Why Your Debttoincome Ratio Is Key

While many factors impact the amount you can borrow, your debttoincome ratio is essential to the equation.

DTI compares your monthly gross household income to the monthly payments you owe on all your debts including housing expenses. The standard maximum DTI for most mortgage lenders is 41 percent.

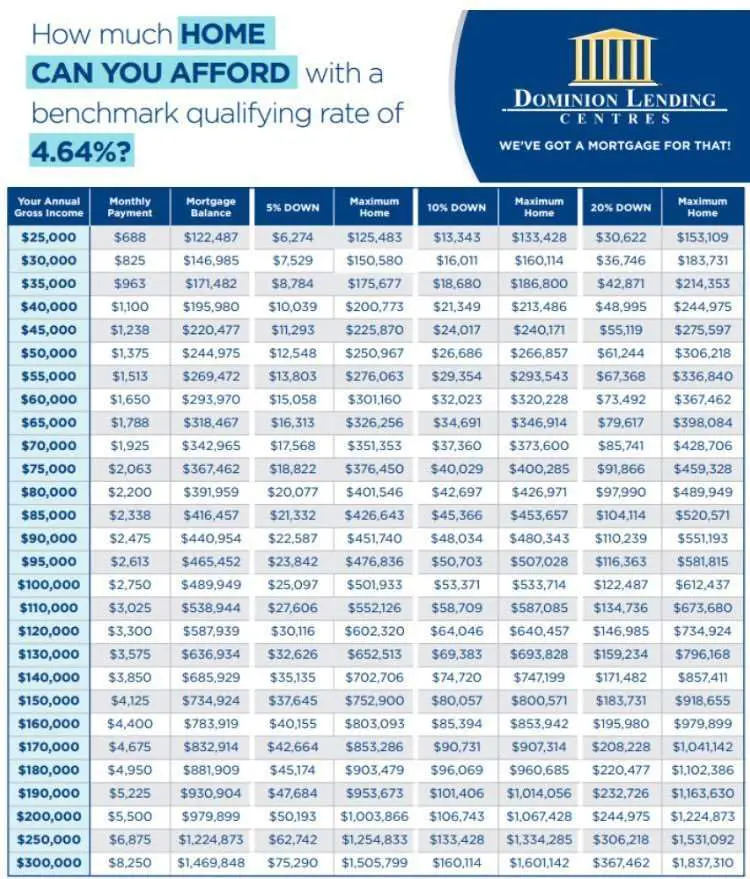

To achieve a 41 percent DTI with a $50,000 annual income , you couldnt exceed $1,700 a month in housing and other debt payments.

The less you spend on existing debt payments, the more home you can afford and viceversa.

Say $400 of your monthly debt payments go to a car loan, a student loan, and minimum payments on your credit card debt. In this case, you would have $1,300 to spend on housing.

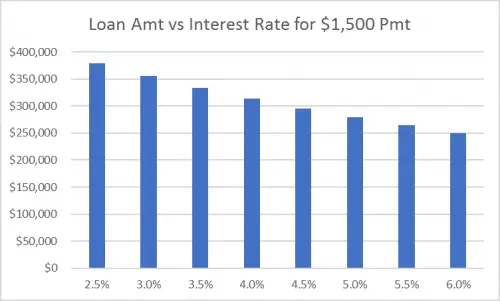

With a $10,000 down payment and 4% interest rate, you could probably buy a home for a maximum price of around $200,000 and still have a $1,300 monthly payment.

If you had no existing monthly debts, you could spend $1,700 a month on your mortgage payment and still keep a 41 percent DTI.

In this case, your home buying budget would increase to about $300,000 even with the same $10,000 down and 4% interest rate.

Thats an additional $100K in home buying power all because of a reduction in your existing monthly expenses not an increase in your annual salary.

Frontend vs backend ratios

As you shop around between mortgage lenders, you may come across the terms frontend ratio and backend ratio.

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

A Home Affordability Calculator Doesnt Tell You:

- Whether the lender will approve you for financing at the sales price shown

- What your final mortgage interest rate or closing costs will be

- How much your payment might vary based on your actual credit score

The bottom line: While the home affordability calculator gives you an idea of what you might qualify for, youre better off getting a mortgage preapproval if youre looking for a dollar amount based on your unique financial circumstances.

MORTGAGE CALCULATOR TIP

Our calculator is pre-set to a conservative 28% DTI ratio. You can slide the bar up to an aggressive 50% DTI ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

Recommended Reading: Does Advance Auto Do Free Code Reading

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

How To Get Pre

The very first and essential step in becoming a homeowner is applying for a mortgage pre-approval. It will give you a sense of what to expect, what your interest rate will be, and most importantly, how much you can borrow.

You can also get a better picture if you use an online mortgage approval calculator or a mortgage qualification calculator before contacting a mortgage lender.

Before getting pre-approved, a lender will ask for information about your assets, your income, and your debt. Moreover, you will have to provide identification, proof of employment, and proof you can afford a down payment.

Don’t Miss: Carmax Pre Approval Hard Pull

How Much Do I Need For A Down Payment

It looks like you may be able to afford a home worth about 386,405 for a payment of about1,300per month/mo.

$376,405 loan amount

10,000 |2.6%

Down payment

Information and interactive calculators are made available as self-help tools for your independent use and are intended for educational purposes only. Any results are estimates and we do not guarantee their applicability or accuracy to your specific circumstances

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting.Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

Recommended Reading: 1-800-689-1789

How Do Lenders Assess Affordability

The way lenders assess affordability wont be exactly the same for each provider, but essentially, they follow the same principles. Theyll look at your situation in more detail than our calculator does. Although our calculations give a good estimate, a lender may come to a slightly different conclusion.

