How To Calculate Car Loan Emi

To calculate the EMI on your car loan, we will use the formula:

EMI = P * R *

where:

-

P Loan amount given to you by the bank

-

R Rate of interest set by the bank and

-

N Loan tenure/duration in months.

For example, suppose you want to buy a Tata Nexon car for an on-road price of about Rs. 8 lakh. If the bank is ready to finance 100% of the on-road price at an annual interest rate of 8.0% for a tenure of 60 months, you can calculate the EMI as following:

Calculate the monthly interest rate:

R = 8 / = 0.00666

Now calculate your EMI on Rs. 8 lakh car loan:

EMI = Rs. 8,00,000 * 0.00666 * \

EMI = Rs. 16,218

Over the entire loan duration, i.e., 60 months, you will make a total payment of:

60 * 16,218 = Rs. 9,73,200

Car Loan Fees And Charges For Top 3 Banks

Given below is a comparison of a few fees and charges levied by three selective banks:

| Name of the bank | Axis Bank | |

|---|---|---|

| Processing fee | 1% of the loan amount. The maximum and minimum amount that can be charged are Rs.5,000 and Rs.10,000, respectively. | Rs.3,500 to Rs.5,500 |

| 3% – 6% depending on amount of time completed* | 5% of the principal outstanding | |

| Loan cancellation | As mentioned by the bank | Rs.2,500 per instance |

| 2% per month |

Note: GST rates will be applicable over and above the rates charges mentioned above.

*HDFC Bank does not allow foreclosure within 6 months from the day the car loan was availed.

Drawbacks Of Fixed Interest Rate:

- Generally, Fixed Interest Rates are 1%-2.5% above Floating rate of interest

- Fixed Interest Rates are subject to vary as per the market fluctuations, hence if accidentally the rate of interest decreases, the fixed rate BOI car loan EMI wont be benefited because the borrower will need to pay an equivalent fixed amount monthly .

