When Is Pmi Required

You may have to pay for PMI if you’re purchasing a house or refinancing your mortgage. Lenders may require PMI on certain loans if:

- Your down payment is less than 20%. Most conventional lenders require a down payment of at least 20% of the purchase price. You can calculate your down payment percentage by dividing the amount you plan to put down by the lesser of the market value or purchase price of the home. If you can’t afford to put down at least 20% on a purchase, you may have to pay for PMI.

- For refinance loans, your loan-to-value ratio is over 80%. If you’re refinancing your current mortgage, most conventional lenders require an LTV ratio of 80% or less to avoid having to pay for PMI. You can calculate your LTV ratio by dividing your new mortgage amount by the market value of your home. If your LTV is over 80%, you may need PMI.

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these aren’t very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you don’t fall short of your annual tax and insurance obligations.

Finding The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

Read Also: Can You Add Onto An Existing Loan

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

How The Cost Of Mortgage Insurance Is Determined

If you dont have 20% down when you purchase a house, or if you dont have 20% equity in your house when you refinance, you will have to pay for mortgage insurance.; Many people want to know how they determine the cost of mortgage insurance, and heres what you need to know.

If you are getting an FHA loan, the calculation for mortgage insurance is easy.; If you have less than 5% down, the annual cost of mortgage insurance is 0.85% of the loan amount.; To get the monthly amount, divide that number by 12.

If you are putting 5% or more down with an FHA loan, the annual cost of mortgage insurance is 0.80% of the loan amount.; Again, to get the monthly amount, divide that number by 12.

One thing to note is that with FHA loans, you always have to pay for mortgage insurance, regardless of how much you put down.

If you are getting a VA loan, there is no mortgage insurance requirement, no matter what the size of your down payment is.

If you are getting a conventional loan , the 20% rule applies.; If you have less than 20% down, you need mortgage insurance.; If you have 20% or more down, you do not need mortgage insurance.

Here are the factors that go into the pricing of private mortgage insurance:

- Loan amount

- Loan-to-Value Ratio loan size divided by property value

- Debt-to-Income ratio total debts divided by total income

- Level of mortgage insurance coverage

- Property type

- Transaction type

Read Also: Can You Take Out More Than One Student Loan

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Mortgage Loan Calculator United Bank Of Union

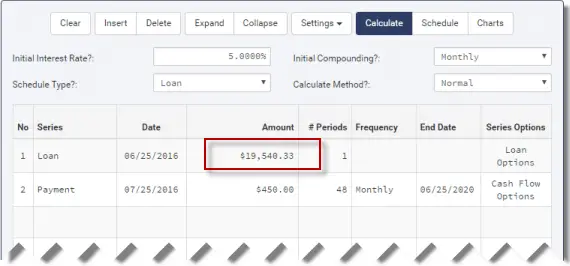

Quickly see how much interest you could pay and your estimated principal balances. Enter prepayment amounts to calculate their impact on your mortgage.

Note 1 This amount does not include escrow, homeowners insurance, property taxes, insurances, HOA fees and other costs associated with owning a home. This;

