What Is A Private Student Loan And How Does It Work

A private student loan is a loan used to cover qualifying educational expenses. You can take out private student loans through banks, online lenders and credit unions, and sometimes through colleges and state agencies. These usually have higher borrowing limits than federal student loans and may offer lower interest rates for borrowers with good credit, but they come with fewer borrower protections.

To qualify, youll need to meet the lenders eligibility requirements and go through a credit check. Applicants with good or excellent credit tend to get the lowest interest rates. But because undergraduates usually dont have extensive credit histories, they typically need a co-signer to take out a private student loan.

How Do I Refinance My Student Loans

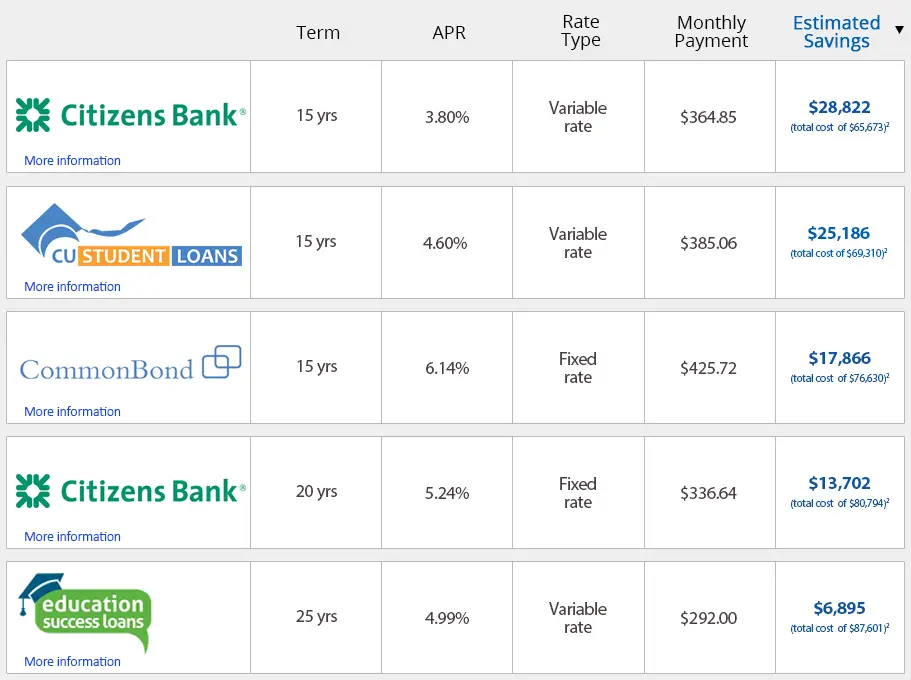

To refinance your student loans, shop around and compare a few lenders to see which one offers the best rate and repayment terms for your situation, getting prequalified where possible. When you’re ready to apply, you can typically apply online, over the phone or in person. Once you’re approved and have submitted the necessary documentation, the lender will pay off your existing loans, and you’ll begin making your new payments.

How Are Interest Rates Determined For Private Student Loans

Private student loans usually offer variable and fixed interest rates that are based on the borrowers creditworthiness. If you have good or excellent credit, then youll be eligible for a lower interest rate. But if you have poor or fair credit, prepare for an interest rate on the higher end of the range.

Variable rates rise and fall according to the index they follow. For example, the lender may use the prime rate as its benchmark.

Also Check: How Can I Get An Rv Loan With Bad Credit

Student Loan Refinance Rates

Overwhelmed by student loan debt? Youre not alone. Some 40 million people still have debt to pay off from their college days.

Letting your student debt pile up year after year without taking action to pay it off is not a good idea. Ignore it long enough and youll eventually find your wages garnished and your credit destroyed. If your credit score drops too low, youll reduce your chances of being able to secure the car or the house you want.

You wouldnt want any of that to happen. So what are your options? If consolidating your loans wont improve your circumstances or you cant qualify for any repayment plans like the federal governments Pay As You Earn Plan you can always consider refinancing your student loans.

Our Picks For The Best Student Loans

If you’re ready to shop around, here are our picks for the best private student loans. We recommend comparing all of them – it honestly only takes a few minutes. You can take a look at our full list of the best private student loan lenders.

