What Is The Average Student Loan Debt

The average loan debt for a bachelors degree among the class of 2019 was $28,950, according to the most recent data available from The Institute for College Access & Success. These stats are for one year, and dont reflect the average total debt. And, keep in mind that these stats dont include private student loans that were borrowed.

Western States Estimated To Be The Quickest To Repay Student Loan Debt While Some Northeast States Struggle

While many states in the West made some of the smallest monthly student loan payments, this region still dominated the top of the list when we ranked states according to how fast borrowers could fully repay their student loan debt.

With an estimated student loan debt payoff time of 8.14 years, Utah had the quickest repayment time. But other states in the West were not far behind, including:

- California

- Delaware

- Vermont

Nationwide, the estimated student loan debt payoff time was 11.30 years. 19 states had a payoff time that was shorter than 11.30 years, while the payoff time for the remaining 31 states was longer. To find the U.S. payoff time, the nationwide average student debt per borrower figure of $28,565 was used.

The Types Of Federal Student Loans

Over three-quarters of all federal loans are direct loans. They are provided directly by the U.S. Department of Education and are available to most students regardless of financial need. Federal Family Education Loans are indirect loans, provided by accredited institutions but guaranteed by the government.

| Loan Type |

| 42.6 |

Perkins Loans are need-based loans of up to $5,500 a year for undergraduate students with very low household incomes they are issued directly by the universities. Federal loans are among the easiest for students to get, but most havelow annual limits, and interest rates can be high.

Graduates with multiple federal loans can turn to consolidation to streamline their finances and lock in lower interest rates.

You May Like: Mlo Endorsement To A License Is A Requirement Of

Average Undergrad Student Loan Payment

- Standard repayment plan $305

- Graduated repayment plan $344

- REPAYE $389

The average student loan debt for recent graduates with a bachelors degree is $29,000. Lets say youre paying the average student loan interest rate of 4.53% for undergrads and enroll in the standard 10-year repayment plan, your monthly payments will be $305.

| Repayment plan | |

|---|---|

| 7 years, 9 months | $35,236 |

| Monthly payments for bachelor’s degree debt of $29,000 at 4.79% average interest rate for undergraduates. REPAYE assumes starting salary of $55,660, the median for younger workers with bachelor’s degrees |

How Big Is The Average Monthly Student Loan Payment In Your State

With recent student loan borrowers owing $28,565 in student loan debt, on average, monthly payments have become a sizable financial commitment that most consumers need to account for in their budget for up to a decade and possibly longer.

Pile a monthly student loan payment of a few hundred dollars on top of other recurring expenses, like rent and groceries, and the narrative that todays young Americans are getting hit with a tight financial squeeze comes into focus.

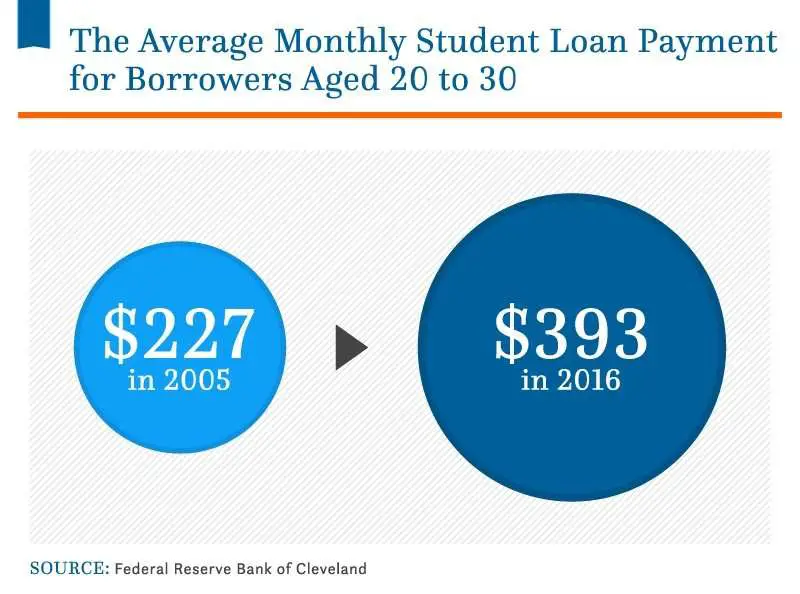

After surveying more than 6,600 Americans in 2016, the Federal Reserve estimated the average monthly student loan payment to be $393, while the median payment was $222.

