Select Portfolio Servicing Lawsuits

If you want to know just how unhappy consumers are with Select Portfolio Servicing, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records . PACER is the U.S.s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display over 5,400 lawsuits filed in the U.S., and these typically involve violations of consumer rights and/or the Fair Debt Collection Practices Act .

Select Portfolio Servicing Warning This Isnt The First Time Sps Has Been Exposed For Having Servicing Issues

In November 2003, Select Portfolio Servicing then known as Fairbanks Capital agreed to pay $40 million to settle with the FTC and the U.S. Department of Housing and Urban Development. Both agencies claimed the company was engaging in unfair, deceptive, and illegal practices in the servicing of subprime mortgage loans.

Fairbanks Capital settled with the FTC and HUD for $40 million as redress to affected consumers. The settlement also imposed specific limitations on Fairbankss ability to charge fees and engage in certain practices when servicing mortgage loans. In June 2004, Fairbanks changed its name to Select Portfolio Servicing, Inc. and SPS Holding Corp.

How Do We Use The Law To Help You

We will use state and federal laws to immediately stop Select Portfolio Servicings debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Select Portfolio Servicing violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you wont pay us a dime unless you win.

THATS NOT ALL

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys fees and costs.

Also Check: Does Va Loan Work For Manufactured Homes

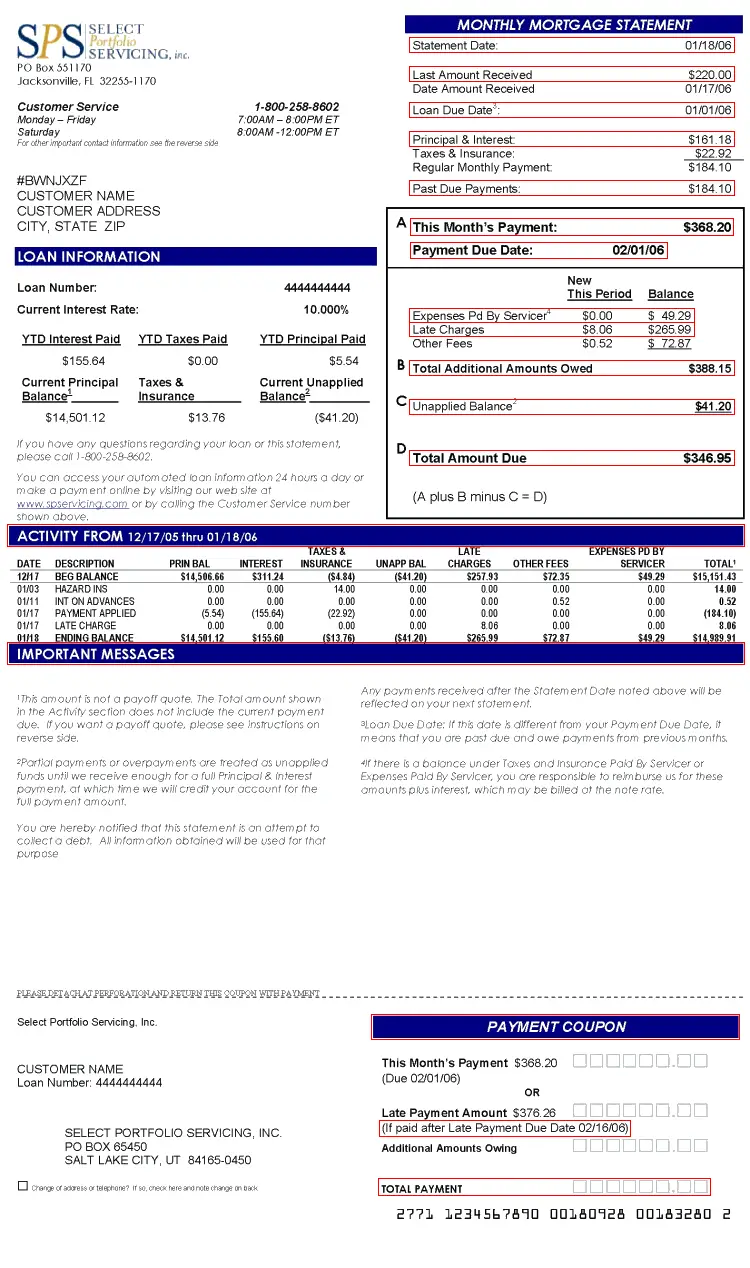

Who Is The Current Servicer

The loan modification application must be submitted to the current loan servicer. This is normally the company that is sending the monthly mortgage statements. The monthly statement will have necessary information like the loan number, interest rate, payment amounts, amounts due and the address that can be used to communicate with the Servicer. It is important to open all mail because the Servicing can be transferred and if you send the application to the wrong servicer, there is no chance to stop a foreclosure or get a modification.

Will Modifying My Mortgage Hurt My Credit

If the modification is federally backed and is a result of the coronavirus, then it will not be reported to the credit bureaus per the CARES Act.

Otherwise, some loan modifications might be reported as settlements or judgments, which could result in a ding to your credit. Be sure to talk to your lender about if their policy is to report modifications. However, a loan modification is not as damaging as a foreclosure.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Do I Qualify For A Loan Modification What Would The Payments Be

At the law firm of Ira J. Metrick, Esq, we can tell our clients if they will qualify for a loan modification and what the new payments would be. We dont apply for a modification unless we have advised the client of what payment terms they can expect.

We offer aggressive loan modification representation, and can bring federal lawsuits against mortgage servicers and their attorneys if they dont properly review modification applications.

We have obtained loan modifications for our clients from:

- 21st Mortgage Corporation

How Can I Prevent My Mortgage From Being Sold