Considering everything else you’ve done to apply for college at this point in time, spending an hour to compare the best student loans is a no brainer!

Note: The student loan offers that appear on this site are from companies from which The College Investor receives compensation. This compensation may impact how and where products appear on this site . The College Investor does not include all student loan companies or all student loan offers available in the marketplace. As always, shop and compare!

Also Check: What Form Is Student Loan Interest Reported On

Choosing Between Federal Student Loans And Private Student Loans

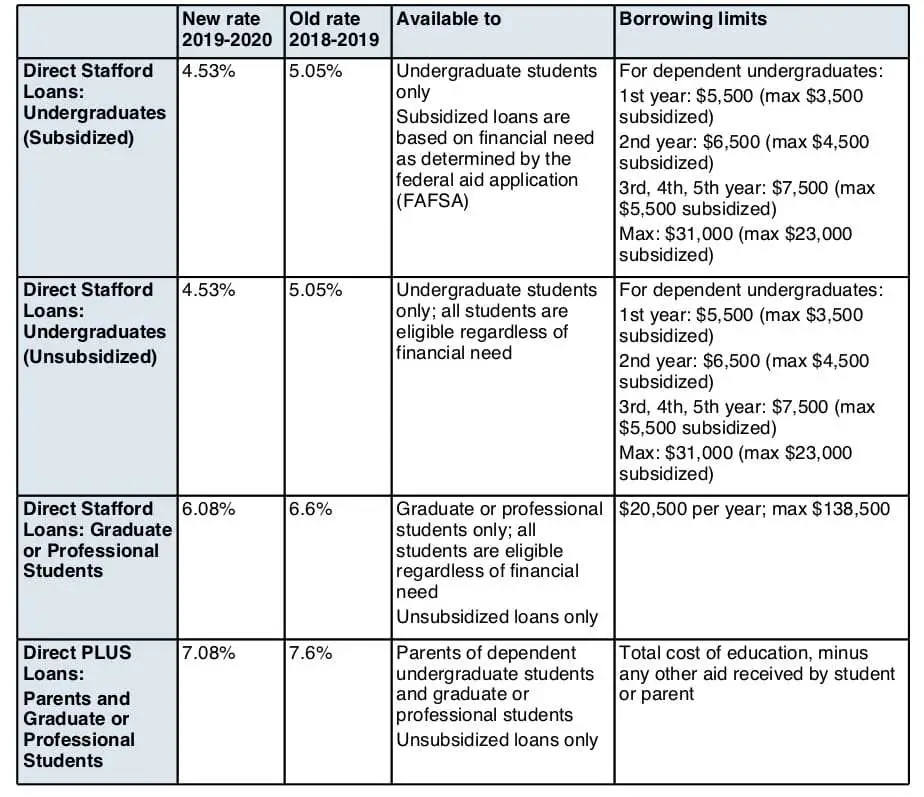

First and foremost, you should look to federal student loans to finance your education. Federal loans can be a better option for students because:

- The government pays interest on subsidized federal loans while youre still in school.

- Federal loans have fixed, not variable, interest rates. So your monthly payments wont change.

