What Is A Home Equity Loan And How Do You Calculate It

Home equity is the stake you have in your property, as opposed to the lender’s stake. To calculate your home equity, subtract your current mortgage balance from the appraised value of your home. Over time, you build up equity in your home as you make payments on your mortgage. Home equity is one way to measure your personal wealth because you can borrow from your home equity in the form of loans or lines of credit.

Youll need a substantial amount of equity in your home to qualify for a home equity loan. A home equity calculator can help you figure out how much you can borrow.

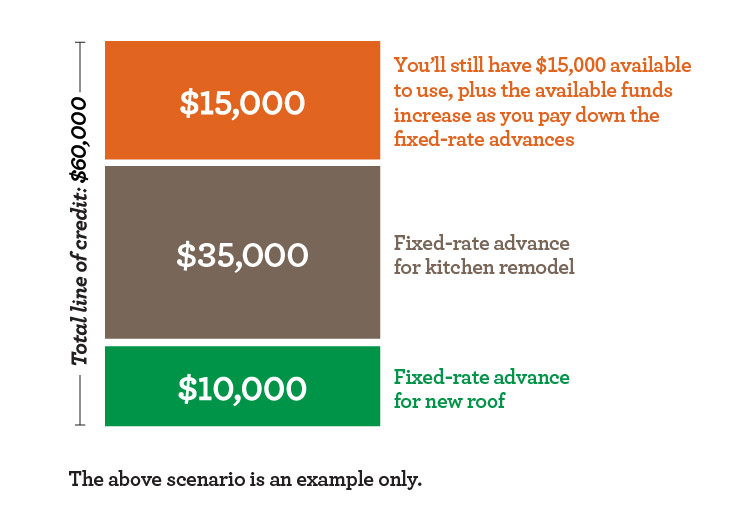

Annual Limits And Rate Lock Fees

Some lenders cap the number of fixed-rate balances you can lock in each year. For instance, you may be able to carry three fixed-rate balances total but only create two new ones in the same year.

Some lenders charge a nominal fee, such as $50 or $100, when you lock in a fixed rate on a balance. Others dont.

How Do I Apply For A Home Equity Loan

Applying for a home equity loan is similar to applying for a mortgage. You need to qualify with a lender or bank who is willing to lend you the money. First, the lender will first want to make sure you have at least 15% to 20% equity in your home. If you do, the lender will take into account your credit score , your income and your current debt-to-income ratio to determine whether you qualify and what your interest rate will be. You should be prepared to have financial documents like pay stubs and W2s in order, as well as proof of ownership and proof of the appraised value of your home. It’s important to interview multiple lenders to determine which lender can offer you the lowest rates and fees.

Also Check: Instant Approval Loans Bad Credit

Highlights From The Bank Of Canada’s July 13 2022 Announcement

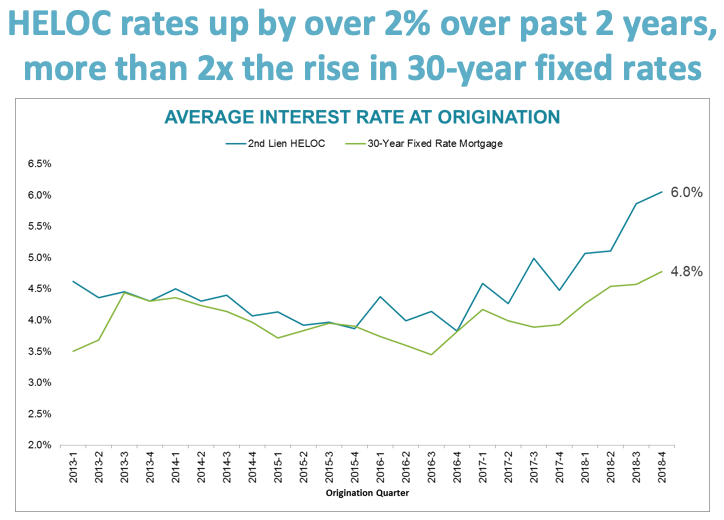

On July 13, 2022, the Bank of Canada increased the key overnight rate by 1.00%. This was the largest rate hike since 1998. The target for the overnight rate is now 2.5%.

