How Can I Pay Less Interest On My Car Loan

Interest charges can add thousands of dollars to the amount you have to repay. But there are ways you may be able to minimize the impact on your wallet if you need to finance your car purchase.

- 0% APR financing If you have excellent credit and the auto manufacturers finance division offers special financing, you may be able to take advantage of 0% APR financing for a certain amount of time.

- Early repayment If you have a simple interest loan, you can reduce your interest charges by paying more than the minimum due each month or paying off the balance early.

- Shorter loan term Choosing a shorter repayment term will lower the total amount of interest you pay in the long run. But itll increase your monthly payments, so be sure you can afford it.

- Refinance down the road If interest rates drop or your credit improves after you get your car loan, you may be able to get a lower rate by refinancing.

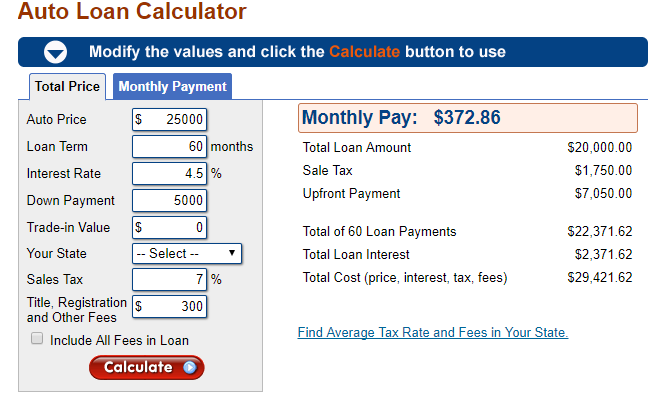

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

What To Know Before Applying For An Auto Loan

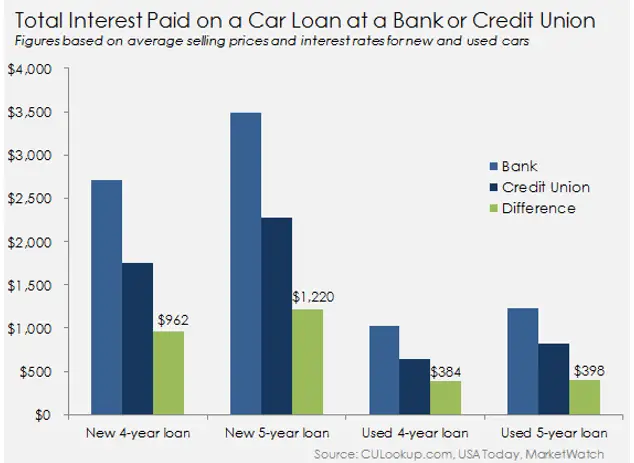

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

Recommended Reading: How To Cancel My Student Loan Debt

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Some Used Cars Are A Real Bargain

Before you take the plunge of buying a new car, consider a used one. Frugal shoppers know that new cars depreciate as soon as they are driven off the lot, and in fact lose on average 15-25% of its value each year the first five years. Buying one that’s a couple years old can still provide you with a reliable vehicle for thousands less while letting someone else take the depreciation hit. If you trade in every few years then depreciation is something to consider, so look for vehicles that traditionally hold their value such as Honda, Toyota or Lexus. If you keep your automobile until it falls apart, then depreciation is not a concern for you. New models for the upcoming year usually arrive late summer or early fall. Although selection may be limited, this is a great time to consider buying last year’s model because the dealer will need to make room for the new ones.

Do Not Buy a Lemon!

Check the used car history by the VIN# on sites like Carfax or AutoCheck. This will help eliminate anything that looks questionable. Anything that says it’s a salvage should raise a red flag. Salvage vehicles are those in accidents that the insurance company has determined repair costs are more than it is worth. Some shops will try to repair them and sale them at a steep discount. These are given salvage titles. Unless you are mechanically savvy, it’s best to avoid these.

Program Cars Are Often a Great Value

Read Also: How To Figure Car Loan Payments

How To Calculate Monthly Interest

The Balance 2020

Calculating interest month-by-month is an essential skill. You often see interest rates quoted as an annualized percentageeither an annual percentage yield or an annual percentage rate but its helpful to know exactly how much that adds up to in dollars and cents. We commonly think in terms of monthly costs.

For example, you have monthly utility bills, food costs, or a car payment. Interest is also a monthly event, and those recurring interest calculations add up to big numbers over the course of a year. Whether youre paying interest on a loan or earning interest in a savings account, the process of converting from an annual rate to a monthly interest rate is the same.

Get Current Auto Loan Rates And Choose A Loan Thats Right For You

Car loan interest rates change frequently, so its important to keep track of them. Your loans interest rate influences how much youre going to pay for month to month. And a lower interest rate can mean thousands of dollars in savings. Our rate table can help you know the best time to buy a new or a used car.