How to Avoid Having Your Mortgage Sold. There is a clause in most mortgage contracts that says the lender has the right to sell the mortgage to another servicing company. 6 If youre getting a notice that your loan is being sold, you have two options: go along with it, or refinance with another company.

You May Like: How Do I Find Out My Auto Loan Account Number

How Can I Apply For A Loan Modification

Homeowners who are facing financial hardship that makes it impossible to fulfill the mortgage contract should get in touch with their lender or servicer immediately, as they might be eligible for a loan modification.

Typically, lenders will ask you to complete a loss mitigation form. Because foreclosures are so costly for investors, a loss mitigation form helps them look at alternatives, such as loan modifications, to figure out what makes the most financial sense.

Be prepared to submit a hardship statement mortgage and property information recent bank statements and tax returns profit and loss statements and a financial worksheet that demonstrates how much youre earning versus spending.

If your loan modification application is denied, usually, you have the right to appeal it. Because rules vary by lender, find out when the appeal deadline is. Next, youll want to get precise information on why your loan was denied, as this will help you prepare a better case in your appeals.

There are many reasons why you might not qualify, from not providing sufficient proof of hardship to having a high debt-to-income ratio . A high DTI means that you have a lot of debt relative to your income, which might signal that you cant afford your mortgage, even at a modified amount.

Working with a housing counselor or attorney who specializes in mortgage modifications can improve your chances of getting approved for a loan modification.

Notice Of Error If The Application Is Not Reviewed Within 30 Days

The Servicer is required to review a complete application within 30 days of receipt. We always try to get written confirmation from the Servicer that the application is complete. If we have written confirmation that the application is complete and it is not reviewed within 30 days, that is a violation. However, many times, we will not get the written confirmation, so we must create it. If we do not hear from the Servicer within 30 days after we submit the application, we will send a Notice of Error if they did not request any additional documents or information, and that they did not review the application within 30 days. It is important to understand that a lawsuit is for violating the rules and, if successful, the Servicer would be required to pay penalties and attorney fees. A successful lawsuit often ends with a settlement that includes a modification, but a violation does not automatically entitle the homeowner to a modification.

You May Like: Is Bayview Loan Servicing Legitimate

If Modification Was Approved Make At Least Three Trial Modification Payments

If a Trial Modification is approved, at least three payments will be required. It is important to make sure the payments are made on time and the payments should be exactly the amount requested. DO NOT PAY EXTRA. In many instances, they want the exact amount and paying extra could be considered a breach of the agreement. Additionally, DO NOT STOP MAKING PAYMENTS. Even if you have made the three required payments and you are waiting for the Permanent Modification, do not stop making payments. It may take 1-2 more months for the final paperwork to be prepared.