- Canadians with home equity lines of credit saw their rates rise accordingly by 1%. They should calculate what their new mortgage payment is and budget for more increases to come this year.

- The Bank of Canada has made it clear that they will continue raising rates this year until inflation moderates. If you are considering getting a HELOC, be aware that HELOC rates will continue to rise in the likely event of further rate hikes.

Equity And Home Appraisals

To determine whether you qualify and how much money you can borrow, a lender will have your home appraised. The home appraisal will tell the lender how much your home is worth.

Rocket Mortgage will allow you to borrow around 90% of the equity in your home. To figure out the amount you could obtain through a home equity loan, youd determine your loan-to-value ratio. To do this, subtract the remaining balance of your primary mortgage from 90% of the appraised value of your home. For example, if your home is appraised at $400,000 and the remaining balance of your mortgage is $100,000, heres how you would calculate the potential loan amount:

$400,000 x .9 = $360,000=$360,000 $100,000 = $260,000

This means you could secure $220,000 if you obtained a home equity loan.

Don’t Miss: Which Loan Options Are Strongly Recommended For First Time Buyers

Tax Benefits Of Homeownership

Before the 2018 tax bill passed homeowners could deduct the interest expenses on up to $100,000 of debt from home equity loans & HELOCs, but interest on these loans is no longer tax deductible unless it is obtained to build or substantially improve the homeowner’s dwelling.

If you are planning on taking a large amount of equity out of your home it may make more sense to refinance your first mortgage, as first mortgages & mortgage refinance loans still qualify for the interest deduction on up to $750,000 of mortgage debt.

Homeowners who had up to $1 million in mortgage debt before the new tax law was passed will still retain the old limit even if they refinance their homes.

How Much Money Could You Save By Refinancing at Today’s Low Rates?

Our home refinance calculator shows how much you can save locking in lower rates.

What Are Predictions For Heloc Rates In 2020

Predictions for HELOC rates generally follow forecasts of prime rate, which in turn correspond to projections of the Bank of Canadas overnight rate. With the economy emerging from recession in 2020, economists expect that prime rate, the overnight rate and HELOC rates will all remain near long-term lows through 2022. For more information, please refer to our prime rate page.

Don’t Miss: How Soon Can I Refinance My Car Loan After Purchase

The Bankrate Guide To Choosing The Best Home Equity Loan

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure our content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Bankrate analyzes loans to compare interest rates, fees, accessibility, online tools, repayment terms and funding speed to help readers feel confident in their financial decisions. Our meticulous research done by loan experts identifies both advantages and disadvantages to the best lenders.

When shopping for a home equity loan, look for a competitive interest rate, repayment terms that meet your needs and minimal fees. Loan details presented here are current as of the publication date. Check the lenders websites to see if there is more recent information. The top lenders listed below are selected based on factors such as APR, loan amounts, fees, credit requirements and broad availability.

Big Banks Vs Small Banks

It’s the eternal questionDavid or Goliath? When you’re looking for low interest rates on a loan, there’s no clear-cut answer to which is better. In broad comparisons, similar interest rates can be found at small or regional banks as at large national banks. But within each category, rates can vary widely.

While the small town bank may know your name, its rates may or may not be competitive. Still, if you already have an account at a local bank, it’s a good place to start your search for a home equity loan. It may have an extra incentive to offer you a lower rate or some reduced fees in hopes of keeping your business.

One thing to be aware of is that some banks stop issuing new home equity loans and home equity lines of credit in volatile markets. For example, as of June 2022, Citi and Wells Fargo aren’t offering home equity loans. U.S. Bank does offer home equity loans and Bank of America only provides home equity lines of credit with a variable interest rate.

Don’t Miss: When Do Student Loans Resume

How A Heloc Fixed

Some lenders brand a HELOC with special names. However, the HELOC fixed-rate option generally works the same way no matter which lender you choose, though there are important differences in the details that might make one lenders product better for your situation than anothers.

