Typical Fha Loan Requirements

- Income Requirements The standard maximum debt-to-income ratio is 43%. However, in some cases, a debt-to-income ratio of up to 50% may be approved.

- Down Payment A minimum down payment of 3.5% of the purchase price is required.

- Property Requirements The property that you are purchasing must meet certain safety, security and soundness requirements.

Two types of mortgage insurance premiums will need to be paid with a FHA loan. One of these premiums is paid up front, while the other is a recurring monthly premium. The upfront mortgage premium is typically 1.75% of the whole loan. As a borrower, you can pay this either at closing, or roll it into the mortgage itself. The recurring premium is an annual mortgage insurance premium, which is paid every month. This premium is based on loan-to-value ratio, the loan amount and the length of the loan. It is typically between .8% and 1.05%.

Just How Do I Qualify For An Fha Loan In Florida

FHA financial loans let people with straight down repayments only 3.5percent to get a house, along with numerous state-sponsored deposit services software, capable obtain the mortgage with zero revenue all the way down, claims Mark Ferguson, realtor, and trader.

Further, FHA loans completelyow up to a 52% debt to income ratio, which is much higher than most loans. That means buyers can qualify for a more expensive house .

Ferguson claims, The costs on an FHA loan become bit more than more financial loans. FHA enjoys financial insurance policies which may not be removed. That financial insurance rates can add a lot of money toward payment and thousands toward initial cost of a property .

FHA financial loans enable purchasers with straight down repayments as low as 3.5per cent purchasing property, sufficient reason for lots of state-sponsored down-payment support training, they could obtain the financing with zero revenue down

For an in depth description associated with the requisite, you can read the HUD handbook and check with prospective loan providers.

Florida Fha Loan Requirements For 2022

These are the basic FHA loan requirements for this year. All of these must be met to be approved for an FHA loan. If you are not positive on whether you meet these standards or have questions, an FHA lender can help.

- Down payment of 3.5% or 10% if your credit score is below 580

- 2-year employment history with some exceptions allowed

- Fully document your income for the past two years

- Minimum FICO score requirement of 500

- Mortgage Insurance Premium is required for every FHA loan

- Maximum debt to income ratio of 43% with exceptions up to 56%

- The home must be your primary residence

- No bankruptcies or foreclosures in the past two years

Recommended Reading: Refinance Auto Usaa

Find The Best Fha Lender In Florida To Meet Your Needs

While HUD in addition to FHA have actually financing information in place for FHA financing, not every mortgage is the exact same. Precisely Why? Because 3rd party loan providers will provide the financial loans.

Each loan provider could add its own requirement, offer various costs, and provide the customer service they views healthy. Given that borrower, you will want to search.

When you compare loan providers, see their particular eligibility criteria to make sure they match together with your desires. After that, test their rate and fees. Could you bring pre-qualified? It can be helpful to find out your own total costs with a few different loan providers.

Next, look over real-user reviews from earlier individuals to learn the way the as a whole event has been the financial institution. After gathering all of this suggestions, you can easily compare your choices to find the best FHA loan provider in Fl for your certain desires.

To start out, visit the Mortgage acquisition Assessment web page locate details on several lenders, like complete feedback and real-user ranks.

How To Apply For An Fha Loan

- Find an FHA lender. To find a HUD-approved lender that offers FHA loans, you can head to the agencys Lender List and search for qualified institutions in your area. Even though FHA loan requirements are the same everywhere, some lenders may have additional credit score requirements for approval. Our list of the best mortgage lenders is also a good place to start.

- Submit the application. Once youve selected a lender, fill out their application and provide all the information they need to process your request, which may include pay stubs, bank statements and old tax returns. The lender will also look into your credit history and your to calculate your debt-to-income ratio.

- Compare loan offers. You should always shop around and request quotes from more than one lender to make sure youre always getting the best loan terms and mortgage rates. Interest rates can vary between lenders even when it comes to federally-regulated programs like FHA-backed loans. Our mortgage calculator can help you figure out which loan is right for you.

- Research down payment assistance programs. Many states have programs in place to help low-income earners or first-time homebuyers purchase their homes. To qualify for an FHA loan, you need to make a down payment of at least 3.5% but this money can come from your savings, your relatives savings or down payment assistance programs.

Dont Miss: Refinance My Avant Loan

Don’t Miss: Va Home Loan Benefits 2020

How To Qualify For An Fha Loan

To be eligible for an FHA loan, borrowers must meet the following lending guidelines:

- Have a FICO score of 500 to 579 with 10 percent down, or a FICO score of 580 or higher with 3.5 percent down.

- Have verifiable employment history for the last two years.

- Have verifiable income through pay stubs, federal tax returns and bank statements.

- Use the loan to finance a primary residence.

- Ensure the property is appraised by an FHA-approved appraiser and meets HUD guidelines.

- Have a front-end debt ratio of no more than 31 percent of gross monthly income.

- Have a back-end debt ratio of no more than 43 percent of gross monthly income .

- Wait one to two years before applying for the loan after bankruptcy, or three years after foreclosure .

Types Of Fha Home Loans

There are several different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another type of government loan.

