Compound Interest And Savings Accounts

When you save money using a savings account, compound interest is favorable. The interest earned on these accounts is compounded and is compensation to the account holder for allowing the bank to use the deposited funds.

If, for example, you deposit $500,000 into a high-yield savings account, the bank can take $300,000 of these funds to use as a mortgage loan. To compensate you, the bank pays 1% interest into the account annually. So, while the bank is taking 4% from the borrower, it is giving 1% to the account holder, netting it 3% in interest. In effect, savers lend the bank money which, in turn, provides funds to borrowers in return for interest.

The snowballing effect of compounding interest rates, even when rates are at rock bottom, can help you build wealth over time Investopedia Academy’s Personal Finance for Grads course teaches how to grow a nest egg and make wealth last.

What Is The Lowest Interest Rate On A Car Loan

Typically, the lowest interest rates on car loans are around 2% or 3%. However, any car loan with an interest rate of less than 5% is considered a low interest rate and you need good or good credit to qualify. However, if you have less than one star loan, the lowest rate you qualify for may be over 10%.

Use Our Interest Rate Calculators

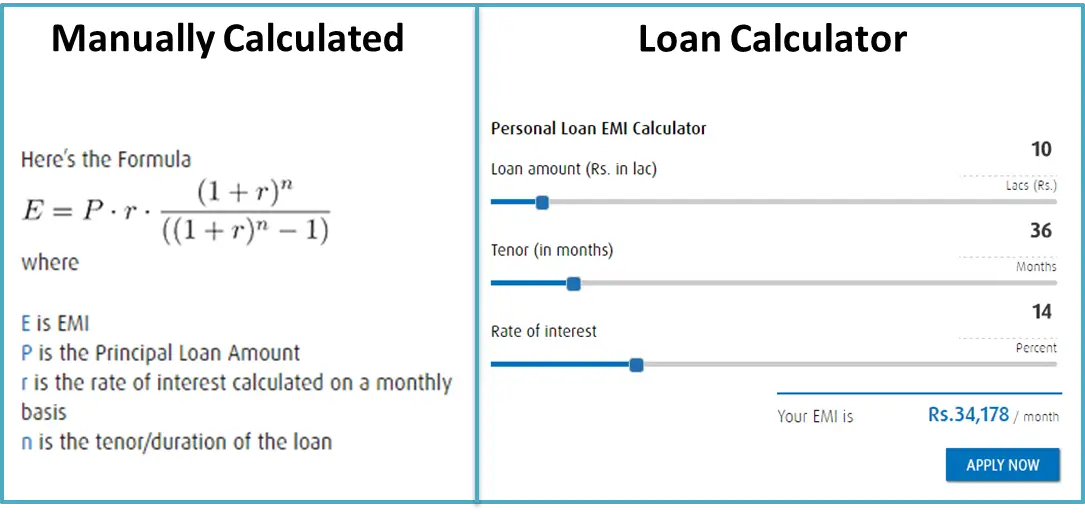

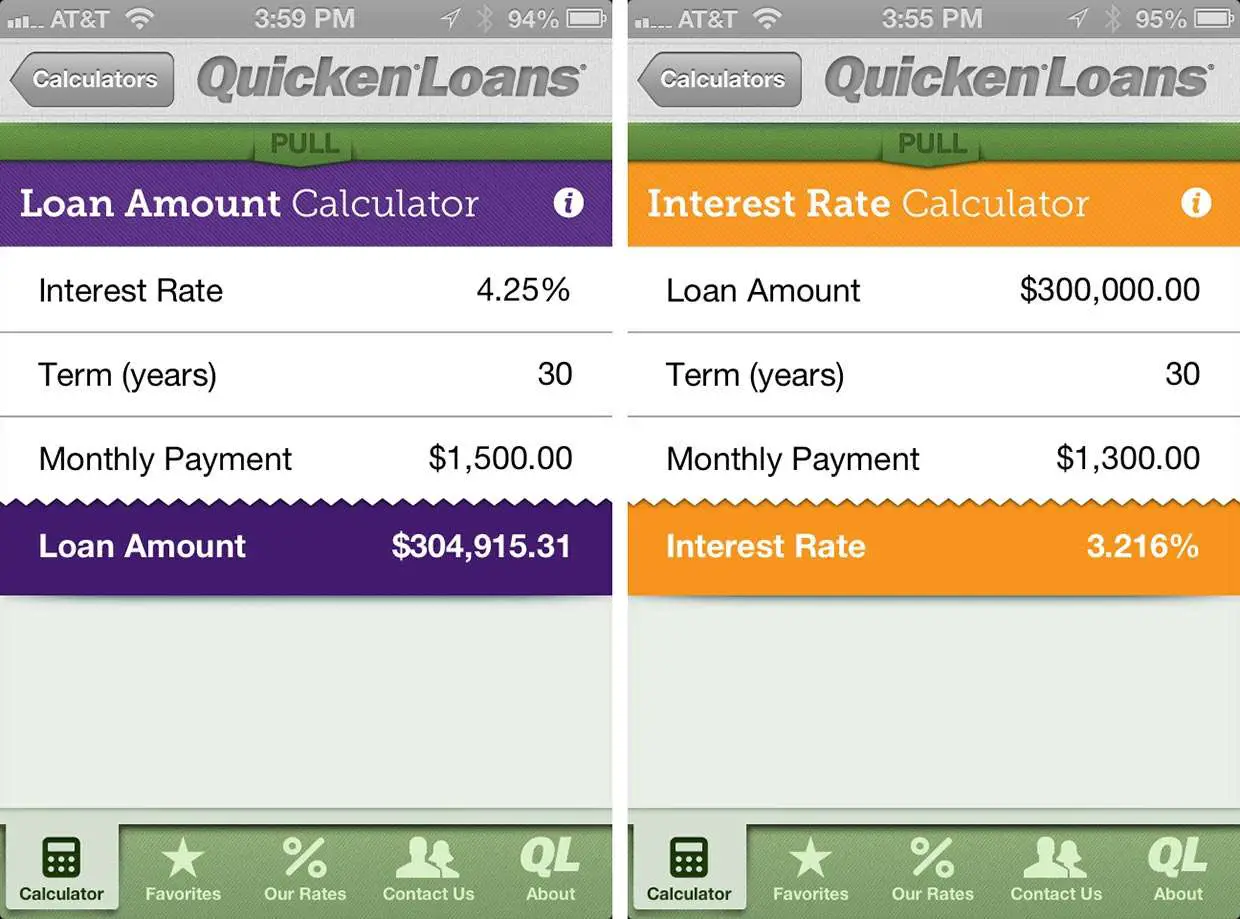

If all of that looks like way too much math to stomach, or if you donât have time to become a spreadsheet expert, you can use our handy financial calculators to do the work for you.

