What Are The Interest Rates On Plan 2 Student Loans

Confusingly, interest rates for Plan 2 loans can vary quite a bit. And to really keep you on your toes, it varies by two different types of circumstances.

Plan 2 interest rates while you’re studying

While studying, and until the April after youve left your course, the interest rate on your Student Loan is RPI plus 3%.

The RPI rate is usually set every September using the rate from March of the same year. RPI in March 2021 was 1.5%, so ordinarily from September 2021 August 2022 your Student Loan would have accrued interest at a rate of 4.5%.

However, due to something called the Prevailing Market Rate, this figure was temporarily reduced to 4.2% in September 2021. For the same reason, the interest rate dropped again to 4.1% from October December 2021, and will rise slightly to 4.4% in January and February 2022. It’s expected to revert to the full 4.5% in March 2022.

Remember though, this figure normally changes every September. RPI in March 2019 was 2.4%, so between September 2019 August 2020, Student Loan interest accrued at a rate of 5.4%.

Plan 2 interest rates once you’ve graduated

After graduating, the interest rate on your Student Loan is set at RPI plus anything from 0% 3% depending on your earnings:

As an example, if you earn £38,213 the interest applied to your loan that year would be RPI plus 1.5% .

In the simplest and least number-y way possible, this means that the higher your income, the more interest will be added to your loan until you pay it off.

Student Loan Payment Pause Is Set To Expire In May But It Could Be Extended

Most federal student loan payments have been paused since the passage of the CARES Act in March 2020. That legislation also froze interest accrual on government-held federal student loans, and suspended collections efforts against borrowers in default. The relief was originally supposed to last only six months, but was subsequently extended several times first by President Trump, and later by President Biden.

The Biden administration had characterized last years extension to January 2022 as the final extension of the student loan payment pause. But following the rapid spread of the Omicron Covid-19 variant and rising inflation, Biden extended the pause again to May 1. Education Department officials, while not expressly ruling out a further extension, have been indicating that borrowers should prepare for repayment to resume this May.

But Klains comments this week suggest that the Biden administration is considering another extension. There might be several reasons for this, including ongoing inflation . Many student loan borrowers may also just not be ready to resume repayment in the spring a poll released in February by the Student Borrower Protection Center and Data For Progress found that nearly four in ten respondents were not confident that they would be able to resume making payments on their loans.

How Do I Make Payments

Once bills are due again, only if they are due youll be responsible for sending your monthly payments to the companies that hold your loans.

If you dont know where to send a payment, check with your schools financial aid office. The financial aid office will be able to tell you who your loan servicers are. You can then contact your loan servicers directly with specific questions.

You also can retrieve loan information via the National Student Loan Data System. Now more than ever, its vital you know your balance details.

Be aware that your payments are due even if you dont receive the bills. If you move after graduation, or you have relocated during the CARES Act pause, tell your loan servicer your new address to ensure you receive bills and can stay on top of your payments when if they resume.

Consider changing your loan due date to make budgeting easier. The monthly payment might be due before you receive your paycheck. Contact your loan servicer to see if your payment date can be switched to a more convenient day.

Read Also: Sss Loan Requirements

Payments Resume On Feb 1 2022

Millions of borrowers are currently taking advantage of the administrative forbearance period initiated by the CARES Act in March 2020, with an estimated 35 million borrowers qualifying for relief. Eligible loans include all federally held student loans, plus privately held FFEL loans that are in default.

With the forbearance period set to expire on Jan. 31, borrowers who have not been making payments need to prepare to resume paying their balances. The Department of Education has said that borrowers can expect information and resources about resuming payments in the final months of the year and will receive a billing statement at least 21 days before the first payment is due.

In the meantime, you can visit the Federal Student Aid website and your loan servicers website to ensure that your contact details are up to date so that youre informed when payments are set to resume.

While You Wait For Principal And Interest Payments To Begin There Are Few Things You Can Do To Get Ready

Get organizedBy the time you leave college, you might have a combination of federal and private loans. Make sure you understand how many loans you have, what types of loans they are, their interest rates, and who the lenders are. Creating a simple spreadsheet can help you .

