Find A Responsive Lender

Choose your VA lender with care. Yes, you want a great deal on your mortgage. But it helps to have a loan officer whos happy to field calls from listing agents. Ten minutes on the phone with a loan officer can turn a listing agent from a VAloan skeptic into an advocate for them and you.

Some suggest that using a local lender or broker can be helpful. Because listing agents feel more affinity with people they might meet in person. But dont end up paying a significantly higher rate and closing costs than necessary just to keep your loan local.

What Are The Va Home Loan Limits By Year And County

Find the VA home loan limit for the county your property is in.

2022 VA home loan limits

VA home loan limits are the same as the Federal Housing Finance Agency limits. These are called conforming loan limits.

Scroll to the Previously Announced Loan Limits section

Review the table with past loan limit information.

Find the year with the limits you need

Years are located in the first column, labeled Description.

Refer only to the One-Unit Limit column in the table

This is the only column that applies to VA home loan limits.

Va Loan Limits Eliminated For Many Borrowers

The Blue Water Navy Vietnam Veterans Act of 2019 eliminated VA loan limits, starting Jan. 1, 2020, for veterans and service members with full entitlement to VA loans. The law, which also increased the VA funding fee, will provide disability benefits for more veterans exposed to Agent Orange during the Vietnam War.

» MORE:How much is the VA funding fee?

Also Check: Credit Needed To Refinance Home

What If I Want To Purchase A Condo With A Va Loan

The Department of Veterans Affairs has a condo database of approved developments. If your dream condo is not on the VAs list, your lender can ask the VA to approve this development. Keep in mind that the VAs process for adding a new condo development to their approved list can take months and is not guaranteed to be approved once the process is over.

Requirements For Reservists And National Guard Members To Apply For Va Home Loans

You might be asking yourself, can I get a VA loan as a Reservist? The answer may be yes, but you must meet specific service requirements in order to qualify. In order to be eligible for a VA home loan, Reservists and National Guard members must have completed at least 6 years of honorable service, been honorably discharged for a service-related disability, or been called for active duty service for at least 90 consecutive days.

The below chart describes the requirements Reservists and National Guard members must meet when applying for VA loans:

| VA Loan Eligibility Requirements for Reservists and National Guard Members |

|

Recommended Reading: Sss Loan Requirements

Other Options & Print Your Results

You can also edit any of the other variables in the calculator. For sections that are minimized by default, please click on the dropper in the upper right section to expand them. Once you are done with your calculations you can click on the button to bring up a detailed report about your loan. Once you are in the active report view you can click the button to create a printer friendly version of your results.

Whats My Va Loan Limit

That depends. VA loan limits vary by county. In fact, within a single state the limit could differ by as much as $500,000 between counties. Limits are higher in wealthier counties where the cost of living is higher. In most places around the country, the current limit is $424,100. That applies to loans closed on or after January 1, 2017. But limits can top a million dollars in the most expensive counties.

Also Check: Usaa Used Car Rates

How To Use The Va Loan After A Foreclosure

Due to unfortunate circumstances, veterans often ask how they can use the VA loan after a foreclosure. In other words, when a home financed with a VA loan is foreclosed upon, can veterans still use their VA loan benefits? They can, but certain restrictions exist. In this article, well explain how veterans can use their VA loan after a foreclosure.

Specifically, well cover the following topics:

- VA Loan Overview

- How to Use the VA Loan After a Foreclosure

- Final Thoughts

The VA Home Loan offers $0 Down with no PMI. Find out if youre eligible for this powerful home buying benefit. Prequalify today!