Financial website LendEDU, with the help of an aggregated analysis of anonymized data from Truebill users, took that studys premise one step further and estimated the average monthly student loan payment in each of the 50 states.

We then estimated the amount of years it should take a borrower from each state to fully repay their student loan debt.

Also Check: Can I Refinance An Fha Loan

Examine Your Current Situation

The first thing you need to do is take stock of your current situation. You dont do this to make yourself feel bad or examine any mistakes that may have been made along the way.

Instead, you examine your current situation to find out what tools you have to work with. Consider where you currently are in these four areas.

If You Enroll In Repaye

Your payments in an income-driven repayment program like REPAYE will depend on your income. Lets say youre making $55,660, the median income for workers who are just starting out and have a bachelors degree. Your monthly payments in REPAYE would start at $308 and gradually increase to $469. Thats an average monthly payment of $389.

You May Like: Can You Refinance A Fha Loan

Surprising Facts About Graduate Degree Seekers

Its expensive, but Americans are still pursuing graduate and professional degrees and the majority are doing so as full-time students. Of the 1.84 million students enrolled in public or private not-for-profit graduate programs in fall 2016, 57.4% were registered full time. Graduate students are also now more likely to be women than men.

More Stats On Federal Student Aid

- In 2017, the overwhelming majority of outstanding student loan debt is owed to the federal government per The Institute for College Access & Success. The remaining 19% is owed to private banks.

- Per StudentAid.gov, over three-quarters of all federal loans are direct loans.

- In 2017, about $1.05 trillion of Americans student loan debt is in the form of direct loans per StudentAid.gov. Thats a steep increase from five years ago when the total was $508.7 billion.

| Loan Type |

You May Like: Refinance Car Usaa

Extra Payments The Right Way

You must let the lender or servicer know if you want extra payments to go toward the principal. Otherwise, the money may go toward the next months interest payment.

Contact your lender or servicer to find out how you can ensure extra payments will be applied to your principal. Here are some ways you may be asked to do it:

-

In writing. Some lenders require a written request for extra payments to go toward the principal.

-

On the phone. If you make a payment by phone, you may need to ask verbally.

-

On your check. If you send a check by mail, add apply to principal to the memo line.

Is It Smart To Pay Off Student Loans Early

Yes, paying off your student loans early is a good idea. … Paying off your private or federal loans early can help you save thousands over the length of your loan since you’ll be paying less interest. If you do have high-interest debt, you can make your money work harder for you by refinancing your student loans.

Also Check: Avant/refinance/apply

Find The Right Repayment Plan For You

Whether you have public or private loans, the same is true: What you owe after receiving your diploma is less than what youll actually pay by your 10-year reunion.

Want to see how your specific loans could be affected by different repayment plans? Use our suite of calculators to find out, or seek out repayment advice from the right sources.

