How Can The Loan Payment Calculator Be Useful To You

When you are planning a purchase, but you realize that you cannot afford it from your savings or income , the most straightforward way to obtain the necessary money is to turn to a bank for a loan. If you are in such a situation, probably one of the first things that comes to your mind is whether you will be able to make the required payments from your income. To solve this puzzle, you need to answer the crucial question: what will my loan payment be?

With our loan payment calculator, you can quickly compute the amount of money you need to devote for loan repayment over a payment period. This device will also give you the total amount you need to pay back during the whole loan term. Alternatively, you can use it to compute the loan amount from the loan payments.

Excel Ipmt Function Not Working

If your IPMT formula throws an error, it is most likely to be one of the following:

That’s how you use the IPMT function in Excel. To have a closer look at the formulas discussed in this tutorial, you are welcome to download our Excel IPMT function sample workbook. I thank you for reading and hope to see you on our blog next week!

Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

You May Like: Usaa Refinance Auto Loan

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Usaa Auto Lease Calculator

How To Calculate Loan Amount From The Payments

Additionally, you can use our loan calculator to compute the loan amount or total loan payment from the periodic installments.

Let’s presume that your monthly loan payment is 100 dollars with a 9 per cent annual rate with two years payment term.

- Periodic loan payment: $500

Periodic rate = Annual rate / Number of payments in a year = 0.09 / 12 = 0.0075 = 0.75%

Number of payments = Number of years * Number of payments in a year = 2 * 12 = 24

Loan amount = Periodic loan payment * ^ Number of payments) – 1) / ^ Number of payments)) = 500 * ^ 24) – 1) / ^ 24)) = $10,944.5

Total loan payment = Number of payment * Periodic loan payment = 24 * 500 = $12,000

How Long Is A Typical Commercial Mortgage

Typically, the term of a commercial mortgage can be anywhere from 1-10 years, with limited exceptions for longer terms on self-amortizing loans such as SBA loans , insurance or Fannie Mae loans , or FHA loans . However, the amortization schedule is typically longer than the 1-10 year loan term in order to keep the monthly payments affordable for the borrower.

Recommended Reading: Drb Student Loan Review

How To Calculate Loan Instalments With Annuity Factors

Almost every large business borrows money. The team leader for borrowings is normally the treasurer. The treasurer must safeguard the firms cash flows at all times, as well as understand and manage the impact of borrowings on the companys interest costs and profits. So treasurers need a deep and joined-up understanding of the effects of different borrowing structures, both on the firms cash flows and on its profits. Negotiating the circularity of equal loan instalments can feel like being lost in a maze. Let’s take a look at practical cash and profit management.

How Do You Calculate A Loan Payment

The first step to calculating your monthly payment actually involves no math at all – it’s identifying your loan type, which will determine your loan payment schedule. Are you taking out an interest-only loan or an amortized loan? Once you know, you’ll then be able to figure out the types of loan payment calculations you’ll need to make.

With interest-only loan options, you only pay interest for the first few years, and nothing on the principal balance – the loan itself. While this does mean a smaller monthly payment, eventually you’ll be required to pay off the full loan in a lump sum or with a higher monthly payment. Most people choose these types of loan options for their mortgage to buy a more expensive property, have more cash flexibility, and to keep overall costs low if finances are tight.

The other kind of loan is an amortized loan. These loan options include both the interest and principal balance over a set length of time . In other words, an amortized loan term requires the borrower to make scheduled, periodic payments that are applied to both the principal and the interest. Any extra payments made on this loan will go toward the principal balance. Good examples of an amortized loan are an auto loan, a personal loan, a student loan, and a traditional fixed-rate mortgage.

Read Also: Upstart Prequalify

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Read Also: Usaa Car Financing Calculator

Definition And Examples Of Monthly Loan Payments

When you receive a loan from a lender, you receive an amount called the principal, and the lender tacks on interest. You pay back the loan over a set number of months or years, and the interest makes the total amount of money you owe larger. Your monthly loan payments will typically be broken into equal payments over the term of the loan.