Essentially, the mortgage lender have their own mortgage calculators and their scorecard will look at things like:

- The amount of money you want to borrow

- How much deposit you have

- Your employment status and job security

- Your income and lenders may view things like overtime, commission and bonuses differently from basic salary as theyre not guaranteed

- Your outgoings the money you spend on bills and on your lifestyle

- Any existing debts

- Your credit report

When looking at your credit report, its not just your overall score that potential mortgage lenders consider. Theyll also look in detail at:

Lenders are likely to look at your bank statements for the last three to six months to show them what your spending is going on and how well you manage your money and finances. Youll need your most recent P60 as proof of earnings too. You could also provide information about your savings accounts and other assets like shares, on your application form, as evidence of your ability to save and manage money.

How Does A Mortgage Work

A mortgage is a loan that is specifically used to purchase a home. Since most people cant afford to pay the total price of their house or condo upfront, they need to secure a mortgage.

This means borrowing money from financial institutions or private lenders. A mortgage is a legal contract, meaning if you dont respect the agreed conditions, the lender has every right to take your property.

Every mortgage is different, and when you shop for one, your lender or mortgage broker will give you options. Before we dive into questions like how to get approved for a mortgage, lets look at some key factors that will affect your mortgage options:

What is gross income?

Gross incomeis a persons total earnings before paying taxes and other deductions. Lenders use an individuals gross income to determine how much they can borrow for a loan.

Also, lenders will analyze the debt-to-income ratio, which is the gross income divided by total monthly debt payments.

If the debt-to-income ratio is high, lenders might not want to loan money, or you will have a high-interest rate. This ratio should not be higher than 36 percent. Still, some lenders will lend as high as 50 percent. If you are unsure about your ratio, you can use an annual income calculator to get a better picture.

What is a down payment?

Down payment is the amount of money you already have and can give towards purchasing a home.

What is a credit score?

| Scores from 760 to 900 | Excellent |

| Scores from 300 to 559 | Poor |

You May Like: Refinance Auto Loan Calculator Usaa

Getting Preapproved Can Tell You Your Home Buying Budget

One of the easiest ways to find your price range is to get a preapproval from a mortgage lender.

Preapproval is kind of like a dress rehearsal for your actual mortgage application. A lender will assess your financial situation as shown by your annual salary, existing debt load, credit score, and down payment size without making you go through the full loan application.

This can tell you whether youre qualified for a mortgage and how much home you might be able to afford.

You could also learn whether you can afford a 15year loan term or whether you should stick with a 30year mortgage. And, a preapproval can show whether youd be better off with an FHA loan or a conventional loan.

Finally, your preapproval shows you the added monthly costs of homeownership such as home insurance, real estate taxes, HOA fees, and mortgage insurance if necessary.

Loan Term And Adjustable Vs Fixed Rate Mortgage

Loans with short terms usually have lower interest rates than loans that are paid off over a longer period of time.

An adjustable-rate mortgage might have a lower rate than a fixed-rate mortgage at first. But over time, the rate on an adjustable-rate mortgage could go up by a lot, while the rate on a fixed-rate mortgage would remain the same.

Also Check: How Much House And Car Can I Afford

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some borrowers opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

How Much House Can I Afford 80k Salary

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

Read Also: Usaa New Auto Loan Rates

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

Read Also: Loan Signing Officer

Calculate Your Mortgage Qualification Based On Income

In this calculator you can inclue investments, annuities, alimony, government benefit payments in the other income sources. Be sure to select the correct frequency for your payments to calculate the correct annual income.

- daily: 365 times per year

- weekly: 52 times per year

- biweekly: 26 times per year

- semi-monthly: 24 times per year

- monthly: 12 times per year

- bimonthly: 6 times per year

- quarterly: 4 times per year

- semi-annually: 2 times per year

- annually: 1 time per year

This calculator defaults to presuming a single income earner. If your household has 2 income earners then you can expand the “spouse or partner” section to enter their income information. We calculate the mortgage qualification ranges using the following maths:

| Your Mortgage Qualification |

|---|

How To Calculate Your Debt

To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100.

Next, determine your gross monthly income.

Take your total debt payments and divide that number by your gross monthly income. Lets say for this example that your monthly income is $4,000. Then your total monthly debt payments divided by your gross monthly income is $1,100 ÷ $4,000, or 0.275. We can convert the result to a percentage: 0.275 x 100% = 27.5%.

Don’t Miss: How Long Does The Sba Take To Approve Ppp Loan

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

How Bankruptcy Affects Your Credit Report

In certain cases, consumers are forced to file for bankruptcy if they cannot keep up with debt obligations. When this occurs, the bankruptcy record stays for 6 years in your credit file. If youre missing mortgage payments, it will certainly impact your credit score negatively. Your lender might file a County Court Judgment against you. This will obligate you to pay off your debt under a deadline as ruled by court.

Depending on your situation, it may also take longer until youre discharged of debts. This will make it harder to obtain new credit or open a new bank account. The magnitude of your bankruptcy will have a negative impact on your creditworthiness. During this time, you might find it difficult to secure renting accommodations, insurance, or even take direct debit . However, over time, as you pay off outstanding balances and significantly reduce your debts, you can recover your credit score. Just be patient because it will certainly take time to rebuild your finances during bankruptcy.

What If I Have Poor or No Credit History?

Also Check: How Much Of A Car Loan Can I Qualify For

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.