How Much Is The Typical Student Loan Payment

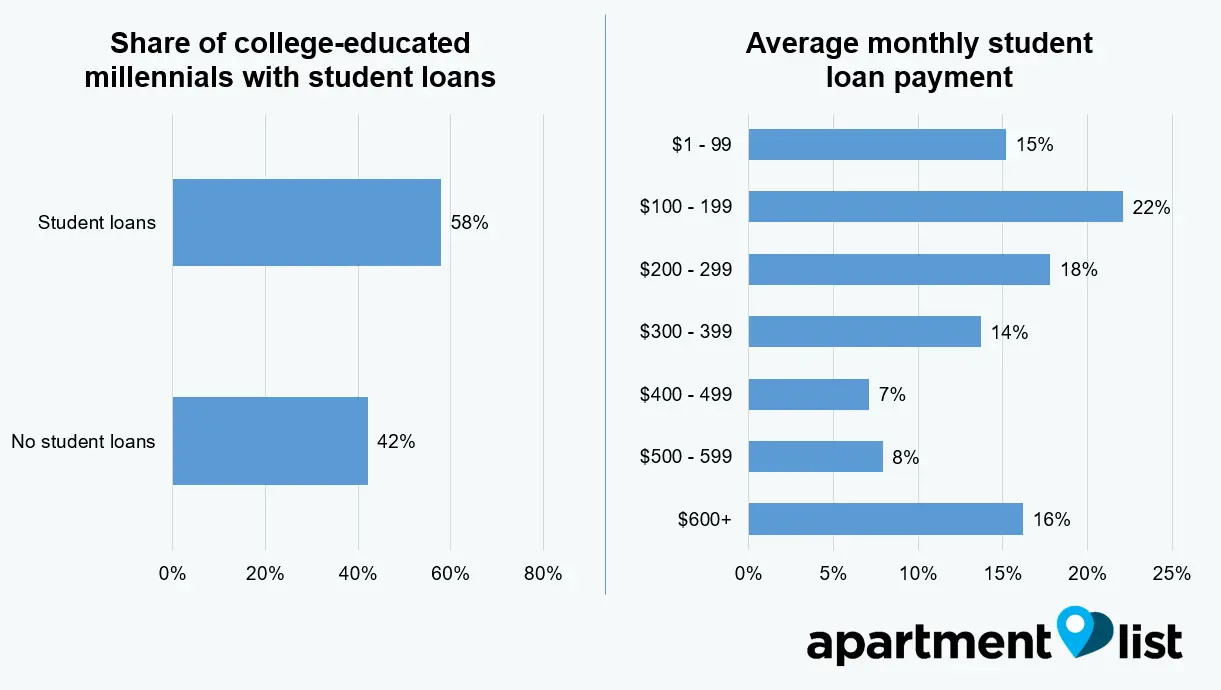

The average monthly student loan payment was $393 in 2016 , which is like buying the newest Apple Watch every two months. That puts the average monthly payment nearly 55% higher than it was a decade ago.

Student loan payments have increased more than two-and-a-half times faster than the rate of inflation. If the typical $227 monthly bill student loan borrowers received in 2005 had kept pace with consumer prices, the cost would only have risen by 22.9% to $279. Paying off student loans is significantly more challenging today than it was in the past, but there are strategies borrowers can use to cut their interest rates and lower their monthly payments.

Also Check: Usaa Boat Loan Credit Score

Budget Wisely For Average Monthly Expenses

Budgeting is an essential step toward getting your financial life in order and reaching your money goals. But it can be hard to know whether youre spending too much or not enough in some areas.

Comparing monthly expenses with national averages can provide reference points to show where you stand. For example, if youre not saving enough, it can encourage you to find areas where you can cut back to save more.

As you consider the average monthly expenses for your top spending categories, consider how you can use the information to improve your own household budget.

2018 5-Year American Community Survey from the Census Bureau, 2018 Consumer Expenditure Survey from the Bureau of Labor Statistics, Mortgage Bankers Association August 2020 Mortgage Finance Forecast, LendingTree, Experian Q1 2020 State of the Automotive Finance Market, Experian 2019 credit card research, Student Loan Hero, CompareCards, Vanguard How America Saves 2020 report, DepositAccounts, Care.com 2019 data, Private School Review 2020 data and 2019 Huntington Backpack Index

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep aneye on your inbox.

Average Monthly Student Loan Payment

If you take into account how much students take out in loans, its estimated that the average student loan payment hovers around $400.

For students making the average starting wage between 30k-40k, this is a doable amount, especially if youre on a Federal Repayment Program with lower payments.

About 72% of borrowers the average amount of debt when they graduate college. So, the question is, when does it get to be too much?

Also Check: Firstloan Com Legit

What Is An Average Student Loan Payment

Asked by: Seth WestView full answer$32,731is $33,654$25,00020 years39 related questions found

If You Have 2 Or More Jobs

If youre employed, your repayments will be taken out of your salary. The repayments will be from the jobs where you earn over the minimum amount, not your combined income.

Example

You have a Plan 1 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £1,000 a month from one job and £800 a month for the other.

You will not have to make repayments because neither salary is above the £1,657 a month threshold.

Example

You have a Plan 2 loan.

You have 2 jobs, both paying you a regular monthly wage. Before tax and other deductions, you earn £2,300 a month from one job and £500 a month for the other.

You will only make repayments on the income from the job that pays you £2,300 a month because its above the £2,274 threshold.

You May Like: Usaa Auto Loans Bad Credit

What Is The Minimum Monthly Payment On Student Loans

Student loans typically have a required minimum monthly payment of $50.00. If the estimated monthly payment is less than the minimum, your estimate will reflect $50.00 and your repayment term may be shortened. The amount of time the borrower is scheduled to repay the principal balance and interest on a loan.

How Can I Pay Off My Student Loans Faster

Paying off your student loans as soon as possible is a dream many Americans have. Fortunately, paying off your student loans is a real possibility if you set yourself up with the proper plan. The best way to pay off your debt is to make the minimum payments on everything else except for the one debt you are attacking.

