Which Are The Most

Levels of educational attainment vary widely across the country. The states with the most bachelors degree recipients age 25 or older are Massachusetts , Maryland , Colorado , and Connecticut . The states with the fewest bachelors degree holders are West Virginia , Mississippi , Arkansas , and Kentucky .

Applying For Federal Financial Aid

The process for obtaining federal financial aid is relatively easy. You fill out a single form, the Free Application for Federal Student Aid and send it to your schools financial aid office. Then they do the rest. The FAFSA is your single gateway to Stafford loans, Perkins loans and PLUS loans. Many colleges also use it to determine your eligibility for scholarships and other options offered by your state or school, so you could qualify for even more financial aid.

There is really no reason not to complete a FAFSA. Many students believe they wont qualify for financial aid because their parents make too much money, but in reality the formula to determine eligibility considers many factors besides income. By the same token, grades and age are not considered in determining eligibility for most types of federal financial aid, so you wont be disqualified on account of a low GPA.

Benefits Of Student Loans Invest In Your Future

Federal student loans are an investment in your future. You should not be afraid to take out a federal student loan because they can help fill the gap by providing essential funds to cover your educational expenses. Student loans offer financial support for students who would otherwise be unable to attend college or graduate/professional school.

Recommended Reading: Usaa Refinance Student Loans

Student Loan Interest Rates From 2006

Over the past 12 years, interest on federal student loans has ranged from 3.4% to 7.90%, depending on the type of loan. Although these student loan rates have fluctuated through the years, rates have been rising since 2016. To see a visual representation of how student loan interest rates have changed over time, we’ve provided a chart that illustrates the rate pattern for three types of student loans since 2006.

*Note that in the above chart we didn’t include the historical rates for Stafford Loans or Federal PLUS Loans. Both loans were part of the Federal Family Education Loan Program , which was terminated in 2010. However, we have included their historical rates from 2006 and on in our breakdown below.

Current & Historic Federal Student Loan Interest Rates

With the passing of the Coronavirus Aid, Relief, and Economic Security Act , no interest will accrue on federal student loans in repayment until May 1, 2022effectively setting the interest rate at 0%. Payments made during this time will first apply to unpaid interest accrued from before March 13, 2020, then directly towards the principal balance of the loan.

In the following table, you will find the current and historic interest rates for federal loans. These rates coincide with the academic year that the loans were taken out .

It should be noted that all of these are fixed rates, meaning that they do not change over time.

| Loan type | |

| 6.31% | 6.84% |

Federal student loans are issued by the Department of Education to eligible students who fill out the Free Application for Federal Student Aid, or FAFSA. The interest rates on these loans are set once a year and are based on the 10-year Treasury note.

Heres how interest works for different borrowers:

An added cost to federal loans worth mentioning comes in the form of an origination fee. Unlike most private lenders, the Department of Education deducts a fee from your loan amount prior to disbursement. This deduction means that your loan amount will be a bit higher than the funds disbursed to your school.

Here are the current and historical origination fees for federal student loans.

| Loan type | |

| 4.27% | 4.29% |

Read Also: Fha Title 1 Loans

Interests On Federal Student Loans

Most student loans in Canada are gotten from the National Student Loan Service Centre. While many students choose federal loans, it is possible for you to access extra funding from provincial loans every year.

Federal loans allow an interest rate of 2.5% plus prime. This means that the interest on federal student loans is added to the average bank prime rate in Canada. Plus prime varies with time, although it remains at 3.95% as of January 2020. Based on this, the interest on federal students loans sums up to about 6.45%.

Most Federal Student Loan Interest Rates Remain At Zero Due To The Payment Pause For Now

All government-held federal student loans have been in a payment pause and interest suspension since March 2020. For nearly two years, no payments have been due on these loans, and interest rates have been frozen at 0%. That relief was originally scheduled to end on January 31, but last month, President Biden extended that relief further to May 1.

Any interest rate increase by the Fed will have no impact on the interest suspension associated with this ongoing payment pause.

Don’t Miss: Bayview Loan Servicing Tucson Az

When To Consider Refinancing For A Lower Interest Rate

If you are paying a high interest rate on your student loans anything at or above 10% according to refinancing lender CommonBond consider refinancing. If you’re on the fence, calculate the amount of interest you pay each month. A lower interest rate will likely save you a considerable amount of money over time.