Lets look at a few different FHA loan classifications.

Don’t Miss: Investment Property Loans For Veterans

The Hidden Costs Of Homeownership

When trying to decide if an FHA loan is right for them, many people make the mistake of only planning for loan-related expenses like insurance and closing costs. But first-time buyers should be aware the homeownership comes with its fair share of unexpected costs, such as:

Property taxes: If you want to live in an area with nice public amenities, be prepared to pay higher property taxes. In the state of Florida, the median annual property tax is $1,773.00, or 0.97% of a propertys assessed market value.

Maintenance and repair: Things like plumbing, landscaping, security systems, trash collection, and homeowners association fees can add up to thousands of dollars annually. A good rule of thumb is to set aside 1% of the value of your home for annual maintenance costs.

Utility bills: You may be no stranger to paying utility bills for a rental property, but be prepared for your electric and water bills to be a bit higher when you move into a home.

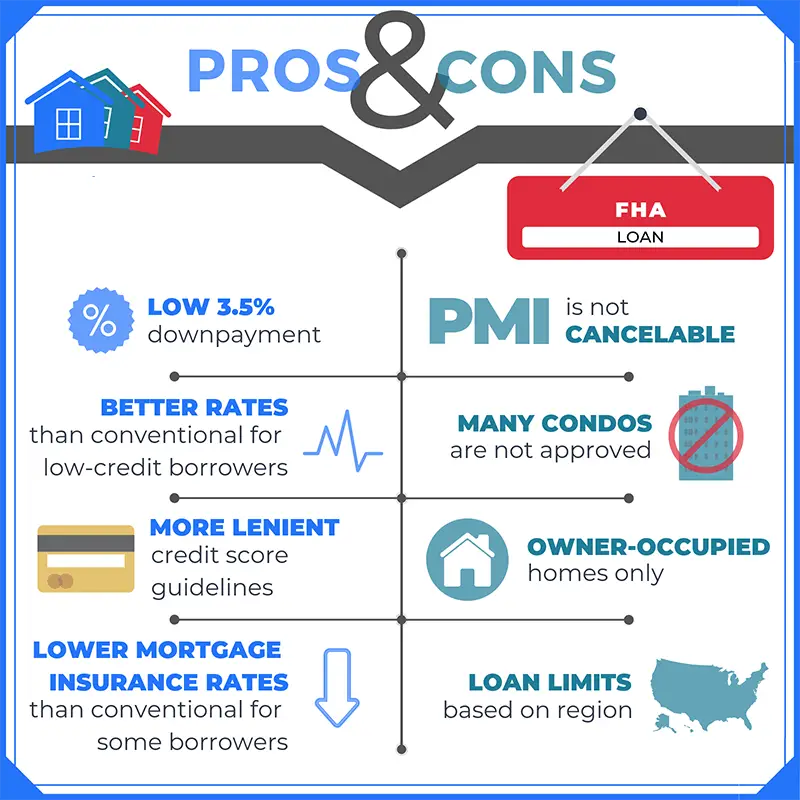

Benefits Of An Fha Loan

FHA loans are appealing to first-time home buyers for many reasons, including:

Lower Interest Rates: FHA borrowers can often get lower interest rates compared with conventional borrowers.

Flexible Credit Requirements: Because the loan is backed by the federal government, lenders are able to have more flexible credit requirements you can be approved with a score as low as 500.

Smaller Down Payment: The average conventional loan requires a down payment of at least 20% FHA loan down payments can be as low as 3.5%.

While there are many benefits, there are also a few downsides youll want to consider as well. For instance, FHA loans come with higher insurance premiums than conventional loans.

Don’t Miss: Usaa Auto Calculator

Basics Of The Fha Mortgage

Down Payment Obligation

FHA states that a minimum of 3.5% of the purchase price must be paid as a down payment at the time of purchase. The money for the down payment may come from the borrowers funds such as checking, savings, or money market accounts. It may also come from retirement accounts or stock and bond investments.

FHA will also allow family members to gift the money to the buyers for the down payment. Certain documents are required in order to show the transfer from the relative to the buyer.

Maximum Mortgage

FHA has maximums in place. The maximums are dependent on the type of property and the county where the home is located.

For example, in Alachua county, the maximum amount for a single-family home in 2022 is $420,680 and for a four-plex, the maximum is $809,150. However, in Collier county, the maximum for a single-family home is $552,000 and the maximum is $1,061,550 for a four-plex. It makes sense to check with your lender to find out the maximums in your county for your intended property type.

View current FHA loan limits.

Seller Contributions

This is one of the major benefits of an FHA mortgage. FHA will allow sellers to pay up to 6% of the selling price towards the closing costs. This is not a requirement of the loan, but merely it is allowed by FHA. The buyer and seller, along with the real estate agents, will need to negotiate this into the contract.

Debt-to-Income Rules

$1,610 + $1100 = $2,710

This debt to income ratio would also be acceptable.

Fha Mortgage Insurance Requirements

Lenders are willing to offer FHA loans because they know that in the worst case scenario, where they have to foreclose on a home, the FHA will pay them back. That’s why you’ll sometimes see the FHA described as insuring home loans.

