What To Do When You Need Money And Dont Have A Job

A no income loan can also be a great way to help you out financially while looking for a job. If you need money but dont have a job, you may want to consider acquiring employment. That way, you wont have to rely on loans to get you by. You dont need a draining full-time 9-5 job in order to earn enough money to pay for your expenses. In fact, there are many part-time jobs that pay well!

To find a job quickly, you can set up job alerts, so employment opportunities frequently pop up in your inbox. From there, all you need to do is select and apply for the opportunities that sound appealing to you. Looking for other tips on finding the best jobs, loan options, or budgeting your money? Head on over to the CreditNinja blog for helpful, accessible, and easy-to-understand information regarding your finances!

What Is Debt Service Coverage Ratio

The debt service coverage ratio is the ratio of the PITI Principal interest, Taxes, Association dues, and Insurance annual divided by the gross operating income as determined by the appraiser, current lease in place, or AIR DNA income projection divided by the PITI Principal interest, Taxes Association dues, and Insurance costs.

Alternatives To Personal Loans

- Home equity loan or Home equity line of credit . Both of these loans are secured with collateral your home. It may be easier to get loan approval for this type of loan than for a personal loan, especially if your credit scores arent high enough to be approved without collateral. These may also be alternatives to consider if you need to borrow a large sum of money.

- Borrowing from friends or family. If considering this as an option, be careful to outline each partys responsibility to limit misunderstanding, hurt feelings, and potential damage to the relationship.

- If you already have a credit card account, you may opt to use those available funds rather than apply for additional credit in the form of a personal loan.

Don’t Miss: How Long Will It Take To Pay Off Loan

Can I Borrow Money If I Am Unemployed

Even if you are unemployed, you can obtain a loan if you have solid credit and another source of income. If you have an unexpected job loss or are chosen to retire, lenders will consider extending you a loan as long as you can show them you will be able to make regular payments on time.

Obtaining a personal loan can be more difficult as a result of unemployment. You will almost certainly need to provide a source of income in addition to your regular source of income. Another factor that lenders take into account is your debt-to-income ratio. In addition to your credit score, lenders will be looking for evidence that you are capable of obtaining a loan. When you are unemployed, getting a personal loan can often be more difficult than when you are employed. If you do not have enough money to pay your bills on time, strong credit can be a positive sign when applying for a loan. Taking out a loan puts you at risk of both the lender and the borrower, depending on how you default.

Get A Flexible Personal Loan That Meets All Your Needs

FlexMoney is committed to offering one of the fastest installment loan services in Canada. Within minutes of submitting your loan application, we provide you with an instant decision. Once approved, we use the industrys fastest tools to transfer your installment loan to you as soon as possible. Our online personal loan products are designed for Canadians like you. Get your no-obligation offer and get the cash you need today.

Recommended Reading: How To Combine Mortgage And Home Equity Loan

Can You Get A Personal Loan With No Income Verification

Sunday, March 1st 2020, 3:11 pm

Borrowing money without having an income is possible.

Many people think its impossible to borrow without proof of income because lenders want to know how much youre making. While a lender will be interested in your income, their main concern is your credit score.

There are several no income verification loans that exist that allow those without a job or income to borrow extra cash. However, you may have to face things like high interest and short repayment periods. Understanding what your options are and improving your credit score will enable you to get a decent loan without paying too much.

Keep on reading to learn how you can get a personal loan with no income verification!

Personal Loan For A Self

If you dont have proof of income, youll want to focus on alternative sources of lending. For example:

Peer-to-peer lending lets you fill out an application and match with an individual investor. You get a risk rating based on your credit score and that determines your interest rates.

operate within a member-owned model. If you belong to the credit union, you can get a no-income loan and borrow from a pool of money that consists of other members deposits. Credit unions exist to serve their members, so they tend to be more willing to work with people who have alternative income situations or are temporarily unemployed.

Home equity loans are a type of second mortgage loan that may be available for those who want loans for self-employed individuals or independent contractors, but youll need very good to excellent credit. If you go this route, expect to pay high-interest rates. And be very careful only to take the no income verification home equity loan if youre sure you can pay it back because you could lose your home if you default.

You May Like: Payday Loan From Direct Lender

Borrowing Money And Debt

If you’re in debt you should stay in control. But don’t avoid it. Debt can quickly increase and before you know it you think you should borrow more in order to pay of debt. Don’t panic and things are gonna be alright. Here are some tips for you:

Look at this report by John Oliver on Last Week Tonight on what is called “predatory lending”. This is a fair warning!

What Are Installment Loans

Installment loans come in larger amounts between $$500 and $15,000 with lower interest rates than payday loans but higher rates than traditional personal loans. Lenders will need to verify your source of income, but it often doesnt have to be employment income. Some installment loans can accept government benefits such as CCB, disability or EI.

