Can I Sell My Car With A Loan

It is possible to sell your car with an outstanding loan, but you may have to go through a few extra steps. If your car is worth less than what you currently owe on the loan, you have what’s known as negative equity meaning you may need to pay the difference out of pocket or refinance the remaining amount with a different type of loan.

If your car is worth more than what you currently owe, on the other hand, you may be able to pocket the difference in cash when you sell the car. Whatever your situation, reach out to your lender about your options, as each lender sets different rules for selling a car with a loan.

Before Signing For A Loan

Before signing for an auto loan in Texas, read the loan terms carefully to make sure you understand the agreed-upon interest rate, fees, and charges that must be paid when purchasing a vehicle in the state of Texas. Decide how much you can pay upfront as a down payment, and make sure youve agreed to the annual percentage rate and specific loan terms, such as the length of the loan. The shorter the loan, the less overall interest paid.

The following taxes and charges apply to the standard presumptive values of most vehicles purchased in the state of Texas, along with the agreed-upon interest rate.

- Title transfer fee: Can be $28 or $33 because the fee varies by county.

- Sales tax: Every car purchase comes with a state tax of 6.25 percent, according to the Texas Department of Motor Vehicles.

- Use tax: Texans who purchase vehicles are also required to pay a use tax, which equals 6.25 percent of the sales tax. Any new or established resident using the vehicle for business must also pay this tax.

- Tag and license fee: The base fee is $51.75, and the local fee ranges from $0 to $21.50.

- Transfer registration fee: Is typically $2.50.

Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

Recommended Reading: Usaa Rv Loan Rates Calculator

Protects You From Dealer Inflation

Dealers can inflate auto loan rates to make a profit, just as they can inflate car prices. Dealerships are loan brokers, so they can sell the loan at a higher rate than what the lender charges. Having a firm car loan offer from a lender lets you know what rate you qualify for without a middleman marking it up.

Here’s How To Pay A Car Payment With A Credit Card:

- Mobile payment services: One way to pay your car loan or lease with a credit card is to use a mobile payment app such as Venmo or PayPal as a middleman. These applications allow you to transfer money from user to user, and you can fund them with a credit card.

So, for example, you could use your credit card to pay a friend or family member through the app, and they can then make your car payment for you or give you the money to do it yourself. Just make sure you really trust the person, and be careful because payments may count as purchases or cash advances, depending on the service and the credit card issuer. But either way, there are fees involved. Venmo, for example, charges 3% of the transaction amount.

- Money transfer services: Companies like MoneyGram and Western Union allow you to directly pay a collection of participating billers, and you can fund the transaction with a credit card. However, this may be treated as a cash advance, which would mean expensive fees and interest charges would apply, in addition to the fees charged by the service. You can learn more about how this works from our explanation of how to transfer money from a credit card to a bank account.

The bottom line is that these options are far from ideal and should only be considered if you’re in a real bind, or if you do the math and somehow find an opportunity to save. That could be the case if you’re able to transfer part of an auto loan to a 0% balance transfer credit card, for example.

|

Category |

Recommended Reading: Prequalify Capital One Auto Loan

Bank Of America Reviews

Bank of America is one of the countrys biggest and most established financial institutions. The company holds both an A+ rating and accreditation from the BBB.

Bank of Americas customer review scores tend to be slightly lower. While most of the loan providers we reviewed dont have great customer scores from the BBB, Bank of Americas 1.1-star rating out of 5.0 from nearly 500 reviews was among the lowest. The company also has a 1.4-star rating out of 5.0 from customers on Trustpilot.

People who give a positive rating to Bank of America often mention helpful customer service and user-friendly online services. Negative reviews consistently mention high fees and frustrations with phone support.

Our team reached out to Bank of America for a comment on these reviews but did not receive a response.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Also Check: Usaa Rv Rates

Features And Benefits Of Car Loan

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

Myautoloan: Best For Shopping For Multiple Loan Offers

Overview: If you want to compare multiple loan offers but you dont want to spend a lot of time doing it, myAutoLoan is a great option. This platform lets you enter your information once and receive multiple loan offers in one place.

Perks: After filling out a single online loan application, youll be given up to four quotes from different lenders. To qualify, you must be at least 18 years old, have an annual income of $21,000, have a FICO score of 575 or greater and be purchasing a car with less than 125,000 miles and that is 10 years old or newer. By comparing multiple auto loan offers at once, you can pick the one with the interest rate, loan term and conditions that work for you and your budget without having to shop around.

What to watch out for: If you have poor credit, your interest rate could be on the higher side. Also note that you can use this platform if you live in most states, but not in Alaska or Hawaii.

| Lender |

|---|

You May Like: How Long Sba Loan Take

What Is A Good Used Car Loan Rate

Loan rates for used cars are higher than rates for new cars. For a 48-month term, a good used auto loan rate from a bank is 5.16% or lower. A good used car rate from a credit union is 3.16% or lower.