But federal borrowers should be aware of certain caveats to refinancing: With the current federal loan payment and interest pause extended through at least Sept. 30, 2021 as part of the Covid relief, it wouldn’t make sense for federal student loan borrowers to refinance with a private lender right now. You can’t get a lower interest rate than the current interest freeze.

In accordance with the Fed lowering interest rates across the board, private lenders have also lowered the rates they offer. But note that refinancing from federal to private lenders is irreversible, so once you switch you can’t go back. Putting your student loan payment instead into a high-yield savings account like the Varo Savings Account from now through September could bulk up your emergency fund while you decide the best course of action.

Types Of Interest Rates In Education Loan

The type of interest rate on educational loans depends on the bank. Some banks offer a fixed interest rate throughout the loan repayment tenure. Others have interest rates that are pegged to the one-year . This can be reset at regular intervals, which would then affect the interest rate of the educational loan.

Recommended Reading: Usaa Used Car Refinance Rates

Average Student Loan Interest Rates In 2022

Edited byAshley HarrisonUpdated December 13, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

From 2006 through 2022, average federal student loan interest rates were:

- 4.60% for undergraduates

- 7.20% for parents and graduate students taking out PLUS loans

Are your rates higher than average?

See what rates you could get using Credibles rate estimator

*Rates displayed above are estimates based on your self-reported credit score and should only be used for informational purposes.

Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan.

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

Recommended Reading: How To Get Mortgage License In California

Interests On Provincial Student Loans

So far, Newfoundland and Labrador, Quebec, and Manitoba are considered the most desirable provinces for obtaining student loans in Canada. Firstly, the process of getting financial aid is easier than in most other regions. In addition to this, schools in these provinces offer some of the lowest tuition rates in the country

Interest Rates For 2021

The federal student loan interest rate for the 2021-2022 school year is:

- Undergraduate students 3.73%

- Graduate students 5.28%

- PLUS loans for students and parents 6.28%

Federal student loans are disbursed with what are known as grace periods, which vary in length depending on the kind of loan you have taken out.

Direct Unsubsidized Loans, Direct Subsidized Loans, Unsubsidized Federal Stafford Loans, and Subsidized Federal Stafford Loans all have a six-month grace period. This means that, upon graduation or falling below half-time student status, youll have six months before you have to begin repaying your student loans.

Meanwhile, PLUS loans, which both students and parents can apply for, have no grace period. Once you have received your first payout for this type of loan, youll need to begin repaying right away. PLUS and other loans can also include fees youll need to pay upfront, which vary on the size of the loan.

Check Out Our Top Picks:Best Private Student Loans of 2021

Don’t Miss: When Can You Refinance An Fha Loan

What Affects Federal Student Loan Rates

Here are some factors that contribute to your interest rate:

- What type of student loans youre getting. Direct subsidized and unsubsidized loans carry the lowest federal student loan rates, while PLUS loans cost more.

- What type of borrower you are. On direct unsubsidized loans, undergraduate students pay rates that are 1.55 percentage points lower than those for graduate or professional school borrowers.

- When you take out a loan. Federal student loan interest rates are decided annually on June 1 and take effect from July 1 to June 30 of the following year. Your loan will be assigned the federal student loan rate based on the date of the first disbursement.

- Recent 10-Year U.S. Treasury yields. The formula for federal student loan rates is based on the 10-year Treasury yield, plus a fixed add-on amount. When U.S. Treasury yields rise or fall, student loan rates track along with them, up to a rate cap set by law.

Theres little that you can do to control the rates on your federal student loansyou and everyone else taking out the same types of loans in the same period will have the same interest rate.

Fortunately, federal student loan rates tend to beat what youd pay on private student loans or other forms of debt, making them a fairly affordable way to finance a college degree.

Student Loans Vs Credit Cards And Auto Loans

In the past decade, total U.S. student loan debt has surpassed credit card debt and auto loan debt. In the third quarter of 2018, Americans owed $840 billion on their credit cards and $1.21 trillion in auto loans. Currently, U.S. student loan obligations are larger than both, trailing only mortgages in scope and impact.