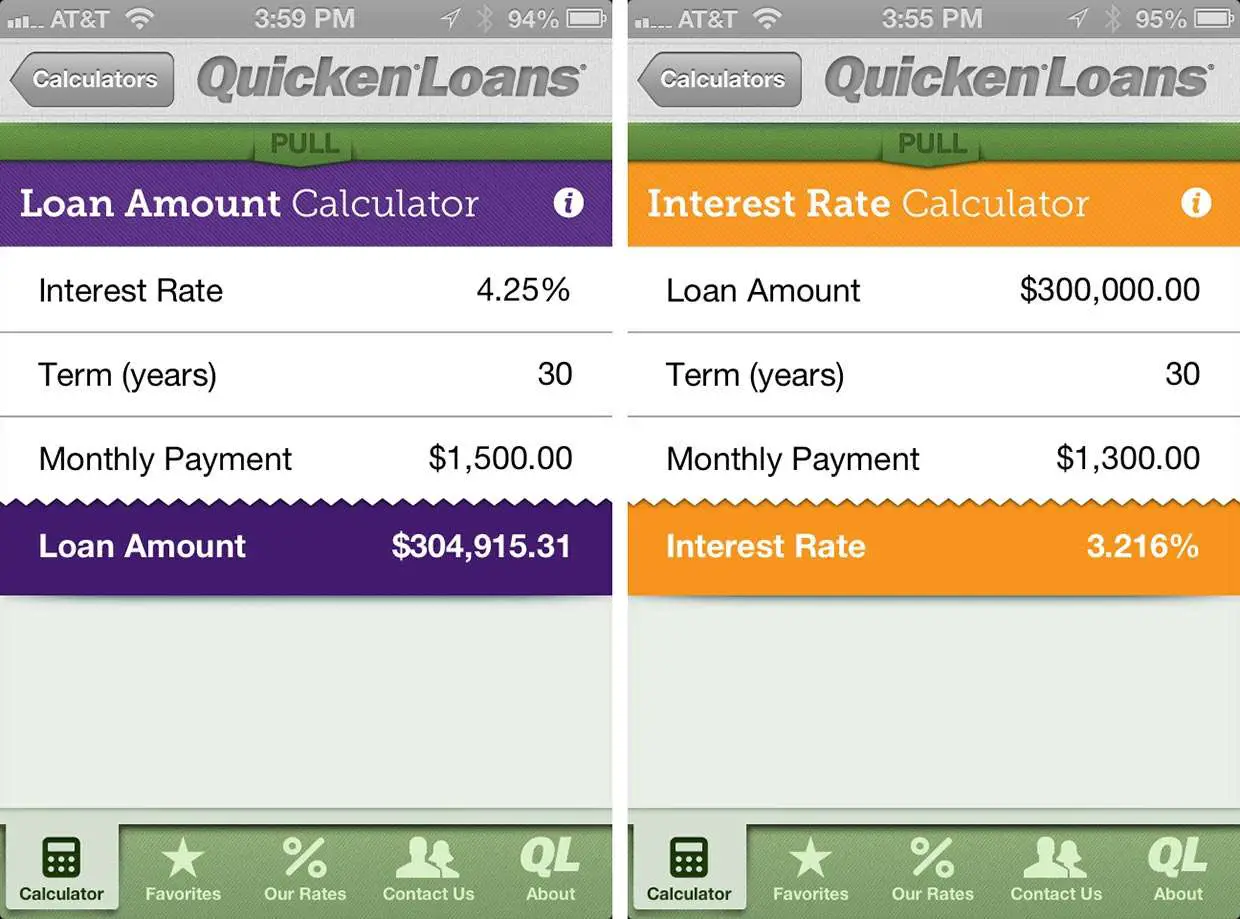

Calculate how much house can I afford with our mortgage calculator. Find out what you can realistically afford before you start looking.

Tell us what you can afford each month and use our home loan calculator to estimate the loan amount.

Buying a home? Use our free mortgage calculator to help you estimate your monthly mortgage payments and evaluate a range of borrowing amounts.

Jul 9, 2021 Lenders typically look at your gross income when they decide how much you can afford to take out in a mortgage loan. The 28% rule is fairly easy;

Not sure how much mortgage you can afford? Use the calculator to discover how much you can borrow and what your monthly payments will be.

Feb 1, 2020 How Do Lenders Assess Your Income? a track record of on-time payments that could indicate youll be a responsible mortgage borrower.

What Other Expenses Does Homeownership Entail I = Interest rate on the mortgage; N = Number of periods . A good way to remember;

A fixed rate mortgage will keep your monthly payments at the same amount and a variable rate mortgage could mean less interest, depending on how the market is;

Read Also: How To Apply Loan In Sss

What Factors Determine Mortgage Rates

Lets start by answering the question: how does mortgage interest work? Youll either have a fixed mortgage interest rate or a variable rate, depending on the type of mortgage you choose.

Fixed-rate mortgages are more popular because they provide an interest rate that never changes over the life of the loan. The rate you start with is the rate you end your loan with. That gives you predictable monthly payments that wont change.

Variable rates, on the other hand, are interest rates that can change with the market over the life of your loan. These rates start out as fixed for a period of time and then change to rates that fluctuate depending on the market and other factors.

No matter which type you opt for, your mortgage rate will determine how much interest youll pay for the money you borrow over the life of your loan.

But how do interest rates work, and how are they determined, when it comes to a mortgage loan? A handful of factors play a role in determining average rates in the market, which is the starting point for the rate youll be offered. You also bring unique factors to the table ;like your credit score and your other existing debts and these factors will further shape the rate you get.

So, how are mortgage rates determined? Here are the broad strokes that lenders consider:

Key Factors That Can Affect How Mortgage Rates Are Determined

Buying a home has been a dream come true for some through outright purchase, yet some others could not achieve it even through a mortgage because some of the factors that affect how mortgage rates are determined did not favor them.

Every lender has a way of arriving at the interest rate given to borrowers, the interest rate usually varies because of the differences in the circumstances that surround each person.

These key factors that can affect how mortgage rates are determined are essential for the security of both the lender and borrower. It also helps to seal the deal of agreement.

How Mortgage Rates Are Determined

Read Also: Should I Refinance My Truck Loan

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

To learn more about how much of a mortgage loan you can afford to borrow, check out our home affordability calculator. If youre ready to get started, you can apply online or give us a call at 452-0335.

