Rate Or Term Refinance On A Jumbo Loan

If you plan on doing a rate or term refinance on a jumbo loan, youll need to have a minimum FICO®Score of 700 and a maximum DTI of 45%.

The amount of equity youre required to have in the home to refinance will depend on the loan amount. For a loan amount of up to $2 million, you must have at least 10.01% equity in your home. For loan amounts up to $2.5 million, youll need to have more equity in the home .

Who Should Take Out A Jumbo Loan

How much you can ultimately borrow depends, of course, on your assets, your credit score, and the value of the property you’re interested in buying. These mortgages are considered most appropriate for a segment of high-income earners who make between $250,000 and $500,000 a year. This segment is known as HENRY, an acronym for high earners, not rich yet. Basically, these are people who generally make a lot of money but don’t have millions in extra cash or other assets accumulatedyet.

While an individual in the HENRY segment may not have amassed the wealth to purchase an expensive new home with cash, such high-income individuals do usually have better credit scores and more extensively established than the average homebuyer seeking a conventional mortgage loan for a lower amount. They also tend to have more solidly established retirement accounts. They often have been contributing for a longer period of time than lower-income earners.

Don’t expect a big tax break on a jumbo loan. The cap on the mortgage interest deduction is limited to $750,000 for new mortgage debt.

These are just the sorts of individuals that institutions love to sign up for long-term products, partly because they often need additional wealth management services. Plus, it’s more practical for a bank to administer a single $2 million mortgage than 10 loans valued at $200,000 apiece.

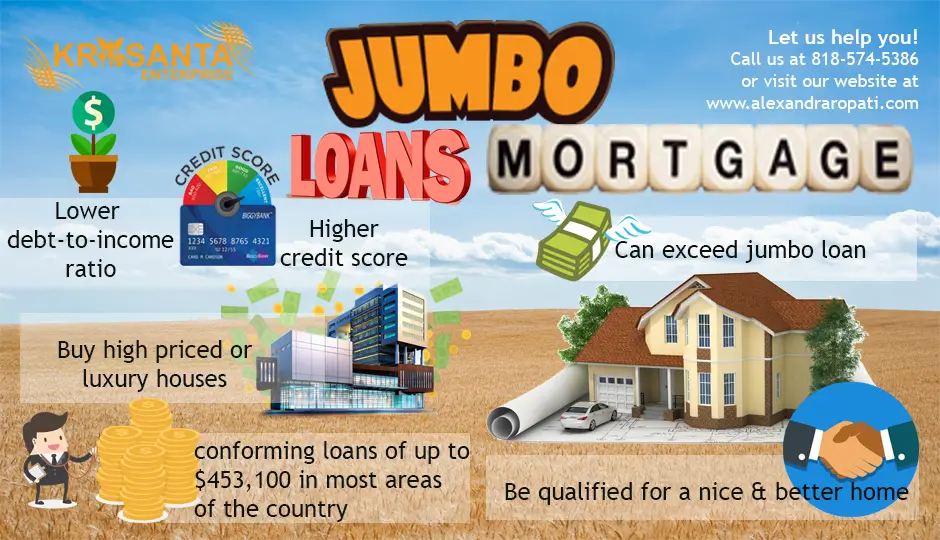

What Is A Jumbo Loan

Any loan that is for a larger amount than conforming loan limits set by government-sponsored enterprises Fannie Mae and Freddie Mac is a jumbo loan. Even if the borrower has excellent credit, jumbo mortgages are a higher risk for lenders since they arent guaranteed by a government agency and cant be purchased by government-sponsored enterprises.

Recommended Reading: Usaa Auto Loan Rates Credit Score

Are There Any Unique Requirements For A Jumbo Loan

Based on the price of the home and other underwriting considerations, some lenders may require you to have cash reserves on hand. It is not uncommon for lenders to require between three and 24 months of cash. There are several ways to satisfy this prerequisite for liquid assets, like retirement accounts. This condition can also be mitigated with a very low DTI or a sizeable down payment.

When Should Jumbo Loans Be Avoided

You may want to avoid a jumbo loan if you doubt your ability to meet its stiff qualification requirements. In addition, if you feel you may need to resell the property quickly at some point in the future, you may want to consider how energetic the local real estate market is. If the market is slow, or if the property is vastly more expensive than most neighboring properties, it may prove difficult to resell. Even in vigorous markets, potential buyers will likely be subject to the same lengthy mortgage-vetting process you’d have to go through as a buyer, and that can lengthen the amount of time required to complete the sale.