Current auto loan interest rates| 4.43% |

Also Check: What You Need For Car Loan

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

How To Use The Auto Loan Calculator To Find The Right Car

Bankrates auto loan calculator will give you a good idea of how much car you can afford from a monthly payment standpoint. Start with a list of vehicles that youre interested in and estimated purchase prices. Then subtract the amount of money you can use for a down payment and an estimate of your current cars trade-in value. Lastly, compare costs to make sure that the calculated auto loan payment based on the amount you need to borrow aligns with your monthly budget.

Recommended Reading: Where To Get Instant Loan

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

Read Also: How To Compare Student Loan Rates

How Average Interest Rates Vary For Loans For New And Used Vehicles

The average interest rates on auto loans for used cars are generally higher than for loans on new models. Higher rates for used cars reflect the higher risk of lending money for an older, potentially less reliable vehicle. Many banks wont finance loans for used cars over a certain age, like 8 or 10 years, and loans for the older models that are allowed often carry much higher APRs. One leading bank offers customers with good credit interest rates as low as 2.99% for purchasing a new model, but the minimum interest rate for the same loan on an older model from a private seller rises to 5.99%.

The typical auto loan drawn for a used car is substantially less than for a new model, with consumers borrowing an average of $20,446 for used cars and $32,480 for new. However, terms longer than 48 or 60 months are generally not allowed for older model used cars, as the potential risk for car failure grows with age.

How To Calculate Auto Loan Interest For First Payment

When figuring out how to calculate auto loan interest for the initial payment, the steps below can help:

The number you get is the amount of interest you pay in month one.

Don’t Miss: Can You Use Fha Loan For Land

Amortization Table And Interest

- Expanding the “Auto Loan Balances and Interest” section below the Auto Loan Payoff Calculator will display a graph illustrating the rate you will pay down your loan with and without any additional payments, plus your accumulated interest charges over time.

For the full amortization schedule, choose whether you want to see monthly or annual amortization then click “View Report” at the top of the page. You’ll then see a page showing how much you’ll shorten your loan by, the graph illustrating your amortization, a summary of the loan and a line-by-line table showing the amortization of the loan over time and comparing regular vs. accelerated payments.

- FAQ: Great tool to make positive decisions on budget planning and goals

If you’re looking to trade in your car at some point in the future, the amortization schedule is useful in that it lets you know exactly how much you’ll still owe on the loan at any point in time. You can then use this information, combined with the vehicle’s depreciation, to estimate what your trade-in value would be.

Calculate Interest Paid By Hand

You can also calculate the total interest you can expect to pay by hand using a simple formula. Before doing so, make sure you have the information you need, including how much you pay per month, the principal loan amount, and the total number of payments you have to make.

Materials Needed

- Calculator

- Paper and pencil

Step 1: Find the monthly interest. Divide the APR by 12 to determine the amount of monthly interest.

For our example we will assume that you have an APR of 6%. Divided by 12, this gives you a monthly interest rate of .5%. Convert this further into its decimal point equivalent, which is 0.005. As part of the equation, you have to add 1 to your monthly APR, giving you 1.005.

- Tip: You could opt to make a higher down payment to qualify for a lower APR. This reduces the total amount of interest you have to pay over the life of the loan.

Step 2: Factor in your other numbers. Further information you need for this equation includes the principal, or the amount you are borrowing, and the length of the loan, or the amount of time in months, that you plan on paying the loan back.

For this example, we will use $15,000 as the amount of the principal, paid off over the course of five years, or 60 months.

Step 4: Multiply with the APR. Multiply the amount gained from the above step by the amount of the original APR, which in this case is 0.005. This gives you the sum of 0.00674.

Don’t Miss: What The Highest Apr For Car Loan

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this tool, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. Full disclaimer. This tool is here purely as a service to you, please use it at your own risk.

Also Check: Can I Get An Investment Property Loan With 10 Down

Interest Rates And Apy

Be sure to use the interest rate in your calculationsnot the annual percentage yield.

The APY accounts for compounding, which is the interest you earn as your account grows due to interest payments. APY will be higher than your actual rate unless the interest is compounded annually, so APY can provide an inaccurate result. That said, APY makes it easy to quickly find out how much youll earn annually on a savings account with no additions or withdrawals.

Simple Interest Car Loans

Most auto loans are simple interest loans, which means that the amount of interest you pay each month is based on your loan balance on the day your payment is due. If you pay more than the minimum due, the interest you owe and your loan balance can decrease.

On a simple interest loan, interest is front-loaded and amortized. With an amortized loan, part of your monthly car payment goes to the principal, which is the amount you borrowed, and part of your payment goes to the interest charges. Because the loan is front-loaded, a larger portion of each car loan payment applies to interest at the beginning of the loan term and at the end of the term more applies to the principal balance.

For example, If you have a $25,000 car loan with a 48-month term and a 4% interest rate, youll pay an estimated $83 in interest and $481 in principal during the first month of the loan term. By the last month, youll only pay an estimated $2 in interest, and $563 will apply to the principal amount.

Read Also: How Much Can I Get From Fha Loan