Below is a chart with NCUA data for average credit union and bank rates for both new and used vehicles.

| New or Used Vehicle Loan | Loan Term |

|---|---|

| 5.16% |

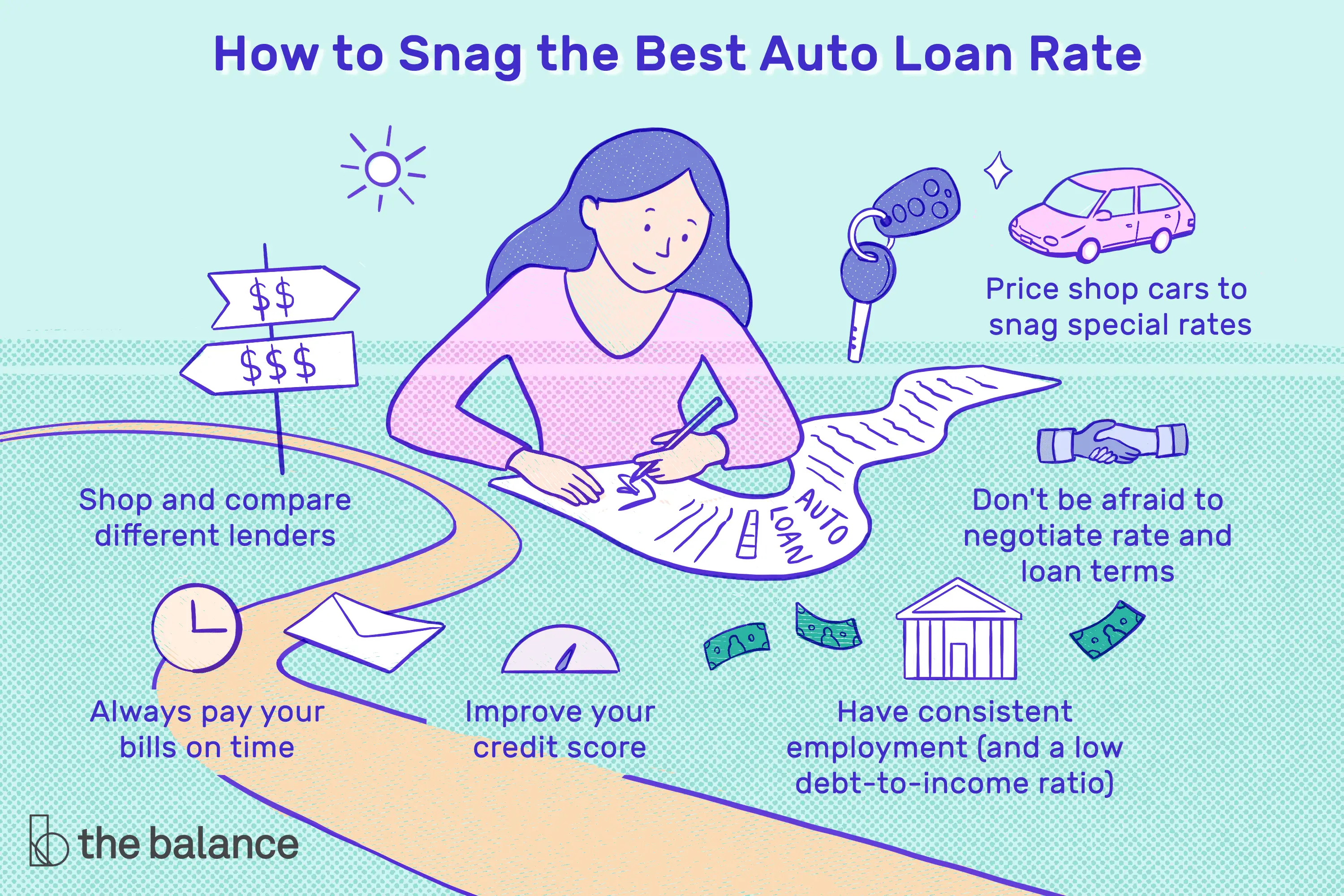

Can You Negotiate Auto Loan Rates

Just like the price of a car, auto loan rates often can be negotiated. Sometimes you can negotiate the rate with the dealer or directly with the lender. The better your overall financial picture, the more success you will have negotiating your rate. You also can negotiate loan terms. For example, maybe you dont want to make a payment for the first 90 days, or you want to finance the vehicle for 60 months instead of 48.

Recommended Reading: How Does Capital One Auto Loan Work

How To Calculate Car Loan Emi

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

What Affects Loan Interest Rates

The rates above are average APRs based on information reported to the NCUA. You may find different rates based on a number of factors, including:

- A low score will require a higher interest rate, and vice versa. Credit score is perhaps the single most important factor lenders use to determine rates.

- Loan term: Shorter terms have lower interest rates. Consider making higher monthly payments to get a shorter-term loan with a lower overall cost.

- Lenders look at your entire credit report, so two people with the exact same score can find different rates based on how their score is calculated.