Installment loans may take longer than 1 hour to process but can still be much quicker than other types of loans.

Recommended Reading: Who Can Apply For Ppp Loan

Home Equity Loans Or Helocs

If you have enough home equity, you might be able to take out a home equity loan or home equity line of credit . To qualify, lenders typically require that you have at least 15% to 20% equity in your home. For example, if you own a home worth $300,000, the lender will require that you have between $45,000 and $60,000 worth of equity in your home.

Although home equity loans and HELOCs are similar in that your home is the asset that secures the loan, they operate differently. The former operates similarly to a personal loan in that the lender gives you a lump sum payment and you repay the loan in fixed installments with a fixed interest rate. However, a HELOC operates like a credit cardyou borrow on an as-needed basis and only pay interest on the money you borrow.

With both of these options, the lender can foreclose on your home if you fail to repay. Think twice before taking out this type of loan without a job. If youre unemployed and cant afford to repay the loan, avoid this option.

Cash Loans Without Poi Needed

You still have options if you need to skip the income verification process on your loan application, but theyre not going to come from a traditional lender. You may be able to get a secured loan, which can be a risky and expensive option.

Lenders generally rely on three things when considering a loan application your credit score, monthly income, and the payment history on your credit report. If you cant provide access to one or more of those things, a lender may refuse your business. But options still exist for securing funds without proof of income, including the options below.

You May Like: How Much Home Loan Can I Afford

What Is A Home Equity Loan

As an absolute last resort, you have the option to take out a home equity loan on your home. Home equity is the value of your house minus the amount of money that you owe on your mortgage.

If you decide to go through with a home equity loan, you will need to appraise your home. Home equity lenders want to see the current appraised value of your home to best determine how much they can lend you.

They also want to appraise your home to protect their interest. In the event that you default on your equity loan, the lender will take over your home to recoup their loss.

How To Compare Unemployment Loans With No Job Verification In Canada

Before you go ahead with your application for a no employment verification loan, compare lenders based on the following factors:

- Interest rates. Low interest rates can save you thousands of dollars in interest over the course of your loan.

- Fees. Keep an eye out for fees like NSF fees, late payment fees, origination fees and prepayment penalties. Steer clear of lenders that ask you to pay a fee before you get your loan.

- Term. Find a loan that is a good length for you. It should be long enough to make monthly payments affordable and short enough to save you money on interest.

- Repayment conditions. You should take time to find a lender that will work with you to set the best terms for your loan, including renegotiating payments if you cant afford them.

- Customer service. Aim to work with a reputable lender. You can check their online ratings or look at a comparison site like this one to see which ones are trusted by other customers.

Recommended Reading: How To Lower Student Loan Repayment

What Kind Of Personal Loan Is Best For No Income Loans

When you want to get a loan with no income, there are two main options: unsecured and secured personal loans. A secured personal loan is a type of funding where the lender takes partial ownership of a piece of collateral during the loan term. This collateral helps lenders for secured loans lessen their financial risk when lending out money. An example of a secured loan would be funding like a title loan or a home loan.

Alternatively, an unsecured loan is funding that requires no collateral. This means borrowers for unsecured loans dont have to give up ownership of any piece of their property in order to get a personal loan. Specifically, unsecured personal installment loans may make a good option for those who need low income loans.

Why should you consider a personal installment loan? To start, installment loans offer competitive interest rates and convenient monthly payments. Unlike some unsecured loans such as payday loans, installment loans provide the flexibility to adjust your payback plan with flexibility and ease. When your loan payment plan fits your unique financial situation, you can set yourself up for success to get your finances back on track and organized.

To get a no income loan like a personal installment loan, potential borrowers would need:

- Government-issued photo identification

- Proof of residency

- An active checking account

Personal Line Of Credit

A personal line of credit is a type of revolving credit account that allows you to borrow a sum of money and pay it off over time. Unlike a loan, you do not have to borrow the entire lump sum all at once. You can choose how much you want to borrow at a given time, and interest will only be charged on the amount of money you borrow. A personal line of credit does not come with fixed rates like personal loans do, so your payments may vary month to month.

Also Check: What Is An Fha Loan Florida

Loans Without Proof Of Income In 2022

Loans for individuals that dont need proof of income or employment are becoming more popular. Almost any stable source of income will suffice to meet the unsecured loan criteria of the lenders and lending services discussed below.

There are a few different kinds of loans that borrowers may get without regard to their income, and these loans can be valuable alternatives.

A job is one way many people bring in money each month, but it is far from the sole. Lenders might consider income from non-traditional sources, including investment returns, alimony, benefits, student loan earnings , etc., when deciding whether to approve a borrower for an unsecured loan.

Although a good credit score is preferred, a good score is sufficient to qualify for one of these loans. Theres also no need to deal with the hassle of a banks loan officer.

