What Is The Difference Between Fixed And Adjustable Rate Loans

The main difference between a fixed and adjustable rate loan is that the interest rate will never change for a fixed-rate mortgage. On the other hand, an ARMs interest rate can change multiple times over the loan term. The monthly mortgage payment will change too if the index rises and falls.

There are also a few other ways that ARMs and fixed-rate loans are different. Lets learn more.

Your ARM rate can never fall below a certain margin specified in your loan documentation. For example, if the margin specified is 3%, the margin is added to the current index number on the date your rate adjusts.

Rate Caps

ARM loans have rate caps that limit the amount your interest rate can rise or drop in a single period and over the lifetime of your loan. Your loan might not increase or decrease exactly along with the market if it hits its cap.

An initial cap is the maximum percentage your rate can increase or decrease in a single period after your fixed-rate period expires. A periodic cap limits the maximum amount that an interest rate can change from one adjustment period to the next.

A lifetime cap puts a limit on the total amount that your interest rate can increase or decrease from the introductory rate over the mortgage term. Your lender will express your ARM caps as a series of three numbers separated by forward slashes in this format: initial cap/periodic cap/lifetime cap. This is your cap structure.

Interest Rates

Ease Of Qualification

Pros And Cons Of Fixed

Fixed-rate loans are generally safer than variable-rate loans, but you pay a price for the stability these loans provide. Ultimately, you need to decide what youre comfortable with and what you think interest rates might do in the future.

-

Predictable monthly payment through the life of your loan

-

Know exactly how much interest youll pay

-

No risk of payment shock down the road from increased interest rates

-

Usually a higher starting rate than variable-rate loans

-

If rates fall, you must refinance or live with your higher rate

-

May not compare well for short-term needs

If youre having trouble choosing, you might benefit from a hybrid of fixed- and variable-rate loans. For example, a five-year, adjustable-rate mortgage has a relatively low fixed rate for the first five years, but the rate can change in subsequent years. If you dont plan to keep your loan for many years, it could make sense to get a rate thats fixed for a limited time. Just be prepared for life changesyou might keep the loan for longer than you expect.

Whats The Difference Between Fixed

A fixed-rate loan has an interest rate that will not change throughout the life of the loan. The same interest rate you have when you took it out will be the same when you pay it off.

A variable-rate loan has an interest rate that can fluctuate based on a market interest rate. This means that when the market interest rate changes, your interest rate can also change. A market interest rate is chosen by the lender and is used to calculate both the fixed and variable interest rates you may have been offered. The interest rate you have when you take out the loan, may not be the same in a few months time. In fact, a variable interest rate will likely change as you pay the loan off.

Recommended Reading: Which Student Loan Servicer Is Best

Fixed Home Loan Interest Rates

Fixed home loan interest rates could be termed predictive. That is, lenders look at the cost of holding money at a certain rate for a certain amount of time, and determine the interest rate accordingly.

In general, if a lender expects the cash rate to rise, the fixed rate will usually be higher than the variable rate on the other hand, if the expectation is for the cash rate to fall, the fixed rate will tend to be lower than the current variable rate.

When a borrower fixes the interest rate on their home loan, they are usually anticipating that the variable rate will rise above the rates which they have locked in.

Lenders may offer fixed terms between 1 and 10 years however, most fixed rate terms are between one and five years.

Once a borrower has locked in their fixed rate, they will start paying the fixed interest rate straight away.

For example, if a borrower fixed their loan today at a five-year fixed rate which is 2% higher than the variable rate, the borrower would start paying an extra 2% interest right away.

Pros and cons of fixed rates

A fixed rate loan is a loan that has a fixed interest rate and therefore fixed loan repayments.