How you calculate your payments depends on the type of loan. Here are three types of loans you’ll run into the most, each of which is calculated differently:

- Interest-only loans: You dont pay down any principal in the early yearsonly interest.

- Amortizing loans: You’re paying toward both principal and interest over a set period. For instance, a five-year auto loan might begin with 75% of your monthly payments focused on paying off interest, and 25% paying toward the principal amount. The amount you pay on interest and principal changes over the loan term, but your monthly payment amount does not.

- A credit card gives you a line of credit that acts as a reusable loan as long as you pay it off in time. If you’re late making monthly payments and carry your balance to the next month, you’ll likely be charged interest.

Rate: Each Periods Interest Rate In Percentage Terms

Lenders usually quote interest rates on an annual basis but this data point uses a periodic interest rate . Since we are calculating the monthly payment, we want to find the periodic rate for a single month. To do this, we’ll divide the interest rate by the number of periods to find the monthly interest rate.

For example: Say you want to calculate a monthly mortgage payment using a 5% interest rate. Youd enter: “5%/12” or “0.05/12”, or the corresponding cell /12. Once you enter the interest rate, type a comma to move to the next data point.

Caution: If you simply enter “5/12” instead, Excel will interpret this as a 500% annual rate paid monthly. Entering “5” will result in a 500% interest rate each month.

Also Check: Arvest Construction Loan

How To Calculate Loan Payments In 3 Easy Steps

Making a big purchase, consolidating debt, or covering emergency expenses with the help of financing feels great in the moment – until that first loan payment is due. Suddenly, all that feeling of financial flexibility goes out the window as you factor a new bill into your budget. No matter the dollar amount, it’s an adjustment, but don’t panic. Maybe it’s as simple as reducing your dining out expenses or picking up a side hustle. Let’s focus on your ability to make that new payment on time and in full.

Of course, before you take out a personal loan, it’s important to know what that new payment will be, and yes, what you’ll have to do to pay your debt back. Whether you’re a math whiz or you slept through Algebra I, it’s good to have at least a basic idea of how your repayment options are calculated. Doing so will ensure that you borrow what you can afford on a month-to-month basis without surprises or penny-scrounging moments. So let’s crunch numbers and dive into the finances of your repayment options to be sure you know what you’re borrowing.

Don’t worry – we’re not just going to give you a formula and wish you well. Ahead, we’ll break down the steps you need to learn how to calculate your loan’s monthly payment with confidence.

Calculating The Payment Amount Per Period

The formula for calculating the payment amount is shown below.

- A = payment Amount per period

- P = initial Principal

- r = interest rate per period

- n = total number of payments or periods

Example: What would the monthly payment be on a 5-year, $20,000 car loan with a nominal 7.5% annual interest rate? We’ll assume that the original price was $21,000 and that you’ve made a $1,000 down payment.

You can use the amortization calculator below to determine that the Payment Amount is $400.76 per month.

P = $20,000 r = 7.5% per year / 12 months = 0.625% per period n = 5 years * 12 months = 60 total periods

Don’t Miss: Www.lowermycarloan.com

How Much Interest Will I Pay On A Commercial Loan

The interest paid on a commercial real estate loan will depend on the interest rate charged, the length of the term, and the amortization schedule. To see the total interest charged over time for any type of commercial loan, visit our calculator on this page and look at the “Total Interest” under the Payment Summary chart after inputting your loan amount, interest rate, and amortization.

Calculating Interest On A Car Personal Or Home Loan

These loans are called amortizing loans. The mathematical whizzes at your bank have worked them out so you pay a set amount each month and at the end of your loan term, youâll have paid off both interest and principal.

You can use an interest calculator to work out how much interest youâre paying all up, or, if youâd rather do it by hand, follow these steps:

1. Divide your interest rate by the number of payments youâll make in the year . So, for example, if youâre making monthly payments, divide by 12.

2. Multiply it by the balance of your loan, which for the first payment, will be your whole principal amount.

This gives you the amount of interest you pay the first month.

So for example, on a personal loan of $30,000 over a period of 6 years at 8.40% p.a. and making monthly repayments:

Because youâve now begun to pay off your principal, to work out the interest you pay in the following months, you need to first calculate your new balance. So:

1. Minus the interest you just calculated from the amount you repaid. This gives you the amount that you have paid off the loan principal.