How To Check The Tire Pressure

The fundamental general policy is to inspect your tire anxiety a minimum of when a month. This is the bare minimum!

It is MUCH smarter to take a look at the pressure prior to the begin of every trip .

All brand-new site visitor trucks marketed in the U.S.A. considered that 2008 are requested to have a tire pressure surveillance system that notifies the vehicle chauffeur when a lowered stress and anxiety scenario exists.

While this is a superb safety as well as security device, it isn’t a substitute for actually evaluating your tire stress and anxiety and also anxiety. TPMS systems will absolutely not inform you if there is an over increasing expense of living circumstance or if a tire is instead under filled with air.

They will just signal you as soon as a tire is extremely under full of air.

Motor homes usually do not come furnished with tire anxiety radar .

There are aftermarket systems you can develop , once a whole lot extra, even if you have a TPMS system established on your Recreational vehicle, you need to routinely literally take a look at the stress on Each Of your tires.

We might make money when you purchase with web links on this web site. Figure out much more.

There are a great deal of choices when it requires tiny mobile air compressors, nonetheless not all are generated equal.

Below are a few of the vital best portable air compressor for off road you must acknowledge.

Recommended Reading: How To Get An Aer Loan

Difficulty In Getting A Loan Modification

Applying for a loan modification or other loss mitigation option isn’t like applying for a library card. It’s a process many homeowners find nightmarishly complex and frustrating. They frequently complain about having to send in the same documents many times and about being denied no matter what they try.

Let’s look at an example of a homeowner, who had a loan serviced by SPS, and the difficulties she’s encountered trying to get a loan modification. Colleen in Bethlehem, Pennsylvania writes of her difficulties on consumeraffairs.com in November 2016:

We have been trying for months to remodify. Every week they need another form. We fax and email. They say they can’t see in computer. They have been giving us the run around for months. You talk to a different person every time and each one gives different answers. They need to be held accountable. We are behind and we are almost in foreclosure. Is it wise to complain to Better Business Bureau… Has anyone dealt with and got good outcome with sps… attorney to contact me???

Colleen also says that they’ve had to send a different form in every week, that there’s bad communication, and that they feel SPS is giving them the runaround, which are all common complaints.

She asks if it would help to complain to the Better Business Bureau. The answer is no. The BBB is not affiliated with a government agency and does not have any enforcement power.

Is Select Portfolio Servicing A Mortgage Company

Select Portfolio Servicingmortgage servicingcompanyservicingmortgage

Select Portfolio Servicing, Inc. is a loan servicing company founded in 1989 as Fairbanks Capital Corp. with operations in Salt Lake City, Utah and Jacksonville, Florida.

Similarly, can I change my mortgage loan servicer? The only way to change mortgage servicers is to refinance your loan and move to a lender that services the loans they originate. Keep in mind, just because a company services a loan today doesn’t mean they’ll continue to do so long term. The industry is always changing.

In this manner, is Select Portfolio Servicing a collection agency?

Select Portfolio Servicing is a loan servicing company based in Salt Lake City, Utah, with an additional office in Jacksonville, Florida. Founded in 1989, SPS is not accredited by the Better Business Bureau and has received hundreds of complaints for billing/collection problems and potential FDCPA violations.

Does Select Portfolio do loan modifications?

A modification is designed to bring your account current and provide you with an affordable monthly payment by modifying the terms of your mortgage. Changes may include a lower monthly payment, a lower interest rate, a partial deferral, or reduction of principal owed, or an extension of your maturity date.

Also Check: Minimum Credit Score For Rv Loan

What Are The Types Of Loan Modifications

A loan modification will restructure your mortgage by changing one or more of the payment terms. The type of modification available will depend upon the investor and servicer for your loan. Common types of loan modifications include:

- Principal Reduction Loan Modification Forgives a portion of the principal loan amount.

- Principal Forbearance Ignores a portion of the amount owed until the end of the loan term, or the sale of the property.

- Interest Rate Reduction Loan Modification Reduces the loan interest rate.

- Loan Term Extension Extends the life of the loan, reducing the monthly payments.

- Late Fee Forgiveness Removes late fees accrued due to missed payments.