- Repayments do not fall if rates fall

- Allows only limited additional payments

- Penalises early payout of the loan

What Is The Definition Of A Fixed Rate Loan

Fixed rate loans are loans that have an interest rate that does not change over the life of a loan, which means you pay the same amount each month. It also means you know with certainty the total interest that youll pay over the life of the loan. Fixed rate is a general term that can apply to different types of loans with a variety of uses, including student loans, mortgages, auto loans, and unsecured personal loans.

You May Like: Are Student Loan Forgiveness Programs Legit

Definition Of A High Ratio Mortgage

A high ratio mortgage is a mortgage in which a borrower places a down payment of less than 20% of the purchase price on a home.

Another way of phrasing a high ratio mortgage is one with a loan to value ratio of more than 80%. A mortgage with more than a 20% down payment is called a conventional mortgage.A high ratio mortgage will require mortgage insurance. Mortgage insurance is usually purchased by the lender through one of Canadas three default insurers:

The cost of the premium is added on to the mortgage and amortized over the length of the mortgage. It can also be added to the closing costs, however this is not the norm.

Example

Mr. McGillicuddy desires to purchase a home with a purchase price of $250,000. He has $30,000, available in cash for a down payment. Since the amount of the down payment is less than 20%, the mortgage is classified as a high ratio mortgage and Mr. McGillicuddy will be required to purchase mortgage insurance.

Related Terms

Short Vs Long Term Amortization Periods

Many home buyers choose shorter amortization periods resulting in higher monthly payments if they can afford to do so, knowing that it promotes positive saving behaviour and reduces the total interest payable. For example, let us consider a $300,000 mortgage, and compare a 25-year versus 30-year amortization period.

| Scenario A | |

|---|---|

| $339,659 | $111,079 |

The mortgage payments under scenario B are smaller each month, but the home owner will make monthly payments for 5 additional years. The total interest saved by going with a shorter amortization period exceeds $100,000.

For the savvy investor, these savings should be compared to the opportunity cost of other investments. Using the example above, the monthly savings of $142 under scenario B, could be invested elsewhere, and, depending on the rate of return, could come out ahead after 35 years.

Prepayment privileges set out by your lender will determine whether you can shorten your amortization period, by either increasing your regular monthly payments and/or putting lump sum payments towards the principal, without penalty. However, beyond these privileges, you will often incur costly penalties for making additional payments. According to the Canadian Association of Mortgage Professionals, 24% of Canadians took advantage of prepayment options in 2009.

Don’t Miss: Va Loans Mobile Homes

Mortgage Term Vs Amortization

One of the most common sources of confusion for prospective home buyers is the difference between a mortgage term and amortization period. Here is a short answer: A mortgage term is the length of your current contract, at the end of which you’ll need to renew The amoritization period is the total life of your mortgage. A typical mortgage in Canada has a 5-year term with a 25-year amortization period.

| Mortgage term | Mortgage amortization | |

|---|---|---|

| Description | The length of time you are committed to a mortgage rate, lender, and conditions set out by the lender. | The length of time if takes you to pay off your entire mortgage. |

| Time frame | CMHC-insured mortgage: Maximum 25 yearsNon CMHC-insured mortgage: 35-40 years |

Fixed And Variable Rate Loans: Which Is Better

It’s important to understand the differences between variable interest rates and fixed interest rates if you’re considering a loan. Whether you’re applying for a new mortgage, refinancing your current mortgage, or applying for a personal loan or credit card, understanding the differences between variable and fixed interest rates can help save you money and meet your financial goals.

