Do Lenders Count Military Income

Lenders can count VA disability income and certain military allowances to determine how much you can borrow with a VA loan. Active duty service members receiving Basic Allowance for Housing can use this income to pay for part or even all of their monthly mortgage payment.

Other types of military allowances that can count as effective income include: flight pay, hazard pay, imminent danger pay and more. Lenders can also count National Guard and Reserve income.

Find Your Home Buying Budget

Its definitely possible to buy a house on $50K a year. For many borrowers, lowdownpayment loans and down payment assistance programs are making homeownership more accessible than ever.

But everyones budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

Thats because your budget doesnt just depend on your annual salary, but also on your mortgage rate, down payment, loan term, and more. Heres how to find out what you can afford.

In this article

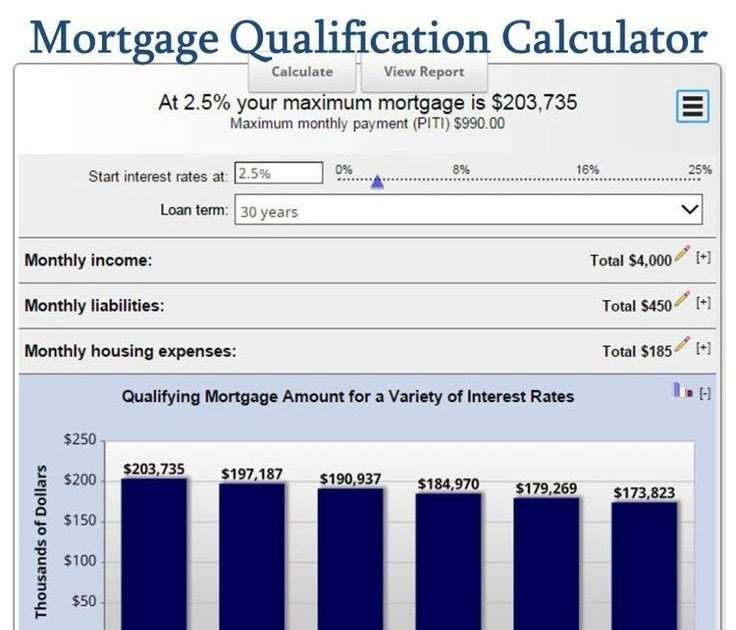

Can I Use A Mortgage Calculator Based On Income

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

Also Check: Can You Refinance A Car Loan With The Same Lender

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Mortgage Approval Process Canada

The actual mortgage approval process starts when your offer has been accepted by the seller because your lender will need to know what the value of the property is based on current market conditions, as well as the amount of your down payment. In order for the approval process to be completed, your lender will require the purchase agreement as well as the MLS listing. The value of the property youve agreed to purchase will be assessed by an appraiser appointed by the lender to make sure that the price you agreed to pay is on par with what the home is actually worth.

The property will also need to be approved by the mortgage insurer if you are putting less than a 20% down payment. Your income, credit score, and debt, and any other financial information will be re-verified, and the specific type of mortgage product that youve decided on will be factored into the equation.

Take a look at this infographic to learn all about the true cost of borrowing.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

If I Reduce The Offer Tenure What Will Be The Effect On The Loan Amount

In case you reduce the offer tenure, your loan offer amount will get reduced according to the tenure so that the overall Equated Monthly Instalment remains same.

Example: If your offer amount is Rs 1 crore and offer tenure is 30 years at ROI of 9%. The maximum EMI you can pay is Rs 80,460.

Suppose you reduce the tenure to 20 years. Now, since the maximum offer EMI is Rs 80,460, the revised loan amount will be computed at an EMI for Rs 80,460 but for a tenure of 20 years which comes to Rs 89.42 lakh.

So, the slider value for loan amount will reduce from Rs 1 crore to Rs 89.42 lakh when you reduce the tenure from 30 years to 20 years.

If you increase the tenure slider back to 30 years, the loan amount will be reset to the offer amount of Rs 1 crore.

Request A Callback

Home Loan Eligibility Criteria

You May Like: How To Get An Aer Loan

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2021, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $548,250. If this is the maximum conforming limit in your area, and your loan is worth $350,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $822,375 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

What Should I Input For The Total Monthly Loan & Lease Pmts Of The Calculator

For this section you should include the monthly payments that you make for any personal loans or vehicle loans or leases.

If you have a car lease that is $325 per month, then input “325”.

If you have a personal loan with a payment of $275/month and a car loan with a payment of 325/month, then add these two numbers together. $325 plus $275 equals $600, then input 600.

Sometimes you have loan or lease payments that are paid every 2 weeks, called bi-weekly. If you debt payment is bi-weekly, then you have to convert that payment to monthly.

To convert a bi-weekly payment to monthly you must multiply the bi-weekly payment by 26 and divide by 12.

Here is an example, you have a bi-weekly payment of $230. To convert this payment to monthly multiply by 26 and divide by 12. Therefore, $230 multiplied by 26 and divided by 12 equals $498.33. You could type in 498 or round up to 500.

Notice that a bi-weekly payment of $230 is not $460 per month. You can type in 460 if you wish, then look at the result. Then type in 500 and look at the result. Is it different?

Sometimes the payments will affect how much mortgage you can qualify for and sometimes they don’t. This difference really depends on your income and the total amount of the payments that you must make each month.

