many states will also follow the federal framework, PPP loan forgiveness may be subject to income tax in some states. .

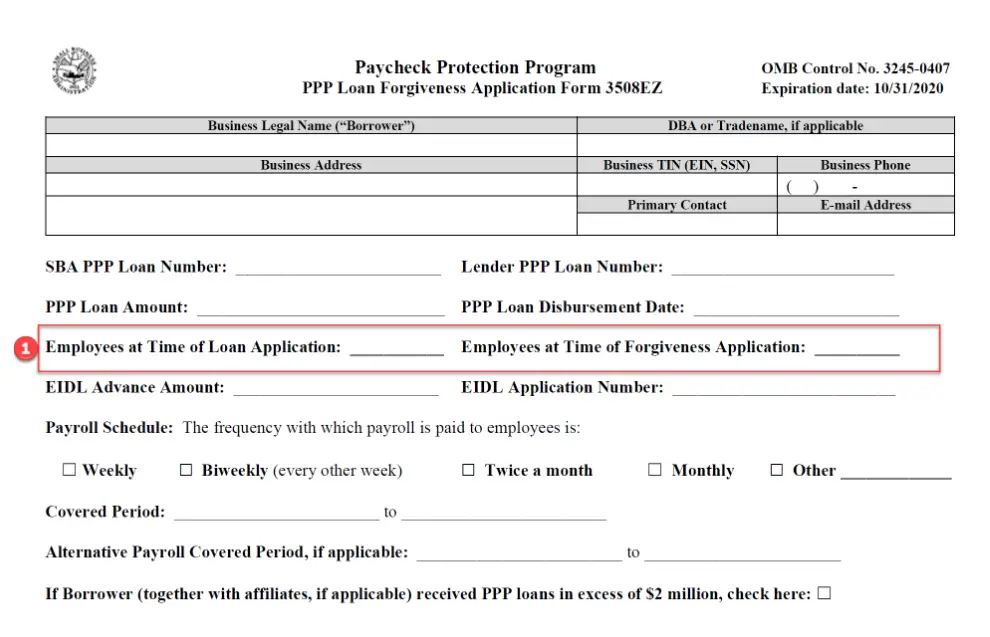

How Does Our Business Request Forgiveness Are We Responsible For Preparing And Submitting The Application

To receive PPP loan forgiveness, the borrower must complete and submit the Loan Forgiveness Application to the lender that originated or is servicing the loan. The borrower is responsible for providing the lender an accurate calculation of the loan forgiveness amount. The lender then reviews the forgiveness application, issues a decision to the SBA, and notifies the borrower of the forgiveness amount, if any, paid by SBA to the lender. .

You May Like: How Do I Find Out My Auto Loan Account Number

The Expectation: What Does Tax

Many business owners, tax professionals, and even lawmakers expected business owners to face no tax burden for these loans.

There are two opportunities for these funds to be taxedone when the funds are handed over and another when businesses pay their estimated quarterly taxes.

- The bill made clear that the forgiven loan amounts would be treated more like a grant and would not be taxed at the time that forgiveness was granted.

- However, the IRS guidance does state that, later, when businesses are preparing to make quarterly or annual tax payments, they are not allowed to deduct payroll and rent expenses that were used to get loan forgiveness. By not being able to deduct those expenses from their business income, those businesses have a higher taxable income, meaning theyll have a higher tax burden later.

When Secretary Mnuchin said, You cant double dip, this is what he meant. In other words, you have to pay taxes on this money at some point. It just wont be up-front when the funds are issued.

As we said before, many have taken issue with this stance, including lawmakers from both political parties.

Senator Chuck Grassley said, Im disappointed by the IRS determination that these business expenses are not deductible, especially since this issue was discussed during the development of the Paycheck Protection Program.

He went on to say that the IRS guidance went against the intent of the Paycheck Protection Program.