Ways To Pay For A No Income Personal Loan When You Dont Have A Traditional Job

Not everybody has income verification from a traditional 9-5 job. But that doesnt mean those people shouldnt be able to get a loan when they need funding! Many people dont have a traditional job but are self-employed or receive regular income through other means. For example, self-employed borrowers can prove their income via bank statements, tax returns, or bank records showing clients payments. Just because someone doesnt receive a regular pay stub doesnt mean they cant prove self-employed income!

What if you dont have qualifying tax returns and are not self-employed but currently unemployed or laid off? In that case, you may be worried you wont be able to provide income verification for a loan. However, depending on your situation, you may qualify for financial assistance that could help you prove income to get a loan!

Below are a few types of income documentation that multiple lenders accept for no income loans.

Read Also: How Many Loans Does The Average Loan Officer Close

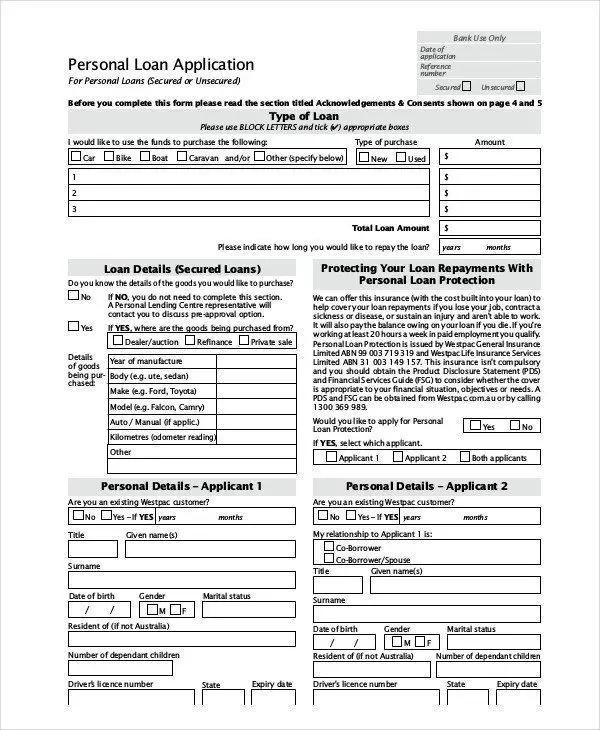

How Do You Apply For A Personal Loan

First and foremost, youll need to figure out how much cash you need to borrow since with a personal loan, youll borrow a fixed amount of money, says Doe.

If youve lost your job and youre considering taking out a personal loan to cover lost wages, consider how much you actually need to live on. Doe recommends you multiple your total monthly expenses by the number of months you think it will take to find a new job. This way, you can apply for a loan with that total amount in mind.

Before you head to a lender, look through your to make sure that everything looks accurate and you know your . In the event that something on your credit report doesnt look right, youll want to dispute the error before applying for a personal loan.

Knowing your credit score can help you shop around for lenders you know you will qualify for. Some lenders like and LightStream have online tools you can use to figure out if you would qualify for a personal loan without putting in a full application.

Select also has a comparison tool that allows you to review different loan offers. Youll need to answer 16 questions, including your annual income, date of birth and Social Security number in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your credit score.