Also Check: Fha Loan Limits Fort Bend County

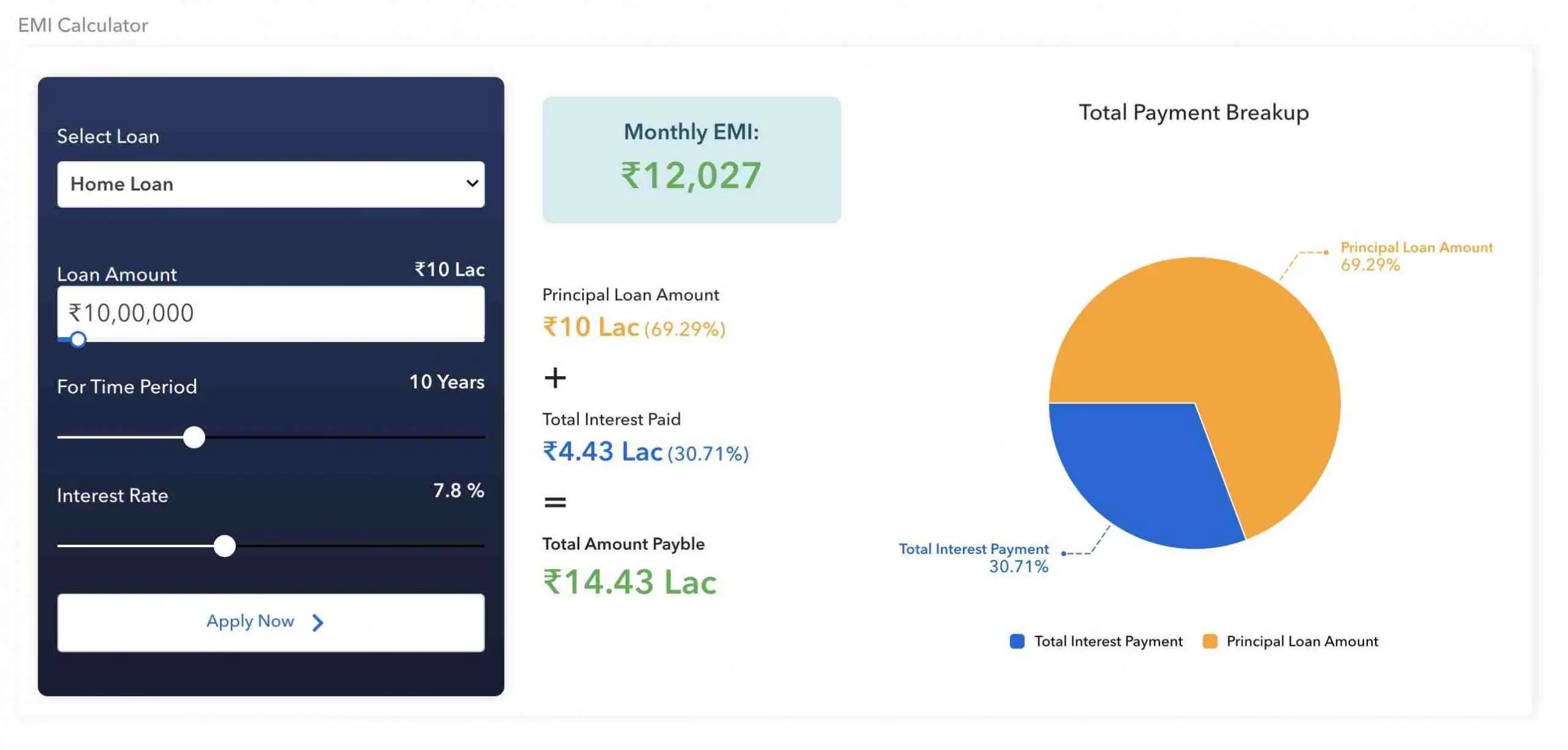

Things You Must Know About Car Loan Emi Calculator

An interest calculator is helpful in terms of planning the monthly expenses. Once you have calculated the installments, you get the idea about a lot of things and some of them are:

- It makes the calculation in a few seconds

- The calculation takes into account the basic loan details like the loan amount, interest rates, and tenure. Based on these details, the calculator not only tell the monthly installment but also show the amortization schedule indicating the interest and principal amount payable over the years

- It will provide the loan amortization schedule, timelines of the loan repayment and the total interest outgo.

- It helps you know the loan affordability and plan your monthly budget to make your loan repayment smoother.

- With the help of the calculator, you can keep a check on the effect of tenure and interest rate on the installments. Doing so will help you make the right decision.

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Don’t Miss: Va Loan On Manufactured Home

Apple Carplay And Android Auto Added To The Hyundai Verna S+ And Sx

Hyundai has updated the Verna with wireless features such as the Apple CarPlay and the Android Auto. Recently, the company updated the Creta with several premium features. The Apple CarPlay and the Android Auto will be available on the S+ and SX variants of the Verna. Some of the main features that the Verna is equipped with are wireless charging, sunroof, ventilated front seats, digital instrument cluster, and smartphone connectivity. The Verna is available in both the petrol and diesel variants and comes with a price ranging between Rs.9.19 lakh and Rs.15.25 lakh.

20 May 2021

Floating Rate Emi Calculation

A person needs to calculate the floating / variable rate EMI for two different cases, which are optimistic and pessimistic . The two factors which you control regarding loan is the amount and tenure. It means you decide how much you will borrow and how long you can repay the loan, i.e. time. But the interest rate is varying in nature and determined by the banks & HFCs as per RBI guidelines. There can be two extreme possibilities of increase and decrease in the rate of interest as a borrower, and you have to calculate EMI under these two possibilities. This calculation type will let you know how much EMI is affordable, the time frame of your loan, and how much you shall borrow.

Optimistic case: Assume the interest rate drops by 1% 3% from the present rate. Take this situation into consideration and then calculate your EMI. Your EMI will be reduced in this situation, or you may choose to shorten the loan tenure. For Eg: If you want to take a home loan to buy a house as an investment, then an optimistic case enables you to compare this with other investment opportunities.

Pessimistic case: Opposite to the optimistic point, let assume that the interest rate is hiked by 1% 3%. Is it feasible for you to pay the EMI without much struggle? Even a 2% rise in the interest rate can result in an increase in your monthly payment for the entire loan tenure.

Make use of the following resources and study online from Embibe.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Variant Of The Bolero Neo Launched By Mahindra In India

The 2021 variant of the Bolero Neo has been launched by Mahindra in India at an ex-showroom price starting from Rs.8.48 lakh. The car is available from the N4 variant to the N10 variant. The N10 variant is available at an ex-showroom price starting from Rs.10 lakh. The car is available with Android Auto and Apple CarPlay. The front of the car comes with a new look. The length, height, and width of the car are 3,995 millimetres, 1,817 millimetres, and 1,795 millimetres, respectively. The car will be powered by a 1.5-litre diesel engine that is BS6 compliant. The N8 variant of the vehicle will be available at an ex-showroom price of Rs.9.48 lakh. The car will compete against the likes of the Tata Nexon and Maruti Suzuki Vitara Brezza.

16 Juy 2021

How Is The Amortisation Schedule Of A Car Loan Useful

Apart from breaking down your car loan payments into the number of EMIs, the amortisation schedule also lets you know how much of your payment is going towards repaying the principal and how much of it is servicing the interest charges. This data can be immensely helpful if you decide to foreclose the debt in the future.