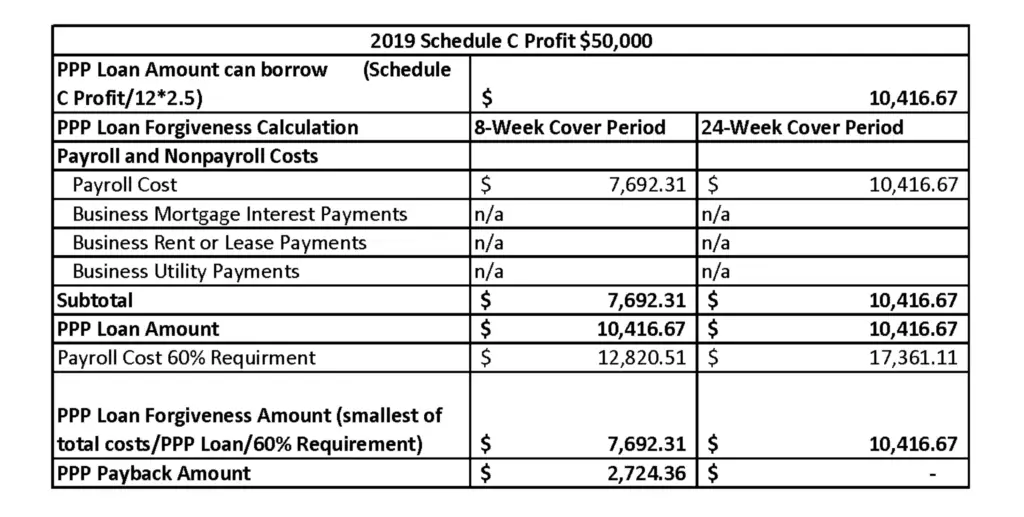

My Small Business Took Out A $100000 Ppp Loan We Plan To Use $55000 For Eligible Payroll Costs $30000 For Eligible Rent Mortgage Interest And Utilities And $15000 To Purchase Supplies We Are Keeping All Of Our Employees On Staff At Their Regular Salaries Is The Forgiveness Amount Zero Since Less Than 60% Of The Total Loan Proceeds Were Spent On Payroll

Although the business used less than 60% of the total loan proceeds for payroll costs, partial loan forgiveness is available. Based on current interpretations of the loan forgiveness program, the estimated loan forgiveness amount would be $85,000, not zero, calculated as follows. Because $15,000 was used for non-eligible costs, the potential loan forgiveness amount would be capped at $85,000. The $55,000 used for payroll costs is 64.7% of $85,000. Therefore, since more than 60% of the forgivable amount of the PPP loan was used for payroll, the estimated loan forgiveness amount would be $85,000. .

Read Also: Texas Fha Loan Limits 2020

Easy Steps To Learn How To Handle The Ppp Loan And Taxes

by Heather | Jan 18, 2021

Are you among the many businesses that received a PPP loan in 2020 to help your business get through the tough times? If so, nows the time to learn how to handle the PPP loan and taxes.

The most recent legislation passed by the US government has made some great changes for those who received the PPP loan. It also clarified points around handling the PPP loan and taxes. Finally, we got some clarity from the government about PPP loans on tax returns and expenses paid with the loan. Woohoo!

Lets dive in.

When Should My Business Submit A Loan Forgiveness Application When Can Lenders Start Submitting Decisions On Applications To The Sba

The SBA began accepting loan forgiveness decisions from lenders on August 10, 2020. Generally, borrowers will submit a Loan Forgiveness Application following the end of the covered period. A borrower may apply for loan forgiveness before the end of the loans covered period, provided that the borrower has used all of the loan proceeds for which its requesting forgiveness and the forgiveness application accounts for any salary reductions in excess of 25% for the full covered period . If a borrower does not apply for forgiveness within 10 months of the end of the covered period, it must begin making payments on the loan at that time. .

You May Like: Becu Auto Smart

Is The Ppp Loan Taxable After Its Been Forgiven

The PPP loan itself is supposed to be completely tax-free on the federal level. This means that you dont have to pay taxes on the funds you received from the loan whether they are forgiven or not.

Generally, a forgiven business loan would become taxable income. However, in this circumstance, Congress opted for these funds to provide further benefit during an economically trying timeand so they are tax-free for federal purposes. In fact, the IRS has said not even to report your PPP loan on your federal tax returns so as to avoid confusion and accidentally facing an underpayment penalty for these funds over the course of the year.

