Yes There Are Different Types Of Small Business Administration Loans But All Require A Core Set Of Documents Heres How You Can Apply To Get A Loan Via The Sba

Tags:Business loans

If youre planning to expand your business or upgrade your equipment, youre likely considering the Small Business Administration loan program.

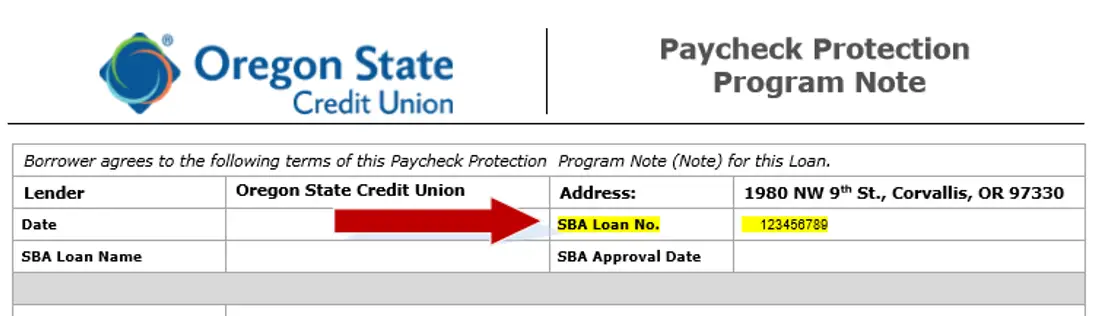

To be considered for an SBA loan, you need to apply for a conventional loan under SBA guidelines with one of the organizations banking partners. The SBA provides a loan guarantee to its partner lenders, allowing them to offer greater flexibility in terms and rates.

While there are different SBA loan programs, heres what they have in common: All applications share a common set of paperwork that must be filed.

This core set includes the following:

Other Sba Loan Documentation Requirements

If you have a 20% or more stake in any other business or own rental properties, youll also need to provide documentation such as financials and the appropriate operating agreements for those businesses. These are used to verify your ability to repay the loan. The overall goal is to show a lender that your company is well managed and has an attainable plan for profitability. Prepare a thorough business plan that includes projections of how you expect the business to perform in the next three to five years.

Much of the speed of your application process will depend on your ability to provide timely and accurate documentation to your lender. Weve developed an SBA loan document checklist to help you get all the information you need to streamline your loan process.

Choose An Sba Loan Program

Youve determined that you fit all of the requirements for obtaining an SBA loan. Now, the next step is to understand the SBA loan programs that are available and which works best for you. Each program has specific rates, terms, and maximum loan amounts, as well as requirements for how the money is used.

Youll need to evaluate your business needs to decide which program is the best fit.

| Loan Program |

|---|

| Review |

7 Loans

SBA 7 loans are the most popular among small business owners. This is primarily because of the extremely favorable terms and the flexibility with how funds can be used. With the 7 program, loan proceeds can be used toward just about any business expense. This includes purchasing equipment or inventory, acquiring a new business, renovating new facilities, working capital, or even refinancing old, high-interest debt. Standard 7 loans have a maximum loan amount of $5 million.

Through the Community Advantage program, underserved communities can receive financing when traditional lending isnt a good fit. The Veterans Advantage program offers the same great benefits along with reduced guarantee fees. Express loans offer less funding but guarantee an approval response within 36 hours. Its important to note that loans through the Express program come with a slightly higher but still competitive interest rate than other 7 loans.

| Loan Amount |

|---|

|

Base rate + 2.75% |

Microloans

504 Loans

| SBA 504 Loans |

|---|

|

10% – 30% |

SBA Disaster Loans

Also Check: How Much Do Loan Officers Make In Commission

What Are The Sba 7 Loan Collateral Requirements

As stated above, lenders generally like to see that you have some collateral in the event that you default on the loan. However, the SBA does not permit a lender to reject an application simply because collateral is not available. How much a lender will require, however, depends on your creditworthiness, ability to repay, revenue, and the loan amount. Expect a smaller loan to have smaller collateral requirements loans under $25,000 may not require any at all.