Also Check: How To Get Leads As A Loan Officer

A Line Of Credit To Help Conquer Your Goals

Get convenient access to cash and only pay interest on the funds you use. Enjoy this low introductory rate, equal to CIBC Prime currently at RDS%rate.PRIME.Published%, until July 22, 2022.

All fixed and variable rate loans are based on the CIBC Current Prime Rate.1

Rates as of RDS%SYSTEM_DATE%

| Loans | |

|---|---|

|

Your choice of term, payment frequency and fixed or variable interest rate. |

1 to 5 years |

|

Get terms up to eight years, with the possibility of no down payment. |

1 to 8 years |

|

Borrow $5,000 to $50,000 to take advantage of unused RRSP contribution room. |

1 to 10 years |

|

Get a lower interest rate by using the equity in your home |

Open ended |

|

Get flexible access to funds at interest rates lower than most credit cards. |

Open ended |

|

Borrow up to $40,000 to help with your post-secondary education costs. |

Open ended |

|

Borrow up to $350,000 to help cover costs. |

Open ended |

Are Student Loans Forgiven After 65

Nothing happens to student loans when you retire. You will still owe your federal student loans. … They’re also not forgiven because you retire. Federal student loans do, however, allow you make monthly payments based on your income, the number of people living with you that you support, and your student loan balance.

Recommended Reading: Specialized Loan Servicing Ceo

Direct Graduate Plus Loan

The Direct Graduate PLUS Loan is for graduate and professional students. Interest begins to accrue once the first disbursement is made. If you are denied the GradPLUS Loan based on credit, you are NOT eligible for additional unsubsidized loan funds. After the second disbursement, you will have a 60-day grace period until your first payment is due. You may be able to defer or delay repayment while you are attending school at least half time.

Whats The Average Interest Student Loan Rate

When it comes to federal student loan interest rates, there technically is no average because rates are set by the government each year and do not change based on the characteristics of individual borrowers. This means there is just one set rate for each type of loan.

The average student loan rate varies only depending on the type of loan including whether its a federal or private loan and the type of degree.

The rates for private student loans, on the other hand, are determined by each lender and can vary depending on the qualifications of the borrower.

Recommended Reading: Transferring Auto Loan To Another Bank

Public Service Loan Forgiveness

The Public Service Loan Forgiveness Program is designed to benefit borrowers who work for a qualified employer, such as a governmental office or not-for-profit organization. Multiple factors influence a borrowers eligibility for this student loan forgiveness program, including their history of qualified payments and type of federal loans they selected. You can learn more about the PSLF Program at StudentAid.gov.

Despite Cost Americans Still Opt For Higher Education

Higher education has long been considered the ticket to affluence and job satisfaction. The earnings premium for degree holders has grown steadily over the past several decades, and college graduates are more likely to become homeowners, according to the Federal Reserve Bank of New York. Among all Americans aged 25 and older, 58.9% have spent at least some time in college, and about 32.5% have earned a bachelors degree or higher. Younger Americans are more likely to prioritize going to college than previous generations. Among people aged 65 and older part of the baby boomer and silent generations 50% have spent some time in college, and 27% have a bachelors degree or higher. Among those aged 25 to 34 who would be considered millennials 65% have spent some time in college, and 36% have a bachelors degree or higher.

Recommended Reading: How Long Does The Sba Loan Process Take

Many Factors Influence Your Monthly Student Loan Payment Including Which Repayment Plan You Choose