Understand what your payments will be

Also Check: Can You Refinance An Fha Loan

When Will Repayment Begin

Repayment of federal student loans typically begins six months after you graduate, withdraw from college, or drop below half-time enrollment. This grace period allows time for you to plan for repayment by evaluating your financial situation and the various repayment options available. For most student loans, interest will accrue during your grace period.

Parent PLUS loan borrowers are expected to begin repayment within 60 days after full disbursement, unless you qualify for a deferment.

Before the end of your grace period, youll get a repayment schedule from your loan servicer that includes details about:

- your balance

- fees

- repayment options

Contact your loan servicer if you have not received this information before the end of your grace period.

Below is a sample schedule for your grace period and first loan payment, depending on when you graduate:

| Graduation Date |

|---|

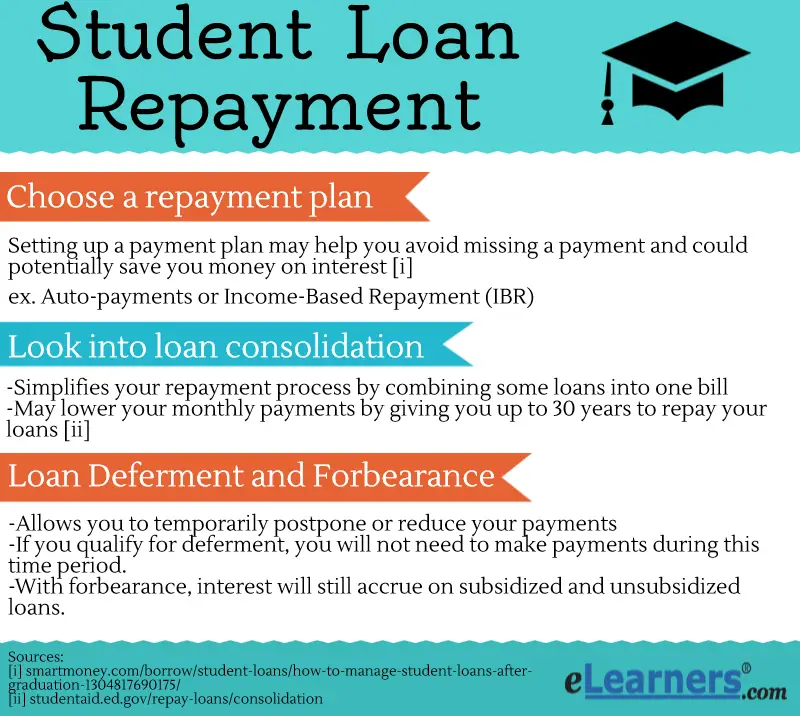

Alternative Student Loan Repayment Options

If you’re worried about repaying your student loans when your grace period ends, there are a few alternatives you can explore. While some of these options only apply to your federal student loan payments, you may be able to apply some to your private loans as well. Some of these alternatives include:

-

Student loan deferment

-

Student loan forgiveness

-

Student loan refinancing

Each program has different eligibility requirements which can be determined by the length of your loan, your employment, the type of loan you have, and more.

You May Like: Max Fha Loan Amount Texas 2020

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan.

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Who Will Be Affected By The Student Loan Changes

The proposed changes will come into effect from the academic year 2023-24, affecting new students beginning their undergraduates courses from September.

The new changes wont be back-dated to former graduates, or students who began their undergraduate degrees before September 2023.

Domestic students who begin an undergraduate degree in September 2023 will be subject to the new student loan changes and will begin paying their loans off earlier and for longer

International students dont currently have access to student loans through the government, which means the updated payment plans will only impact domestic students.

The proposed changes do not impact postgraduate degrees or PhDs, which have their own separate repayment plans.

Also Check: Usaa Car Loan Pre Approval

Federal Vs Private Loans: Similarities And Differences

When it comes to repaying your student loans, your first step will be to determine whether you borrowed private student loans or federal student loans . Private student loans are borrowed from a bank, credit union, or another lender. Federal loans are backed by the U.S. Department of Education.