- Income: Lenders can have minimum income requirements for borrowers to qualify and also to secure the best auto loan rates.

- Down payment: A higher down payment not only reduces the total amount of the loan, but it shows that you are committed to purchasing the vehicle, and this can also reduce your interest rate.

- Interview process: If you impress a loan officer with professionalism and supporting documentation in discussing your financial situation, you may have a better chance of getting the best auto loan rates for your situation.

- Negotiation: If you get multiple pre-qualification offers, you can use those when negotiating interest rates from lenders.

- Autopay: Many lenders offer discounts for making automatic payments. Credit unions can also offer a discount if you pay for the loan with an account at that same credit union.

You May Like: Car Refinance Usaa

Can You Sell A Car With A Loan

It is possible to sell a vehicle when you still have a loan, but it adds a few extra steps. There are a few different options in this situation. One option is to pay off the loan in full before selling the vehicle, which involves contacting your lender to determine your payoff amount. After paying off the loan, your lender will release the lien.

You can sell a vehicle that’s financed without paying it off by selling it to a private buyer or trading it in with a dealer.

How Do Lenders Determine Your Auto Loan Rate

Much like insurance companies, lenders determine auto loan rates based on information about you and your vehicle. Here are some of the factors that can affect your car loan rate:

- :By far the biggest influence on your rate is your credit score. People with the highest credit scores get the best auto loan rates.

- Loan term:Generally, the longer your loan term, the higher your interest rate will be.

- Vehicle age:Banks and other lenders often charge higher interest rates on older cars.

- New or used vehicle: Most lenders save their lowest interest rates for new car loans. If you want a used car loan, you might pay a higher interest rate.

- Down payment:Some lenders will adjust interest rates based on what percentage of a vehicles cost you put down when you buy it.

Be sure to compare auto loan quotes from lenders before making a decision. Some lenders may weigh factors such as your credit score differently than others. Do the math and look at the total cost of your loan over its lifetime, and not just the APR.

Recommended Reading: Fha Loan Limits In Texas

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Gives You A Price Range

With a preapproved car loan, youll know your monthly payment, loan term and the price of the car you can afford, all before you walk onto the blacktop parking lot. You wont be nervous sitting at a table in the dealership, waiting to hear whether the bank thinks you can afford the car because youll know youre already approved.

A salesperson might try to guide you to the most expensive models and tell you not to worry they can give you a longer term and keep your payment low! But youll already know that a longer term on a larger loan amount means a whole lot more in interest.

Read Also: How Much Can I Qualify For A Car Loan

Finding Good Car Loans Rates

It does not matter your , looking for a good lender can be challenging, especially if you are unaware of all your options. You may be tempted to take the first car loan deal that you find however, this could be a big mistake. By using a car loan service, such as Auto Finance Canada, you can complete your application and send it to several qualified lenders at the same time. This gives you more options and a much better chance at a great deal.

When you have different offers to look at, you can decide what option works best for you. It is important that you hear each offer and carefully pay attention to all the details when you speak with your representative.

You can rest easy because using a site like Auto Finance Canada will save you money, time and headaches! With an easy process, you can be pre-approved before you go to purchase a vehicle. This give you many benefits such as knowing what vehicles are in your price range. Getting this information beforehand will save you time and stress. The full process is very simple. Simply filling out the application at Auto Finance Canada will make your life easy!

Best Credit Union For Auto Loans: Consumers Credit Union

Consumers Credit Union

- As low as 2.24%

- Minimum loan amount: None

-

No minimum or maximum loan amount

-

Offers new, used, and refinance loans

-

Offers transparent rates and terms

-

Lowest rates require excellent credit

-

Membership in credit union is required

Consumers Credit Union offers auto loan rates to its members as low as 2.24% for new car loans up to 60 months. Like other credit unions, it requires membership, but it’s easy to join. You can become a member by paying a one-time $5 membership fee. There are no geographic or employer requirements.

CCU doesn’t have a minimum or maximum loan amount. Your loan is approved based on your credit score, credit report, and vehicle information. There’s also no minimum loan termyou submit a request based on what you need.

Generally, borrowers with excellent credit will qualify for the lowest rates from Consumers Credit Union. But even members who have less than excellent credit have access to discounts. There’s a 0.5% discount available for those who autopay from a CCU account. The discount falls to 0.25% for those who make automatic payments from an outside financial institution.

Also Check: Usaa Consolidate Student Loans

Income Tax Benefits On Car Loans Taken To Purchase Electric Vehicles

If you have taken a car loan to purchase an Electric Vehicle , you can now enjoy a tax rebate of Rs.1.5 lakh on the interest paid. This was announced in the latest Union Budget by Finance Minister Nirmala Sitharaman and is a part of the governments efforts to stimulate the adoption of environment-friendly mobility solutions. If you have purchased an electric vehicle, you will be able to avail a benefit of about Rs.2.5 lakh during the entire term of the loan. The government has also slashed the tax rates on electric vehicles to 5% from the earlier 12%.