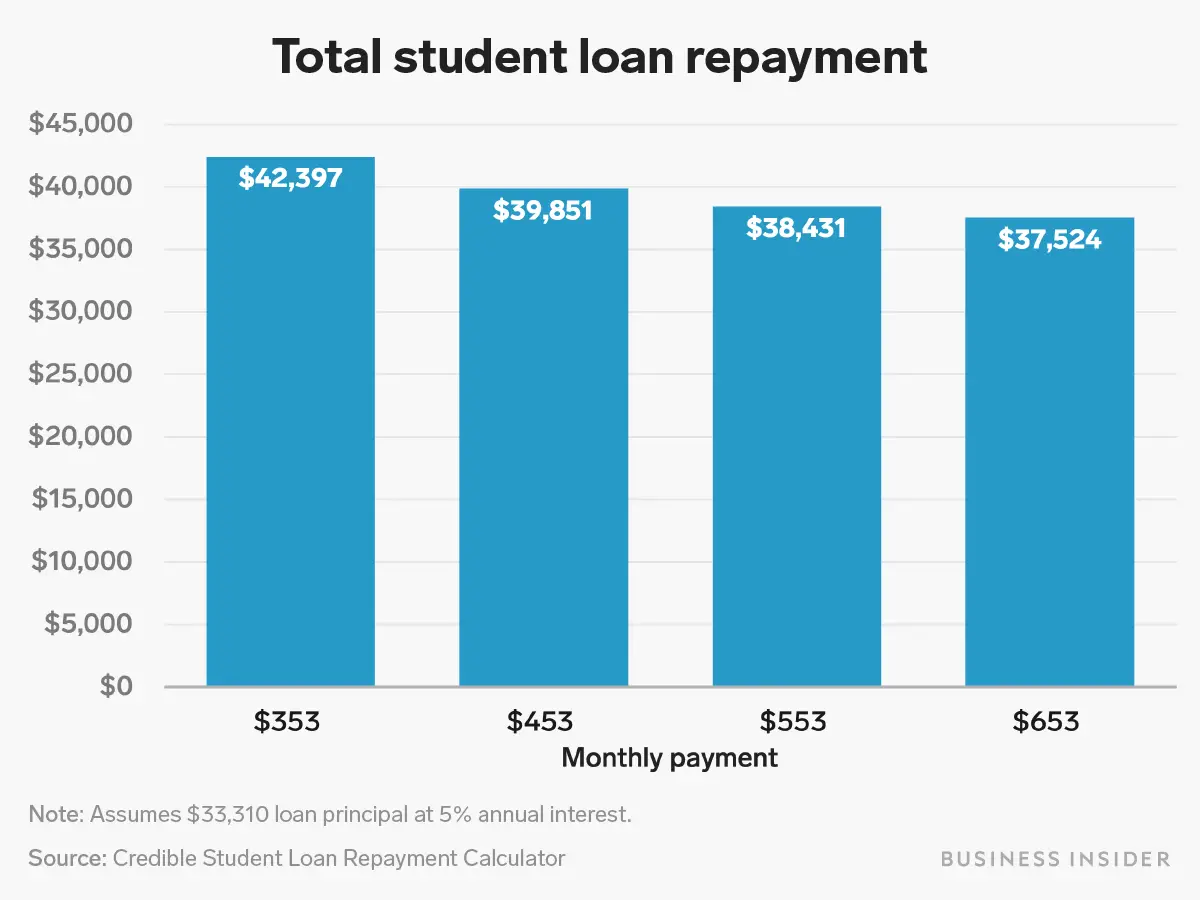

The type of loan, loan term, interest rate, and repayment plan all affect student loan payments.

Whether youre a new student or recent graduate, you may want an idea of how much your student loan payments will be when you have to begin repaying your student loans. Calculating your monthly student loan payments can be difficult, even when you know the interest rate and loan principal.

Fees, the type of loan you have, and multiple other factors can influence the payment amount, adding hundreds or even thousands of dollars to your loan total.

Lets look at what the average student loan payment is, how to calculate yours, and how you could lower your student loans. If you have personal student loans, refinancing them into a lower interest rate or longer repayment term may help reduce your monthly payments. Credible makes it easy to see current student loan interest rates.

How Much Would Students Really Save

The problem with the hypothetical math above is that most students arenât taking out $50,000 in loans. For the class of 2019, the average student loan debt for undergraduates was $28,950. So for a student taking out that average amount spread over 10 years, what kind of difference would 0% interest make compared to 3.73%?

About $48 a month.

People with a lot of debt could save a great deal of money if interest was eliminated. But the reality is that most students are not taking out loans large enough for the interest to be deeply impactful.

âI would be surprised if a 3% interest rate on a student loan would make or break someoneâs decision to go to college,â Delisle says.

But what about grad students? They pay higher interest rates than undergraduates do, so setting their rate to 0% would result in them saving more money. But interest rates for graduate school are higher because these borrowers can largely afford it. Generally speaking, the more advanced the degree that people have, the more money they haveâalong with earning potential.

Also Check: Usaa Car Loan Credit Score