2. Take this amount away from the original principal to find the new balance of your loan.

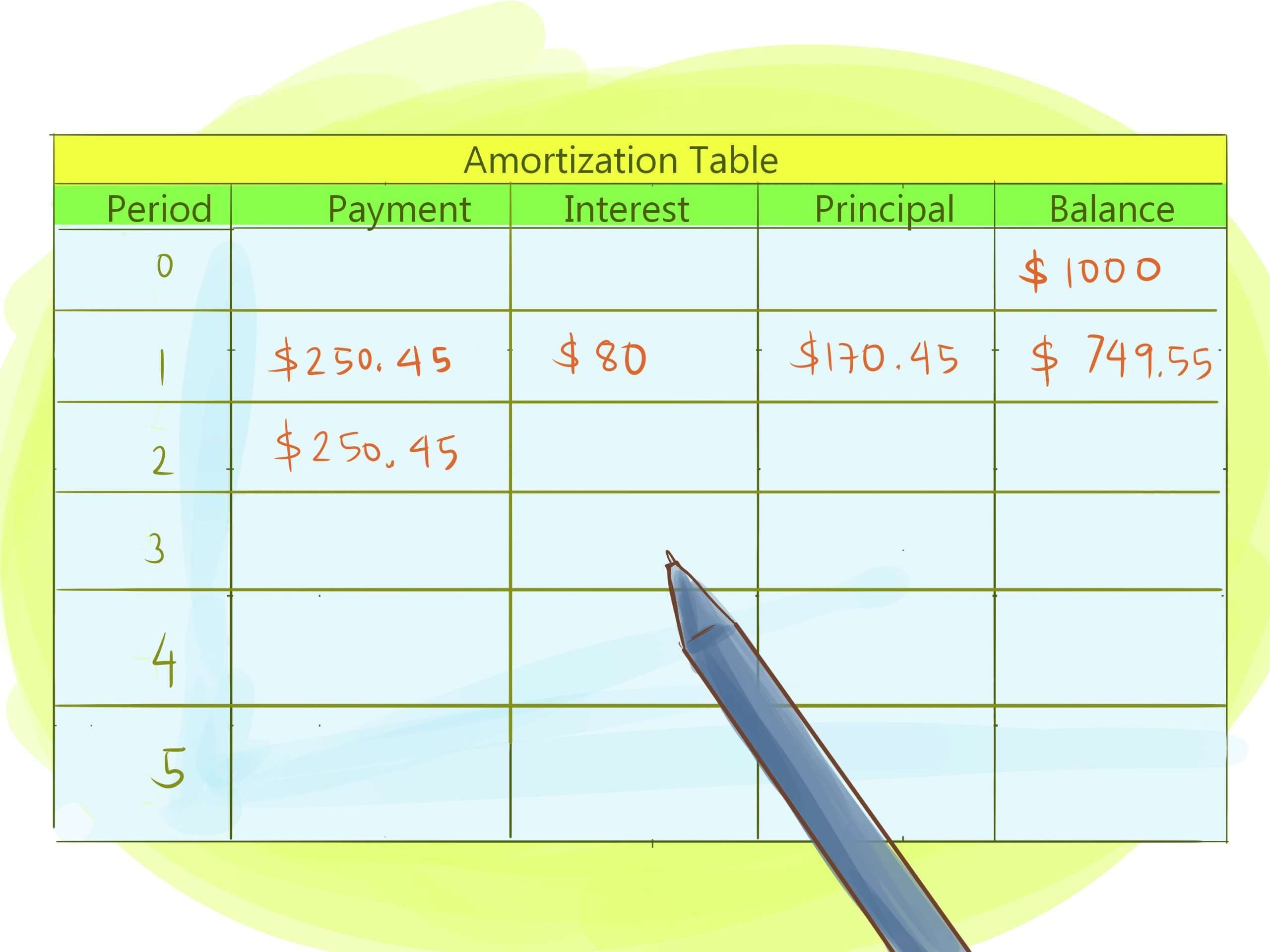

To work out ongoing interest payments, the easiest way is to break it up into a table. So using the above example, your calculations might look like this:

Also Check: Car Loan Interest Rate With 600 Credit Score

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

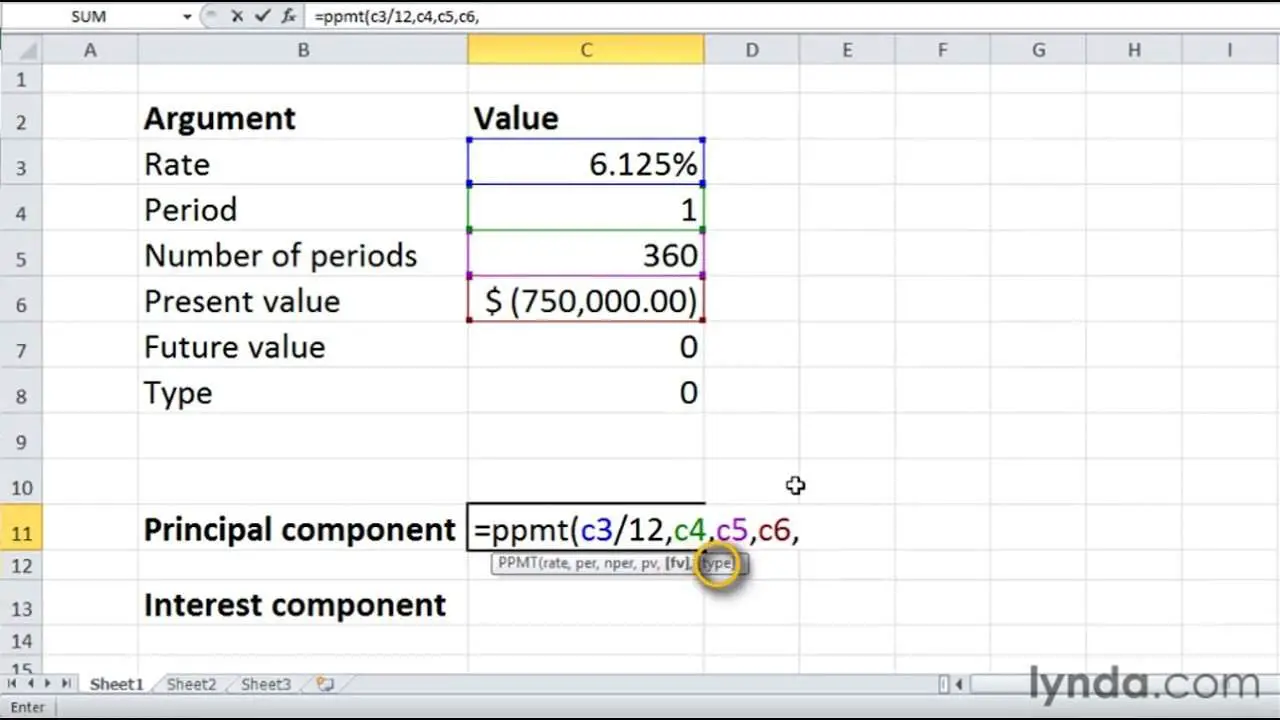

What Is The Pmt Function In Excel

The PMT function calculates monthly loan payments based on constant payments and a constant interest rate. It requires three data points:

-

Rate: Interest rate of the loan

-

Nper : The number of loan payments

-

Pv : The principal or current value of the sum of future payments

While optional, there are two additional data points you can use for more specific calculations:

-

Fv : The balance you want to achieve after the last payment is made. If omitted, this value is assumed to be 0, meaning that the loan is paid off

-

Type: Use “0” or “1” to specify whether the payment is timed to occur at the beginning or end of the period