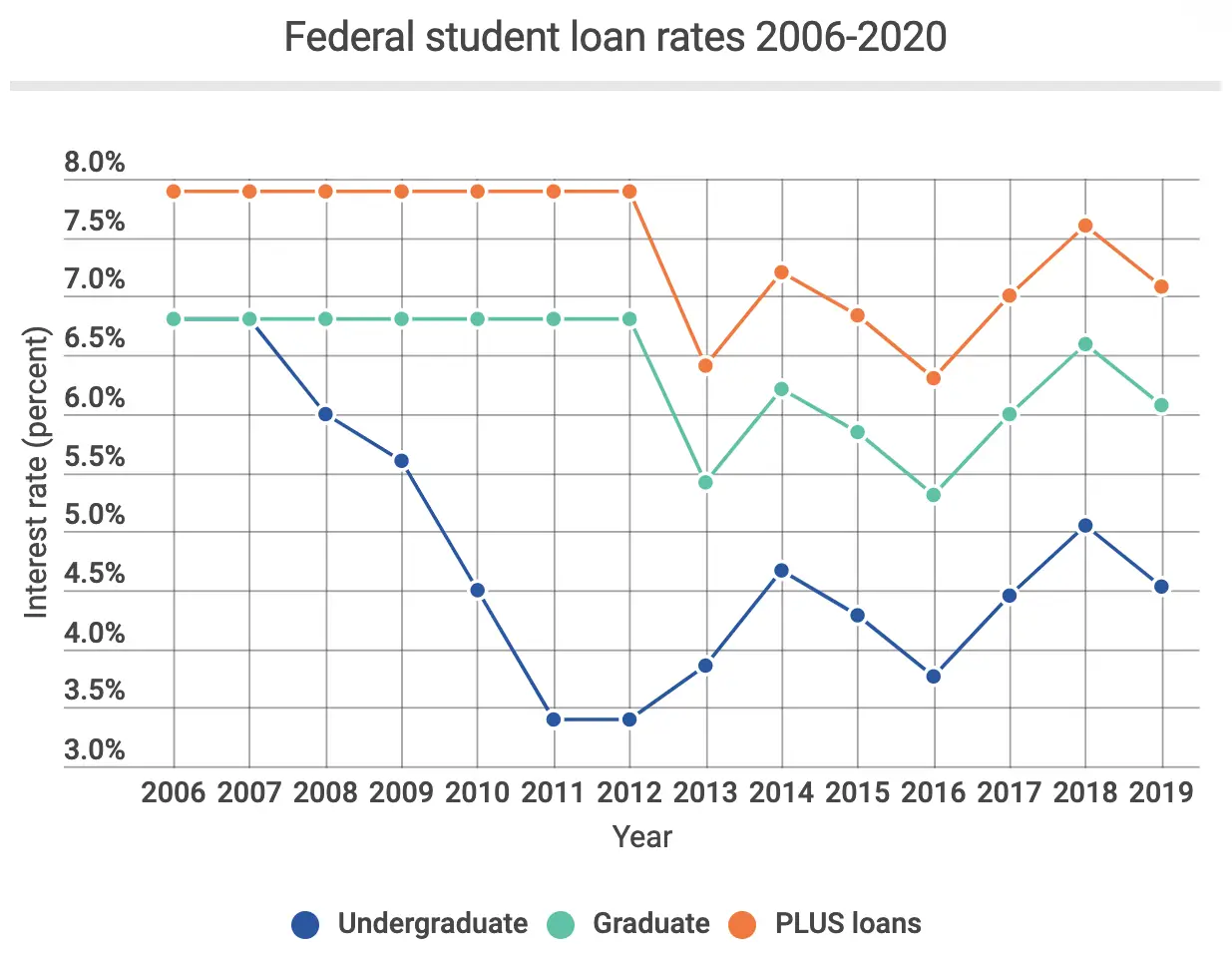

- The typical interest rate on student loans from the federal government are lower than ones youll get on a private student loan. For the 2020-2021 year, subsidized and unsubsidized Direct loans for undergraduates have an interest rate of just 2.75%.

- Federal student loans offer flexible repayment options, including income-driven repayment plans. That means you can keep your payments affordable.

- Some students might be eligible for federal loan forgiveness after 10 years of working in qualifying public service jobs.

Thoroughly compare the differences between federal and private student loans before deciding which option is best for you.

Can I Pay More Than My Minimum Payment When I Refinance My Student Loans

Heck yeah! Just like most loans, you can always make extra or overpayments. Actually refinancing can make it a little easier because you dont have to pick a loan to direct your overpayment to. That means you dont have to decide between the debt snowball or avalanche method, you just make a larger payment.

Paying more than the minimum payment is a great way to save money and reduce the life of your loan. After you refinance, contact your lender first so you know how to overpay.

Recommended Reading: How To Calculate Mortgage Loan To Value

How Do I Apply For A Student Loan

You can apply for a student loan through banks, online lenders, credit unions and the federal government. To apply for a federal student loan, you’ll fill out the Free Application for Federal Student Aid , which opens up on Oct. 1 each year. Once you fill it out, you will be notified about your eligibility for federal student loans and other financial aid.

To apply for a private student loan, first compare a few lenders to determine which offers the best rates and terms for your needs. You can prequalify with most lenders, which lets you see your loan offer before submitting a formal application. When you’ve selected a lender, you can apply online, over the phone or in person, if the lender has physical locations.