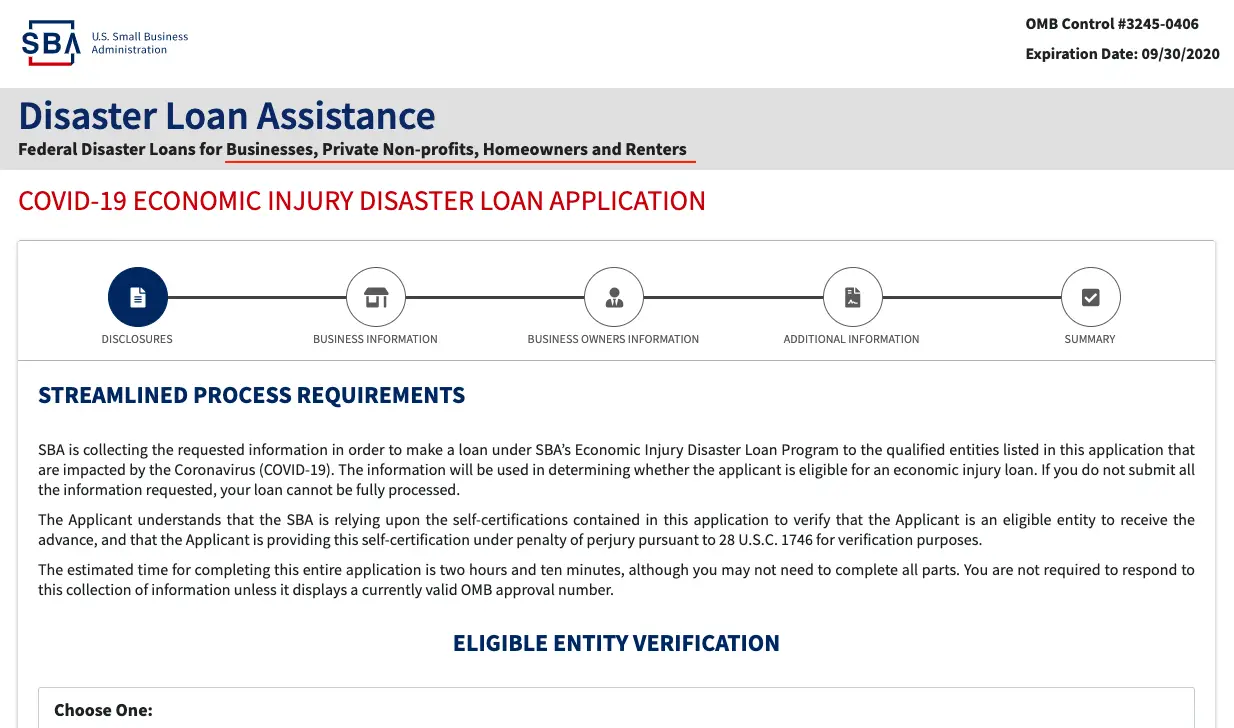

Who Qualifies For Eidl

You can apply for an Economic Injury Disaster Loan if you can demonstrate that your business has suffered severe economic hardship because of the pandemic. You no longer need to be unable to obtain loans from elsewhere .

Also, independent contractors who work for a separate business can qualify if theyâre able to prove theyâre separate from that business .

Currently, businesses in all U.S. states and territories are eligible to apply.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Make Sure Youre Eligible Based On The Loan Requirements

SBA loans are highly competitive. As such, you need to meet the following SBA loan requirements:

- You have a U.S.-based, for-profit business in a relevant industry.

- Your business meets the requirements to be considered a small business.

- You have been in business for at least two years.

- Youve invested equity in your business.

- Youve exhausted all other funding options.

Check If You Meet Sba Lending Requirements

Before you even fill out an application or talk to a lender, the first step to obtaining an SBA loan is to make sure that youre qualified to receive one. In order to obtain a loan from the SBA, your business must qualify as a small business under the organizations guidelines. Typically, this means that your business must have no more than 500 employees, although this number could rise based on your industry. Net annual income should not exceed $5 million, while the business net worth shouldnt be more than $15 million.

To be eligible for an SBA loan, the business must also be operated and headquartered in the United States. The small business should be for-profit and not engaged in illegal activities. Businesses involved in lending, investing, and real estate rentals do not qualify for most programs.

Depending on which loan program you select, there may be additional requirements. For example, only veterans, service members, or the spouses or widows of veterans or service members can apply for the Veterans Advantage program. The Community Advantage program is limited to underserved areas, which include low-income communities and businesses owned by women, minorities, and veterans.

Don’t Miss: Usaa Prequalify Auto Loan

Eligible Ways To Use The Loan

You may use the loan proceeds for any of the following: payroll costs, salaries, sick leave, rent or mortgage payments, material costs, and pre-existing debt. While you are able to receive other financial assistance programs from the CARES act in addition to your SBA disaster loan, you will need to have separate business use cases listed for each program.