If youre not sure, you can take a look at the National Student Loan Data System to review information on federal loans. If you took out student loans with a private lender, contact the loan servicer for more information.

What Does Your Student Loan Statement Mean

Every so often the Student Loans Company send out a Student Loan statement to every student/graduate, and we receive loads of worried emails and messages.

There’s a lot of scary numbers involved on the statement, as well as a lot of confusion about what it all means. Here’s our breakdown to put you at ease:

We’ve numbered the statement above to help explain what each part means.

As this statement runs from April 2012 to April 2016, we can assume that this student started a three-year course in 2012 and graduated in 2015. In the year or so after graduating, you’ll likely receive a Student Loan repayment statement very similar to this one.

Read Also: Usaa Auto Loan Approval Odds

When To Start Paying Private Student Loans

Some private student loans operate with a six-month grace period, similarly to federal student loans. However, its up to each individual lender to implement a grace period of any kind. If you have a private student loan, check your loan terms to see if you have a grace period.

If youre looking to take out a private student loan with a grace period, consider reviewing different lenders to see if any terms are comparable to federal student loans. Unlike federal student loans, interest rates for private student loans vary based on individual factors including your credit history. Because of this, your interest rates might be higher than they would be with federal loans.

If You Want To Pause Payments

You don’t have to do anything to get a forbearance to stop student loan payments. Interest wont continue to accrue, as it normally would.

A forbearance could give you breathing room to address other financial concerns.

If you are jobless or working reduced hours, a forbearance may free up cash to pay the rent and utilities or grocery bills. Even if your pay is unaffected, a forbearance could help you divert some money toward building an emergency fund or help you pay another, more pressing debt.

Usually forbearance is granted at the discretion of the servicer and interest will continue to build. In this case, the Education Department instructed all servicers to automatically place all loans into a forbearance without interest.

You May Like: Interest Rate For Car Loan With 650 Credit Score

Get A Lower Payment For Your Student Loans

There are many ways to get a lower payment for your student loans. . One strategy is to use an income-driven repayment plan, which can also lead to student loan forgiveness. With an income-driven repayment, your monthly payment is based on your discretionary income and family size and could be as low as $0 depending on your financial situation. There are four major income-driven repayment plans Income-Based Repayment , Pay As You Earn , Revised Pay As You Earn or Income-Contingent Repayment . Find the best income-driven repayment payment plan for you, particularly if youre struggling with student loan payments. You can enroll through your student loan servicer. If youre already enrolled, make sure to recertify your income now, as it may have changed during the Covid-19 pandemic. .

How Student Debt Affects Your Credit Score

Student loans and lines of credit form part of your credit history. If you miss or are late with your payments, it can affect your credit score.

Your credit score shows future lenders how risky it can be for them to lend you money. A poor credit score can also affect your ability to get a job, rent an apartment or get credit.

Recommended Reading: Can I Buy Land With A Va Loan

Should I Think About Refinancing My Student Loans

Borrowers thinking about refinancing their federal student loans into private loans for a lower interest rate may want to wait, Kantrowitz said. For one, the interest rate on most federal student loans is 0% for at least another three months.

What’s more, “they will feel foolish if they refinance only to have the federal government announce loan forgiveness,” Kantrowitz said.

Does A Student Loan Have To Be Paid Back

Student loans. Unlike grants and scholarships, loans are money that you borrow that must be paid back with interest. In most cases, you must repay your loans even if you don’t complete your degree, are unhappy with the education you received or experience financial difficulty as the result of unemployment or bankruptcy …

Recommended Reading: Does Advance Auto Rent Tools

Repayment Assistance For Students With Permanent Disabilities

If you are applying with a disability

If you were confirmed to have a permanent disability when you applied for OSAP while you were a postsecondary student, you do not need any further documentation.

If you were not confirmed as having a permanent disability when you applied for OSAP, you will be required to complete a Verification of Permanent Disability form. You will also need to provide medical documentation to support your permanent disability.