Recommended Reading: Usaa New Car Loan

What Is A Fixed Interest Rate

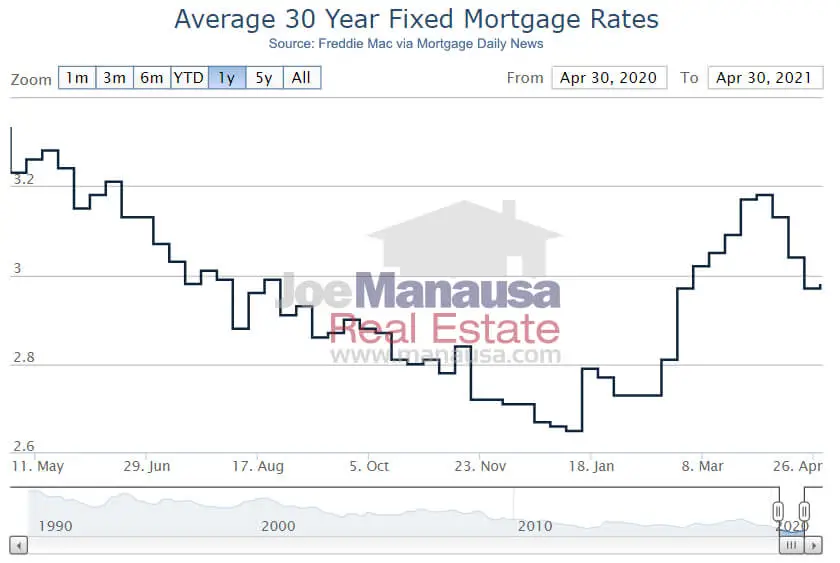

A fixed interest rate is a rate that will not change for the entire term of a loan. For example, a 30-year fixed-rate mortgage keeps the same interest rate for the whole 30-year period. Your monthly loan payment calculation is based on the interest rate, so locking in the rate results in the same principal and interest payment every month.

Broadly speaking, loans come in two forms: fixed and variable. Variable-rate loans have an interest rate that can change over time even if the rate may be fixed for several years at the beginning of your loan. These rates are structured based on a international rate called LIBOR plus a spread.

When conditions in the global markets change, LIBOR can increase or decrease and tag along with it these variable rates. If rates increase, your monthly payment on a variable-rate loan may also risesometimes substantially.

Although your loan payment should not change with a fixed-rate loan, your monthly obligation could change over time. For example, if you include property taxes and insurance premiums in your mortgage payment, those amounts can vary from year to year.

Variable Home Loan Interest Rates

Lenders variable home loan interest rates fluctuate approximately in parallel with the Reserve Bank of Australias cash rate.

Variable rates are a reflection of the current economic climate. The Reserve Bank uses the cash rate as a blunt instrument to try to control inflation when inflation is getting too high the cash rate goes up when the economy is weakening the cash rate often comes down.

Don’t Miss: Credit Score Usaa

What Is A Variable Rate Mortgage

Like fixed rate mortgages, variable rate mortgages also have a set term , but they have one big difference: the interest rate can go up and down during your mortgage term. This can happen as often as every month, as its tied to whatever is happening with the rate set by the Bank of Canada.

How does it work? The variable rate is related to the prime interest rate, which refers to the interest rate that a bank offers to their most trusted customers. This preferential rate is based on the Bank of Canadas overnight rate or key interest rate which is the interest rate at which banks get money from the Bank of Canada.

The bottom line: if you choose a VRM, your payment will go up or down depending on what the Bank of Canada does and how your lender reacts with their prime interest rate. While some people think can predict what the Bank of Canada is going to do, the truth is that no one has a crystal ball and can see what interest rates will do over the long term.

You may see banks advertise their variable interest rates as prime minus 0.2% or something similar. This means that you will get 0.2% off of the floating prime interest rate which could go up or down throughout your mortgage term.

Variable Vs Fixed Rate Mortgage: How To Choose

Choosing between a variable vs. fixed mortgage really comes down to your financial circumstances. Are you comfortable with fluctuation payments? Do you have debts or big-ticket expenses to tackle in the near future? Is your employment precarious or do you have a steady paycheque coming in every month? Is your priority to pay off your mortgage early or invest the extra cash? Its really a personal choice and youll need to crunch the numbers to figure out which one is right for you.

