Why Can’t Customers Outside The Us And Canada Use Affirm

Affirm is available only to shoppers residing in the United States and Canada. The U.S. locations include the following:

- All states in the United States

- the District of Columbia

- Puerto Rico and

- the U.S. Virgin Islands

Affirm hopes to expand its services to customers outside the U.S. and Canada in the future.

What Are The Requirements For Affirm Personal Loans

There is no minimum credit score required for an Affirm loan. Affirm will complete a soft check on your credit – a bonus to many consumers, since it wont affect your credit score. Some borrowers will be required to submit a down payment, but once you have been approved, you can choose from three repayment period options.

Once you select your choices, your payment then proceeds as normal. Affirm will send you monthly reminders of your payments, which start one month after your loan is processed.

One of the nicest features of Affirm is that it offers instant approval and financing at the point of sale , whereas as a personal loan or credit card application will take a flat minimum of twenty-four hours to process. Affirm offers lower interest rates than most credit cards, particularly for consumers with excellent credit.

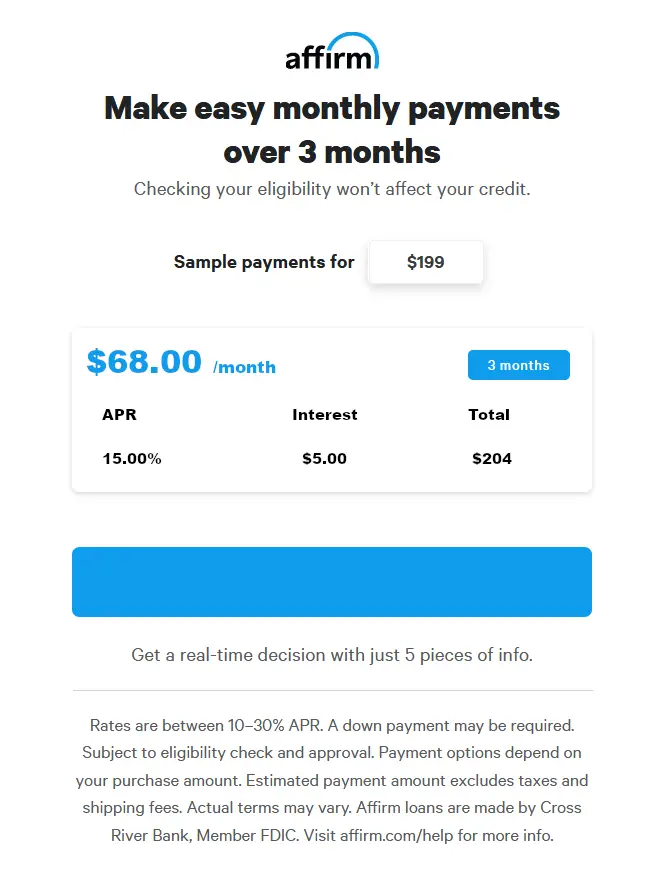

Does Affirm Charge Interest

If you read the fine print, Affirm does not guarantee that you’ll qualify for 0% interest financing. Depending on your credit and eligibility, your APR can end up being 0%, or 10% to 30%. A down payment may also be required for some purchases.

So how do Affirm’s interest rates compare to the average credit APR? The average credit card’s APR was 16.44% for all accounts that assessed interest, as of November 2021, according to the most recent data from the Federal Reserve. So it’s possible that Affirm could be a less expensive option, assuming you qualify for 0% financing.

But if not, then it’s possible that you could end up with a higher interest rate compared to what you might pay with a credit card.

You may also be wondering whether you can pay an Affirm loan off early to save money on interest. The answer is yes. And in case you’re curious about whether Affirm charges a prepayment penalty for doing so, the answer is no.

You May Like: When Is The Best Time To Refinance Your Car Loan

How To Increase Credit Limits

If you’re initially approved for a loan with Affirm but were hoping for a higher credit limit, there are a couple of things you may be able to do to improve it.

First, you can pay off your current Affirm loan on schedule. As mentioned, Affirm looks at how you’re managing existing loans when approving you for new buy now, pay later arrangements.

Next, you can work on boosting your overall. Things like paying bills on time, reducing debt balances, and limiting how often you apply for new credit could work in your favor for getting a higher credit limit with Affirm or any other lender.