Repayment terms

If you have a permanent disability, you can apply to the debt reduction stage immediately when you enter repayment, without receiving any interest relief as part of stage one.

The governments of Canada and Ontario help borrowers who have permanent disabilities pay off their loans in 10 years.

You can also provide documentation to have your disability-related expenses considered when your affordable monthly payment is calculated. To do this, you must:

- complete a Repayment Assistance Plan for Borrowers with a Permanent Disability Expenses form from National Student Loans Service Centre

- provide proof of your expenses and insurance coverage

How Much Interest Do Students Pay On Their Loans And How Is It Calculated

The proposed changes to student loans will mean many students end up paying back more overall.

But although they will pay back more of the balance of their loans, most will end up paying less interest on them.

Experts suggest the changes will cripple most graduates and make it more difficult to save for a house or invest in private pensions

This is because of a proposed change in the way interest on student loans is calculated.

At the moment interest is charged at the Retail Price Index plus three per cent, but in future this will be changed to RPI plus zero per cent.

The DofE said: To make the system fairer for students, the student loan interest rate will be set at RPI+0 per cent for new borrowers starting courses from 2023-24, meaning that graduates will no longer repay more than they borrowed in real terms.

Combined with the continued tuition fee freeze announced earlier this month, a student entering a three-year course in 2023-24 could see their debt reduced by up to £11,500 at the point at which they become eligible to repay.

Also Check: Usaa Consolidate Student Loans

What Are The New Student Loan Repayment Rules And How Will They Affect Graduates

University graduates will start paying more of their student loans back as the student loan repayment term is set to be extended from 30 years to 40.

The salary cap is also set to be reduced from £27,000 to £25,000, meaning millions of students who begin their courses from September 2023 will be left paying thousands more towards their student loans.

The UK government has said student finance will be put on a more sustainable footing ensuring students pay their loans in full.

It has also said it wants a clampdown on poor-quality university courses that dont benefit graduates in the long-term.

Heres everything This is Money knows about the upcoming student loan changes.

Student loan changes could mean low-income graduates pay more than £7,000 more towards their debt, as the UK government sets out its plan to tacklepoor-quality courses

Youll Avoid Paying Interest On Top Of Interest

When your grace period ends, the interest that has accrued on your student loans is typically added onto your principal balance. In the above example, youd end up with a balance of $33,162, even though you initially borrowed $30,000.

At this point, student loan interest will start accruing on this new higher balance. This is called negative amortization. Youll end up paying more interest than you would have if you decided to pay student loan interest while in school.

As you saw in the example above, your monthly payments will also be higher to account for the higher balance and increased interest charges. If you can afford to cover the interest while youre in school, your monthly payment will be lower.

Also Check: What Is The Average Interest Rate On A Commercial Loan

What Could Cause Another Extension

Top Democrats have been some of the loudest voices calling for further student loan forbearanceâand even debt cancellation. Travis Hornsby, founder of Student Loan Planner, says that political considerations could cause the administration to extend the pause on student loan forbearance into 2023. An additional extension would require a balance of economic considerations, however.

The forbearance extension until May 1, Hornsby says, elicited pushback from economists such as Larry Summers, former President Barack Obamaâs head economic adviser.

âJudged purely in terms of economic impacts, the dministrationâs decision to extend student loan moratorium is highly problematic,â Summers tweeted on Dec. 24, 2021.

Biden could decide to extend forbearance yet again if he decides doing so will help his party win the midterm elections, Hornsby says. Otherwise, another virus wave or if the economy were to be âpulled back significantlyâ could spark a need for further extension, he adds.

âContinuing to suspend student loan payments provides fodder for critics to say that the economy is not strong and the pandemic is not over,â Kelchen says. âMy best guess is that student loan payments resume on May 1 barring an unexpected new wave of the pandemic, but I would put the chances of resuming at only about 70%.â

âThis adds to borrower confusion, especially for our clients, who are still waiting for their fraudulent loans to be canceled,â Connor adds.