Va Loans: How They Work And Qualifications For 2022

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

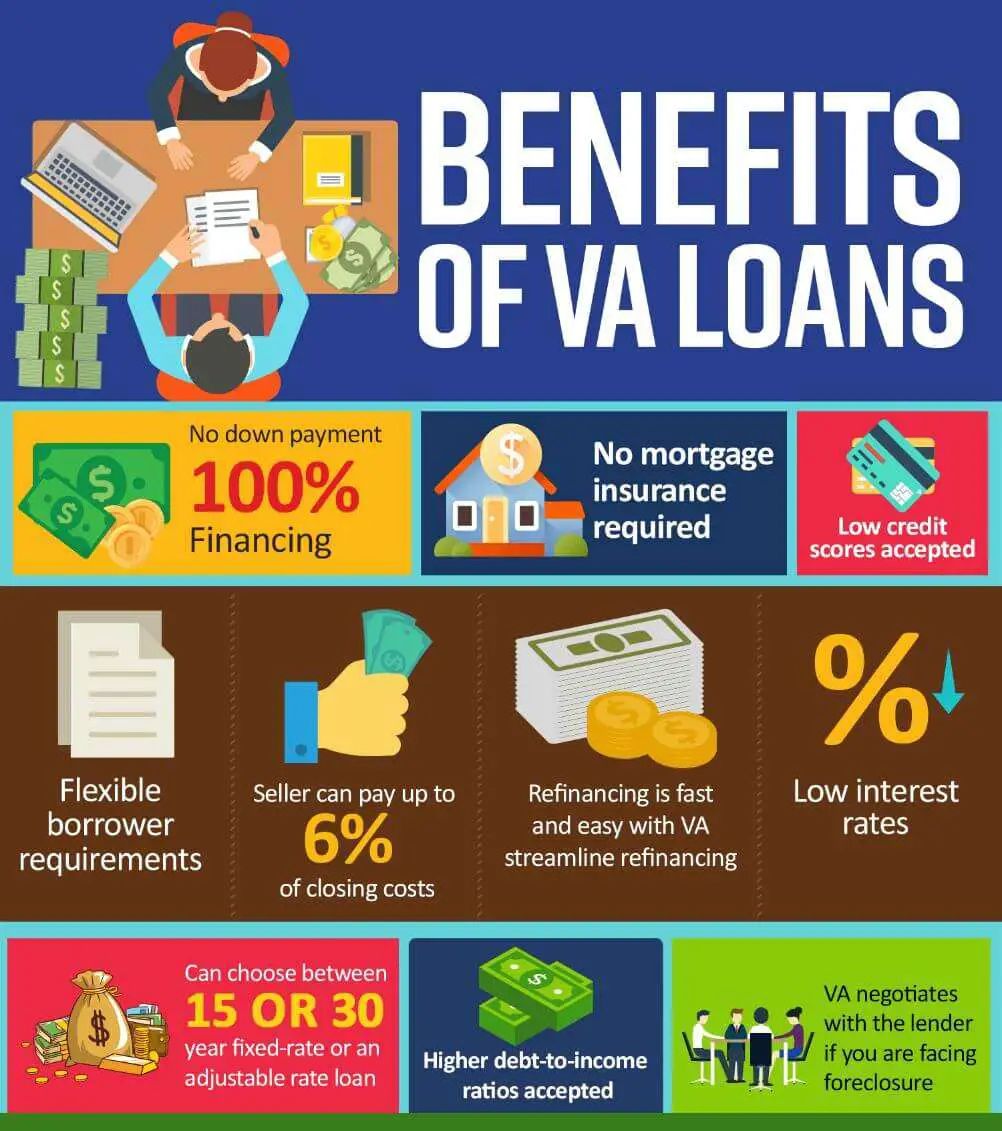

A VA loan allows eligible active-duty service members, veterans and eligible surviving spouses to finance a home with no down payment, no mortgage insurance and lenient credit requirements. Understanding how a VA loan works will help you determine if its the right mortgage for your purchase or refinance plans.

Don’t Miss: Usaa Classic Car Loan

If You Apply With A Credit

In states with community property laws, VA lenders must consider the credit rating and financial obligations of your spouse. This rule applies even if he or she will not be on the homes title or even on the mortgage.

Such states are as follows.

- Arizona

- Washington

- Wisconsin

A spouse with less-than-perfect credit or who owes alimony, child support, or other maintenance can make your VA approval more challenging.

Apply for a conventional loan if you qualify for the mortgage by yourself. The spouses financial history and status need not be considered if he or she is not on the loan application.

How To Qualify For A Va Loan

The VA home loan program and its military benefits are available for:

- Active-duty military members

- Past and present members of the National Guard

- Surviving spouses of military personnel who died in combat

A VA home loan does not have a minimum credit score, but most participating VA loan lenders require a minimum credit score of 620. Our advice? Always check your credit report and your debt-to-income ratio before applying for a loan and improve it if you can.