Do Affirm Personal Loans Affect My Credit Score

A soft credit check by Affirm will not affect your credit score, but it should be noted that it shows up on your credit report as a consumer financial loan. This can signal as a red flag to some lenders, as it makes you look a riskier borrow.

Many consumers ask the question, How many Affirm loans can I have at once? The short answer is no more than one. It should not be used by individuals who are trying to rebuild their credit, as each loan exists as a separate line entry.

That being said, if used responsibly and only when absolutely needed , these loans do not do any more damage to your credit than any other loan, and can actually help build your credit if your history is nonexistent.

Don’t Miss: How To Transfer Credit Card Balance To Personal Loan

How Does Affirm Approve Borrowers For Loans

- Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number.

- Affirm verifies your identity with this information and makes an instant loan decision.

- Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if don’t have an extensive credit history.

Wide Range Of Interest Rates Between Merchants

Because Affirm negotiates interest rates with each merchant separately, there may be significant interest rate differences between merchants. So, while you may have gotten 0% APR on that $500 television last week from one merchant, you may be surprised to get a 19% APR on a $2,000 couch from a different merchant.

You May Like: What Kind Of Loan For Land

Why Was I Prompted For My Checking Account

Affirm may sometimes need more information about your finances and your ability to repay in order to make a credit decision. If you are prompted to link your checking account and would like to proceed, please provide the login information for your online bank account. Affirm does not store your online login credentials—they are transmitted securely to your bank.

If Affirm asks you to link your checking account, Affirm won’t be able to offer you credit if:

- Your bank is not listed

- You choose not to link your checking account

- You don’t use online banking

- The username and / or password you provide is incorrect

- You’re unable to successfully connect your checking account

Affirm Personal Bank Loan Costs & Words

While the additional retailers give additional package selection, the brand new cost and terminology differ widely. However, as a whole, we provide interest rates in order to range from 0% Apr investment to 31%.

Very fund are around for around three, half a dozen, otherwise 12 months. Although not, in certain points, such as for instance for smaller requests, you are able to get financing getting very little in general month. For big sales, a merchant youll allows you to pay during the period of 48 months. Of many unsecured loans features expanded fees symptoms, thus Affirm supplies the possibility of small-identity financial support with no higher rates of interest out of payday loans.?

Before you choose an agenda, youll be able to feedback a number of options, and you will decide which terms and conditions better fit your means.

There is good $17,five hundred maximum to the commands with Affirm. Typically, you only glance at the available percentage preparations, apply for one you like, immediately after which see if you happen to be acknowledged for your pick. You could have multiple Affirm commission plans at a time to have additional instructions.

However, you will want to understand that Affirm is refute your capital predicated on extent you have currently lent, as well as other situations. Thus, even though there is not any specialized limit towards the number of funds you will get, you can sooner be refused financing.

Recommended Reading: How Do I Apply For Sba Loan

What Credit Score Do I Need To Qualify For An Affirm Loan

You need to have a credit score of at least 550 to qualify for an Affirm loan. But other factors like income, employment and your debt-to-income ratio can also affect loan applications.

To create an account directly with Affirm:

To create your account with Affirm, follow these steps.

Once you have an account, you can apply for a loan through Affirm for purchases at its partner merchants. Each inquiry begins with a soft credit check, and you’ll learn whether you’re approved shortly after.

Affirm might ask for additional information about your checking account to verify your identity and ability to pay. If you’re offered a loan, confirm it to finalize your purchase.

Have More Questions About Affirm

How do I contact Affirm?

Email or call 855-423-3729 to get in touch with an Affirm representative.

Are Affirm loans insured?

Yes. Affirm funds its loans through Cross River Bank, which is insured by the Federal Deposit Insurance Corporation.

Is there a credit limit with Affirm?

No. Affirm considers each application individually. You can take out multiple loans, but excessive loans or unpaid debts could result in the rejection of future applications.

What should I do if I know I’ll be late on my bill?

Contact Affirm as soon as possible to let them know you might be late. While Affirm does not impose late fees, late payments can affect your credit and ability to borrow in the future. Make sure that your budget can handle your loan before signing any contract.

Don’t Miss: How To Get Pre Approved For Fha Loan

Can I Amend My Order After My Purchase Has Been Processed Can I Be Approved For A Higher Loan Amount If My Purchase Amount Increases

You cannot edit your order after you have confirmed your loan. If you want to add items to your purchase, apply for another loan with Affirm or use a different payment method.

*Disclosure: Subject to credit check and approval. Down payment may be required. For purchases under $100, limited payment options are available. See www.affirm.com/faqs for details.