How Do I Use The Maximum Mortgage Calculator

To use our maximum mortgage calculator, all you have to do is:

- Input the interest rate you expect to pay on your mortgage.

- Select your loan term from the drop-down menu. The loan term represents the number of years itll take you to repay your mortgage.

- Input your monthly income and that of your co-borrower. That could be your spouse, next-of-kin, etc.

- Under the Monthly Liabilities section, put in any usual repayments that you have to make on a monthly basis.

- Under the Monthly Housing Expenses section, select the appropriate answers from the list provided.

Don’t Miss: How To Apply For Direct Loan

Mortgage Calculator: How Much Can I Borrow Nerdwallet

Most lenders require that youll spend less than 28% of your pretax income on housing and 36% on total debt payments. If you spend 25% of your income on housing;

Mortgage lenders calculate metrics called front-end and back-end ratios by plugging your annual salary into a mathematical formula. Your front-end ratio, also;

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit;

Borrowers With A Low Down Payment

Many of todays buyers, especially when purchasing their first home, find saving for a down payment challenging. As housing costs rise and people are saddled with student loan debt, many folks need a loan with low down payment requirements.

FHA loans require only 3.5 percent down . This is good news for folks who would otherwise be required to make a larger upfront payment.

You May Like: How To Get Pmi Off Fha Loan

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

What Are My Options If The Result Is Less Than I Need

In this case, you may find that adjusting the loan term enables you to meet your requirements. Although it will mean repaying more in total over the course of your loan, the lower monthly repayments could help you to afford more than your initial result suggests.

Alternatively, you can experiment with different interest rates to get the best options delivered directly to you, click the Get the FREE Quote button to get in touch with lenders who will be able to assist you.

Read Also: What Kind Of Loan For Land

What Credit Score Do I Need To Buy A House

Credit scores do not factor into the mortgage calculator directly, but they have a major influence on the interest rate charged on your loan. are designed to predict your likelihood of defaulting on a loan, or going 90 days without making a payment. People with lower credit scores are statistically more likely to default than those with higher credit scores. A widespread lending industry practice known as risk-based pricing typically assigns higher interest rates to loan applicants with lower credit scores and reserves the lowest rates for applicants with high credit scores.

Lenders make their own determinations, based on prevailing interest rates and their own lending strategies, when deciding which credit scores ranges they will assign which interest rates. Because each lenders approach is different, its prudent to apply to multiple lenders when seeking a mortgage, because some may offer you a lower interest rate than others.

Can You Reduce Or Eliminate Pmi

If you’re concerned about this extra expense, you’ll be relieved to know that PMI usually ends before your loan does since lenders only require you to pay PMI while your LTV is above 80%. Once your LTV is below 80%, you can request to stop paying PMI.

To determine when your loan will reach the point where you no longer need PMI, lenders use an amortization schedule. If you opted to pay PMI at closing, your lender already used this schedule to calculate your total PMI amount. In most cases, you can’t reduce or get a refund for part of your upfront premium.

If you pay a monthly premium, you may be able to eliminate PMI a little early since lenders end PMI automatically when you’re;scheduled to reach the 78% LTV point. You may qualify for early PMI termination if you meet the following criteria:

- Your LTV is 80% or lower

- Your loan started on or after July 29, 1999, when the Homeowners Protection Act began

- You’re current on your mortgage payments

Call your lender to cancel PMI early if you meet these qualifications. Typically, your lender will request a broker price opinion to confirm the current market value of your home. Your lender needs this data to calculate your current LTV. If the value of your home has decreased significantly, your LTV may have increased, which could disqualify you for early PMI termination.

Read Also: How Much Business Loan Can I Get

Cherry Creek Mortgage Best For First

Cherry Creek Mortgage, which also does business as Blue Spot Home Loans and under a few other names, lends mortgages in 33 states.

Strengths: Cherry Creek Mortgage offers several low-down payment loan programs, including Conventional 97 and HomeReady loans and FHA, VA and USDA loans. The lenders website includes educational resources for first-time homebuyers, including a free downloadable guide to homeownership.

Weaknesses: Cherry Creek Mortgage isnt available in every state, and for FHA loans, it requires a minimum 620 credit score, which is higher than what some other lenders will accept.

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

Don’t Miss: When To Take Home Equity Loan

Show The Seller Youre Making A Serious Offer

Youve probably heard of earnest money, but maybe you arent quite sure what it is. Think of it as your security deposit.

Earnest money tells the seller youre serious about buying their home. If you follow through with the contract, the money will be applied to your purchase. If you break the terms of the contract, you risk forfeiting the money to the seller.

There is no minimum requirement for earnest money. Youll negotiate an amount with the seller. Then, within a few days of the seller accepting your offer, youll deposit the earnest money into an escrow account.

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to breakeven in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

Recommended Reading: When Do Student Loan Payments Start After Graduation