For more information, read our 5 tips for getting a VA loan as well as our guide on how to dispute your credit report.

Service requirements

Veterans and active-duty service members need to have served at least 90 days during wartime, or 181 days during peacetime. National Guard members must have served at least 90 days of active-duty service during wartime or six years of creditable service in the Select Reserves or Guard.

Once you have been deemed eligible, you must apply for a Certificate of Eligibility . The COE proves to the VA mortgage lender that you meet the VAs eligibility requirements.

Recommended Reading: How Long Until Sba Loan Approval Take

How Many Va Home Loans Can You Have

There is no limit to how many VA loans you can have simultaneously, but they must be used for primary residences and have strict occupancy criteria. It is feasible to have two VA loans for multiple residencies at the same time.

Lets imagine you purchase a property in your current duty station and, years later, receive PCS orders. As an alternative to selling the house, you could rent it and use your remaining VA loan eligibility to buy a new property at your new duty station.

See all of the different VA loan types you can choose from!

How To Assume A Va Loan

There are currently two ways to assume a VA loan.

The lender and/or the VA needs to approve a loan assumption.

Loans serviced by a lender with automatic authority may process assumptions without sending them to a VA Regional Loan Center.

For lenders without automatic authority, the loan must be sent to the appropriate VA Regional Loan Center for approval. This loan process will typically take several weeks.

When VA loans are assumed, its the servicers responsibility to make sure the homeowner who assumes the property meets both VA and lender requirements.

Don’t Miss: Can You Refinance With An Fha Loan

No Down Payment On A Va Loan

Most home loan programs require you to make at least a small down payment to buy a home. The VA home loan is an exception.

Rather than paying 5%, 10%, 20% or more of the homes purchase price upfront in cash, with a VA loan you can finance up to 100% of the purchase price.

The VA loan is a true no-money-down home mortgage opportunity.

Well Septic And Termite Inspection Fees

Buyers may need some or all of these, depending on the property and other factors. In all but a few states, VA buyers arent allowed to pay the termite inspection fee, which in most cases is covered by the seller. But buyers may be able to pay for any repairs stemming from well, septic or termite issues.

Don’t Miss: Usaa Auto Loan Credit Requirements

Will My Va Loan End Up In The Secondary Mortgage Market

Probably. Most VA loans end up being packaged up by lenders and passed to Ginnie Mae, a government owned corporation that allows individuals and pension funds to invest in the secondary mortgage market. Ginnie Mae guarantees mortgage-backed securities for government-backed mortgages, but doesnt buy them or sell the mortgage-backed securities. Ginnie Mae securities are backed by the full faith and credit of the U.S. government.

How Does My County Loan Limit Affect Me

You may need to make a down payment if youre using remaining entitlement and your loan amount is over $144,000. This is because most lenders require that your entitlement, down payment, or a combination of both covers at least 25% of your total loan amount.

So if youre able and willing to make a down payment, you may be able to borrow more than the county loan limit with a VA-backed loan. Remember, your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:

- Income

- Assets

We dont require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare.

Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You wont need to use these terms when applying for a loan.

Read Also: Usaa Consolidate Student Loans

How Do The Interest Rates For Va Home Loans Compare With Those For Other Mortgage Products

As noted previously, the interest rates for VA home loans are generally quite a bit lower than for traditional mortgage products. In fact, this is one of their major selling points and is the main reason why so many people are sold on them. For people with poor credit, especially, the low interest rates offered through the VA home loan program are very enticing. After all, those with low credit scores generally enjoy the same competitive interest rates that people with topnotch credit scores enjoy. Whether your credit score is 750 or 600, you’re going to pay a lot less interest with a VA loan.

Basically, if you want to get a feel for how much a VA home loan will cost in terms of interest, you should just look at what standard, fixed-rate, 30 year mortgages are going for in terms of interest and shave a little bit off of the total. Since rates fluctuate, there is no point in documenting how much you are going to pay in interest for a VA home loan. Suffice it to say that it is generally a great deal less than you would pay for many other popular mortgage products.