That FHA backing is funded by you, the homeowner, via FHA mortgage insurance. You’ll be required to make an upfront mortgage insurance premium equal to 1.75% of the loan amount at closing, though this can be rolled into the loan. After that, you’ll make monthly mortgage insurance payments. If your down payment is 10% or more, you’ll have to make these payments for 11 years.

But if you make a down payment of less than 10% on an FHA loan, the only way to get out of paying monthly FHA mortgage insurance is to refinance into a conventional loan. FHA mortgage insurance can’t be canceled the way private mortgage insurance can. The amount of insurance you’ll pay is calculated based on the length and total cost of your mortgage as well as the amount of your down payment.

Don’t Miss: Capitol One Autoloans

Understanding Federal Housing Administration Loans

In 2021, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of just 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lendera bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers who qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

Though FHA loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| For How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is an FHA Mortgage Still a Bargain?

How To Qualify For An Fha Loan In Suwannee County Fl

You must meet some requirements for you to qualify for an FHA loan. The federation has a set of minimum stipulations, and the lenders may also have additional conditions. Ensure that you shop for the best loan terms and FHA loan rate by checking with several FHA-certified lenders and compare their products.

The ideal score for an FHA loan is 580, and a minimum limit of 500. If your score lies between 500 and 579, you will still get an FHA loan, although you will be required to make a more significant down payment.

- Down payments funds

If your credit score is 580 or more, you can make a down payment as low as 3.5%. If your credit score ranges from 500 to 579, you will be required to raise your down payment to 10% of the price of the house. The amount must not necessarily come from your savings. The program allows you to use gift money on the condition that your donor gives a letter showing their relationship with you, contact information, the total amount of the gift, and a statement to show that you are not to make any repayment. Pro tip: Ensure that you check with the local or state down payment assistance programs for first-time homebuyers. You can find low or no-interest loans or grants to assist you in raising a down payment. A first-time homebuyer is defined as someone who has not owned a home in the past three years.

- Debt to income ratio

- Property approval Suwannee County, FL

-

Mortgage insurance Suwannee County, FL

Also Check: Golden1 Car Loan

Fha Vs Conventional Loan

FHA loans loans were established to give individuals with a lower median income a chance to own their own homes. If you find yourself in any of the following categories, an FHA loan may be a good solution for you:

- First time home buyer with a low or bad credit score

- First time home buyer with little or no money saved for a down payment

If you have a lower credit score, but have saved money for years to buy a home, you may also be given the opportunity to qualify with a larger down payment of 10%.

Conventional loans are the best option for people with excellent credit, savings, or other assets, and a small amount of debt. They can take on the form of either a regular mortgage or a piggyback mortgage, which allows you to take out two loans for the same home. In either case, conventional loans typically require both of the following:

- A substantial down payment, usually up to 20%

- FICO credit score of 620 or higher

Once you meet the minimum requirements, these loans can offer a few advantages, such as lower closing costs and lower costs for mortgage insurance. If the homes loan value to property value ratio is at least 80%, conventional loans also offer the opportunity to forego mandatory monthly home insurance payments.

Fha Loan Requirement & Fundamentals

FHA stands for the Federal Housing Administration. The FHA loan allows borrowers to purchase a home with a low down payment. Currently the minimum is 3.5%. The government actually started the program back in the 1930s following the great depression. It was meant to stimulate the housing market as the banks were afraid to lend money, and most people didnt have a down payment.

Recommended Reading: Auto Loan With 650 Credit Score

How To Apply For A Fha Loan In Florida

FHA income

Regardless of the FHA loan limit for your area, the amount of loan you qualify for depends on your income and ability to pay. Under FHA standards, you should spend no more than 31% of your monthly income on your mortgage, property tax, and insurance. In addition, you should spend no more than 54.99% of your income on total debt payments, including student loans, car loans, and credit card debt.

FHA down payment

FHA down payment requires a minimum of 3.50% of the purchase price. The funds may be the borrower’s own funds, a gift from a family member, rent credit or borrowed.

If you will be using your own funds for the down payment you will have to provide two recent months bank statements showing the funds in your account.

FHA credit score are less stringent than conventional mortgage credit score. FHA will still look at credit, income, assets and ability to repay the mortgage loan.

FHA doesn’t require you to have a traditional credit history in order to consider your reliability.

They will also consider whether you’ve had a bankruptcy in the last two years. You should have a good history of on-time payments in the last two years and be current on all payments. If you’re in default on any student loans, you will not qualify for an FHA loan.

Borrowers with a credit score above five hundred are eligible for an FHA loan.

We look forward to working with you.

Applying For An Fha Loan

Home ownership is a goal that can be tough to reach. FHA loans can make it easier. With low down payments, relaxed credit requirements and competitive rates, FHA loans are designed to meet the needs of first-time homebuyers and other buyers whose credit or finances might make it difficult to qualify for a conventional mortgage.

You can submit an application for an FHA loan at most mortgage lenders. Here’s what you should know in order to apply.

You May Like: Va Business Loan For Rental Property