However, this doesnt mean that your forgiven PPP loan is completely tax-exempt, depending on where you live. Certain states have chosen to tax forgiven PPP loans, so youll want to check with your tax professional and be aware of the laws around this in your state before you submit your state tax returns. Some states also wont allow you to deduct your PPP loan expenses from your state taxes.

Aicpa Asks For Guidance On S Corp And Partnership Ppp Loan Forgiveness

Taxpayers urgently need guidance on Paycheck Protection Program loan forgiveness issues, the AICPA has told the IRS, and the AICPA has made recommendations proposing solutions to those issues.

The proposed solutions came in a letter sent March 15 from the AICPA Tax Executive Committee to two members of the IRS Chief Counsels office, asking for additional guidance and making recommendations on how to apply the Consolidated Appropriations Act , 2021, P.L. 116-260, and specifically Section 276 of the COVID-Related Tax Relief Act of 2021, enacted as part of the CAA. Section 276 of the act provides that expenses paid with forgiven PPP funds are deductible, that PPP borrowers are not to reduce any tax attributes, and that no basis increase shall be denied by reason of the exclusion of PPP forgiveness from gross income. Section 276 also provides S corporation and partnership PPP borrowers instructions for the tax treatment of the amount excluded from gross income due to PPP loan forgiveness. With tax filing deadlines approaching, practitioners and taxpayers need additional guidance on these provisions.

The AICPAs Paycheck Protection Program Resources page houses resources and tools produced by the AICPA to help address the economic impact of the coronavirus.

Accounting firms can prepare and process applications for the PPP on the CPA Business Funding Portal, created by the AICPA, CPA.com, and fintech partner Biz2Credit.

You May Like: How To Get Loan Originator License

New Advance Payment Requirements

Beginning April 2021, a provision in the FY21 budget requires that some vendors and operators, depending on amount of tax or excise liability from previous year, make an advance payment before the related tax return is due. This requirement will begin for tax periods ending after April 1, 2021.

This change applies to tax returns filed for the following tax types:

- Sales/use tax

I am a vendor who reported use tax on purchases on my sales and use tax return last year. Do I include the use tax I reported on purchases in the prior year for purposes of calculating my cumulative prior year sales and use tax liability?

No. Vendors who reported use tax are not required to include use tax on purchases for purposes of calculating their cumulative prior year tax liability to determine whether they are over the $150,000 threshold.

If I was not in business for all 12 months of 2020, how do I determine if Im required to make an advance payment?

If your cumulative tax liability was over $150,000 for the period of time you were operating during calendar year 2020, you are required to make advance payments beginning in April 2021. If your cumulative tax liability for 2020 was $150,000 or less for the months you were operating, you are not required to make advance payments in 2021.

If I was not filing and paying for most of 2020 due to the COVID relief extension, how do I determine if Im required to make an advance payment?

Is there a penalty for not making an advance payment?

A Handful Of States Are Looking To Fix The Problem But You May Not Like The Changes

Tax time is confusing and stressful under the best of circumstances. It could be even worse if you’ve taken out a loan from the government’s Paycheck Protection Program.

The tax status of the PPP has been muddled from the beginning. While these forgivable loans were never meant to be taxed as income, the Treasury Department and the Internal Revenue Service, under the Trump administration, held that business owners could not deduct expenses that were paid for with PPP. Congress disagreed, and in December 2020 put its position into law with the Consolidated Appropriations Act, which also contained a $900 billion relief package.

Unfortunately, that doesn’t quite settle the issue. Right now, 19 states tax forgiven PPP loans, either by including them as taxable income or disallowing deductions for business expenses made with the loans, says Katherine Loughead, senior policy analyst for the Tax Foundation, which has published a map showing the loans’ tax status by state. Those states include California, Texas, and Florida.

States have different methods for bringing their own tax regimes into alignment with federal law–or for refusing to do so. Many states use a process called “rolling conformity” to make sure their regulations match those of the federal government. Others use so-called static conformity, so that they match the federal rules as of a given date. States that use “static conformity” must proactively adopt more recent changes.

Also Check: Va Manufactured Home 1976