There is a third option when it comes to mortgage interest rates called a hybrid mortgage. This is essentially when a mortgage agreement has a certain portion of the amount borrowed as a fixed rate, and the rest as a variable rate. This option is rarely chosen by Canadians but can offer an interesting middle-ground when it comes to risk and reward.

Start by shopping around for the lowest interest rate on the market. A good place to start is one of the best online banks, as their rates are often rock bottom.

Another great option is to use an online mortgage broker, like Breezeful. Search more than 30 banks to get the most competitive rates in just minutes far faster than approaching banks directly through its online platform. Youll have a mortgage expert available to walk you through the process step-by-step and close the best deal on your behalf. Any time you have questions about your mortgage just text them to an advisor through a dedicated text line.

Don’t Miss: Usaa Rv Loan Reviews

What Is A Conventional Fixed

A “fixed-rate” mortgage comes with an interest rate that won’t change for the life of your home loan. A “conventional” mortgage is a loan that conforms to established guidelines for the size of the loan and your financial situation. Conventional loans may feature lower interest rates than jumbo loans, FHA loans or VA loans. Terms of these conventional loans typically range from 10 to 30 years.

Monthly principal and interest payments on a conventional fixed-rate mortgage remain the same for the life of the loan making it an attractive option for borrowers who plan to stay in their home for several years. The alternative to the fixed-rate mortgage is the adjustable-rate mortgage loan, which features lower monthly principal and interest payments during the first few years. While many prefer the security of a fixed-rate loan, an ARM may be a better option – especially if you know you’ll be moving within the next several years.

How Do Variable Interest Rate Products Work

Most variable rate credit products are tied to an underlying interest rate index, such as the prime rate or the London Interbank Offered Rate If the corresponding index rate goes up, your loans interest rate and monthly payment will also rise. But the opposite is also trueif these rates fall, so will your loans interest rate and monthly payment.

Almost all credit cards come with variable rates tied to the prime rate. When the Federal Reserve raises interest rates, chances are highly likely the prime rate will also rise. This means the interest you pay on your outstanding balance and your minimum payment could increase as soon as your next monthly bill.

Most lenders put a cap on variable rate loans to limit how much the interest rate can rise over time. If its a lifetime cap, the rate will never go above a pre-determined interest rateno matter how much the index rises during the life of the loan.

Don’t Miss: What Credit Bureau Does Usaa Use For Auto Loans

Pros & Cons Of A Fixed

A fixed interest rate can offer safety. With a fixed-rate loan, your payments will stay the same over the life of your loan, which allows you to plan and budget long into the future.

While fixed loans can offer stability, the interest rates typically start higher than their variable-rate siblings. This means that you could pay more over time in interest with a fixed-rate loan if variable rates drop. But, if variable rates rise, you could also be saving on interest because your fixed-rate loan is locked in at a lower rate.

Why select a fixed-rate loan? Many people choose a fixed-rate for long-term loans, such as mortgages, because they dont know what the market will look like in 1530 years. They want to count on the consistency that a fixed-rate loan offers.

The Problem With The 30

So heres the big question: After looking at the math, why would anyone choose the 30-year mortgage over the 15-year?

Well, when you think about it, we do a lot of things that dont make sense.

We say heads up when we mean heads down. We call them chicken fingers, but chickens dont have fingers. We put pizzas in square boxes even though theyre round. And people who want financial freedom take out 30-year mortgages. Okay, okay, maybe its a stretch to compare 30-year mortgages to pizza boxes and chicken fingers. But seriously, contrary to what many people think, the 30-year mortgage is not a smart financial move in the long run.

Most people would probably say, “Look, I just want a cheaper monthly payment. Im not actually going to stay in the house for 30 years.”

The problem with this way of thinking is that it keeps people in debt longer. For example, if you sold the house before the 30-year term was up, youd have to use a portion of what you earned from the sale to pay off the loanwhich means youd likely take out another loan to buy your next house. Talk about stealing your wealth!

You May Like: Can You Refinance Sallie Mae Student Loans