Tip : Read The Fine Print

Sometimes lenders include an interest rate discount or certain loan terms in their advertised rates. For example, some lenders give borrowers a lower interest rate if they are already a customer or enroll in auto debit payments. Keep in mind that if the auto debit discount is factored into the advertised rate, this discount may not kick in until you have entered repayment, which is likely after you graduate.

The advertised rate may also factor in that you’ll start to repay the loan while in school or that you’ll agree to a shorter repayment term . So even with perfect credit, you may not qualify for the advertised rate if you don’t also agree to these other terms.

Reading the fine print when you are comparing private student loan rates and looking at the monthly payment amounts could help you make a better apples-to-apples comparison. If your plan includes an interest-rate discount or one of the shorter-term options, be sure you can qualify for the discount and that your budget will allow for higher payments.

Also Check: How Much Loan Can I Get With 800 Credit Score

What Other Services You Can Find With Credible

If youre getting serious about paying off your credit card debt, Credible also offers personal loans that can be used to consolidate your credit card debt in one easy payment. Credit cards have notoriously high-interest rates, and consolidating your credit cards by finding a personal loan through Credible, might cut your rates in half.

Credible even has a calculator that shows your potential savings, and heres an example:

Say you have $30,000 in credit card debt. Credible estimates that they can save you around $5,700 over the course of your payoff.

Unlike student loans, when you consolidate your credit cards with a personal loan, youre not losing income-driven repayment options, forgiveness, or deferment and forbearance. But, you will still need a good to excellent credit score to qualify for the best rates.

In addition to personal loans, you can also use Credibles marketplace for:

- Mortgages

- Mortgage refinancing

- Comparing credit cards to find the best travel rewards card, best card for students, best balance transfer card, etc.

The Credible marketplace works the same way for each of those services fill out a quick survey, compare rates and terms, then select a lender to lock in your rates.

The Interest Rate And Loan Fees

Interest is the cost of borrowing, paid as a percentage of your principal balance. Fees could include origination fees, application fees, late payments;and prepayment penalties.

While federal student loans have low fixed interest rates that are the same for every borrower regardless of or income, private lenders work differently. Rates can vary from one lender to the next and lenders often offer a choice of fixed or variable rate loans. Use Credible;to find a rate that fits your budget.

Private lenders offer a range of rates for their loans with only well-qualified borrowers getting the lowest rates. Fees can also vary, with most private student loan lenders charging no origination fees or prepayment penalties. Some impose;late payment penalties while others don’t.

You can use an online student loan calculator to see how different interest rates affect the amount you pay each month for your loan. The cheaper the rate and the lower the fees, the lower your monthly payment and the more affordable total debt payoff will be.

You May Like: How To Get Lowest Interest Rate On Personal Loan

Refinance Loan Interest Rates

Federal and private student loans can only be refinanced through private lenders.

- One study found that if every eligible borrower refinanced their loans, the national average interest rate would drop to 4.2%.

- 52.8% of borrowers are eligible for refinancing.

- 33.3% of borrowers consolidate or refinance their loans.

For more information, see our report on Student Loan Refinancing.

Duet Admit Cards To Be Available Soon

The DU entrance exams also known as DUET for the year 2021 which is conducted by the Delhi University will be held soon for several UG, PG and MPhil and PhD courses from 26 September to 1 October. The candidates who will be appearing for the entrance exam will now soon be able to download their admit cards for the same.

The candidates will be required to carry the self-declaration letter downloaded from the NTA website along with the call letter, transparent ballpoint pen, passport size photo, personal hand sanitiser, transparent water bottle and ID proof on the day of the exam.

The candidate in order to download the admit card will have to click on the link nta.ac.in/duetexam, where on clicking the DUET Hall Ticket link they will be taken to a different page where the login credentials are to be entered. Once the candidate has logged in, click on Download DUET 2021 Admit Card. Once the admit card is downloaded, get a print out of the same and keep it safely for future reference.

20 September 2021

Don’t Miss: What’s The Smallest Car Loan You Can Get

Can I Refinance More Than Once

Sure, but first think about why youre refinancing. Is it because rates have gone down and you want to save even more? Refinancing in this situation could make sense.

But, if youre refinancing again for a longer loan term because you cant afford your payments, then thats another thing entirely, especially if the rates are higher now.

Have you tried to cut your monthly household expenses? Have you looked into a side hustle?