How Do Returns Work When Using Affirm

If you’re not happy with your purchase, you can return the item and have the merchant credit your refund to your Affirm loan balance. Depending on the store’s policies and how much you owe, two things could happen:

- The merchant only refunds a portion of the cost: You may still have an outstanding Affirm balance in this case, which you’ll still need to pay off even though you don’t have the product anymore. Your payments will stay the same but you’ll have fewer of them, and your final payment may be for a smaller-than-normal amount.

- The merchant refunds the entire cost: In this case, you might get back more than you owe on your Affirm loan. Affirm will then zero out your balance and return any overpayment to your original payment method or by check.

Don’t Miss: When Do You Repay Student Loan

Who Accepts Affirm

Affirm works with many point-of-sale retailers. Its a popular option on Amazon, with almost all merchants offering Affirm payment options at the checkout.

Affirm also works with niche retailers and brands selling their products online. You can get loans for anything from fertility trackers to exercise equipment with Affirm loans.

Well-known brands like Apple Pay integrate with Affirm for instant loans on tech products. There are hundreds of other global retailers working with Affirm look for it at your next checkout.

Who Is Affirm For

Affirm is for anyone who wants to take their online or offline purchase on credit. Youll need a good credit rating probably a score of at least 550 to apply for Affirm financing. However, if you meet the lending criteria, you get instant approval on your loan and flexible payment terms.

When it comes to point-of-sale loans, Affirm has one of the best offerings, with a large loan facility and payments up to 12 months.

One of the best points of choosing Affirm is your ability to reschedule charges. If youre sure youre going to be late with your payment, log into your dashboard, and reschedule your payment date at no extra cost or late fee penalty. However, paying late could affect your credit score.

Don’t Miss: What I Need For Mortgage Loan

Can You Get Affirm If You Dont Have A Credit Card

You don’t necessarily need to have a credit card to use Affirm. If you don’t have a credit card and Affirm didn’t approve your loan application, it’s not necessarily because of the card. Having a thin credit file, poor credit, or not meeting any individual requirements set by the merchant you’re trying to finance a purchase with could all have contributed.

How To Apply For A Loan

After you’ve submitted some information about yourself to Affirm, you’ll be approved or denied a loan almost instantaneously. Affirm won’t change the terms and conditions that you agree to. You want to read the fine print carefully to figure out if you’ll be able to make your installment payments over the duration of the loan. Sometimes you’ll be approved for a loan, but will also have to make a down payment on it.

If you’re rejected for a loan, you’ll receive an emailing telling you why.

If you’re unsure about whether you want to apply for a loan, Affirm also offers consumers the option to ‘prequalify’ for a loan which allows you to see the value of the loan you would qualify for. You can prequalify for a loan in two ways: either through the app or the merchant’s website. Prequalification does not affect your credit score.

Read Also: How To Find Student Loan Number

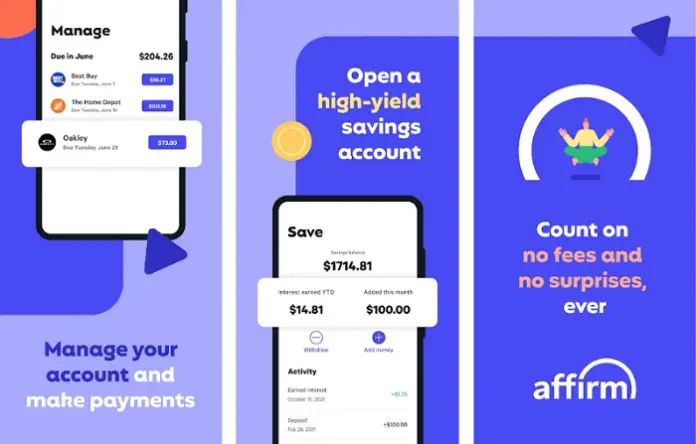

The Financing Options Offered By This Leader In The Buy Now Pay Later Field

Buy now, pay later is a financing method that more Americans are using to make discretionary purchases, especially online ones. In fact, at least 39% of consumers have tried this option, also known as a point of sale installment loan, at least once, according to a 2021 survey from The Strawhecker Group. One of the biggest players in this fast-growing financing field is Affirm .

Established in 2012 by CEO Max Levchin, who co-founded the company that eventually became PayPal, Affirm trades on Nasdaqit went public in January 2021and has a market capitalization of $10.6 billion.