Our repayments calculators will tell you the repayment youâll make on a monthly, fortnightly or weekly basis, and give you the total amount of interest youâll wind up paying on your car, personal or home loan. And our credit card debt payment calculator will show you how long it will take you to pay off a credit card debt, plus how much youâll pay in interest and fees.

Also Check: Usaa Proof Of Residency Request Form

How To Calculate Apr On A Car Loan

- You get the total amount of the payment by multiplying the monthly payment by the term of the loan in months.

- Subtract the loan amount from the total payment to find the total interest payments on the loan.

- Divide the total interest rate by the number of years of the loan to find the annual interest amount.

What Your Credit Score Means Right Now

In the interim, you must identify whether you can qualify for a loan at all. Your credit score will be graded on a scale from 300-850, and a higher score is better. If your grade is lower than 600, you will struggle to get credit. Even if you do, your rate may be so high that you are better served waiting until your credit score improves rather than borrowing money.

A credit score higher than 700 indicates that you pay your bills on time. A score in excess of 760 means that you will be getting the best possible interest rates, which is understandable. After all, you pose the least risk of failing to live up to your financial obligations.

If your credit score is in the 600-700 range, all three services will consider you a fair risk, which means that they believe you probably will pay back your loan. They are not absolutely certain of it, though. Due to their concern, you will be charged a higher interest rate as a sort of precaution.