Don’t Miss: How To Refinance An Avant Loan

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

The Value And Condition Of The Home

Finally, lenders want to make sure the home you’re buying is in good condition and is worth what you’re paying for it. Typically, a home inspection and home appraisal are both required to ensure the lender isn’t giving you money to enter into a bad real estate deal.

If the home inspection reveals major problems, the issues may need to be fixed before the loan can close. And, the appraised value of the home determines how much the lender will allow you to borrow.

If you want to pay $150,000 for a house that appraises for only $100,000,, the lender won’t lend to you based on the full amount. They’ll lend you a percentage of the $100,000 appraised valueand you’d need to come up with not only the down payment but also the extra $50,000 you agreed to pay.

If a home appraises for less than you’ve offered for it, you’ll usually want to negotiate the price down or walk away from the transaction, as there’s no good reason to overpay for real estate. Your purchase agreement should have a clause in it specifying that you can walk away from the transaction without penalty if you can’t secure financing.

Recommended Reading: Usaa Car Interest Rates

About Home Loan Eligibility

Home loans are easily accessible financing options in India when it comes to property buying. Borrowers can avail funds of up to 80% of the propertys current market value.

With Bajaj Finserv, receive adequate financial assistance in the form of Home Loan for up to Rs. 3.5 crore and invest in the purchase or construction of your residential property. It comes with a plethora of benefits to aid you in getting your dream home easily.

How Does Residual Income Factor Into Affordability

Residual income is a VA loan guideline that looks at your remaining gross monthly income after paying major monthly debts, including the new mortgage payment.

Residual income guidelines vary based on geography and family size. They help ensure VA buyers have sufficient income to weather lifes unexpected challenges, and theyre a major reason VA loans have been the safest mortgage product on the market for most of the last decade.

Read Also: Is Bayview Loan Servicing Legitimate

Get Information From A Source You Trust

It’s natural to have questions. Besides the basics such as the interest rate and term, it’s a good idea to ask about other things like prepayment charges if you plan to sell your property or pay down your mortgage loan faster. To ensure that you get accurate, actionable information we recommend seeking answers from a trusted source. TD Mortgage Advisors are well versed in every aspect of the mortgage process and can be an easily accessible source of information.

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

Don’t Miss: What Happens If You Default On Sba Loan

What Is Home Loan Eligibility

Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a particular loan amount. Home loan eligibility depends on criteria such as age, financial position, credit history, credit score, other financial obligations etc.

Illustration :

For e.g. If a person is 30 years old and has a gross monthly salary of Rs. 30,000, he can avail a loan of Rs. 20.49 lakh at an interest rate of 6.90% for a tenure of 30 years provided he has no other existing financial obligations such as a personal loan or car loan etc.

How Do Interest Rates Impact Affordability

Interest rates have a direct impact on VA loan affordability. Mortgage rates reflect the cost of borrowing money, and they can vary depending on the lender, the borrowers credit profile and more.

VA borrowers benefit from having the industrys lowest average interest rates.

More:See today’s VA loan interest rates

Don’t Miss: How Can I Refinance My Car Loan With Bad Credit

What Should I Input For The Credit Card & Loc Balances Section Of The Mortgage Pre

For this section of the calculator add up all outstanding balances that you keep on your credit cards or lines of credit each month.

If you use your credit cards and pay them off to zero each month, then type in “0”. If you pay off your credit cards but keep a balance on your line of credit of $5,000 then add “5000” to this section.

The calculator will determine the minimum payment that you are required to make based on the balance that you input. The qualifying mortgage amount is then calculated based on all the input including your credit card and line of credit debt.

You will noticed that you can have a credit card balance without any effect on the approved mortgage amount. Once you increase the balance over a certain number, then qualifying mortgage amount decreases.

Play around with the numbers, it’s fun to see how different revolving balances will change the results.

How To Use Myloancare Home Loan Eligibility Calculator

You can check your home loan eligibility at MyLoanCare with the following steps:-

- Fill in the required details like name, mobile number, income etc in form.

- Complete OTP authentication by entering OTP , which you have received on the entered mobile number.

- After OTP verification, enter additional details about your profession, the reason for taking a home loan, and your current work experience.

- Verify all the details and click Get Offers.

- You can now view the multiple banks for which you are eligible based on the details filled in by you.

- You can choose the bank after a complete comparison, or a MyLoancare advisor will contact you in a while to assist you with the process.

Also Check: Usaa Auto Refinance Phone Number

Qualifying For A Mortgage With Student Loan Debt

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

What Factors Affect Va Loan Affordability

To calculate how much home you can afford with a VA loan, VA lenders will assess your debt-to-income ratio . DTI ratio reflects the relationship between your gross monthly income and major monthly debts. Our calculator uses the information you provide about your income and expenses to assess your DTI ratio.

There isnt a hard cap on DTI ratio for VA loans. Benchmarks can vary by lender and the borrowers specific circumstances. Buyers whose DTI ratio exceeds 41 percent will encounter additional financial scrutiny, but thats by no means a strict cutoff.

During the VA loan process, lenders gather debt information from credit reports, looking for big or recurring payments. Expenses like groceries, gas and other lifestyle needs typically do not factor into VA loan affordability calculations.

Also Check: What Kind Of Loan Do I Need To Buy Land