Read Also: Loan Options Is Strongly Recommended For First-time Buyers

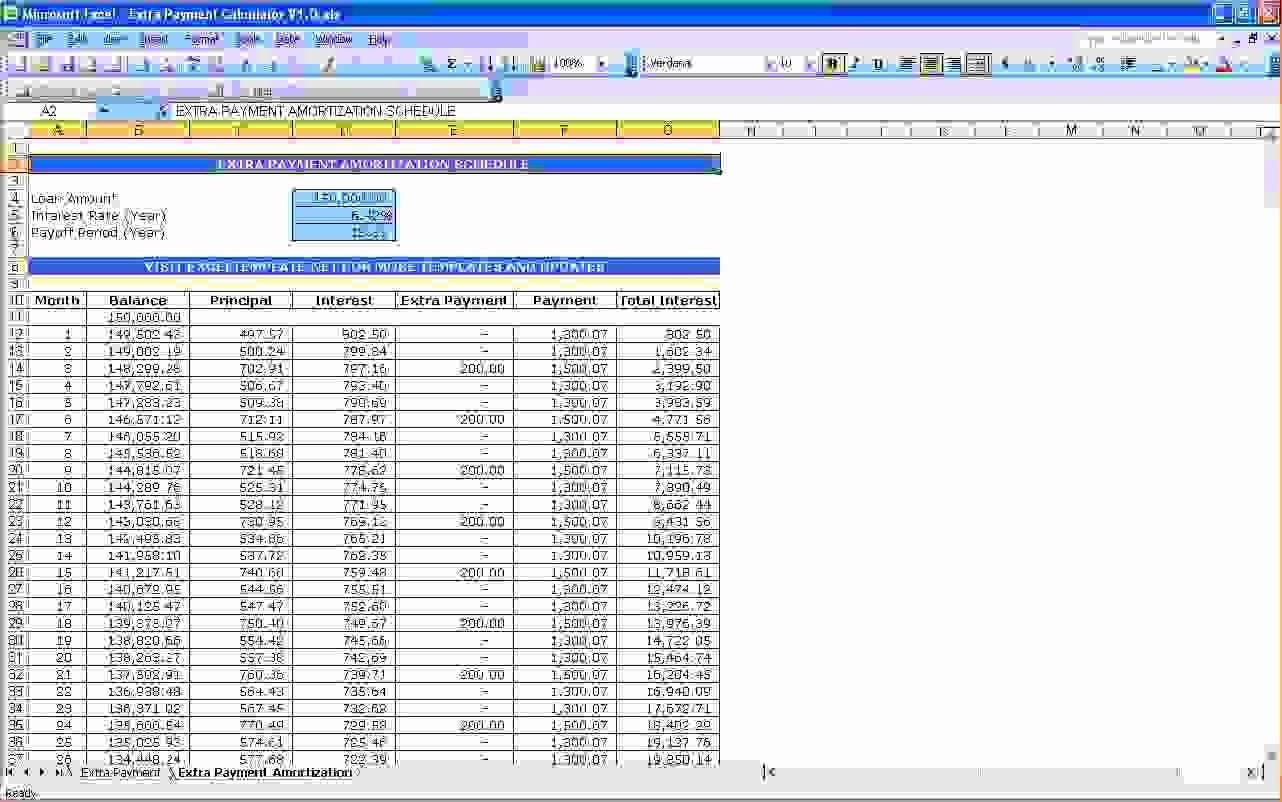

Using The Annual Amortization Calculator For Estimating Your Annual Borrowings

In order to get the annual amortization from the calculator, the following details would be required from you:

- Loan Amount: This is the principal balance as discussed above.

- Loan Term: Enter the term of the loan in years, no need of any division or multiplication.

- Interest Rate: Input the interest rate value that is offered by your bank.

Just by entering the above information, the calculator will provide you with a chart that will contain your desired results. Let’s see how using the calculator will benefit you.

What Is Amortized Loan Formula

The amortized loan formula deals with the determination of annual or monthly payment that the borrower has to make to the lender for the loan undertaken by them. The Annual payment is composed of annual interest payments and the annual portion of the long-term debt. The interest component in the annual payment remains to be high during the initial tenure of the loan, however, during the ending tenure, the principal components dominate the annual payment.

The formula is expressed as follows:

Amortized Loan Formula = / [ n 1)

Here,

- The rate of interest is represented as i.

- The tenure of the loan is represented as n.

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:

Don’t Miss: Usaa Car Loan Number