There are two different schools of thought on the best way to attack your debts. I wrote an in-depth article about these two methods, namely the Debt Snowball and the Debt Avalanche method.

Check out the link above to find out which method is right for you and how you can take control of your student loan debt once and for all.

Read Also: What Degree Do You Need To Be A Loan Officer

If You Have A Plan 4 Loan And A Plan 1 Loan

You pay back 9% of your income over the Plan 1 threshold .

If your income is under the Plan 4 threshold , your repayments only go towards your Plan 1 loan.

If your income is over the Plan 4 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan threshold of £1,657.

Your income is £743 over the Plan 1 threshold which is the lowest of both plans.

You will pay back £67 and repayments will go towards both plans.

How To Pay Off $100k In Student Loans

It is possible to pay off six figures in student loan debt, but youll need to take a strategic and determined approach.

While some college graduates may only owe a few thousand dollars in student loans, many borrowers owe much larger balances. Often a graduates student loan debt is well into six-figure territory especially those with professional degrees or a private-school education.

With a 10-year standard repayment plan, that kind of debt may equate to a monthly payment of more than $1,000, easily affecting your budget and your ability to save for other goals. Plus, owing a lot of money can be really stressful.

If youve got $100,000 in student loan debt, know that youre not alone. You have several options to help you pay off your student loans faster and for less than you may expect.

Heres everything you need to know about paying off $100,000 in student loans.

Don’t Miss: Refinancing Fha Loan

Federal Student Loan Status By Servicer

The major loan servicers handle billions of dollars of loans on behalf of the federal government. The chart above shows the status of loans managed by each entity. The nonprofit servicers have the lowest rate of loans in repayment and the lowest rate of loans in forbearance . Of the four biggest servicers, repayment and forbearance rates are as follows:

- AES-PHEAA: 67% repayment, 13% forbearance

- Great Lakes: 60% repayment, 11% forbearance

- Nelnet: 61% repayment, 8% forbearance

- Navient: 65% repayment, 12% forbearance

If Youre Having Trouble Repaying

If you need help with repaying your Canada Student Loan, you may qualify for the Repayment Assistance Plan .

If youre having trouble repaying a provincial student loan, contact your student aid office. For repayment assistance with a loan or line of credit provided by your financial institution, contact your branch to determine what your options are.

Understand that by making your payments smaller, it will take you longer to pay back your loan. Youll end up paying more interest on your loan.

If you consider refinancing or consolidating your student loan, note that there are important disadvantages.

If you transfer your federal or provincial student loan to a private lender, you will lose any tax deductions on your student loan interest. You wont qualify for the interest free period while you’re in school and will end up paying more interest over time.

Read Also: Usaa Car Payment Calculator

How Are Interests Charged On Canadian Student Loans

Interest is charged on your student loan when you enter the repayment status. Usually, interest amasses daily and is estimated monthly. This implies that interest charges are applied to your loan balance on the last day of each month once your repayment period begins.

The Canada student loan interest rate is charged based on the prime rate which is posted by each of Canadas five main banks.

Any change to the prime rate affects the interest calculations on your Canada student loan. If the prime rate surges, you will pay more interest on your student loan and vice versa.

How Much Student Loan Debt Is Too Much

Student loans are a burden that an estimated 44.7 million people throughout the U.S. are dealing with. Although its incredibly common, it can be hard for students to understand when they have too much student loan debt.

Honestly, any debt is a lot when you dont know how much money youll be making upon graduation. Unfortunately, many of us dont have many other options outside of taking out a student loan to pay for our education. When 69% of students are taking out loans, you can at least be sure youre not alone.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

What Is The Average Student Loan Monthly Payment

Answers vary, but the most recent data says that students between the ages of 20 and 30 paid an average of $393 per month in 2016. Studentaid.gov breaks it down a bit further: for example, on a $10,000 Direct Unsubsidized Loan with a 6.8% interest rate, the amount of interest that accrues per day is $1.86 . If you are in a deferment for six months and you do not pay off the interest as it accrues, the loan will accrue interest totaling $340.

Student Loans Vs Credit Cards And Auto Loans

In the past decade, total U.S. student loan debt has surpassed credit card debt and auto loan debt. In the third quarter of 2018, Americans owed $840 billion on their credit cards and $1.21 trillion in auto loans. Currently, U.S. student loan obligations are larger than both, trailing only mortgages in scope and impact.

You May Like: Refi Conventional Loan