General Sba Loan Requirements

While the Small Business Administration offers a handful of different loan products, most share the same general requirements for anyone looking to borrow. These have generally not changed much over time, and you can expect to have to meet these qualifications before being considered a serious candidate for SBA loans. Know that the following arent black and white if, for example, you dont have a solid business credit history but have a decent personal credit score, you may still qualify.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Businesses Can Apply For Eidl Reconsideration Appeals And Increases After December 31st

The deadline to apply for a first-time EIDL loan is December 31st, but the Covid EIDL program will continue to process applications after the deadline. If you are denied an EIDL loan you have six months from the date of denial to request reconsideration. For example, if you apply for an EIDL loan today and do not hear back until February 10, 2022, you have until August 10, 2022, to apply for reconsideration. Any appeals must be made within 30 days of the date of decline.

Businesses have two years from the origination date to request an increase, even past this December. If, for example, you are approved for an EIDL loan on December 1, 2021, you have until December 1, 2023, to request an increase. This holds true as long as the SBA has the available funds.

Currently, the SBA still has close to $100 billion allocated to EIDL funding, but that may quickly dwindle as more businesses apply and request increases. The best option is to request reconsideration or an increase right away, while the SBA has the funds available.

Get Your Guide To Sba Loans

While this cheat sheet of SBA loan requirements is not exhaustive, it should give you a good idea of the most prominent things the Small Business Administration, as well as an approved intermediary lender, will review. By preparing these documents in advance, you will set yourself up for a far less stressful process when it comes time to submit your SBA loan application.

Don’t Miss: Pre Approved Auto Loan Usaa

Sba Community Advantage Loans

A startup that doesnt meet the eligibility criteria for the standard SBA 7 loan should consider applying for the SBA Community Advantage program. This program offers very similar rates and terms to the traditional 7 program with just a few minor differences.

One of the most significant differences is the amount that can be borrowed through this program. Borrowers can receive up to $250,000 with an SBA Community Advantage loan.

Guidelines for how money is spent are the same as standard SBA 7 loans. Funds from the Community Advantage program can be used to purchase another business, finance equipment, or for just about any business purpose.

While the lowered maximum loan amount is a drawback, this program can be extremely beneficial for startups. This is because Community Advantage loans are designed for under served communities, such as low-income areas. Startups are qualified to receive these loans.

Businesses that have been operating for two years or less that have been disqualified from other loans may receive a Community Advantage loan if all requirements set by the SBA have been met.

Sba Loans For Established Businesses

Benefit from easier qualification, longer terms and lower down payments on fixed assets than most standard loans.

You own a for-profit business that does not generally qualify for conventional credit.

- You own and operate a for-profit business

- Your business is legally organized as a sole proprietorship, corporation, partnership or LLC

- Your business does not generally qualify for conventional credit

Get a 1.99% interest rate for the first 6 months on qualifying Small Business conventional and SBA secured term loans. Loans from $100,000. Apply by September 30, 2021 and close by January 31, 2022.

- Get a 1.99% interest rate for the first 6 months on qualifying Small Business conventional and SBA secured term loans. Loans from $100,000. Apply by September 30, 2021 and close by January 31, 2022.

Benefit from no upfront fees on secured loans plus no appraisal fees on your commercial real estate secured loan

- Benefit from no upfront fees on secured loans plus no appraisal fees on your commercial real estate secured loan

- Qualifying loans starting at $100,000. Exclusions apply

Take advantage of a 25% discount on loan administration or origination fees.Offer valid for veterans of the U.S. Armed Forces on new credit facility applications submitted in Small Business.

- Take advantage of a 25% discount on loan administration or origination fees.

- Offer valid for veterans of the U.S. Armed Forces on new credit facility applications submitted in Small Business.

Recommended Reading: What To Do If Lender Rejects Your Loan Application

Faqs About Sba Loans For Startups & New Businesses

Yes. Startups can qualify for SBA loans as long as they can demonstrate the ability to repay the loan.

To qualify for an SBA loan, youll need to provide proof that your business is legitimate and you have the ability to repay the loan. Depending on the loan program, you might have to provide documentation like:

- Business plans

Learn more in our guide to SBA loan requirements.

Getting an SBA loan for your startup can be quite hard. You will have to provide extensive documentation that proves that you have the experience, plan, and resources necessary to run a business and repay your loan.

Yes, SBA startup loans often require collateral. However, some SBA loans might not require collateral, such as CDC/504 loans, microloans, and some loans under $25,000.