The reason VA loans are able to charge a lower rate than other mortgages is the Veteran’s Administration guarantees to pay the lender up to 25% of the value of the home. This means if a buyer bought a house for $500,000 & was foreclosed on the VA would cover the lender for any loses up to $125,000.

Are Va Loan Offers Bad For Sellers

You found your perfect home. But the seller rejected your VA loan offer on the grounds that VA loans are too troublesome.

That seems to be happening more and more. And yet theres no good reason for it. Because VA loans are as good for a seller as any other type of mortgage.

This happens because some sellers and even their agents harbor misconceptions about the VA loan program that make them hesitant to accept VA offers.

In this article, well explore those myths along with the best ways to negotiate and get your VA offer accepted.

Don’t Miss: Does The Capital One Pre Approval Car Loan Work

Can Closing Costs Be Included In Your Va Loan

When facing closing costs, you might not have the funds available. Thats OK! The VA loan allows you to include some of the closing costs into your total loan amount.

The big thing is that you can roll your funding fee into the total mortgage amount. Although youll pay more in interest, this can help you get into a home now.

The other fees that create your closing costs cannot be rolled into the loan. But you may receive seller or lender concessions to bring the upfront cash cost down.

Also Check: How To Find Your Student Loan Number

What Are The Va Loan Terms For 2022

As of 2020, VA loan no longer have value limits for qualified borrowers. That means first-time VA loan borrowers will have no cap on the size of $0 down VA loans. The VA funding fees, which most borrowers have to pay when they close on their mortgage, remain the same as they were in 2020.

The funding fees range from 0.5 percent on some refinances to 3.6 percent for some home purchases. The exact fee varies depending on the value and type of your loan, how much you put down, and whether its your first VA financing.

These one-time fees help keep the loan program running. However, some borrowers may have to pay slightly more than the published rates in 2021. Veterans and service members will be charged the higher rates though National Guard and Reserve members will have their funding fee lowered to the same level as other military borrowers.

Veterans with service-related disabilities and some surviving spouses dont have to pay a funding fee. Purple Heart recipients on active duty are also exempt from the fee.

Recommended Reading: Usaa Auto Loan Approval

Getting A Reconsideration Of Value

If a VA appraisal comes in low, a reconsideration of value could be the best option.

An ROV is when the VA reevaluates how much the home is actually worth. Depending on how it goes, it could completely change the VA appraisal.

One way to get an ROV is to find better comps. Comps is short for comparable homes or comparable sales: similar homes to the one youre trying to buy. If you can find comps closer to your expected price range, the VA may reevaluate their decision. For example, a similar home with no view may be valued the same as the home youre buying. But that view has a market value, and you can make the argument the home should be valued higher.

Theres also always the chance the appraiser made an error in valuation, or they missed something when appraising the house. If this is the case, then a new appraisal could shift the value of the property in the borrowers favor.

Minimum Service Required For A Va Mortgage

VA home loans are available to active-duty service members, veterans , and in some cases, surviving family members.

To be eligible, you need to meet one of these service requirements:

- Youve served 181 days of active duty during peacetime

- Youve served 90 days of active duty during wartime

- Youve served six years in the Reserves or National Guard

- Your spouse was killed in the line of duty and you have not remarried

Your eligibility for the VA home loan program never expires.

Veterans who earned their VA entitlement long ago are still using their benefit to buy homes.

Read Also: Usaa Rv Interest Rates

How Do Disabled Veterans Qualify For Va Loans

While VA loans are a beneficial form of financing for many military service members, there are certain requirements they must meet. The VA typically requires service for a certain length of time under specific circumstances. However, veterans with disabilities caused by injuries sustained in the line of duty may be eligible for a VA loan without meeting all of the conditions.

Most service members have to meet one the following requirements to apply for a VA loan:

- Have served for 181 days of active service during peacetime

- Have served for 90 consecutive days of active service during wartime

- Have served 90 days under the Title 32 with at least 30 consecutive days

- Have served more than 6 years of service with the National Guard

Veterans and service members may also need to meet additional criteria set in place by their lender or submit specific documentation of one of the above requirements, like a certificate of eligibility , DD Form 214, NGB Form 22 or another VA form.

Again, you may not have to meet the above conditions to be eligible for a VA loan as a disabled veteran.