Apart from breaking down your car loan payments into the number of EMIs, the amortisation schedule also lets you know how much of your payment is going towards repaying the principal and how much of it is servicing the interest charges. This data can be immensely helpful if you decide to foreclose the debt in the future.

Also Check: How To Apply For Fha Loan In Illinois

What Happens When I Pay A Bigger Amount Than My Actual Emi For A Car Loan

When you are paying off a part of the car loan by making larger payments than the EMI, before the end of the tenure, then it is called part prepayment. By part prepayment, your principal outstanding will be reduced and also reduce your future EMIs. Usually, banks accept part prepayment of upto 25% of the principal outstanding amount in a year, charges against the part prepayment depends upon the due month of the EMI.

For example: HDFC charges 5% on the part payment amount in case part prepayment is within 13-24 months from 1st EMI and 3% on the part payment amount in case part prepayment is post 24 months from 1st EMI.

The Hyundai Genesis S80 Spotted In Mumbai

The Hyundai Genesis S80 has been spotted testing in Mumbai. The sedan will compete with the likes of the BMW 5 Series and the Mercedes-Benz E-Class. The car made its debut in the global markets in March 2020. However, there is still no confirmation that the car will launch in India. The Genesis line-up was launched in the international markets in 2015. Currently, there are two SUVs and three sedans under the Genesis brand. The car comes with a 4-door coupe design. Some of the main interior features of the car include a 12.3-inch digital instrument cluster, a two-spoke steering wheel, and a 14-inch infotainment unit.

19 February 2021

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Is There Any Difference Between The Emi As Shown By The Calculator And Actual

If the amount of loan is accepted as it is, then there are few factors that might change the actual EMI a bit. The first factor is the interest rate. It might change from the time you applied for Loan and when it was accepted. Please note the free online tool gives the approximate amount and it is better to get a representative from the financial institution to give you the exact figure.

How To Calculate Sbi Car Loan Emi

The SBI Car Loan EMI Calculator uses the below-mentioned formula to determine the EMI amount-

EMI = /

In the said formula,

- P stands for the principal amount or the loan amount.

- R stands for the monthly rate of interest that is applicable.

- N stands for the number of instalments.

It must be noted that the formula does not take into account the amount that was extended as pre-payment towards the amount received as an SBI car loan.

The example below will help you understand how the SBI car loan calculator works

Mr J availed an SBI car loan of Rs. 5 Lakh at the rate of 8.7% p.a. for a term of 5 years.

EMI = /

EMI=

EMI= Rs. 10,307

Recommended Reading: How Much To Loan Officers Make

Documents Required To Avail A Car Loan

As with all other loans, you need to submit a number of documents to avail a car loan. Salaried individuals need to furnish a different set of papers when compared to self-employed borrowers.

Listed below are the exact documents required for both groups of individuals.

Documents for Salaried Applicants – If you are a salaried professional, arrange the following documents before applying for a car loan:

- Proof of identity – PAN Card, Voter ID, Aadhaar Card

- Proof of address – Aadhaar card, Voter ID, Passport, utility bills

- Proof of income – Salary slips and bank account statements for a particular number of months

Additionally, you would need to submit a proof of signature as well, which is necessary to verify you as the buyer of the car at the auto dealer.

Documents for Self-Employed Individuals – If you own and operate your own business, you would need to furnish the following documents to avail a car loan

- Proof of identity – PAN Card, Voter ID, Aadhaar card, Passport

- Proof of address – Passport, Aadhaar card, Voter ID, utility bills

- Proof of business ownership – Maintenance bill, office address proof, business utility bills.

- Proof of income – Income tax returns necessary for the preceding two years, along with profit & loss statement and audited balance sheet.

You would need to provide the necessary signature proof as well, which is highly useful in verification when you are about to purchase the car from the dealership.

Car Loan Interest Rates

The interest rates for car loans vary from one lending institution to another. In general, the interest rates start from about 7.0% and can go up to about 15.0%. You can also choose between floating and fixed rates of interest.

Most lending institutions also charge a one-time processing fee varying between 0.2% to 0.5% of the loan amount. Therefore, it is always advisable to compare the APR for various banks before applying for a car loan.

Recommended Reading: Rv Loan Calculator Usaa

How Is Emi Determined

The EMI for any type of loan is essentially calculated using a formula. The formula is as follows:

E = P x R x ^n /

where E stands for the EMI you owe,

P stands for the principal amount,

R stands for the interest rate applicable to your car loan,

and n stands for the tenure of the car loan .