The Owners Should Be Eligible

SBA assesses your criminal background before approving you to get an SBA loan. The assessment is, however, on a case-by-case basis. Not all crimes are grounds for disapproval. Here are the crimes that may lead to disqualification from acquiring an SBA loan:

- Felonies

- Crimes relating to financial dishonesty such as embezzlement.

- Crimes of moral turpitude like murder, drug-related crimes, kidnapping, and child abuse.

Owners that have defaulted on a government loan or federal funding program in the past may also not get an SBA loan. There are, however, exceptions to this rule. Just for clarification, an owner is somebody who owns more than 20% of the small business.

Apart from these general requirements, SBA lenders can also set additional eligibility rules. When applying for the SBA loan, check with your lender to see if they have any other requirements.

Some lenders might require you to have been in business for a particular number of years. Others may want to see your financial projections and how you plan to pay the loan back. Most lenders require that you be in business for two years or more. It, however, depends on the lender.

Read Also: Va Manufactured Home Guidelines

Know The Lenders Qualifications And Requirements

This article is a great place to start in terms of understanding what an SBA-preferred lender looks for, but make sure you talk specifics with your lender. Lenders often prefer to lend to certain types of businesses. As long as they meet the minimum SBA requirements and dont discriminate, they can add their own requirements.

Apply For Sba Eidl Loan Increase Up To $500k Email Sample Template

Know how to apply for the new SBA EIDL Loan Increase of up to $500,000 in 2021 to get additional SBA Economic Injury Disaster Loan funds for your small business during this Covid-19 pandemic.

DISCLAIMER This video is intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Freedomtax Accounting and Multiservices Inc. is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience. Freedomtax Accounting and Multiservices Inc. or its members cannot be held liable for any use or misuse of this content.

EIDL Increase Request for

Email Content

We would like to request an increase in our EIDL Loan.

Loan Application Number XXXXXXXXXX

Thank you in advance for your service,

Your Name

Transcript

Now we always emphasize the date on the recording of any video relating to PPP and EIDL because these programs have been constantly changing. So, there may be things we discuss in this video that can change as soon as tomorrow, so thats the importance of subscribing to our channel that way youre always up to date with the most current and correct information relating to these SBA loans, okay.

So, if you follow these instructions, you should be good to go.

So this is our contact information:

Recommended Reading: How To Refinance An Avant Loan

Do I Qualify For An Sba 7 Loan

If youre thinking about applying for an SBA 7 Loan, youre in good company the 7 is one of the SBAs most popular programs. It can feel like youre being held back without access to more working capital, so the SBA offers small business owners support when you havent been able to find funding elsewhere. Just because youre lacking cash flow history or a pristine credit score doesnt mean you must automatically give up on your dreams! If you apply and are approved, the SBA will guarantee a loan from an SBA-approved lender for up to 90% percent of your loan amount quite a sweet deal for startups or small businesses if youre looking to make a leap in your growth.

How To Apply For An Sba Loan To Buy A Business

When SBA loan proceeds are used to purchase a business, the process does not differ much from what it would be when applying for any other loan. Credit reports and financial documentation will be required to determine eligibility. However, there are a few additional documents needed for approval of the loan.

If real estate is being purchased using the loan, business, stock, and asset purchase agreements are required. A real estate purchase agreement is also needed and will be submitted along with other documentation and the SBA loan application.

A business plan is also typically required. The applicant must also show that they have experience in the industry of the business they plan to acquire.

Read Also: How Can I Refinance My Car Loan With Bad Credit

Sba Loans For Startups: Final Thoughts

The process for obtaining an SBA loan is daunting for any business. As a startup or new business, the process can be even more complicated. However, with a solid business plan in place and a good credit score, its possible to obtain the funding you need and put your new business on the path to success. Good luck!

Who Is Eligible For An Express Bridge Loan For Covid

To be eligible, your business must have been in operations as of March 13, 2020, have been adversely impacted by COVID-19, have a pre-existing relationship with a lender that offers EBL loans as of March 13, 2020. You must also have 500 or fewer employees, although this number is higher for certain industries heavily impacted by the COVID-19 pandemic, like the restaurant industry or hospitality industry. Other requirements may apply, so be sure to go over the process in detail with your lender.

Loans must also undergo and underwriting process that looks at the borrowers FICO Small Business Scoring Service Score, the personal credit score of any guarantor, the IRS tax transcript for the borrower, and other items.

Recommended Reading: Usaa Car Loans Review