In fact, some of the biggest lenders, such asBank of America have used fixed-rate home equity lines of credit to replace home equity loans, possibly because of new mortgage regulations they might find burdensome.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development .

Heloc & Home Equity Loan Qualification

The three primary things banks look at when assessing qualification for a home equity loan are:

- Available equity in the home: as mentioned above, banks typically allow a max LTV of 70% to 85%

- People with an excellent credit score of above 760 will get the best rates. Those with good credit of 700 to 759 will still be able to access credit, though typically not at the best rate. People with a fair credit score of 621 to 699 will typically be able to obtain credit, though at higher rates. People with poor credit scores may not be able to obtain credit.

- Debt to income ratio: lenders generally like borrowers to spend less than 36% of their pre-tax income on monthly mortgage & debt payments, though some banks may allow borrowers to obtain funding with DTI ratios as high as 43%

Read Also: How To Apply For Student Loan Forgiveness Due To Disability

Discover: Best Home Equity Loan For Low Rates

Overview: Discover is well known for its rewards credit cards, but this national bank also offers a full lineup of banking services, such as checking and savings accounts, personal loans and student loans. We chose this bank as the best for low rates because of its national reach and low rates.

Why Discover is the best home equity loan for low rates: Its APRs start at 3.49 percent, which is 1.21 percentage points below the average home equity loan rate as of late June 23, 2021. Thats also lower than six of the other lenders profiled on this page.

Perks: Discovers home equity loans allow you to borrow up to $300,000 against your home equity. You can choose a loan term of 10, 15, 20 or 30 years. Plus, borrowers wont pay origination fees, application fees, home valuation fees or cash at closing. Its a solid option thats available to most borrowers across the country.

What to watch out for: The best rates go to customers with excellent credit, so if your credit score needs work, you may want to look elsewhere. Also, borrowers who pay their loans off within 36 months may have to repay closing costs covered by Discover .

- LENDER:

How Do I Calculate My Home Equity Line Of Credit

As per the Office of the Superintendent of Financial Institutions , a HELOC can give you access to no more than 65% of the value of your home. It’s also important to remember that your mortgage loan balance + your HELOC cannot equal more than 80% of your home’s value.

To see how this works, let’s look at an example:

The maximum amount of equity you could pull from your home through a HELOC is $105,000.

Now, you still need to make sure that $105,000 doesn’t exceed 65% of your home’s value. To be sure, simply divide the HELOC amount by the value of your home:

In this example, you could access $105,000 through a HELOC, as it only amounts to 30% of your home’s value.

Don’t Miss: What Is Loan Interest Rate

Repaying A Home Equity Loan

After you receive your loan amount, get ready to start paying it back. Your monthly payments will be a consistent amount throughout the term of your loan and include both principal and interest.

You may think its best to choose a shorter loan term, so you can pay off your debt faster. Remember, a 10-year term will have higher monthly payments than a 15- or 30-year term.

Will My Monthly Payments Increase Or Decrease

If converting from a HELOC to a home equity loan would result in lower monthly payments, then it could be a smart move. But if it would lead to higher monthly payments, you might want to think twice about whether refinancing the HELOC into a home equity loan is a good idea. Before you sign any loan paperwork, a lender can give you a more accurate idea of what your monthly payments would be.

Read Also: Will Ally Refinance My Auto Loan

Evaluating Your Home’s Equity

You can calculate how much equity you may be able to borrow by dividing the amount you owe by the value of your home.

For example, say you owe $200,000 on a home worth $400,000. Thats $200,000 / $400,000 = 0.50 or 50 percent loan to value . This means that you have 50 percent equity in your home. Compare that number to your lenders maximum LTV ratio to see if you might qualify for a home equity loan.

Next, calculate how much you may borrow by multiplying your home’s value by the lender’s maximum LTV and subtracting your mortgage balance.

Say your lender allows you to borrow up to 85 percent of your home’s value. In this example, that would be $400,000 x 0.85 = $340,000. From there, you would subtract your mortgage balance: $340,000 – $200,000 = $140,000 as the maximum amount you may be eligible to borrow.