Qualifying for a jumbo mortgage can be a daunting process, and the loan will likely be costly in terms of interest rates and fees even for applicants with very good credit. If your sights are set on an exceptionally expensive property, and you have the means to qualify, a jumbo loan may be the best option for financing your dream home.

Recommended Reading: How Do I Find My Student Loan Account Number

Your Lender May Not Offer Jumbo Loans

Most mortgages fall within the conforming loan limits, so some lenders dont offer jumbo loans because of the increased risk and small pool of borrowers who want them. Jumbo loans are considered riskier because the bank is lending a large amount of money and borrowers tend to take longer to pay off. Ilyce Glink, CEO of Best Money Moves and author of 100 Questions Every First-Time Home Buyer Should Ask, suggests using a mortgage broker to find jumbo loan options, as brokers have relationships to many types of lenders.

Why Jumbo Loan Limits Matter

If the amount you want to borrow goes beyond the limits of a conforming loan and you need to get a jumbo loan, your lender may require:

-

A stronger credit score. The minimum credit score for a jumbo loan is typically at least 680, but some lenders may require an even higher one. The higher your credit score, the lower your interest rate is likely to be.

-

More cash in the bank. Knowing you have cash reserves, and not too much debt, makes lenders more likely to approve your jumbo loan.

-

A larger down payment. Requirements vary by lender and depend on your financial history.

-

An extra appraisal. Some lenders may require a second opinion on the homes value to be sure its worth the amount youre borrowing.

-

Additional fees. Since youre borrowing a larger amount, there may be some extra steps in the loan process, leading to higher closing costs.

-

Higher interest rates. Although this can fluctuate based on market conditions and individual lender offerings, jumbo loan rates may be higher than those for conforming loans.

Read Also: Does Va Loan Work For Manufactured Homes

Jumbo Mortgage Terms And Payment Structures

Jumbo loans can be paid in different terms, the most common of which are 15 and 30-year loans. You also have the option to choose from 10, 20, and 25-year terms. Expect shorter terms to have higher monthly payments, albeit with lower rates.

Only take the shorter payment term if youre sure you can afford it. The good news is a shorter term will save you thousands of dollars on interest charges. This allows you to pay off your mortgage sooner compared to a 30-year term.

Though its available in fixed-rate options, many borrowers tend to take jumbo loans as adjustable-rate mortgages . ARM terms usually have introductory periods for 3, 5, 7, and 10 years. They are commonly known as 3/1 ARM, 5/1 ARM, 7/1 ARM, and 10/1 ARM. ARMs account for at least a single digit percentage of the U.S. mortgage market.

How do ARMs work? The introductory period begins with a low interest rate. For example, if you have a 5/1 ARM, your interest rate will be the same for 5 years. After this, it will reset periodically depending on the market index. Your interest rate may increase of decrease for the succeeding years. For this reason, you must have adequate funds to pay for larger monthly payments in case rates get higher. This is risky for most borrowers, so many prefer fixed-rate mortgages.

Fixed-rate mortgages, meanwhile, maintain the same interest rate for the entire life of the loan. This is regardless of whether mortgages rate rise or drop throughout the term.

Role In Us Housing Bubble

As house prices rose as part of the United States housing bubble, there was a large increase in the number of jumbo loan applicants. Due to rising prices, many consumers had to take out jumbo mortgages in order to buy modest homes in big-city areas this option was no longer limited to high-end luxury residences.

Many of these new loans were 40- or 50-year amortization, or had an interest-only option, similar to subprime loans. That meant that the jumbo loan borrower would pay the loan back over a longer period of time, or could defer any repayment of principal for a few years .However from 2007, as prices fell and the number of foreclosures rose, lenders turned away from providing jumbo mortgages. Lenders that did remain in the jumbo loan market increased rates sharply, with rates up to 1.5 percentage points higher than for conforming loans. This withdrawal from the market led to a lack of lending available to fund the purchases of expensive homes, thus putting further downward pressure on house prices and completing a vicious circle.

The delinquency rate on jumbo loans rose dramatically, tripling over the course of 2009, and by February 2010, almost one in ten jumbo mortgages were ‘seriously delinquent’ .