Whats The Difference Between Government Loans And Private Loans

Loans are offered by the federal government or by private companies.;

There are three main types of federal student loans:

The first two are generally loans with very good terms, better than what youd find elsewhere from private companies. So if you need to take out loans, always max out your offers of these first.

Unfortunately, after accepting 100% of your Direct Stafford loans, you might still have a financial gap.

In that case, you should consider Parent PLUS loans as well as private loans . Parent PLUS loans are designed to be more similar to offers you might find elsewhere, so theyre not always better.;

For more information on federal student loans, we have a full article on how those work.;

Recommended Reading: Can I Pay Off Personal Loan Early

Latest Updates For Nta Neet 2021 Entrance Exam Date Admit Card Guidelines Omr Answer Sheet Exam Centre List

The National Testing Agency announced the date for releasing of the admit cards for National Eligibility Entrance Test 2021 entrance exam on 9 September. Once the admit card is released, it can be download from the NTA’s official website- neet.nta.nic.in. The NEET 2021 entrance examination has been scheduled to take place on 12 September.

Applicants can visit the NTAâs official website to check the exact location of their NEET 2021 entrance exam centre.The NEET 2021 entrance exam admit cards will have all the detailed guidelines on entry at the exam centre and the dress code too. The admit card will also have the guidelines to be followed in order to restrict the spread of COVID-19.The NTA has also released a list of instructions on how one can fill the OMR sheet along with a sample OMR sheet on its official website to help the candidates get clear demonstration.

25 August 2021

How To Compare Private Student Loans

First, take a look at the loans overall cost. Consider both interest rate and fees. Also, look at the type of help each lender offers if youre not able to afford your payments.

If you have good or excellent credit, you have a better chance at landing the best interest rates.

How much should you borrow? Experts generally recommend borrowing no more than youll earn in your first year out of college. How much can you borrow? Some lenders cap the amount you can borrow each year, while others dont. When youre shopping around for a loan, take to lenders about how the loan is disbursed and what costs it will cover.

Read Also: Where To Get Quick Cash Loan

Factors To Consider When Comparing Student Loan Companies

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Results Declared For Ap Polycet 2021

On 15 September 2021, the State Board of Technical Education announced the results of the Andhra Pradesh Polytechnic Common Entrance Test . Individuals who have given the test can check their results by visiting polycetap.nic.in. In order to download the result, you will need to visit polycetap.nic.in and click on âResult & OMRâ. Next, you will need to click on the download link. Next, you will need to enter the TS POLYCET â 2021 hall ticket number. On the next page, you will be able to download and print the result.

16 September 2021

Recommended Reading: Who Do I Talk To About An Fha Loan

Save Money With Student Loan Refinancing

The average student graduates college with more than $30,000 dollars in student loans. Those that go on to graduate school will graduate with even more debt, many times in the six figures for professional degrees. Borrowers dont always realize that their loans are costing them more than they think. Interest is tacked on to the loan amount making the total cost of the loan greater. While there is no way to eliminate student loan debt without paying it off, there are some tactics to reduce the overall cost of the principal and interest combined. One way is with a student loan refinance.

Education Loan Repayment Process

The loan repayment period usually starts 6-12 months after completing your course or when you get a job, whichever occurs first. Different lenders provide different moratorium periods to applicants to repay the loan. You will have to repay your loan through EMIs.

Here are the different modes of repayments usually available:

- Internet Banking – Pay online through the lenderâs website or mobile app.

- Cheque â Drop a cheque at any of the branches.

- Direct debit â Set up recurring payments for your EMI to be directly debited from your bank account on the payment due date.

- Demand Draft â Pay through a DD.

The preferred method of repayment varies between lenders. Therefore, it is advisable to check with your lender when taking the loan.

Discussed below are a few important details in regard to education loan repayment process:

Moratorium period: In the case of education loans, the beneficiaries will be able to start paying off the loan after the completion of the educational course or after successful employment.

Part-payment of education loans: The beneficiaries of education loans will be allowed to make part payments towards their loans. As an applicant, you can pay back a lump sum amount to make part repayment of the loan.

Pre-payment of education loan: If an applicant is able to manage the funds for the pre-payment of the loan amount, he or she will be able to do the same. However, it should be kept in mind that this might invite a processing fee.

Recommended Reading: How To Apply Loan In Sss