Home Equity Loan Requirements

Guidelines for home equity loans will vary from lender to lender, but youll typically need to meet the following general requirements to qualify:

43% maximum DTI ratio. Lenders divide your total debt by your pre-tax income to calculate your debt-to-income ratio, and the standard home equity guideline maximum DTI ratio is 43%.

620 minimum credit score. Although lenders may set the bottom score limit at 620, they may set more strict guidelines on your DTI or LTV ratio.

80% maximum LTV ratio. According to the FDIC, many home equity lenders set the maximum LTV ratio at 80%. However, some specialty home equity loan lenders will set higher LTV ratio limits.

Owner occupancy. Some home equity lenders allow you to borrow on a second home or investment property but at much lower LTV limits than a primary residence. Youll get the best rates and highest LTV ratios if the home equity loan is secured by a home youre living in.

Closing costs. Youll typically spend between 2% and 5% of your home equity loan amount on closing costs. Some banks and credit unions may offer special discounts if you open a checking or savings account and have your payment debited directly from your account.

Pros and cons of home equity loans

- Your payment will be fixed and stable every month.

- You may be able to deduct the mortgage interest on your taxes

- You can use the money for any purpose

- Your closing costs are typically less than cash-out refinance costs

You May Like: How Much Income Needed For Fha Loan

Getting A Home Equity Loan With Bad Credit

If you have poor credit, you may have a harder time getting approved for a loan, but it is still possible. If you’re interested in applying for a bad-credit home equity loan, the first step is to shop around with a few lenders. Since each lender has its own requirements, it’s possible one lender will be more accepting of poor credit scores and offer better rates than a similar lender.

Generally, you’ll have to meet the following criteria to qualify for a home equity loan:

- At least 15 percent to 20 percent equity in your home

- A minimum credit score of 620

- On-time bill payment history

- Stable employment or income history

If you don’t meet the requirements, you may want to consider getting a co-signer to increase your chances of approval.

Why Take A Home Equity Loan From Discover

One loan, multiple goalsGet the cash you need to tackle your to-do list. Consolidate debt, improve your home or finance a large purchase.

Erase expensive debts

Consolidate high-interest debt with a low fixed rate starting at 6.99% APR for second liens and save on monthly interest!

Access your application online, anytime

You can check the status of your loan 24/7 on any device using our secure website.

You May Like: How Many Loans Does The Average Loan Officer Close

What Is The Difference Between A Home Equity Loan And A Home Equity Line Of Credit

- Main

-

With a home equity line of credit , you get the flexibility to withdraw money as you need it up to a predetermined credit limit and repay the loan over a fixed term. Typically HELOCs have a variable interest rate that can increase or decrease over time. Generally, there is a fixed “draw” period, during which you may with draw funds, repay them or a portion of them up to a credit limit, similar to a revolving credit card. During the draw period, many lenders permit you to make interest-only payments. After the draw period ends, you can no longer request funds and are required to repay the outstanding balance over the remaining term of the loan. By contrast, a home equity loan gives you all of your funds upfront in a lump sum and usually comes with a fixed interest rate and monthly payment that never change for the life of the loan. Discover offers home equity loans and mortgage refinances instead of HELOCs.

Apply For A Home Equity Loan

To swap your HELOC for a home equity loan, youll submit a loan application. In order for your home equity loan application to be approved, youll need to meet the lenders requirements for credit scores, credit history, income, and home equity. After you apply, the lender will assess your creditworthiness, determine your eligibility for a loan, order an appraisal of your homes value, and assemble the necessary loan documents.

Recommended Reading: How Many Affirm Loans Can I Have

What Is A Home Equity Line Of Credit

A home equity line of credit is a revolving account that lets you borrow against your home equity at will. The lender secures it against your home, which is often why theyre called secured lines of credit .

The repayment terms are fully open, meaning that you can repay up to 100% of the loan in a lump sum payment anytime. The monthly payments generally consist of interest only, and the interest rate varies with the prime rate.