Read Also: What Does Usaa Certified Dealer Mean

What Are Jumbo Loan Rates

Jumbo loan rates tend to mirror those for conforming loans. Currently, the benchmark 30-year fixed jumbo loan rate is 3.020%, according to Bankrates national survey of mortgage lenders.

The long-held practice was that jumbo rates were higher than conforming loans because they lacked the government guarantee, McBride says. However, in the years following the financial crisis we have seen that change as the secondary market for jumbo loans all but disappeared, loan performance was particularly strong relative to smaller conforming loans and additional add-ons were tacked onto conforming loans.

Rates on jumbo loans are also tied to the credit profile of the borrower, just like any other type of mortgage.

Credit scores are a critical input in the lending decision, McBride says. Lenders may use compensating factors such as higher income or significant assets to offset a deficiency in the credit score, and this tends to be more common in jumbo loans than the smaller conforming and government-backed loans.

What Is A Jumbo Loan In New Jersey

Loan limits are based on median home values, which means they can vary from one county and region to the next. When a person borrows more than these limits, it is considered to be a jumbo mortgage product.

So lets get specific. What is considered a jumbo loan in New Jersey? Depending on where you live, the conforming limit for your county is either $424,100 for $636,150 . So a jumbo mortgage would be anything above those amounts. These are referred to as the floor and ceiling limits.

Heres how it breaks down by county:

- Floor areas: The conforming loan limit is $424,100 in the following counties: Atlantic, Burlington, Camden, Cape May, Cumberland, Gloucester, Mercer, Salem and Warren. In these New Jersey counties, a jumbo loan is anything larger than $424,100.

- Ceiling areas: Due to higher home prices, the loan limit is $636,150 in the following counties: Bergen, Essex, Hudson, Hunterdon, Middlesex, Monmouth, Morris, Ocean, Passaic, Somerset, Sussex and Union. Anything above that amount will be considered a jumbo mortgage loan.

Recommended Reading: Usaa Used Auto Loan Rates

Jumbo Vs Conventional Loans Down Payments

If you want a very low down payment on a higher loan balance, it might be tough to find.

Some lenders set their down payments as low as 5% for jumbo loans. Some require much more. But if you want to put less down, things get more complicated.

Fannie Mae and Freddie Mac only allow a 3% down payment on loans at or below $548,250 as of 2021. Loans bigger than that, but below the local limit are considered conforming high-balance loans and are not eligible for 3% down.

The minimum down payment for a conforming high-balance loan is 5%.

For example, the high-balance loan limit in Orange County, New York is $726,525. If you needed a loan for $700,000, you would need 5% down if you chose a conventional conforming loan. Your loan amount would have to be $548,250 or less to put 3% down, even in this high-cost area.

Because theres a lot on the line, jumbo lenders as well as Fannie Mae/Freddie Mac lean toward larger down payments for big loan amounts.

How Big Is Jumbo Mortgage

A jumbo loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan. The maximum amount for a conforming loan is $510,400 in most counties, as determined by the Federal Housing Finance Agency . Homes that exceed the local conforming loan limit require a jumbo loan.

What is a jumbo loan 2020?

A jumbo loan is a type of financing where the loan amount is higher than the conforming loan limits set by the Federal Housing Finance Agency . The 2020 loan limit on conforming loans is $510,400 in most areas and $765,600 in high-cost areas.

Also Check: What Do Mortgage Loan Officers Do

Jumbo Vs Conventional Loan

Jumbo loans and conventional loans are both issued by private lenders, and neither is insured by a government agency. The difference between a jumbo loan and a conventional loan is that a conventional loan meets conforming limits set by government-sponsored enterprises and jumbo loans do not. If a loan amount is larger the governments conforming limits, then it cant be securitized by Fannie Mae and Freddie Mac. Private lenders then must set their own rules and regulation in order to make a jumbo, or nonconforming, loan to borrowers.

The interest rate on a jumbo mortgage loan is usually higher than a conventional loan, though weve seen that gap close since 2010. Similarly, jumbo mortgage loans typically require a higher down payment, but some lenders are lowering their minimum down payments to be closer to that of a typical conventional or conforming loan.