Thinking of it from the perspective of the bank, they earn the most money early in the life of the loan when you are paying toward the interest more than the principal. By giving you a higher rate, they protect their investment somewhat. In the example above, think about how much of a difference there was between the two rates.

Don’t Miss: Usaa Auto Loan Rates

What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

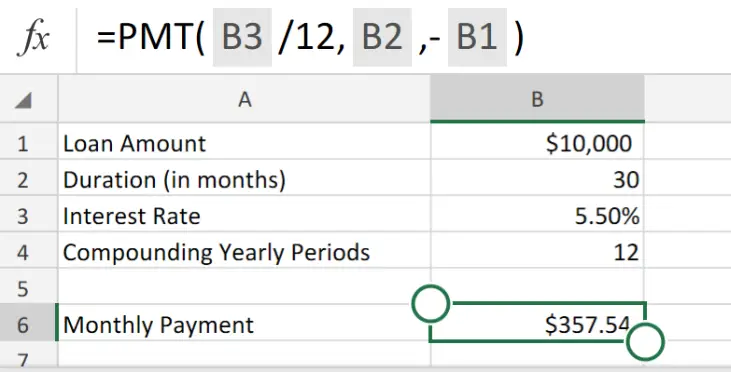

Diy Tips Formulas And Tools

Theresa Chiechi / The Balance

The easiest way to compute loan interest is with a calculator or spreadsheet, but you can also do it by hand if you prefer. For quick answers, use technologyonline calculators or spreadsheets. To understand the details, do a portion of the math yourself. You’ll make more informed decisions when you understand the numbers.

Read Also: California Mortgage License Requirements

How To Calculate Loan Payments In 3 Easy Steps

Making a big purchase, consolidating debt, or covering emergency expenses with the help of financing feels great in the moment – until that first loan payment is due. Suddenly, all that feeling of financial flexibility goes out the window as you factor a new bill into your budget. No matter the dollar amount, it’s an adjustment, but don’t panic. Maybe it’s as simple as reducing your dining out expenses or picking up a side hustle. Let’s focus on your ability to make that new payment on time and in full.

Of course, before you take out a personal loan, it’s important to know what that new payment will be, and yes, what you’ll have to do to pay your debt back. Whether you’re a math whiz or you slept through Algebra I, it’s good to have at least a basic idea of how your repayment options are calculated. Doing so will ensure that you borrow what you can afford on a month-to-month basis without surprises or penny-scrounging moments. So let’s crunch numbers and dive into the finances of your repayment options to be sure you know what you’re borrowing.

Don’t worry – we’re not just going to give you a formula and wish you well. Ahead, we’ll break down the steps you need to learn how to calculate your loan’s monthly payment with confidence.

How Can An Interest Rate Calculator Help You

Here are some of the primary benefits that a loan interest rate calculator provides.

- Such a platform helps you with a reliable resource that helps you stay abreast of your outstanding liabilities.

- The tool is also a very potent bank interest rate calculator. If you have availed credit from a bank, you need to repay the entire loan in time. Else, your CIBIL score suffers and your creditworthiness will also reduce.

- An interest rate calculator in India aids you in planning which EMIs have greater priority and which can wait for later.

- Lastly, an interest rate calculator will save you time, eliminate errors and help you stay atop your current financial situation.

Since most loans have long tenures, figuring out their repayment status is often difficult. It is why you need to find an interest rate calculator. Groww has a wide array of financial tools which you will find listed at the end of this page.

Also Check: Does Autozone Rent Torque Wrenches

Controllable Factors That Determine Interest Rate

While many factors that affect the interest rate are uncontrollable, individuals can, to some degree, affect the interest rates they receive.

Individual Credit Standing

In the U.S., credit scores and credit reports exist to provide information about each borrower so that lenders can assess risk. A credit score is a number between 300 and 850 that represents a borrower’s creditworthiness the higher, the better. Good credit scores are built over time through timely payments, low credit utilization, and many other factors. Credit scores drop when payments are missed or late, credit utilization is high, total debt is high, and bankruptcies are involved. The average credit score in the U.S. is around 700.