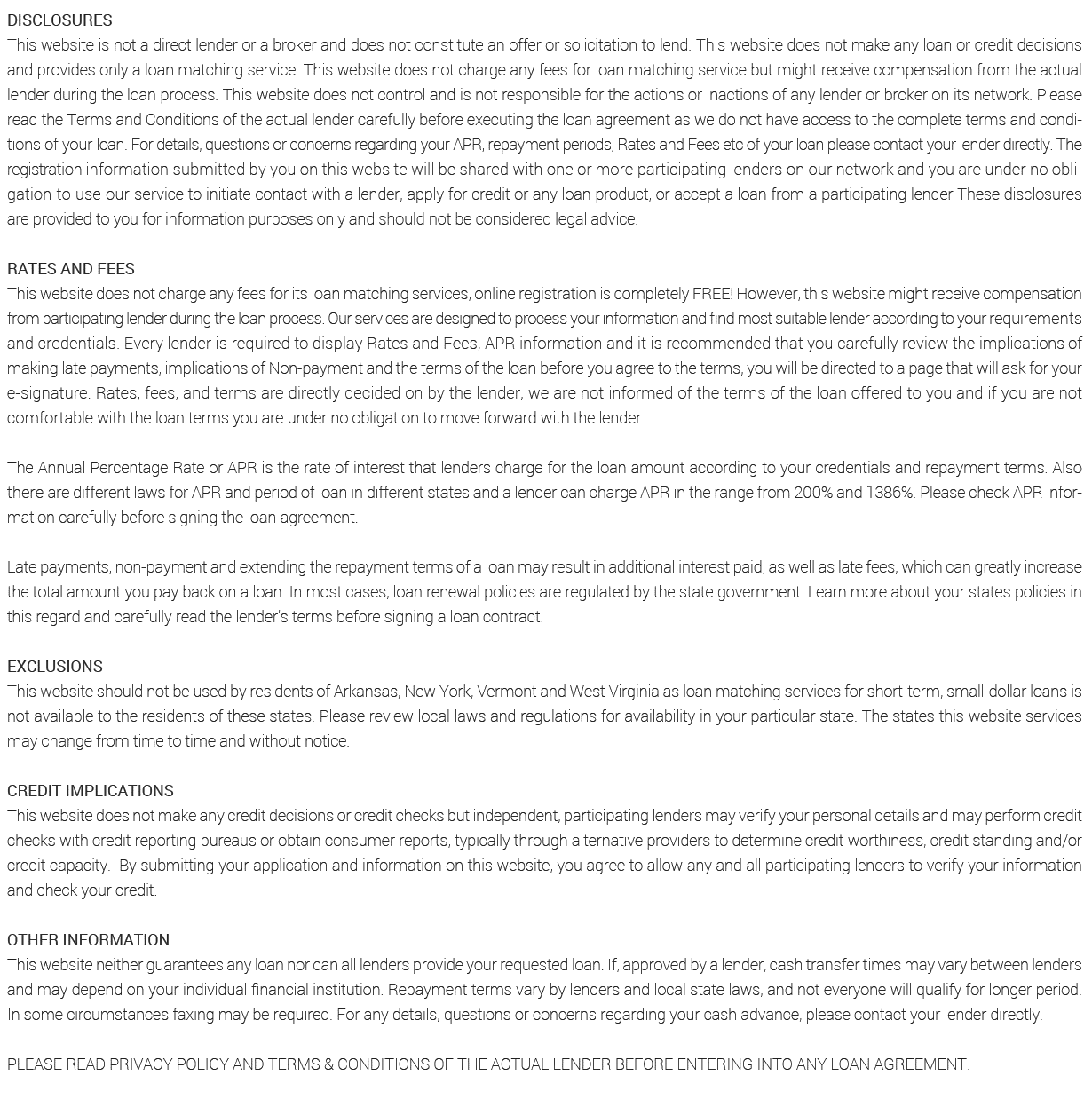

Review Personal Loans With No Income Verification Carefully

Our review of personal loans with no income verification highlights several online lender-matching services that do not require you to prove employment to get a loan, although you may have to show some form of income. Alternatively, you can get a loan from family and friends, a pawnshop, or a title loan company without proving income.

The easiest way to get a no-verification loan is to pledge collateral that has a value exceeding the loan amount. The bottom line is that even if you have a bad credit history and no job, you still may be able to borrow money if you know where to look.

Read Also: Navy Federal Auto Loan Requirements

What Is The Cost Of A Loan Without Employment Verification

If youre looking to get a loan and you are currently unemployed, its worth noting the risks that youll be facing. Below is a list of what to expect.

- Higher interest rates. As a person with no steady employment, youre going to be seen as a higher risk to the lender. To compensate for this risk, the lender will offer you higher interest rates on the loan.

- Smaller loan amounts. Because of the higher risk involved with lending to those without a steady job, lenders will feel less confident about giving out large loans.

- Shorter repayment periods. Higher-risk borrowers mean shorter repayment periods for the loans. These repayment periods can typically be a few months.

- Higher fees. Again, the riskier the loan for the lender, the more expensive the loan will be for the borrower.

Loans Without Employment Verification Frequently Asked Questions

What Can You Expect When You Apply For Loans Without Income Check

The process and the requirements are different when applying for a personal loan for self-employed with no proof of income. Instead of verifying your income, the creditors may check your personal credit score.

For your lenders, a good credit score means that you have a history of paying financial obligations on time, making you less of a risk for default or non-payment of your debts. While this alone does not guarantee loan approval, an exceptional credit score points you in the right direction.

For instance, lenders typically charge lower interest rates for people who have a good credit record. This allows you to save money on your debt repayment expenses, which should be your goal when applying for no income verification personal loans.

Aside from looking at your credit score, lenders might ask you to pledge or at least present proof of an asset that can be used as collateral, such as your car or property. You must prove that you or the lender can liquidate this asset into cash to repay your obligations in case of a default. The downside of pledging collateral when applying for personal loans no income verification is the risk of losing that asset should you fail to repay the loan.

Last but not least, lenders could require proof of alternative income aside from your main gig. These include Social Security benefits if youre retired, dividends from your investments, and public assistance funds, among others.

You May Like: Freddie Mac Loan Look Up