Find Out If A Jumbo Loan Is Right For You

Jumbo loans are for people who want to borrow more than the conforming loan limit allows. If you have a strong credit history, plenty of savings, and consistent income, qualifying for a jumbo loan could be the best way to finance your home. Either way, Better Mortgage can help you get a clearer picture of your homebuying potential and give you access to some of the most competitive rates in the industry. In as little as 3 minutes, you can get pre-approved with Better Mortgage and receive your free, no-commitment pre-approval letter. Well show you the types of loans and interest rates you qualify for so you can set your house-hunting budget.

Also Check: Does Va Loan Work For Manufactured Homes

Top 5 Bankrate Jumbo Refinance Lenders

Methodology

Bankrate helps thousands of borrowers find mortgage and refinance lenders every day. To determine the top mortgage lenders, we analyzed proprietary data across more than 150 lenders to assess which on our platform received the most inquiries within a three-month period. We then assigned superlatives based on factors such as fees, products offered, convenience and other criteria. These top lenders are updated regularly.

Also Check: What Does Jumbo Loan Mean

How Big Is A Jumbo Mortgage

4.6/5jumbo loanmortgageloanloanloanjumbo loananswer here

For 2019, the organization set the jumbo loan limit for most of the country at $484,350. It’s different outside the continental United States, however. For Alaska, Guam, Hawaii and the U.S. Virgin Islands, the limit rose to $726,525.

Also Know, what is the difference between a jumbo loan and a conventional loan? Conventional mortgages can either conform to government guidelines or they can be non-conforming. Jumbo mortgages tend to fall outside conforming loan restrictions, typically because they exceed the maximum amount backed by Fannie Mae or Freddie Mac.

Subsequently, one may also ask, what is the jumbo loan limit for 2020?

Jumbo Loan Limit 2020: Minimum and Maximum Loan AmountsFor 2020, the Federal Housing Finance Agency raised the maximum conforming loan limit for a single-family property from $484,350 to $510,400. In high-cost areas, the ceiling for conforming mortgage limits is $765,600 for 2020.

Is a jumbo loan a bad idea?

Jumbo loans aren’t necessarily badagain, you might even get a better interest rate. But conforming loans or government programs might be a better fit for you. If you’re in a high-cost area, you can often borrow much more than the standard limit.

Don’t Miss: When Can I Apply For Grad Plus Loan 2020-21

What If I Cant Find A House Within The Conforming Limits

If you want to own a home in some of the most expensive housing markets in the U.S., youll probably need a jumbo loan. Dont worry, though youre not alone. With the currently sizzling housing market, many people are finding that even modest homes require a jumbo mortgage in some areas.

Because of this demand, lenders are becoming more comfortable offering jumbo mortgages. Rocket Mortgage® currently offers the Jumbo Smart loan, which offers loans up to $2.5 million, doesnt charge PMI and seeks to streamline the amount of paperwork that lenders have traditionally required for amounts above the conforming loan limits.

Jumbo Loans In Nc And Sc

What is a jumbo mortgage?

A jumbo mortgage has a value that is over the established conforming loan limits. These limits are set by county by the government each year.

How much is a jumbo mortgage?

A jumbo mortgage is a home mortgage over $510,400 for most of the country. The cost of a jumbo mortgage includes fees associated with the application, the interest rate, and closing costs, which range from five to seven percent of the purchase price.

Can you get a jumbo mortgage with 10 percent down?

Some lenders will approve a jumbo loan with 10 percent down, though others require as much as 20 percent. In most cases, jumbo mortgages require a higher down payment. This is up to the lender and your other credit qualifications.

What is the limit for a jumbo loan?

The amount you can borrow with a jumbo loan depends on your circumstances, the area youre purchasing in, and more. So what amount do jumbo loans start at? For most of the country, jumbo loan amounts start at $510,400. Areas with a high cost of living have jumbo loan amounts starting at $765,600. These limits are set by the federal government as well as the lending programs within them and change annually.

Legal information

Also Check: Becu Auto Smart

How To Know If A Jumbo Loan Is Right For You

Jumbo loans are designed for higher-priced properties. They come with more stringent qualifying requirements, which could sometimes mean higher monthly payments and higher interest rates. Because of this, theyre best reserved for buyers with good credit, consistent income, and lower levels of debt.

If you do decide a jumbo loan is right for you, its imperative you shop around for your lender. Jumbo loan standards vary widely, and shopping around can help you get the best rate, lowest closing costs, and most appropriate mortgage for your needs.

Use Credible to get started and compare interest rates from multiple mortgage lenders in just a few minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.