The higher a borrower’s credit score, the more favorable the interest rate they may receive. Anything higher than 750 is considered excellent and will receive the best interest rates. From the perspective of a lender, they are more hesitant to lend to borrowers with low credit scores and/or a history of bankruptcy and missed credit card payments than they would be to borrowers with clean histories of timely mortgage and auto payments. As a result, they will either reject the lending application or charge higher rates to protect themselves from the likelihood that higher-risk borrowers default. For example, a credit card issuer can raise the interest rate on an individual’s credit card if they start missing many payments.

How to Receive Better Interest Rates

Educational Loan Minimum Monthly Payments

Some educational loans have a minimum monthly payment. Please enter the appropriate figure in the minimum payment field. Enter a higher figure to see how much money you can save by paying off your debt faster. It will also show you how long it will take to pay off the loan at the higher monthly payment.

Don’t Miss: Where Do I Find Student Loan Account Number

Your Credit Score Is Crucial

Armed with this information, your point of attack is clear. You must attempt to find the lowest rate possible for your loan. In order to do that, you have to take a hard look at your personal history. Specifically, you need to know your credit score and understand exactly what this information means to a lender.

Your history of payments is considered by potential lenders as an indication of your character. You see your monthly payments as an aggravating process that drains money out of your bank account. A lender sees it as indicative of whether you are a person of your word. If you sign a contract with your utility company to pay for the amount of water and electricity that you use during a given month, how well you live up to your end of the bargain is important.

A lender wants to know that you have a track record of honoring your scheduled payments as much as possible. Your credit score has been monitored by a third party who then relays this information to the would-be lender. What goes into your credit score calculation is a subject of some speculation. There are fluctuating variables depending upon the credit service used.

The three major credit services are Equifax, Transunion, and Experian. Each of them will have a slightly different score for you. Learn each one to be best prepared for negotiations with lenders. Surprisingly, most creditors do not use all three, instead selecting one company as their exclusive credit score provider.

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Read Also: Usaa Interest Rates Auto

Does 0% Apr Mean No Interest On Purchases

An interest rate of 0% on an annual basis means that you do not pay interest on certain transactions for a certain period of time. When it comes to credit cards, the 0% annual interest is often related to the starting price you can get when you open a new account. A 0% promotional APR can be applied to the APR for card purchases or wire transfers, or both.

How To Calculate Interest Rate On Car Home Or Personal Loan:

These are loans that are more aptly called amortizing loans.

These are the loans whose mathematical aspects have already been pre-decided and taken into consideration. There is the fixed interest you have to pay continuously, after which the interest and the principal amount are both cleared off.Hence, below youll be taught how to calculate the effective interest rates on a loan.

This is how to calculate the effective interest rate on a car loan:

I = * A

N = Number of repaymentsA = Principle amount creditedLet us consider you are buying a vehicle worth 30,000$ which you have taken for a period of 6 years at a rate of 8.40%, then,

x 30000 = 210$

This is your interest in the first month. Now, since this interest includes the amount borrowed also, the new amount would be:

- New Balance for current month = principle amount .

So now you know how to calculate the interest rate on a car loan. This is how an auto loan interest works.

Read Also: Refinancing A Fha Loan To A Conventional Loan

Amortization And Compound Interest

Compound interest is when the unpaid or accumulated interest at the end of the first period is added to the principal for the second period , allowing the interest to compound. This is often referred to as interest on interest. As you can imagine, this results in higher interest payments.

The good news is that compound interest is not a common method for determining interest for home mortgages here in the U.S.** Your mortgage interest is actually calculated on a backward-looking monthly basis, which is to say its paid in arrears.

For example,* the September payment on your mortgage is for August interest and September principal. That’s why when you close your loan you don’t make your first payment the next month you make it the following month and just pay interim interest for the month you close in. A September 10th closing date, for example, would mean a November 1st first payment that includes October interest. At closing, youll pay the interim interest for September on the amount you borrowed .*

It can all sound a little confusing, but if you look at your loan estimate and particularly your closing disclosure, there should be a table that accounts for future projected payments over 360 months . Thats the beauty of an amortization schedule: It creates visibility into the entire repayment of the loan + interest. There are no surprises.