- Capitalization of Arrears All missed payments and fees are added to the end of the loan.

Contact the law firm of Ira J. Metrick today for a free consultation to learn more about how we can help you apply for a loan modification and stay in your home. We can help you understand your loan modification options in all New Jersey counties:

- Atlantic County

Is Sps A Mortgage Company

SPSmortgagecompanymortgagecompanymortgage

Select Portfolio Servicing Inc. is a nationally recognized leader in the residential mortgage servicing business. The company specializes in the servicing of single-family residential mortgage loans, and has been in business since 1989 with operations in Salt Lake City, Utah and Jacksonville, Florida.

Likewise, why did chase sell my mortgage to SPS? There are basically two main reasons why a lender might sell your mortgage. Another reason why a lender might sell your loan is because it makes money off the sale. Lenders can make money by charging fees when the loan originates, earning interest from your monthly payments, and selling it for commission.

Keeping this in view, does SPS refinance?

SPS is a mortgage servicer, which means we manage your account on behalf of the note holder. SPS is not a bank so we do not refinance. If you would like to refinance you house, please contact the bank or lender of your choice to start the process.

Does Select Portfolio do loan modifications?

A modification is designed to bring your account current and provide you with an affordable monthly payment by modifying the terms of your mortgage. Changes may include a lower monthly payment, a lower interest rate, a partial deferral, or reduction of principal owed, or an extension of your maturity date.

You May Like: Va Manufactured Home 1976

About Select Portfolio Servicing

Select Portfolio Servicing, Inc. is a nationally recognized mortgage servicer specializing in the servicing of single-family residential mortgages. SPS was founded in 1989 and is headquartered in Salt Lake City, Utah, with an office in Jacksonville, Florida. As a mortgage servicer, SPS manages the day-to-day administration of mortgage accounts, including collecting regular monthly mortgage payments.

What Is A Borrower Response Package

Introduces the Borrower Evaluation Notices and explains how to communicate your decision to the borrower. Borrower Response Package. A complete Borrower Response Package includes the following: Guide Form 710, Mortgage Assistance Application, completed and signed by the borrower, and co-borrower if.

Read Also: Va Manufactured Home Loans

What Our Clients Say About Us

Agruss Law Firm has over , an A+ BBB rating, and . Heres what some of our clients have to say about us:

Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sisters case quickly and now her debt is clear. I highly recommend Michael.

Agruss Law Firm was very helpful, they helped me solve my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!

Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! Even settled it so I was paid back for the problems they caused!

Prepare And Submit A Complete Modification Application

Once we know the Servicer, the Owner/Investor, the Modification program we believe will be used, the laws that apply and the status of any Foreclosure, we are ready to prepare and submit a complete application. It is always my advice not to submit an application in pieces. It should be complete in one package with proof of delivery, so that if there are any issues with the review, there can be no claims that they never received some of the documents. If available, we will send the Modification Application by email or fax, but we will always send hard copies to the designated address and to the attorneys if there is a foreclosure. To have the best protections, all submissions need to be made to the address designated by the lender and we always make sure we have proof of delivery.

If there is a Sheriff Sale scheduled and we adjourned the sale to have time to submit the application, we always include the letter from the Sheriff to confirm the sale has been adjourned and there is enough time for a review. The Servicer does not get automatic notice when a Borrower requests an adjournment. They have the date in their system that was provided by their attorneys. They need to be made aware that the sale has been postponed and there is time for the review.

Read Also: Becu Car Repossession

What Is Sps On Credit Report

Select Portfolio Servicing is a loan servicing company based in Salt Lake City, Utah, with an additional office in Jacksonville, Florida. Founded in 1989, SPS is not accredited by the Better Business Bureau and has received hundreds of complaints for billing/collection problems and potential FDCPA violations.

Understanding Loan Modification And Your Rights As The Borrower

It is important to understand your rights as a borrower in regards to loan modification. There are powerful new regulations that have been promulgated by the Consumer Finance Protection Bureau under the Real Estate Settlement Procedures Act and the Truth in Lending Act that finally give borrowers the right to sue when mortgage loan servicers fail to meet their servicing obligations. We can sue your lender if they violate these regulations.

You May Like: What Happens If You Default On Sba Loan