How Can Sbi Car Loan Emi Calculator Prove Helpful

SBI extends several car loan schemes, each of which caters to the specific requirements of the applicants.

For example,

Each of these SBI car loan options can be availed for different tenure and is extended at a different rate of interest.

This being said, the tenure, loan amount and rate of interest tend to influence the EMI amount that individuals have to pay. For instance, borrowers have to pay a higher amount as EMI when they avail a loan with a shorter tenure.

The table below offers a glimpse of the same.

| Car loan amount | |

| 8.7% | 37,114 |

To calculate their respective car loan EMI against their choice of loan option, individuals can use the SBI car loan calculator for a much hassle-free way experience.

Don’t Miss: Creditloancompare

Why Should I Use A Car Loan Emi Calculator Instead Of Performing The Same Calculations On An Excel Sheet

Only those proficient in the functionality of MS Excel can use the EMI calculation formula on the sheet to simplify such calculations. For others, this option would be too complex, as they would first need to learn the softwares operations. Using the car loan EMI calculator is often the simpler option since it is a readymade tool, where one need only enter the information in the relevant fields.

Only those proficient in the functionality of MS Excel can use the EMI calculation formula on the sheet to simplify such calculations.

For others, this option would be too complex, as they would first need to learn the softwares operations.

Using the car loan EMI calculator is often the simpler option since it is a readymade tool, where one need only enter the information in the relevant fields.

Please try one more time!

Car Loan Emi Calculator Disclaimer

You should consider the present car loan EMI calculator as a model for financial approximation. All payment figures, balances, and interest figures are estimates based on the data you provided in the specifications that are not exhaustive despite our best effort.

We have created the calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive helpful feedback and advice.

You May Like: How Do I Find Out My Auto Loan Account Number

Calculate Car Loan Emi

city

Disclaimer :

The car loan EMI, which you calculate from this EMI calculator, helps as a guide only. The resulting calculations from our end do not constitute a loan application or offer. The figures and formulae used by DriveSpark may change at any time without notice. The car loan EMI calculation does not take into account any government taxes or charges, which may apply to monthly repayments or the calculation of the car loan. DriveSpark accepts no responsibility for any loses or conclusion reached using the car loan EMI calculator.

Is Emi Calculator The Same For All Kinds Of Loans

You can take a home loan, car loan, personal loan or education loan. The concept of principal, interest, repayment time, etc. remains similar. Thus, they all can be calculated by the same EMI calculator. However, there might be a difference with other factors such as location and special schemes, and this will reflect in the loan amount.

You May Like: Va Loans On Manufactured Homes

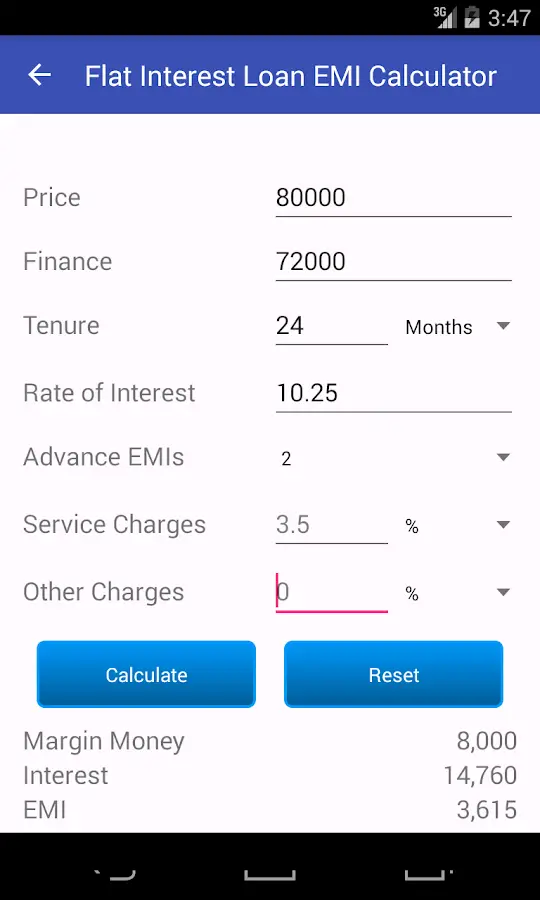

A Car Loan Emi Calculator Helps You Calculate Your Car Loan Emi Here Is How You Can Use It

You can easily calculate the EMI of your car loan. As soon as you enter the loan amount and car EMI interest rate into the EMI calculator, the EMI amount will be visible. The EMI calculator calculates the instalment based on the balance amount you need to pay after the down-payment. Processing fees or other charges may be included in the car EMI that is computed, although it depends on the lending institution.