Amortization formula: total monthly payment and interest payment

M = P /

P = principal loan amount

Example*

Month two:*

What Cars Have Zero Financing

- Altima: 0% financing for 36 months plus cash bonus up to $1,250

- Frontier: 0% financing for 60 months plus cash bonus up to $1,500

- Jumping Highs: 0% funding for 36

- Giveaway: 0% financing for 72 months and a cash bonus of up to $7,000.

- Murano: 0% financing for 60 months and up to $2,500 in cash.

- Rogue Sport: 0% financing for 60 months plus a cash bonus of up to $500

You May Like: Does Va Loan Work For Manufactured Homes

What’s Considered A Good Apr For Your Credit Card

- Annual interest rates on credit cards range from 13% to 25%, while the national average in January 2021 will be around 16%.

- You can review this area in the cardholder agreement before submitting your request.

- The issuer may charge a different annual fee for purchases, balance transfers, and cash advances.

When do credit cards charge interestWhat do credit cards have the highest interest? The data showed that refundable credit cards had the highest interest rates among student credit cards, followed by the travel rewards card. The lowest interest credit cards were business credit cards.How do you calculate daily interest on a credit card?To calculate the amount of interest you pay on each day of the report, you can convert yo

How Do They Calculate Your Car Loan Apr

The annual interest rate on the loan is calculated by multiplying the amount borrowed plus the commission by the interest rate, and you get a number that is slightly higher than the interest rate, since it includes all the costs associated with the loans. There are two types of APR: floating and fixed.

Also Check: Upstart Com Myoffer

What Is The Best Bank To Get A Mortgage

SunTrust Bank – With its wide range of flexible and fixed mortgages, SunTrust has become one of the best mortgage banks. The bank has about 1,000 centers in the US and offers FHA, VA and large loans in addition to traditional mortgages. The deposit can be up to 3%. It also offers online loan application and tracking.

What Can A Personal Loan Be Used For

One of the benefits of taking out a personal loan is that you can use the money for almost anything. Popular uses include paying for home or vehicle repairs, medical bills, weddings and paying off higher-interest loans or credit cards.

is one of several ways you can use a personal loan to save money by refinancing higher-rate debts. For example, say you have $10,000 in credit card debt at a 16% APR and get approved for a $10,000 personal loan with a 10% APR and no origination fee. If you take the same amount of time to pay off the debt36 monthsyoull save about $1,040 by paying off the credit card debts with the lower-rate personal loan instead of leaving the debt on your credit card.

You could also take out one loan and use it for several purposes. Read the lenders terms before applying, however, because the lender may limit how you can use the funds. Common restrictions include:

- Gambling

Read Also: Usaa Used Car Loan Interest Rates

How To Use This Calculator

The personal loan calculator estimates your monthly payment once you input the loan amount, estimated interest rate and repayment term. By changing one or more of the numbers, you can see how different loan offers will impact your monthly payment and how much interest youll pay overall.

Generally, a loan with a longer term will have a lower monthly payment, as youre taking more time to repay what you owe. But youll also wind up paying more interest because it will accrue over a longer period. Some lenders may also charge a higher interest rate if you choose a longer term.

As you compare lenders and loan offers, also find out whether the loans youre considering charge an origination feea common fee on personal loans thats generally a percentage of the loan amount.

Lenders may deduct this fee from your loan disbursementfor example, sending you $9,500 if you accept a $10,000 loan that has a 5% origination fee. In these cases, use the full loan amount , as thats the amount youll need to repay. But if a lender adds the origination fee to your loan rather than subtracting it from your disbursement, use the total of the loan plus the fee as your loan amount in the calculator. In both situations youll be paying interest on the full outstanding amount, which may include the fee.

Based on the numbers you enter, our calculators results will show you how many months it will take to pay off the loan, when it will be paid off and how much youll pay in interest.