Affirm purports to offer a new spin on consumer financing: helping people afford to buy the things they want without getting into unmanageable debt. Here’s a closer look at how Affirm works and the pros and cons of its short-term installment loan arrangements.

Creating An Affirm Account

Any citizen or permanent resident of the US or a US territory can create and use an Affirm account. However, due to Iowa and West Virginia state laws, you cant prequalify or get a loan there.

Creating an Affirm account requires your phone number for verifications at subsequent logins.

Affirm conducts soft credit checks for loan requests, which does not affect your credit score.

They also claim that your credit score and credit report doesnt affect your chances of approval. But, Affirm often considers other factors like your payment history and how long youve had an Affirm account.

Over 6,500 merchants partner with Affirm in the US to offer consumer lending to their shoppers. Top Affirm partner vendors include Adidas, Walmart, Peloton E-commerce, West Elm, and Purple.

With the Virtual card feature, theres no limit to where you can use your Affirm account online.

Also Check: How Much Loan Can I Get On 90000 Salary

How Affirm Can Improve

An Affirm personal loan could be a good option if you dont have access to a credit card or cant qualify for a low-interest personal loan. But there are a few areas where Affirm could improve:

- Have more consistent interest rates between merchants: With Affirm, the interest rate and loan term youre approved for can vary depending on which partner merchant youre shopping at there isnt one set rate or term for your credit profile. If youre making multiple purchases, youll have to apply for a different Affirm loan each time, and you might get a different interest rate with each one.

- Lower interest rates: The APR on Affirm personal loans can be as high as 30%. In some cases, you might be better off using a credit card if you can pay off the balance quickly or if you qualify for a card with an introductory 0% APR offer.

- Offer longer repayment terms: Most Affirm merchants have short repayment terms typically 12 months or less. If you need more time to repay your loan, you might be better off taking out a traditional personal loan.

- Offer loans that cover multiple purchases: Each purchase you make with Affirm counts as a separate loan and hard credit inquiry. Multiple credit inquiries might harm your credit, which means using Affirm could negatively impact your credit score. This might make it more difficult to qualify for other forms of credit later on.

Learn More: Loans for Bad Credit

How Returns Work When Using Affirm

If you have an issue with a purchase or need to return an item, Affirm advises customers to contact the merchant directly. You’d then have to follow the store’s policies for returns.

In terms of what happens to your Affirm loan after making a return, there are a few possibilities. For instance, Affirm can cancel your loan completely if the merchant has finalized the return. If the amount that’s returned to you is more than the loan, then Affirm can return this overpayment to you.

But the result may be different if the merchant only issues a partial refund or issues store credit in lieu of a refund. In that case, you would still be responsible for paying any remaining balance due on your Affirm loan, even if you’ve returned the item you purchased.

If you’re not able to resolve a return or refund issue with a merchant, you can initiate a dispute with Affirm. If you win the dispute with the merchant, Affirm will refund the full amount of the purchase along with any interest paid. But if the dispute goes in favor of the merchant, you’d still be responsible for paying your Affirm loan in full.

Read Also: Is Student Loan Refinancing Worth It

Start Raising Your Credit Score Today

An Affirm loan is a quick and easy way to finance large purchases at point-of sale. Offered at over 2,000 companies including Walmart, Wayfair, Casper, and Expedia, Affirm is known for requiring a soft credit check with no hidden fees.

In the sections below, we will discuss the Affirm loan in greater detail as well as how it will affect your credit.

What is an Affirm loan?

An Affirm loan is a point-of-sale payment plan that consists of monthly installments for consumers who are new to credit and want to make a large purchase. The companys point-of-sale financing appeals to many new buyers with since there is no minimum credit score required and no prior credit history requirements.

Affirm uses what is called a soft credit check, a soft credit inquiry that doesnt affect your credit score, to process their borrowers applications for approval.

Lenders at Affirm will also take a look at the extent of your credit and payment history. The company might even ask for a deposit or want to peer over your bank transactions to get a general idea of your spending habits before offering you a loan.

If youve already used a lot of credit and arent the sharpest at making payments, theres a good chance you wont get approved.

Pros and cons of Affirm personal loans

If youre trying to decide if an Affirm loan is the right choice for you, weigh the pros and cons. Here is a quick breakdown:

Pros:

Cons:

A few other things you should know about Affirm loans:

TELL US,